Trump's Trade War: A $174 Billion Blow To Global Billionaires

Table of Contents

The Target: Specific Industries and Billionaires Affected

Trump's trade war didn't impact all industries equally. Certain sectors felt the brunt of the economic fallout, significantly impacting the net worth of many billionaires.

Technology Sector Losses

The technology sector, a cornerstone of the global economy, suffered significant losses due to Trump's Trade War. Companies heavily reliant on Chinese markets, like Apple and Qualcomm, experienced decreased sales and disruptions to their supply chains.

- Apple: Estimated losses from reduced iPhone sales in China and increased production costs due to tariffs are significant, impacting CEO Tim Cook's personal wealth.

- Qualcomm: The company faced challenges due to restrictions on its chip sales to Huawei, a major Chinese telecom giant, resulting in substantial financial setbacks.

- Supply chain disruptions impacted numerous tech firms, leading to increased production costs and delays in product launches, affecting shareholder value and the net worth of numerous tech billionaires.

Retail and Consumer Goods Impacts

The retail and consumer goods sectors also felt the pinch. Tariffs on imported goods led to increased costs for companies, forcing them to either absorb the losses or raise prices, impacting consumer spending and profitability.

- Increased costs: Companies like Nike and Walmart faced higher costs for imported goods, squeezing profit margins.

- Reduced consumer spending: Tariffs translated to higher prices for consumers, leading to reduced demand and impacting the bottom lines of major retailers.

- Manufacturing relocation: Some companies relocated manufacturing facilities outside of China to mitigate the impact of tariffs, a costly and time-consuming process impacting short-term profits.

Financial Sector Fallout

The broader economic consequences of Trump's trade war had a noticeable impact on the financial sector and the investment portfolios of billionaires.

- Stock market volatility: Increased uncertainty created market fluctuations, causing significant volatility in stock prices and impacting investment returns.

- Decreased investment returns: Billionaire investors experienced reduced returns on their investments due to the overall economic slowdown caused by the trade war.

- Global trade slowdown: The trade war contributed to a general slowdown in global trade, further affecting the profitability of companies and investor confidence.

Mechanisms of Impact: How the Trade War Affected Billionaires' Wealth

The impact of Trump's trade war on billionaire wealth wasn't a direct result of targeted sanctions on individuals, but rather a consequence of wider economic effects.

Tariffs and Increased Costs

Tariffs were a central mechanism of the trade war. They directly increased the cost of imported goods, impacting profitability and shareholder value for many companies.

- Specific tariff rates: Tariffs on steel, aluminum, and various consumer goods significantly increased production costs.

- Increased cost of goods: These increased costs were often passed on to consumers, leading to inflation and reduced consumer demand.

- Reduced profit margins: Businesses faced reduced profit margins as a result of increased production costs and stagnant or declining sales.

Supply Chain Disruptions

The trade war caused significant supply chain disruptions, leading to logistical challenges and financial losses for businesses.

- Sourcing difficulties: Companies faced challenges sourcing materials and manufacturing goods due to trade restrictions and increased transportation costs.

- Increased shipping costs: Transportation costs increased due to tariffs, trade restrictions, and logistical bottlenecks.

- Production delays: Supply chain disruptions led to delays in production, impacting sales and profitability.

Geopolitical Uncertainty and Market Volatility

The trade war created considerable geopolitical uncertainty, negatively impacting investment decisions and market stability.

- Market fluctuations: The uncertainty surrounding trade policies led to unpredictable market fluctuations, impacting investor confidence.

- Decreased investor confidence: The unpredictable nature of the trade war created a climate of uncertainty and reduced investor confidence, leading to reduced investment and economic stagnation.

- Impact on investment portfolios: The resulting market volatility significantly impacted the value of investment portfolios held by billionaires.

Long-Term Consequences: Lasting Effects on Global Economy and Billionaires' Wealth

Trump's trade war had long-lasting consequences on the global economy and the wealth distribution among global billionaires.

