Trump's XRP Endorsement Fuels Institutional Interest

Table of Contents

The Trump Factor: Understanding the Impact of the Endorsement

Donald Trump's influence on global markets is undeniable. His vast social media following and outspoken nature can significantly impact asset prices. His endorsement carries considerable weight, potentially swaying both retail and institutional investors.

-

Trump's large social media following and its potential impact on XRP price: With millions of followers across various platforms, a single tweet or statement from Trump regarding XRP could trigger a significant price surge due to increased demand. The sheer volume of his followers translates to potential market manipulation, although not necessarily intentional. The speed at which information spreads through these channels can lead to rapid price fluctuations.

-

Analysis of his past endorsements and their market effects: Analyzing Trump's previous endorsements of companies or products reveals a pattern of short-term price increases. While the long-term effects vary, the immediate impact is often substantial, influencing investor sentiment and driving market activity. This precedent adds weight to the potential impact of his XRP endorsement.

-

Discussion of the potential for increased retail investor interest driven by Trump's support: The "Trump effect" can attract a wave of new retail investors, many of whom may be less experienced in cryptocurrency trading. This influx of new capital can further contribute to price volatility and increased trading volume in the XRP market.

[Insert relevant links to news articles about the endorsement here]

Institutional Interest in XRP: A Growing Trend?

Institutional adoption of cryptocurrencies has been a gradual process, but the crypto market is maturing. Several factors point towards increased institutional interest in XRP, amplified by Trump's endorsement.

-

Exploration of XRP's technology and potential use cases: XRP's underlying technology and its potential for fast, low-cost cross-border payments make it attractive to financial institutions seeking efficient solutions for international transactions. This inherent utility strengthens the case for institutional investment.

-

Analysis of potential regulatory changes impacting institutional investment in crypto: Regulatory clarity is crucial for institutional participation in the crypto market. Any positive regulatory developments in the US or globally could further encourage institutions to consider XRP as a viable asset. Trump's influence on regulatory policy could play a role here.

-

Discussion of the role of Trump's endorsement in influencing institutional decisions: While institutions typically conduct thorough due diligence, Trump's endorsement might accelerate their consideration of XRP, potentially pushing forward timelines for investment decisions. It adds a layer of "social proof" to XRP's investment thesis, even if indirectly.

[Insert links to relevant reports and analyses on institutional crypto investments here]

Ripple's Response and Future Strategy

Ripple, the company behind XRP, will likely adjust its strategy in response to Trump's endorsement. While an official statement might be cautious, the company may leverage this unexpected development to advance XRP adoption.

-

Impact on Ripple's ongoing legal battles: The increased attention on XRP could indirectly impact Ripple's ongoing legal battles with the SEC. A more favorable public perception might improve their negotiating position.

-

Potential acceleration of XRP adoption by financial institutions: Ripple can use Trump's endorsement to bolster its outreach to financial institutions, highlighting the potential benefits of XRP in light of this high-profile endorsement.

-

Long-term implications for Ripple's market position: This unexpected event could be a turning point for Ripple and XRP, potentially solidifying its position as a leading cryptocurrency in the long run.

