Tuesday's CoreWeave (CRWV) Stock Dip: A Detailed Explanation

Table of Contents

H2: Market-Wide Factors Influencing CRWV Stock Performance

Several broader market forces likely played a role in Tuesday's CoreWeave stock decline.

H3: Overall Market Sentiment and Volatility:

Tuesday's market displayed a degree of volatility, impacting even strong performers like CoreWeave. The overall market sentiment was somewhat negative, possibly influenced by [insert specific economic news or events that impacted the market on that day, e.g., a concerning inflation report, geopolitical uncertainty]. This general negativity could have triggered a sell-off across various sectors, including cloud computing. Major indices like the S&P 500 and Nasdaq experienced [mention percentage changes] on that day, reflecting the broad market downturn. This market volatility and negative sentiment likely contributed to the decrease in CRWV's stock price.

- Market volatility created uncertainty among investors.

- Negative market sentiment led to widespread selling.

- Poor index performance dragged down many stocks, including CRWV.

H3: Sector-Specific Trends Affecting Cloud Computing Stocks:

The cloud computing sector, while generally robust, isn't immune to market fluctuations. On Tuesday, [mention any specific negative news related to the cloud computing sector, e.g., a regulatory announcement, a competitor's strong performance, or concerns about a specific technology]. This sector-specific pressure, combined with the broader market downturn, may have exacerbated the decline in CoreWeave's stock. Other cloud computing stocks, such as [mention examples], also experienced [mention their performance on that day for comparison].

- Negative news within the cloud computing sector impacted investor confidence.

- Increased competition or regulatory concerns could have affected CRWV's valuation.

- Comparison with other cloud stocks helps to contextualize CRWV’s performance.

H2: CoreWeave (CRWV)-Specific News and Events

In addition to market-wide factors, several CoreWeave-specific elements might have influenced Tuesday's stock dip.

H3: Absence of Positive Catalysts:

The absence of positive news or announcements from CoreWeave itself might have contributed to the downward pressure on its stock. Positive catalysts, such as strong earnings reports, strategic partnerships, or product launches, are crucial for maintaining investor confidence and driving stock prices upwards. The lack of such positive news on Tuesday might have left the stock vulnerable to broader market pressures.

- No significant positive announcements were made by CoreWeave on Tuesday.

- The absence of positive catalysts left the stock susceptible to negative market sentiment.

- Positive news events are vital for sustaining positive investor sentiment.

H3: Potential Negative News or Speculation:

While no major negative news was officially released by CoreWeave on Tuesday, market rumors or speculation could have played a part. [Mention any rumors or speculation that circulated, if applicable, and assess their credibility and potential impact]. Such negative sentiment, even if unfounded, can significantly impact stock prices.

- Market rumors and speculation can influence investor decisions.

- Negative news, even if unsubstantiated, can create selling pressure.

- It’s crucial to evaluate the credibility of market rumors before making investment decisions.

H3: Technical Analysis of CRWV Stock Chart:

A brief look at the CRWV stock chart on Tuesday might reveal technical indicators contributing to the decline. [Mention any relevant technical indicators, such as the breaking of a support level or a negative trend in moving averages. Keep this section concise and avoid highly technical jargon]. These technical factors, while not the sole cause, could have amplified the downward movement.

- Technical analysis provides additional insights into the price movements.

- Support and resistance levels can predict potential price changes.

- Technical indicators provide an additional layer to interpreting stock price changes.

H2: Investor Sentiment and Trading Activity

Investor behavior also plays a significant role in shaping stock prices.

H3: Increased Selling Pressure:

Tuesday likely witnessed a significant increase in the selling volume of CRWV shares. This increased selling pressure could be attributed to several factors, including profit-taking by investors who had previously benefited from CRWV's upward trajectory or a general risk-aversion response to the broader market downturn.

- High trading volume indicated significant selling activity.

- Profit-taking could have contributed to the increased selling pressure.

- Risk aversion in the broader market might have triggered selling.

H3: Short Selling and Its Potential Impact:

[If applicable, analyze the potential role of short selling in the stock price decline. Discuss the implications of increased short interest]. Short selling, while a normal part of the market, can amplify downward pressure in certain situations.

H3: Conclusion: Analyzing the CoreWeave (CRWV) Stock Dip and Looking Ahead

Tuesday's CoreWeave (CRWV) stock dip resulted from a combination of market-wide factors, including broader market volatility and negative sector-specific trends, and potentially company-specific elements, such as the absence of positive catalysts and the influence of market rumors. Understanding the context of these various elements is crucial for interpreting stock market fluctuations. While the future performance of CRWV remains uncertain, ongoing monitoring of market conditions and company news is essential. Stay updated on CoreWeave (CRWV) stock trends and monitor CoreWeave (CRWV) market performance closely. Further research on CRWV stock is crucial before making any investment decisions.

Featured Posts

-

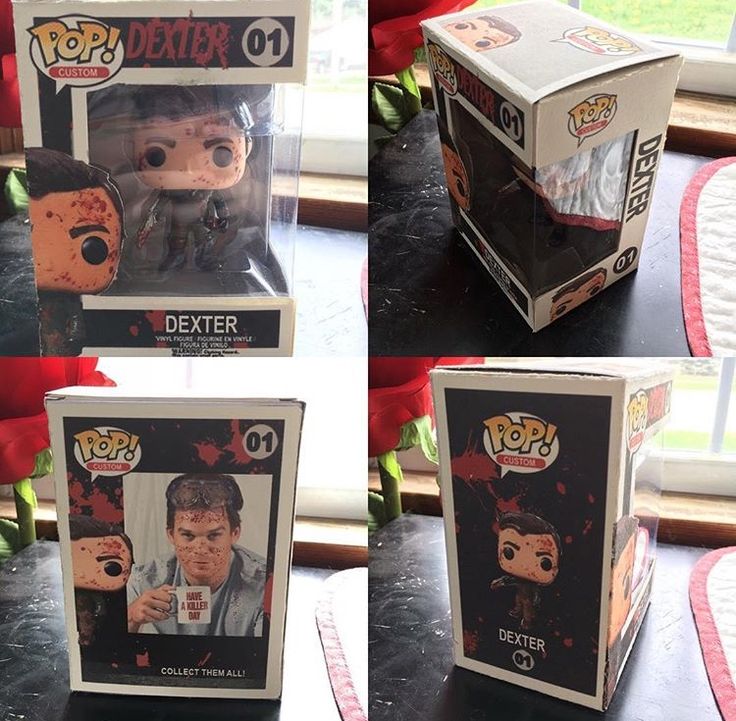

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025

Dexter Funko Pop Figures A Collectors Guide

May 22, 2025 -

Thames Water Executive Compensation An Analysis Of Recent Figures

May 22, 2025

Thames Water Executive Compensation An Analysis Of Recent Figures

May 22, 2025 -

Wordle 1358 Saturday March 8th Hints And Answer

May 22, 2025

Wordle 1358 Saturday March 8th Hints And Answer

May 22, 2025 -

David Walliams Slams Simon Cowell In Bitter Britains Got Talent Dispute

May 22, 2025

David Walliams Slams Simon Cowell In Bitter Britains Got Talent Dispute

May 22, 2025 -

Understanding The Sound Perimeter Musics Role In Our Lives

May 22, 2025

Understanding The Sound Perimeter Musics Role In Our Lives

May 22, 2025