Two Days Of Crypto Chaos: A Party Retrospective

Table of Contents

Bitcoin plummeted 15% in a single day, sending shockwaves through the crypto community and leaving many investors reeling. This wasn't an isolated incident; the entire cryptocurrency market experienced a dramatic two-day rollercoaster, a period we'll analyze as "Two Days of Crypto Chaos." This article provides a retrospective analysis of those tumultuous 48 hours, exploring the triggers, ripple effects, and lessons learned from this significant market event. We will examine the volatility and its impact, providing insights into navigating future periods of similar crypto market turbulence.

The Initial Trigger: Unpacking the Catalyst for the Crash

The initial trigger for this period of intense crypto market volatility was a confluence of factors, rather than a single event. While pinpointing the exact cause is difficult, several key elements contributed to the downturn.

-

Regulatory Uncertainty: Increased regulatory scrutiny in several major jurisdictions, particularly concerning stablecoins and exchanges, created a climate of fear and uncertainty. This uncertainty led to significant sell-offs as investors sought to reduce their exposure to potentially higher-risk assets.

-

Whale Sell-Offs: Large institutional investors ("whales") initiating significant sell-offs exacerbated the downward pressure. Their actions, amplified by algorithmic trading bots, contributed significantly to the rapid price drops seen across the board.

-

Negative Market Sentiment: A general negative sentiment surrounding the broader economic landscape played a role. Fears of rising interest rates and potential recession further dampened investor confidence, impacting not only crypto but traditional markets as well. This macroeconomic anxiety fueled further selling in the already volatile crypto market.

The impact on various cryptocurrencies was widespread. Bitcoin, the dominant cryptocurrency, experienced the most significant drop, followed closely by Ethereum and a broad range of altcoins. The following chart (insert chart here illustrating price movements of Bitcoin and Ethereum during the two-day period) clearly illustrates the severity of the price swings.

- Specific Examples: Bitcoin fell by 15%, Ethereum by 12%, and many altcoins experienced even steeper declines.

- Key Players: While specific whales were not publicly identified, the scale of the sell-offs pointed to substantial institutional involvement.

- News Sources: [Link to relevant news articles reporting on regulatory changes and market events].

The Ripple Effect: How the Chaos Spread Across the Market

The initial crash had a profound ripple effect across the entire cryptocurrency ecosystem. The correlation between different crypto assets was high, with almost all experiencing significant price drops. This highlighted the interconnectedness of the market and the systemic risk inherent in such a volatile environment.

- Altcoin Plunge: Numerous altcoins suffered double-digit percentage losses, with many smaller-cap projects experiencing particularly steep declines.

- DeFi Liquidations: The volatility led to significant liquidations within decentralized finance (DeFi) protocols, as automated liquidation mechanisms triggered margin calls on leveraged positions.

- Market Capitalization: The combined market capitalization of all cryptocurrencies experienced a dramatic drop, reflecting the overall panic and sell-off.

The impact on DeFi was particularly noteworthy. Several DeFi lending and borrowing protocols experienced a surge in liquidations as leveraged positions were unwound. This led to further downward pressure on crypto prices as users scrambled to cover their positions.

Social Media Sentiment: A Rollercoaster of Fear, Uncertainty, and Doubt (FUD)

Social media platforms became a battleground of opinions during the "Two Days of Crypto Chaos." Fear, uncertainty, and doubt (FUD) were rampant, with many investors expressing anxieties and concerns about the future of the market.

- Trending Hashtags: #CryptoCrash, #BitcoinCrash, #CryptoMarket, dominated Twitter and other platforms.

- Influencer Opinions: Prominent crypto influencers played a significant role in shaping public sentiment, with some amplifying fears while others attempted to offer reassurance.

- Social Media Manipulation: Concerns emerged about potential manipulation of social media sentiment, with accusations of coordinated FUD campaigns to drive prices down.

The rapid spread of information (and misinformation) on social media amplified the panic and contributed to the market's volatility. The role of social media in shaping investor behavior during such events cannot be understated.

Winners and Losers: Who Benefited (or Suffered) the Most?

While most investors suffered during the "Two Days of Crypto Chaos," some assets and strategies performed relatively well.

- Safe Haven Assets: Some stablecoins, although affected, held up better than other assets, offering some degree of stability during the turmoil. Certain established projects with strong fundamentals also showed more resilience.