Market Volatility and Price Predictions

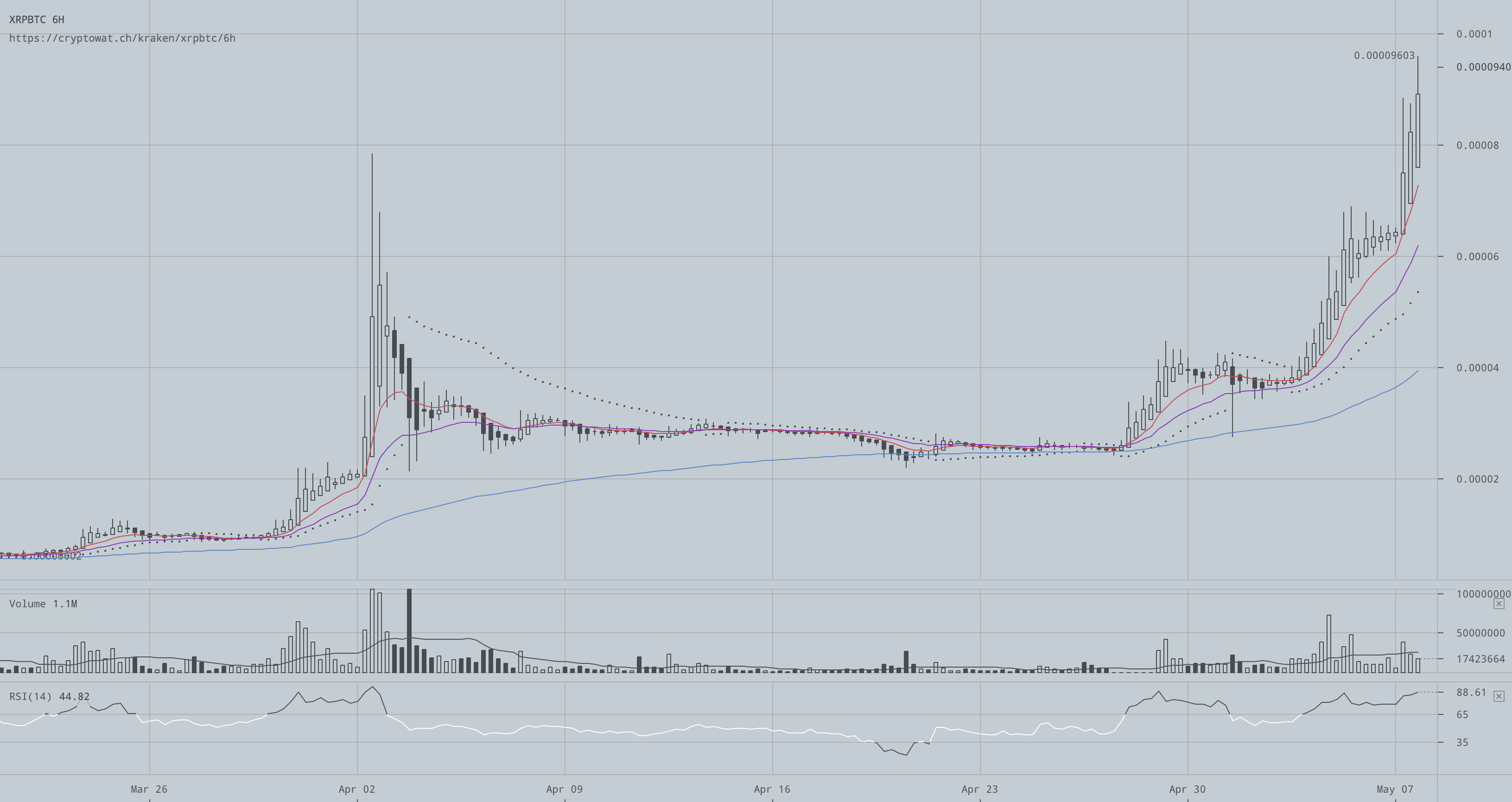

Trump's endorsement has already caused significant volatility in the XRP price. Predicting the future price is inherently speculative, but various factors influence potential short-term and long-term movements.

-

Technical analysis of XRP price charts following the endorsement: Analyzing price charts, trading volume, and technical indicators can provide insights into potential price trends, although these are not foolproof predictions.

-

Discussion of factors influencing price volatility beyond Trump’s endorsement (e.g., regulatory changes, market sentiment): Market sentiment, regulatory announcements, and broader crypto market trends will also impact XRP’s price. Trump’s endorsement is just one of many influential factors.

-

Expert opinions and predictions from crypto analysts: While predictions should be viewed with caution, consulting expert opinions from reputable crypto analysts can offer valuable perspectives on potential price movements.

[Include charts and graphs to visually represent price fluctuations here]

Risks and Challenges Associated with the Trump XRP Endorsement

While the endorsement presents opportunities, several risks and challenges must be considered.

-

Risk of a price correction after initial surge: Any significant price surge is often followed by a correction as the market stabilizes. Investors should be aware of this risk.

-

Concerns regarding the influence of political endorsements on the crypto market: The endorsement highlights the potential vulnerability of crypto markets to external, non-market factors, raising concerns about market manipulation and speculative bubbles.

-

Potential regulatory scrutiny following the increased attention: Increased attention on XRP might invite closer regulatory scrutiny, which could potentially lead to stricter regulations or even a crackdown.

