Trump's Trade Threats Send Gold Prices Climbing

Table of Contents

Safe Haven Demand Drives Gold Prices Higher

Gold has long been considered a safe haven asset, a store of value that holds its worth during times of economic and political turmoil. When uncertainty grips markets, investors often flock to gold as a way to protect their capital. Trump's trade threats have significantly contributed to this increased demand.

- Increased geopolitical risk due to trade wars: The imposition of tariffs and retaliatory measures creates significant geopolitical uncertainty, making investors nervous about the stability of global markets.

- Investor flight to safety amidst market volatility: As stock markets fluctuate and economic forecasts darken, investors seek the relative stability of gold, driving up demand and prices.

- Decline in the US dollar strengthening gold's appeal: The US dollar, often inversely correlated with gold prices, can weaken during periods of trade uncertainty, making gold, priced in USD, more attractive to international investors.

- Weakening global economic growth forecasts: Trade wars disrupt supply chains and stifle economic growth, prompting investors to seek refuge in the perceived safety of gold.

Trump's aggressive trade policies, including tariffs on steel, aluminum, and goods from China, have repeatedly injected uncertainty into the market. For example, the announcement of tariffs on Chinese goods in 2018 coincided with a significant jump in gold prices, reflecting investor anxiety. This pattern has repeated itself throughout his presidency.

Impact of Trade Wars on Global Markets

Trade wars have a demonstrably negative impact on global economic growth. The uncertainty they create discourages investment, dampens consumer confidence, and disrupts established supply chains.

- Increased tariffs leading to higher prices for consumers: Tariffs increase the cost of imported goods, leading to inflation and reducing consumer purchasing power.

- Disruption of global supply chains: Trade disputes can disrupt the flow of goods and services across borders, leading to shortages and increased costs for businesses.

- Uncertainty impacting business investment and consumer confidence: The unpredictable nature of trade wars makes businesses hesitant to invest and consumers reluctant to spend, further slowing economic growth.

- Potential for currency devaluation and market instability: Trade wars can lead to currency fluctuations and market volatility, increasing the risk for investors.

These negative factors contribute to the appeal of gold as a safe haven. The 2018 trade dispute between the US and China, for example, significantly impacted global markets, and during this period, gold prices saw a substantial increase.

Analyzing the Relationship Between Gold Prices and Trump's Trade Actions

A historical analysis of gold prices during periods of heightened trade tensions under the Trump administration reveals a clear correlation.

- Correlation between specific trade announcements and subsequent gold price movements: Examination of gold price charts alongside a timeline of major trade actions demonstrates a clear upward trend in gold prices following significant trade announcements or escalations.

- Chart showing gold price performance alongside a timeline of major trade actions: (Include a visually appealing chart here showcasing this correlation).

- Analysis of market sentiment and investor behaviour during these periods: Market sentiment indicators and investor surveys during these periods show a clear shift toward risk aversion and increased demand for safe-haven assets like gold.

- Mention relevant economic indicators and their influence on gold prices: Economic indicators like the VIX volatility index (a measure of market uncertainty) and the US dollar index can be used to further support the relationship between trade tensions and gold price increases.

The data strongly suggests that Trump's trade actions have been a key driver of gold price appreciation, as investors seek protection from the resulting market volatility.

Investment Strategies in Response to Trade Uncertainty

Incorporating gold into a diversified investment portfolio can be a prudent strategy to mitigate the risks associated with Trump's trade threats and resulting market uncertainty.

- Strategies for diversifying investments to minimize risk: Gold should be considered one component of a broader investment strategy, not a sole investment.

- Types of gold investments (physical gold, gold ETFs, gold mining stocks): Investors have various options for including gold in their portfolios, each with different levels of risk and liquidity.

- Considerations for risk tolerance and investment goals: The appropriate level of gold exposure depends on an investor's individual risk tolerance and investment objectives.

- Importance of consulting with a financial advisor: It's crucial to consult with a qualified financial advisor to determine the appropriate allocation of gold within your portfolio.

By carefully considering these factors, investors can utilize gold as a tool to navigate the complexities of the current market landscape.

Conclusion

This analysis demonstrates a strong correlation between Trump's trade threats and the rise in gold prices. Increased safe-haven demand, driven by global market uncertainty and the negative impacts of trade wars, has fueled this upward trend. Investors seeking to protect their portfolios against the ongoing uncertainty created by Trump’s trade policies should consider including gold as part of a diversified investment strategy. Learn more about mitigating risk with strategic gold investments and building a resilient portfolio in the face of trade tensions.

