U.S. Fed Holds Rates Amid Inflation And Unemployment Concerns

Table of Contents

Inflationary Pressures and the Fed's Response

The current inflation rate remains a significant concern for the U.S. Federal Reserve. While showing signs of cooling, inflation is still stubbornly above the Fed's target of 2%. Several factors contribute to this persistent inflationary pressure. Supply chain disruptions, though easing, continue to impact the availability and cost of goods. Elevated energy prices, driven by geopolitical factors and increased demand, further fuel inflation. Strong consumer demand, fueled in part by robust job growth, also plays a role.

- CPI (Consumer Price Index): Recent CPI data shows a continued, albeit slowing, increase in prices, suggesting that inflation, while easing, hasn't yet reached the Fed's comfort zone.

- PPI (Producer Price Index): The PPI, which measures inflation at the wholesale level, also remains elevated, indicating that inflationary pressures persist throughout the supply chain.

- Impact on Spending and Investment: High inflation erodes consumer purchasing power, potentially dampening consumer spending and impacting business investment decisions.

The Fed's justification for holding rates likely stems from a cautious approach. While further inflation is a risk, raising rates too aggressively could trigger a recession, jeopardizing employment gains. The delicate balancing act between curbing inflation without harming economic growth is the core challenge for the central bank.

Unemployment Rates and the Labor Market

The current unemployment rate sits at a historically low level. This reflects a robust labor market, with significant job creation in recent months. However, this tight labor market contributes to upward pressure on wages, potentially feeding into inflationary pressures—a classic wage-price spiral. The complexities of the labor market include persistent labor shortages in certain sectors, leading to increased competition for workers and wage increases.

- Job Growth: Recent job growth figures remain positive, indicating a strong labor market. However, the pace of job growth might be slowing, reflecting the cooling economy.

- Wage Growth: Wage growth continues to outpace inflation in some sectors, but overall, the increases are moderating, reflecting potential cooling in the economy.

- Workforce Participation Rate: The workforce participation rate remains below pre-pandemic levels, suggesting there's still room for growth in the labor force.

The Fed carefully considers the unemployment rate when deciding on interest rate policy. While low unemployment is generally positive, excessively low unemployment can exacerbate inflation. The risk of raising rates too quickly is the potential for increased job losses and a slowing economy.

Economic Forecasts and Future Fed Actions

Economic forecasts for the coming months vary, but a general consensus suggests that inflation will continue to cool gradually, while unemployment might remain relatively low, but potentially see a slight uptick. The Fed's future actions will largely depend on the incoming economic data.

- Scenario 1: Continued Rate Holds: If inflation cools further and unemployment remains stable, the Fed might continue to hold rates steady, allowing the economy to adjust gradually.

- Scenario 2: Gradual Rate Increases: If inflation remains persistent, the Fed might opt for gradual interest rate increases to bring inflation back to its target level without triggering a recession.

- Scenario 3: Aggressive Rate Hikes: A rapid acceleration of inflation could prompt the Fed to adopt more aggressive rate hikes, risking a sharper economic slowdown.

These scenarios have significant implications for businesses and investors, influencing investment decisions, borrowing costs, and overall economic growth. Uncertainty remains high, and the Fed’s ability to precisely control inflation and unemployment is limited given the complex and dynamic nature of the economy.

Market Reactions to the Fed's Decision

The immediate market reaction to the Fed's decision to hold rates was relatively muted. Stock markets showed a slightly positive response, reflecting some relief that the Fed wasn't implementing more aggressive rate hikes. Bond yields also reacted modestly. The long-term implications will depend on how inflation and the labor market evolve.

- Stock Market Performance: Stock markets generally reacted positively, although the response was not dramatic.

- Changes in Bond Yields: Bond yields remained relatively stable, reflecting investor confidence in the Fed's measured approach.

- Impact on the Dollar and Exchange Rates: The U.S. dollar's exchange rate was relatively unaffected by the announcement.

Investor sentiment remains cautiously optimistic, although uncertainty persists regarding future Fed actions and the broader economic outlook. The continued interplay between inflation, unemployment, and the Fed's response will shape market behavior in the coming months.

Conclusion: Understanding the U.S. Fed Holds Rates Decision

The U.S. Fed's decision to hold rates reflects a careful consideration of the current economic climate, balancing the risks of persistent inflation against the potential for job losses. The ongoing tension between inflation and unemployment remains a central challenge for the U.S. economy. The Fed's future actions will hinge on incoming economic data, specifically inflation and unemployment figures.

Stay informed about future U.S. Fed interest rate decisions by following reputable financial news sources and economic reports. Understanding the complexities of inflation and unemployment is crucial for making informed financial decisions. Keep an eye on updates regarding U.S. Fed interest rates, inflation updates, and unemployment reports for insights into the evolving economic landscape.