- Hard Hit Projects: Smaller, less established projects with weak fundamentals suffered the most, experiencing significant price drops and even project failures.

- Diversification: Investors who had diversified their portfolios across different crypto assets and traditional investments fared better than those heavily concentrated in a single asset or sector.

The divergence in performance highlighted the importance of careful due diligence and risk management. Investors who had implemented sound risk management strategies and diversified their portfolios were better positioned to weather the storm.

Conclusion: Learning from the Two Days of Crypto Chaos

The "Two Days of Crypto Chaos" served as a stark reminder of the inherent volatility of the cryptocurrency market. Understanding market volatility and implementing effective risk management strategies are crucial for navigating the crypto space. Diversification, careful due diligence, and a realistic understanding of risk are essential for long-term success. This period highlighted the interconnectedness of the crypto market, the impact of regulatory uncertainty, and the powerful role of social media in shaping investor sentiment. Staying informed about market trends and developing a robust investment strategy are critical to mitigate the effects of future periods of volatility, whether it's another "Two Days of Crypto Chaos" or other market events. Continue learning about crypto market analysis and risk management strategies to prepare yourself for future challenges in this dynamic sector.

Featured Posts

-

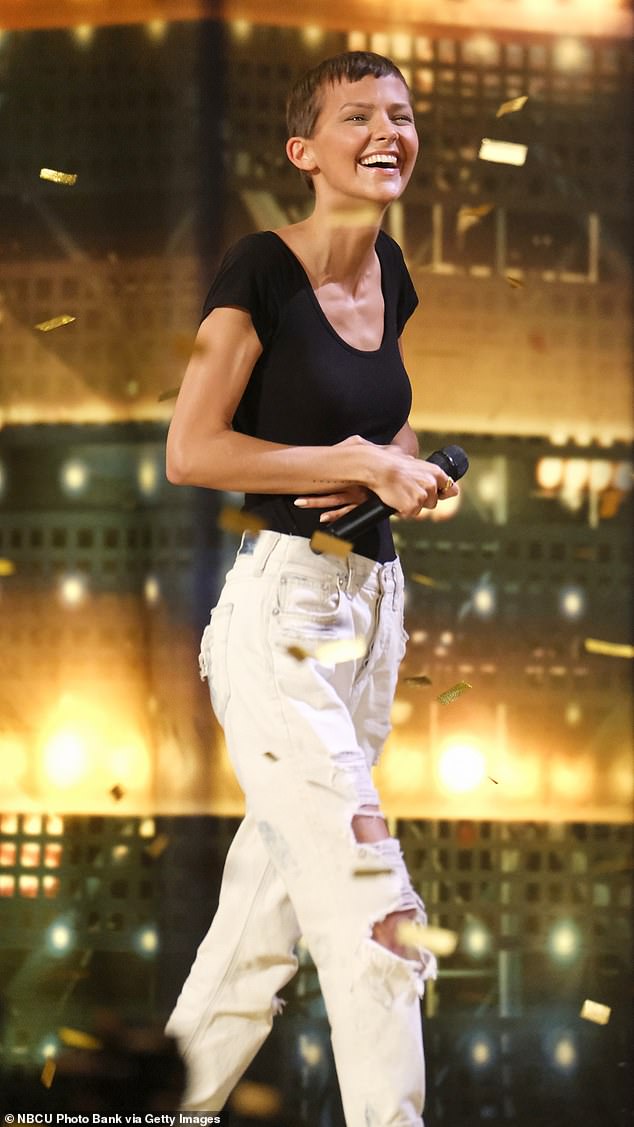

Britains Got Talent Child Contestant Withdraws On Air

May 04, 2025

Britains Got Talent Child Contestant Withdraws On Air

May 04, 2025 -

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 04, 2025

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 04, 2025 -

Live Stream Canelo Vs Ggg Get The Results And Play By Play Action

May 04, 2025

Live Stream Canelo Vs Ggg Get The Results And Play By Play Action

May 04, 2025 -

Molchanie Narusheno Dzhidzhi Khadid O Romane S Kuperom

May 04, 2025

Molchanie Narusheno Dzhidzhi Khadid O Romane S Kuperom

May 04, 2025 -

Nelson Dong Triumphs In Apo Main Event Winning A 390 000

May 04, 2025

Nelson Dong Triumphs In Apo Main Event Winning A 390 000

May 04, 2025