Two Stocks Poised To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: [Company Name 1] – The Disruptive [Industry 1] Player

[Company Name 1], a leader in the [Industry 1] sector, is poised for significant growth, potentially surpassing Palantir in market value within the next three years. Its innovative approach and strong market position make it a compelling investment opportunity.

[Company Name 1]'s Innovative Technology and Market Position

- Unique Selling Proposition (USP): [Company Name 1] boasts [briefly explain the USP, e.g., a proprietary AI algorithm for [specific application] that offers superior accuracy and efficiency compared to competitors]. This gives them a significant competitive edge in the rapidly expanding [Industry 1] market.

- Technological Breakthroughs: Recent breakthroughs in [mention specific technological advancements, e.g., quantum computing, advanced AI, etc.] have significantly enhanced the capabilities of their [product/service], attracting high-profile clients and boosting revenue.

- Market Disruption: [Company Name 1] is disrupting the traditional [Industry 1] landscape with its innovative solutions. This disruptive force, combined with strong revenue growth of [percentage]% year-over-year, strongly suggests its potential to outpace Palantir. [Company Name 1] stock is therefore a compelling prospect for growth-oriented investors.

[Company Name 1]'s Strategic Partnerships and Future Growth Prospects

- Strategic Alliances: Recent partnerships with [mention key partners, e.g., major tech firms, government agencies] will open new markets and expand their customer base significantly. These strategic alliances position [Company Name 1] for substantial future growth.

- Market Expansion Plans: The company is actively expanding into [mention key geographical markets or industry segments] to fuel further growth. Their global expansion strategy indicates a clear path to capturing a larger market share.

- Investment Opportunities: [Company Name 1]'s innovative technology and strategic partnerships create significant investment opportunities for those seeking exposure to the high-growth [Industry 1] sector.

Stock #2: [Company Name 2] – Riding the Wave of [Trend]

[Company Name 2] is ideally positioned to capitalize on the explosive growth of the [Trend] market, making it another strong contender to surpass Palantir's valuation within three years.

[Company Name 2]'s Capitalization on the [Trend] Boom

- Business Model: [Company Name 2]'s business model is directly aligned with the burgeoning [Trend] market, leveraging [explain how they leverage the trend]. This allows them to efficiently capture a large share of the expanding market.

- Growth Trajectory: [Company Name 2] has demonstrated impressive growth, with [mention specific growth metrics, e.g., a consistent increase in user base, exponential revenue growth]. This robust growth trajectory makes it a compelling investment opportunity.

- Investment Potential: The [Trend] market is expected to continue its rapid expansion for the foreseeable future, offering significant investment potential for [Company Name 2] and its shareholders. [Company Name 2] stock provides exposure to this high-growth market.

[Company Name 2]'s Strong Financials and Management Team

- Financial Performance: [Company Name 2] boasts strong financial performance, with [mention key financial indicators, e.g., increasing revenue, high profit margins, low debt levels]. This financial strength provides a solid foundation for future growth.

- Strong Management: The experienced and highly capable management team at [Company Name 2] has a proven track record of success in the [Industry 2] sector. Their expertise provides confidence in the company's ability to execute its growth strategy.

- Long-Term Investment: [Company Name 2] represents a promising long-term investment opportunity for investors seeking exposure to the high-growth [Trend] market. Their strong financials and capable management team bolster this outlook.

Conclusion: Investing in the Future – Beyond Palantir

Both [Company Name 1] and [Company Name 2] present compelling cases for outperforming Palantir in the next three years. Their innovative technologies, strategic positioning, and strong financial performance suggest significant growth potential. [Company Name 1]'s disruptive force in the [Industry 1] sector and [Company Name 2]'s strategic alignment with the rapidly expanding [Trend] market make them attractive options for investors seeking high-growth opportunities.

To capitalize on these promising investment opportunities, we encourage you to conduct thorough due diligence and consider these stocks as part of a diversified portfolio. To learn more about investing in high-growth stocks like these, or to discuss these stocks with a financial professional, contact a qualified financial advisor today. Consider exploring stocks to outperform Palantir for further research and to find other promising future tech investments.

