U.S. Economic Slowdown: 0.2% Drop Reflects Spending Weakness And Tariffs

Table of Contents

Weakness in Consumer Spending: A Major Driver of the U.S. Economic Slowdown

Consumer spending forms the backbone of the U.S. economy, accounting for roughly 70% of GDP. Any significant decline in this sector has far-reaching consequences. Recent data reveals a noticeable decrease in consumer spending, a key factor contributing to the current U.S. economic slowdown. Several factors are at play:

-

Rising Inflation: Soaring inflation has eroded purchasing power, leaving consumers with less disposable income. The rising cost of essential goods like food and energy forces households to cut back on discretionary spending. This impacts various sectors, from retail to entertainment.

-

Increased Interest Rates: The Federal Reserve's efforts to combat inflation through interest rate hikes have made borrowing more expensive. This affects both consumers and businesses. Higher interest rates translate to increased costs for mortgages, auto loans, and credit card debt, reducing consumer spending capacity.

-

Economic Uncertainty: Concerns about future economic prospects, including potential job losses and further inflation spikes, have led many consumers to adopt a more cautious approach to spending, opting to save rather than spend. This uncertainty is a significant drag on economic growth.

The chart below illustrates the recent decline in consumer confidence and its correlation with reduced spending. [Insert relevant chart/graph here showing decline in consumer spending and confidence].

The Impact of Tariffs on the U.S. Economic Slowdown

Tariffs, essentially taxes on imported goods, were implemented with the intention of protecting domestic industries and boosting domestic production. However, the unintended consequences have contributed significantly to the U.S. economic slowdown.

-

Increased Prices for Consumers: Tariffs increase the cost of imported goods, leading to higher prices for consumers. This reduces purchasing power and further dampens consumer spending.

-

Negative Impact on Businesses: Businesses reliant on imported goods or components face higher input costs, forcing them to either absorb these costs or pass them on to consumers, ultimately impacting competitiveness and profitability.

-

Trade War Implications: The imposition of tariffs often triggers retaliatory measures from other countries, leading to trade wars that disrupt global supply chains and harm international trade. This ripple effect negatively impacts economic growth across the board.

For example, tariffs on steel and aluminum significantly impacted the automotive industry, leading to higher vehicle prices and reduced sales. The disruption of supply chains due to trade disputes has also hampered economic activity.

Other Contributing Factors to the U.S. Economic Slowdown

Beyond consumer spending and tariffs, other factors are contributing to the current economic slowdown:

-

Global Economic Uncertainty: Global factors, such as the war in Ukraine and energy price volatility, add to the existing economic uncertainty, affecting investor confidence and investment decisions.

-

Geopolitical Events: Geopolitical instability and international tensions can create uncertainty, reducing investment and hindering economic growth.

-

Housing Market Slowdown: The housing market, a key driver of economic activity, has shown signs of cooling down, impacting construction and related industries.

Potential Consequences of the U.S. Economic Slowdown

The current U.S. economic slowdown poses several significant risks:

-

Increased Unemployment: A slowing economy often translates to job losses as businesses reduce operations or lay off workers to cut costs.

-

Stock Market Volatility: Economic uncertainty can lead to increased volatility in the stock market, potentially impacting investor confidence and retirement savings.

-

Recession Risk: A prolonged slowdown could increase the risk of a recession, a period of significant economic contraction.

-

Government Intervention: The government may need to intervene with fiscal or monetary policies to stimulate the economy and mitigate the negative impacts of the slowdown. This could involve increased government spending or further adjustments to interest rates.

Understanding and Navigating the U.S. Economic Slowdown

The 0.2% drop in GDP growth is a serious warning sign. The confluence of weak consumer spending, the lingering impact of tariffs, and other contributing factors has created a challenging economic climate. The potential consequences, including increased unemployment and the risk of a recession, cannot be ignored. It's crucial to stay informed about the evolving situation. Understanding the complexities of the U.S. economic slowdown is crucial for navigating these uncertain times. Stay informed about the evolving U.S. economic slowdown by subscribing to our newsletter for regular updates and expert insights.

Featured Posts

-

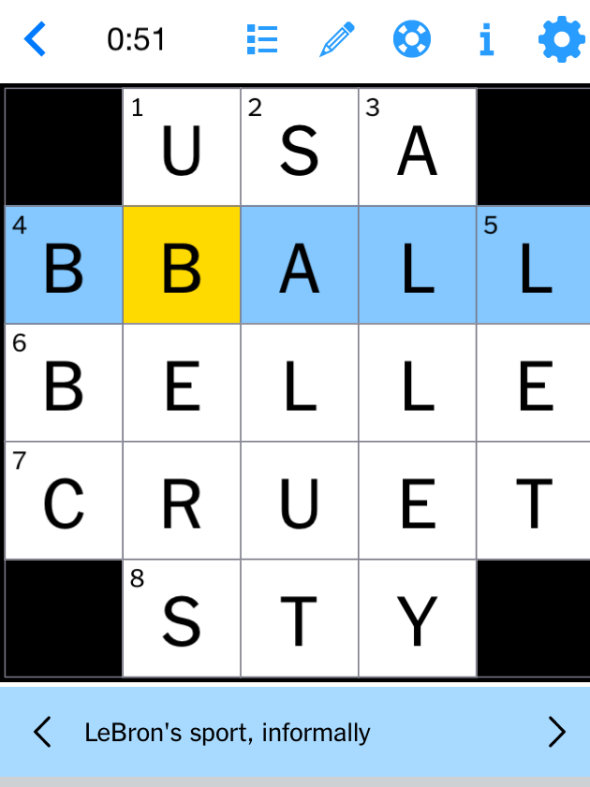

Marvel The Avengers Crossword Clue Nyt Mini Crossword Answers May 1st

May 31, 2025

Marvel The Avengers Crossword Clue Nyt Mini Crossword Answers May 1st

May 31, 2025 -

Historic Meeting Pope Leo Xiv Greets Giro D Italia Peloton

May 31, 2025

Historic Meeting Pope Leo Xiv Greets Giro D Italia Peloton

May 31, 2025 -

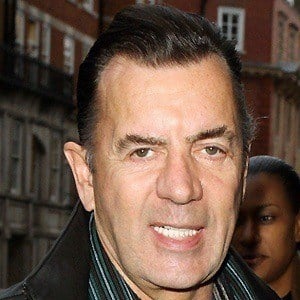

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025 -

Alcarazs Rome Triumph Key Moments From The Italian International

May 31, 2025

Alcarazs Rome Triumph Key Moments From The Italian International

May 31, 2025 -

Rejets Toxiques Sanofi Le Geant Pharmaceutique Refute Les Accusations

May 31, 2025

Rejets Toxiques Sanofi Le Geant Pharmaceutique Refute Les Accusations

May 31, 2025