Featured Posts

-

Historia De Roc Agel La Propiedad Grimaldi Y El Retiro De Charlene

May 26, 2025

Historia De Roc Agel La Propiedad Grimaldi Y El Retiro De Charlene

May 26, 2025 -

Ikuti Balapan Moto Gp Inggris Jadwal Dan Informasi Penting

May 26, 2025

Ikuti Balapan Moto Gp Inggris Jadwal Dan Informasi Penting

May 26, 2025 -

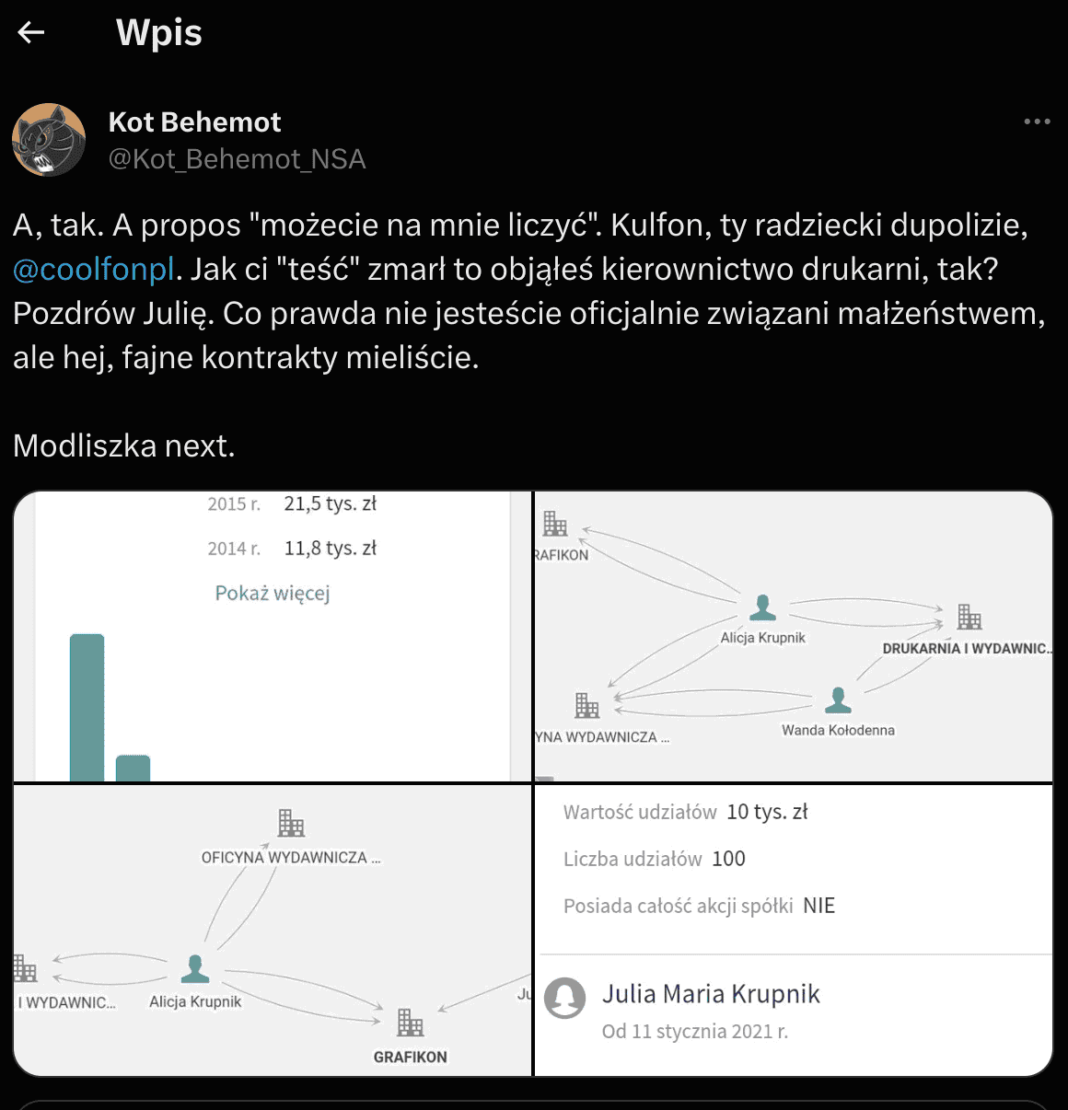

Wplyw Unikania Pytan Przez Prokuratorow Na Wizerunek Wymiaru Sprawiedliwosci W Polsce

May 26, 2025

Wplyw Unikania Pytan Przez Prokuratorow Na Wizerunek Wymiaru Sprawiedliwosci W Polsce

May 26, 2025 -

Relay Sweep Leads T Bird Girls To Home Invite Victory

May 26, 2025

Relay Sweep Leads T Bird Girls To Home Invite Victory

May 26, 2025 -

Fallece Eddie Jordan Noticias De Ultima Hora

May 26, 2025

Fallece Eddie Jordan Noticias De Ultima Hora

May 26, 2025