Conclusion

Donald Trump's endorsement of XRP is a significant event with far-reaching implications for the cryptocurrency's future. While the impact remains to be fully seen, it has undoubtedly sparked renewed interest from both institutional and retail investors. The event highlights the ever-evolving nature of the cryptocurrency market and its susceptibility to influential figures. The long-term effects of Trump's XRP endorsement are still uncertain, and only time will reveal the full consequences of this surprising development.

Call to Action: Stay informed about the ongoing developments surrounding Trump's XRP endorsement and its impact on the crypto market. Continue researching the potential benefits and risks associated with investing in XRP. Learn more about the current landscape of Trump's XRP endorsement and its implications for the future of cryptocurrency.

Featured Posts

-

March 2024 Play Station Plus Premium And Extra Game Catalog

May 08, 2025

March 2024 Play Station Plus Premium And Extra Game Catalog

May 08, 2025 -

Dossier On Papal Candidates Cardinals Weigh Their Choices

May 08, 2025

Dossier On Papal Candidates Cardinals Weigh Their Choices

May 08, 2025 -

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025

Wednesday April 2nd 2025 Official Lotto And Lotto Plus Results

May 08, 2025 -

Should You Buy Xrp Ripple Now Weighing The Risks And Rewards

May 08, 2025

Should You Buy Xrp Ripple Now Weighing The Risks And Rewards

May 08, 2025 -

Bitcoins Current Rebound A Comprehensive Market Overview

May 08, 2025

Bitcoins Current Rebound A Comprehensive Market Overview

May 08, 2025

Latest Posts

-

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025 -

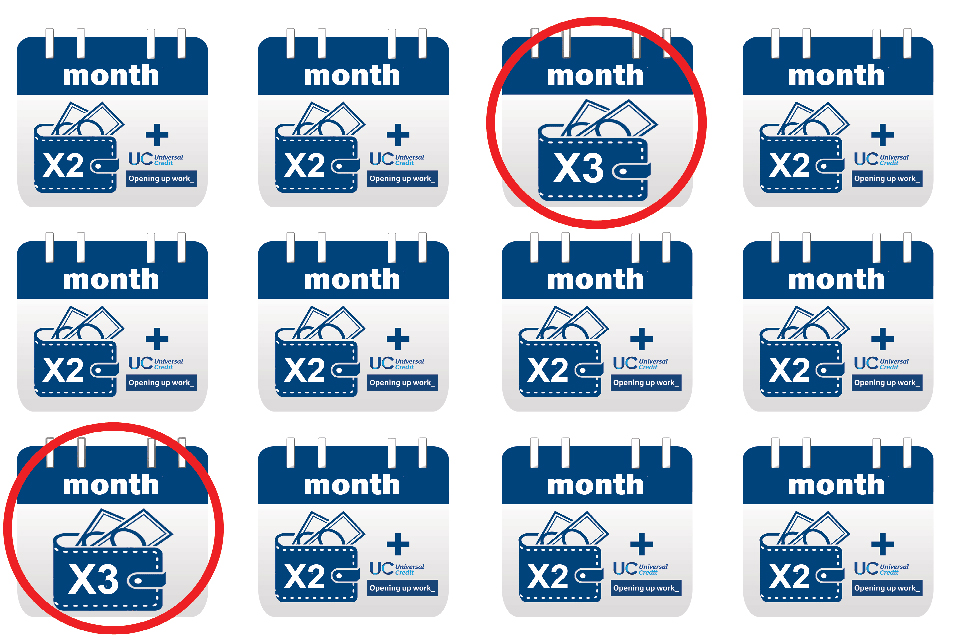

Universal Credit Back Payments Are You Eligible For A Refund

May 08, 2025

Universal Credit Back Payments Are You Eligible For A Refund

May 08, 2025 -

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025 -

Colin Cowherd Criticizes Jayson Tatum Following Celtics Game 1 Defeat

May 08, 2025

Colin Cowherd Criticizes Jayson Tatum Following Celtics Game 1 Defeat

May 08, 2025 -

Missing Dwp Letter 6 828 Costly Mistake

May 08, 2025

Missing Dwp Letter 6 828 Costly Mistake

May 08, 2025