Featured Posts

-

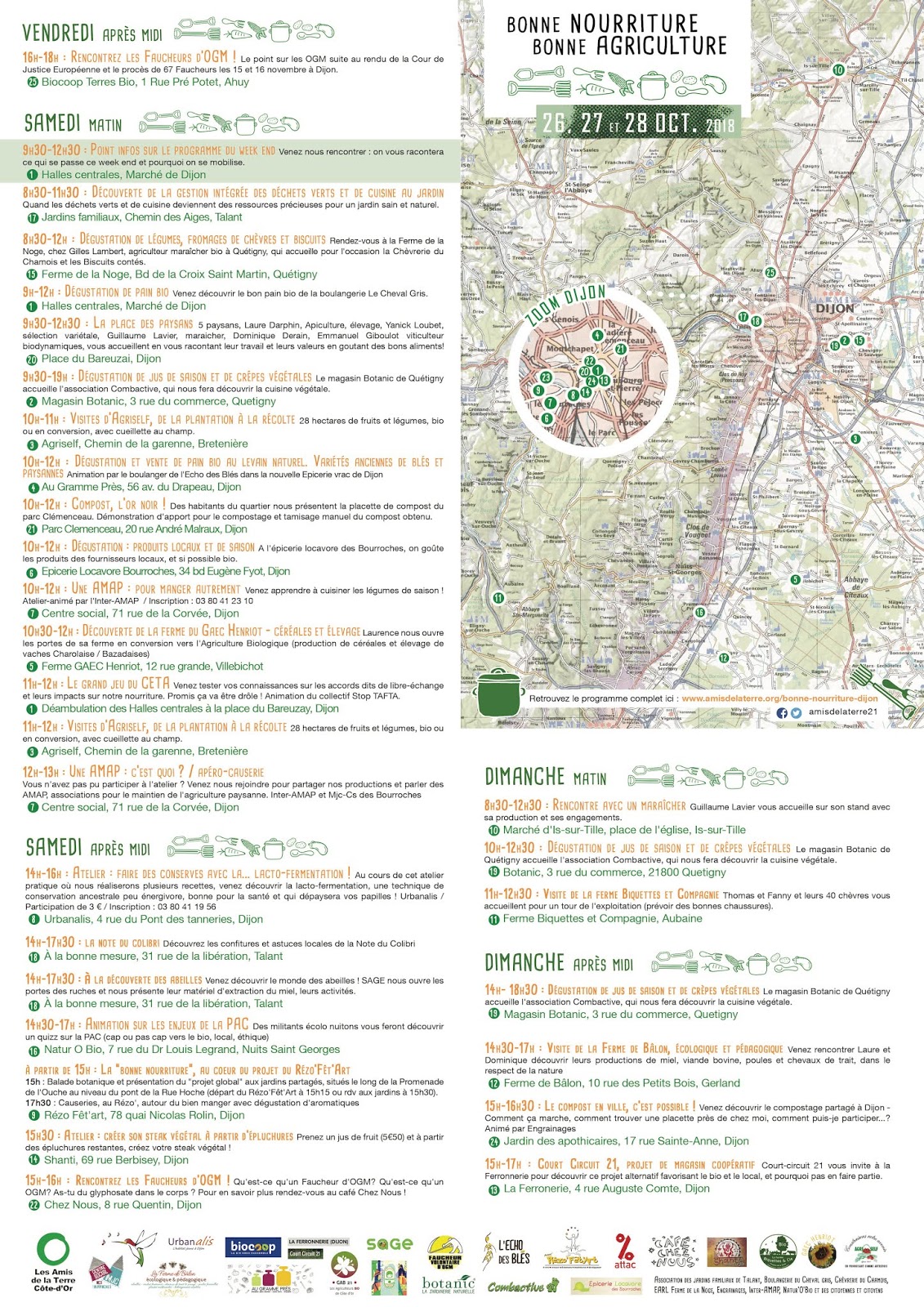

Strategie Ecologiste Pour Les Municipales A Dijon En 2026

May 10, 2025

Strategie Ecologiste Pour Les Municipales A Dijon En 2026

May 10, 2025 -

Warren Buffett Jeff Bezos Among Billionaires Hurt By Trump Tariffs

May 10, 2025

Warren Buffett Jeff Bezos Among Billionaires Hurt By Trump Tariffs

May 10, 2025 -

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram

May 10, 2025

Nyt Spelling Bee April 4 2025 Clues Hints And Pangram

May 10, 2025 -

Landlord Price Gouging In The Wake Of La Fires A Selling Sunset Stars Perspective

May 10, 2025

Landlord Price Gouging In The Wake Of La Fires A Selling Sunset Stars Perspective

May 10, 2025 -

Nyt Strands Puzzle April 9 2025 Theme Spangram And Answers

May 10, 2025

Nyt Strands Puzzle April 9 2025 Theme Spangram And Answers

May 10, 2025