Featured Posts

-

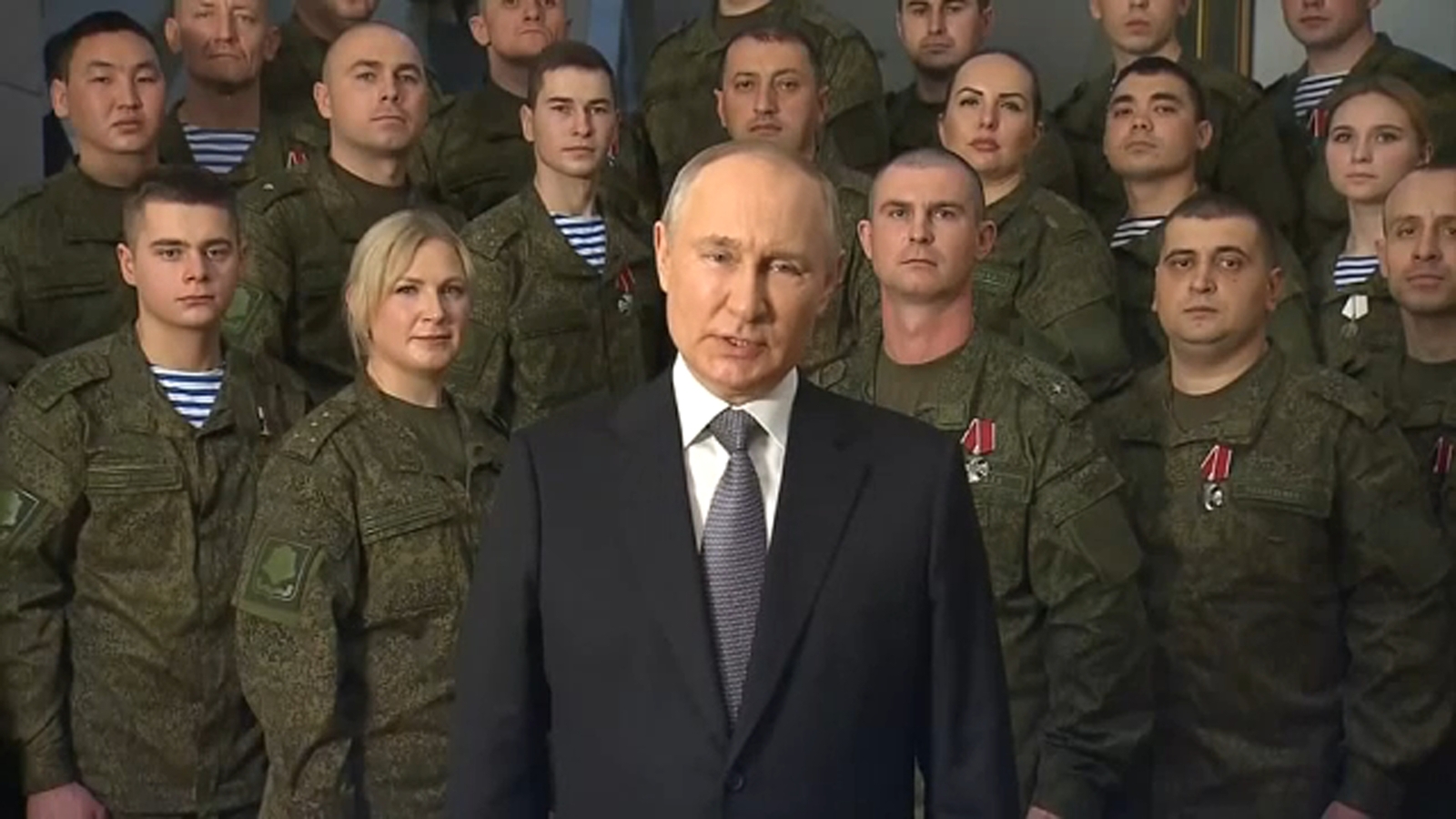

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025 -

Asylum Seeker Kilmar Abrego Garcia Highlights Us Immigration Policy Debate

May 09, 2025

Asylum Seeker Kilmar Abrego Garcia Highlights Us Immigration Policy Debate

May 09, 2025 -

Sporedba Na Bekam So Drugi Legendi Dali Zasluzhuva Titulata Na Dobar

May 09, 2025

Sporedba Na Bekam So Drugi Legendi Dali Zasluzhuva Titulata Na Dobar

May 09, 2025 -

Trumps Ag Delivers Chilling Message To Political Foes

May 09, 2025

Trumps Ag Delivers Chilling Message To Political Foes

May 09, 2025 -

North Carolina Daycare Suspension The Wfmy News 2 Story

May 09, 2025

North Carolina Daycare Suspension The Wfmy News 2 Story

May 09, 2025

Latest Posts

-

Nottingham Stabbing Investigation Into Unauthorized Access By Nhs Staff

May 09, 2025

Nottingham Stabbing Investigation Into Unauthorized Access By Nhs Staff

May 09, 2025 -

Nhs Staff Illegal Access Of Nottingham Stabbing Victim Records

May 09, 2025

Nhs Staff Illegal Access Of Nottingham Stabbing Victim Records

May 09, 2025 -

Exclusive Nottingham Attack Survivors Emotional Account Of The Tragedy

May 09, 2025

Exclusive Nottingham Attack Survivors Emotional Account Of The Tragedy

May 09, 2025 -

Nottingham Attack Survivor Speaks Out I Wish He D Taken Me Instead

May 09, 2025

Nottingham Attack Survivor Speaks Out I Wish He D Taken Me Instead

May 09, 2025 -

Character Development In Wynne And Joanna All At Sea

May 09, 2025

Character Development In Wynne And Joanna All At Sea

May 09, 2025