Shifting Global Trade Dynamics

The trade war accelerated the shift towards regional trade agreements and potentially reshaped global supply chains.

- Shift in manufacturing locations: Companies moved manufacturing facilities to regions less affected by the trade war, resulting in a change in global manufacturing dynamics.

- Increased regional trade agreements: The trade war spurred a renewed focus on strengthening regional trade agreements.

- Rise of new economic powers: The trade war might have unintentionally boosted the economic strength of some countries not directly involved in the conflict.

Increased Protectionism and its Impact

Trump's trade war exemplified a broader trend towards protectionism, potentially leading to a more fragmented and less efficient global economy.

- Free trade vs. protectionism: The trade war reignited the long-standing debate about the benefits and drawbacks of free trade versus protectionism.

- Adoption of protectionist policies: Other countries might have adopted similar protectionist policies, creating a domino effect of trade restrictions.

- Impact on global economic growth: Protectionist policies tend to decrease global economic growth and increase prices for consumers.

Lessons Learned and Future Implications

Trump's trade war offered valuable lessons about the complexities of international trade and the potential risks of protectionist policies.

- Potential future trade conflicts: The trade war highlighted the potential for future trade conflicts and the need for effective strategies to mitigate economic risks.

- Importance of international cooperation: The experience underscored the importance of international cooperation and multilateral agreements to foster a stable global trading system.

- Predicting economic risks: Understanding the potential cascading effects of protectionist policies on global trade is vital for making informed decisions in the future.

Conclusion

Trump's trade war resulted in a significant $174 billion loss for global billionaires, impacting various sectors, including technology, retail, and finance. This was primarily due to tariffs, supply chain disruptions, and the resultant geopolitical uncertainty and market volatility. The long-term effects include shifting global trade dynamics, an acceleration of protectionist policies, and crucial lessons learned about the fragility of global trade relations. Understanding the complexities of Trump's trade war and its impact on global billionaires is crucial. Continue your research on the long-term effects of protectionist policies and the future of global trade to gain a deeper understanding of this pivotal economic event and the enduring effects of Trump's trade policies on the global landscape.

Featured Posts

-

Oilers Vs Kings Expert Prediction For Game 1 Of The Nhl Playoffs

May 10, 2025

Oilers Vs Kings Expert Prediction For Game 1 Of The Nhl Playoffs

May 10, 2025 -

Wynne Evans Unexpected Career Move After Strictly Come Dancing

May 10, 2025

Wynne Evans Unexpected Career Move After Strictly Come Dancing

May 10, 2025 -

Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 10, 2025

Fast Flying Farce Takes Flight At St Albert Dinner Theatre

May 10, 2025 -

Us Tariffs French Minister Pushes For Stronger Eu Retaliation

May 10, 2025

Us Tariffs French Minister Pushes For Stronger Eu Retaliation

May 10, 2025 -

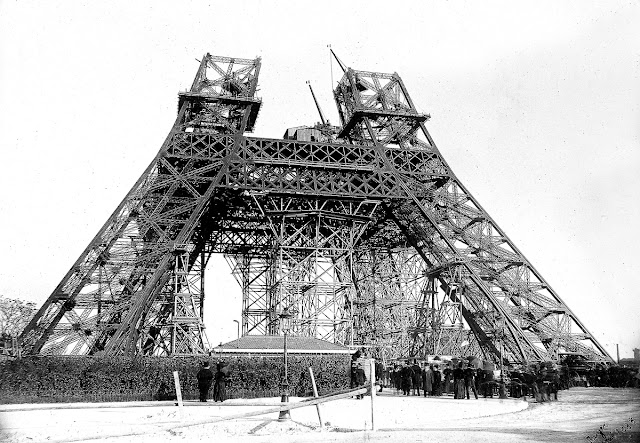

La Mere De Gustave Eiffel Une Influence Dijonnaise Sur La Construction De La Tour Eiffel

May 10, 2025

La Mere De Gustave Eiffel Une Influence Dijonnaise Sur La Construction De La Tour Eiffel

May 10, 2025