U.S.-China Tariff Rollback: Economic Implications For American Businesses And Consumers

Table of Contents

Impact on American Businesses

A U.S.-China tariff rollback would dramatically reshape the economic landscape for many American businesses. The impact would be felt across various sectors, influencing profitability, investment decisions, and overall competitiveness.

Reduced Production Costs

Lowering tariffs on goods imported from China would directly translate to reduced production costs for American businesses. This is particularly relevant for businesses in manufacturing, retail, and technology sectors heavily reliant on Chinese-made components or finished products.

- Lower import prices: Businesses would face lower costs for raw materials, components, and finished goods sourced from China.

- Increased profit margins: Reduced input costs directly boost profit margins, allowing businesses to reinvest profits or lower prices for consumers.

- Enhanced global competitiveness: Lower production costs enhance the price competitiveness of American-made goods in both domestic and international markets.

- Potential for job creation: Increased profitability could lead to expansion and hiring, creating jobs within the affected industries.

For example, a U.S. furniture manufacturer relying on Chinese-made wood components would see a significant drop in their production costs, increasing their profit margin and allowing for potential expansion or price reductions for consumers.

Supply Chain Restructuring

The complexities of global supply chains have been highlighted by recent trade tensions. A tariff rollback could simplify the process of supply chain restructuring, though challenges remain. Shifting production away from China, a process known as "reshoring" or "nearshoring," has significant costs and logistical hurdles. However, a more stable trade relationship with China could mitigate these risks.

- Streamlined supply chains: A rollback simplifies supply chain management, reducing the need for complex workarounds and multiple sourcing locations.

- Reduced logistics costs: Reduced tariffs lead to lower shipping and handling costs, improving overall efficiency.

- Improved delivery times: Simpler supply chains translate into faster delivery times, reducing lead times and inventory costs.

- Less reliance on a single sourcing nation: While still significant, China's dominance in the global supply chain would lessen, reducing geopolitical risk.

The potential for streamlined supply chains offers significant advantages. Companies would experience reduced lead times, decreased logistics expenses, and a more predictable production environment.

Investment and Growth

Reduced tariffs can act as a powerful stimulus for business investment and overall economic growth. The certainty provided by a stable trade environment encourages both domestic and foreign investment.

- Increased capital expenditures: Businesses are more likely to invest in expansion, modernization, and new technologies when facing reduced trade uncertainties.

- Job creation and economic growth: Increased investment generates jobs and contributes to broader economic expansion.

- Stimulated innovation: A stable business environment encourages research and development, fostering innovation and technological advancement.

- Enhanced competitiveness: Reduced costs and increased investment improve the competitiveness of American businesses in the global marketplace.

A significant influx of Foreign Direct Investment (FDI) is a likely outcome, further boosting economic activity and creating new employment opportunities.

Impact on American Consumers

The consequences of a U.S.-China tariff rollback extend directly to American consumers through lower prices, increased choice, and potential shifts in inflation.

Lower Prices for Goods

A significant benefit of a tariff rollback is the anticipated drop in prices for various consumer goods. This is especially true for products heavily reliant on Chinese manufacturing, such as electronics, clothing, and household appliances.

- Reduced cost of goods: Lower import tariffs directly translate into lower prices for consumers at retail stores.

- Increased consumer purchasing power: Lower prices increase the purchasing power of consumers, allowing them to buy more goods or services.

- Higher disposable income: Reduced spending on essential goods frees up disposable income for consumers to spend on other things.

- Stimulated consumer demand: Lower prices boost consumer demand, driving economic growth through increased spending.

For example, the price of smartphones and other electronics could decrease significantly, increasing consumer spending and overall economic activity.

Increased Consumer Choice

Reduced trade barriers lead to increased competition and a wider variety of goods for consumers. This wider selection allows for greater choice, potentially driving down prices further.

- Wider product selection: Consumers would have access to a greater variety of brands, styles, and features.

- Increased competition: More imported goods lead to increased competition among suppliers, driving down prices and improving quality.

- Better quality at lower prices: Increased competition encourages businesses to offer higher quality goods at competitive prices.

- Greater consumer satisfaction: Consumers benefit from increased choice, better value, and improved product quality.

This wider selection empowers consumers to find products that better meet their needs and preferences.

Inflationary Pressures: A Nuanced Perspective

While a tariff rollback generally lowers prices, it's crucial to consider potential inflationary pressures. A sudden increase in demand without a corresponding increase in supply could lead to inflation.

- Potential for increased demand-pull inflation: Lower prices could stimulate demand, potentially outstripping supply and pushing prices upward.

- Impact on wages and salaries: Increased demand could lead to higher wages and salaries, pushing up production costs and contributing to inflation.

- Balancing increased demand with supply capacity: Careful management is necessary to avoid situations where increased demand outpaces supply, leading to inflationary pressures.

However, increased competition spurred by the tariff rollback could also offset these inflationary pressures, leading to a more balanced outcome.

Geopolitical Considerations

The U.S.-China trade relationship is deeply intertwined with geopolitical considerations. A tariff rollback would have significant implications for the overall political climate and international relations. It might influence relations with other trading partners and impact global trade dynamics. A reduction in tensions between the two superpowers could improve overall global economic stability.

Conclusion

The potential for or actuality of a U.S.-China tariff rollback presents a complex array of economic implications for American businesses and consumers. While a rollback promises benefits such as reduced production costs, increased consumer choice, and stimulated economic growth, potential challenges like inflationary pressures and supply chain complexities must be addressed. Understanding the multifaceted impacts – both positive and negative – is crucial for navigating this evolving trade landscape. Stay updated on U.S.-China tariff rollbacks and their potential effects on the American economy. Understanding U.S.-China tariff changes is crucial for businesses to adapt and consumers to make informed decisions.

Featured Posts

-

Will Trumps Executive Order Lower Drug Costs An Analysis

May 13, 2025

Will Trumps Executive Order Lower Drug Costs An Analysis

May 13, 2025 -

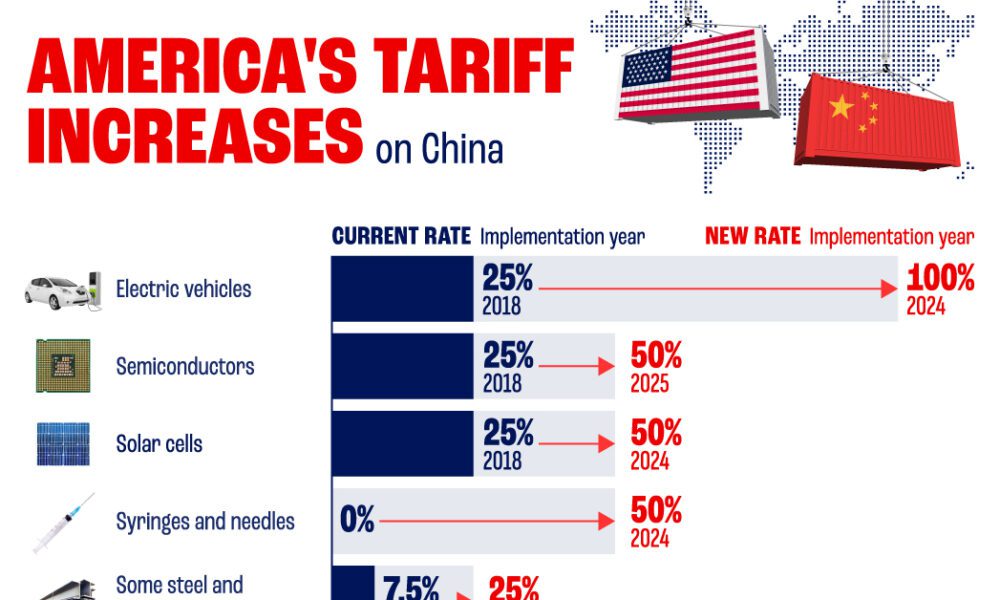

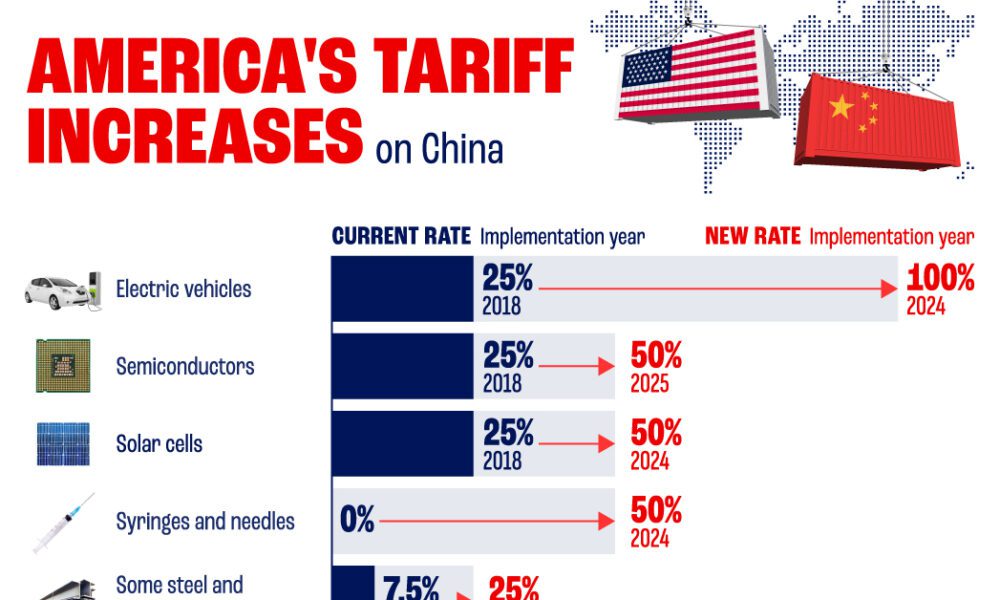

2024 100

May 13, 2025

2024 100

May 13, 2025 -

Peregovory O Bezopasnosti Velikobritaniya I Es Na Poroge Soglasheniya

May 13, 2025

Peregovory O Bezopasnosti Velikobritaniya I Es Na Poroge Soglasheniya

May 13, 2025 -

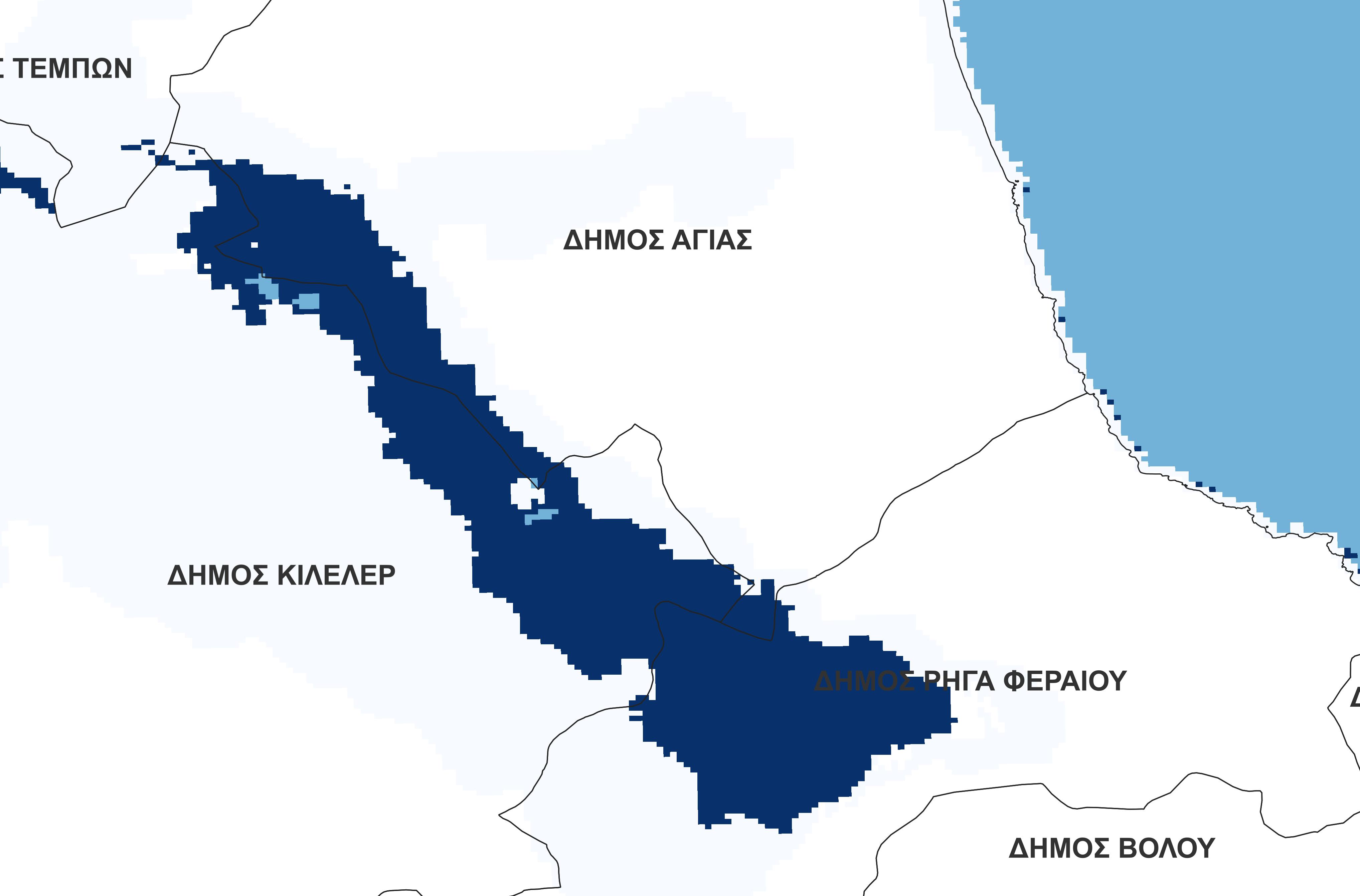

Megalos Kataklysmos Mesogeioy Nea Dedomena Gia Tin Plimmyra

May 13, 2025

Megalos Kataklysmos Mesogeioy Nea Dedomena Gia Tin Plimmyra

May 13, 2025 -

Local Happenings Earth Day Celebration May Day Parade And Junior League Gala

May 13, 2025

Local Happenings Earth Day Celebration May Day Parade And Junior League Gala

May 13, 2025