U.S. Federal Reserve Holds Steady: Rate Decision Amidst Growing Economic Pressures

Table of Contents

The Federal Reserve's Decision to Hold Rates Steady: A Deep Dive

The Federal Open Market Committee (FOMC) decided to maintain the federal funds rate within a target range of [Insert current range]. This decision, following [number] previous rate hikes, signals a potential pause in the aggressive monetary policy tightening implemented to combat inflation. The Fed's statement cited [insert key reason from Fed statement, e.g., "slowing inflation", "uncertain economic outlook," "need to assess previous rate hikes' impact"] as the primary justification for maintaining rates at their current level. This cautious approach suggests a more data-dependent strategy going forward.

- Specific rate levels held unchanged: The federal funds rate remained at [Insert current rate]. The discount rate also remained unchanged at [Insert current rate].

- Key quotes from the Federal Reserve's statement: "[Insert direct quotes from the official Fed statement highlighting the reasoning behind the decision]".

- Mention of any dissenting votes within the FOMC: [Mention any dissenting votes and their reasoning if applicable].

Inflation and Economic Data Influencing the Decision

The Fed's decision was heavily influenced by the latest economic data, which presents a mixed picture. While inflation, as measured by the Consumer Price Index (CPI), has shown signs of cooling from its peak, it remains above the Fed's 2% target. The Producer Price Index (PPI), which measures inflation at the wholesale level, also showed [insert trend: slowing/accelerating] inflation. GDP growth has [insert trend: slowed/accelerated] in recent quarters, while unemployment rates currently stand at [insert current unemployment rate], indicating [insert assessment: a strong/weak] labor market. Consumer confidence, however, remains [insert assessment: high/low].

- Latest inflation figures and year-over-year changes: CPI is currently at [Insert current CPI percentage] year-over-year, while PPI is at [Insert current PPI percentage] year-over-year.

- Key economic indicators and their current trends: GDP growth [insert percentage and trend], Unemployment rate [insert percentage and trend], Consumer confidence index [insert number and trend].

- Analysis of the strength and weaknesses of the economic data: The mixed data makes it challenging to predict the next moves for the Federal Reserve. While inflation is cooling, it's not yet at the desired level, and recessionary risks remain.

Market Reactions and Future Outlook: What's Next for Interest Rates?

The market's initial reaction to the Fed's decision was [Insert description of market reaction: positive, negative, mixed]. Stock markets [rose/fell/remained relatively unchanged], while bond yields [rose/fell/remained relatively unchanged]. The Fed's forward guidance [Insert summary of forward guidance], leaving the door open to [further rate hikes/rate cuts/holding steady] depending on future economic data. However, significant uncertainties remain, including the ongoing geopolitical situation and potential supply chain disruptions.

- Stock market performance following the announcement: The Dow Jones Industrial Average [rose/fell] by [percentage], while the S&P 500 [rose/fell] by [percentage].

- Changes in bond yields and their significance: The yield on the 10-year Treasury note [rose/fell] to [percentage], reflecting [interpretation of the change in yield].

- Potential future scenarios and their probabilities: The probability of further rate hikes depends on the trajectory of inflation and GDP growth.

The Impact on Consumers and Businesses: Implications of the Rate Decision

The Fed's decision to hold rates steady will have wide-ranging consequences for consumers and businesses. While it offers some relief from further interest rate increases, the continued high inflation rate will still exert pressure on consumer spending. Mortgage rates, although not directly influenced by the federal funds rate, are largely affected by the general interest rate environment, and may [rise/fall/remain stable] depending on market conditions. Similarly, business loan interest rates are expected to [rise/fall/remain stable], impacting investment decisions.

- Impact on mortgage rates and home affordability: Mortgage rates are likely to [rise/fall/remain stable], impacting home affordability.

- Effects on business loan interest rates and investment: Higher interest rates could curb business investment and hinder economic expansion.

- Consequences for consumer spending and overall economic growth: High inflation continues to reduce consumer spending power, potentially slowing economic growth.

Conclusion: Understanding the U.S. Federal Reserve's Rate Decision and its Implications

The Federal Reserve's decision to hold interest rates steady reflects a cautious approach amid conflicting economic signals. The decision, influenced by slowing inflation, recessionary fears, and the need to assess prior rate hikes' impacts, has led to mixed market reactions and leaves the path for future monetary policy uncertain. The impact on consumers and businesses will be significant, affecting borrowing costs, investment decisions, and overall economic growth. The Federal Reserve's role in managing the economy and its influence on individuals and businesses remain crucial. Continued monitoring of the economic situation is vital. Stay informed about future Federal Reserve decisions and economic updates by subscribing to our newsletter or following reputable financial news sources. For more information, search for "US Federal Reserve interest rate decisions" or "Monetary policy and economic outlook."

Featured Posts

-

Taiwans Vice President Lai Warns Of Growing Totalitarian Threat

May 09, 2025

Taiwans Vice President Lai Warns Of Growing Totalitarian Threat

May 09, 2025 -

Oboronnoe Soglashenie Frantsiya Polsha Posledstviya Dlya Evropeyskoy Bezopasnosti

May 09, 2025

Oboronnoe Soglashenie Frantsiya Polsha Posledstviya Dlya Evropeyskoy Bezopasnosti

May 09, 2025 -

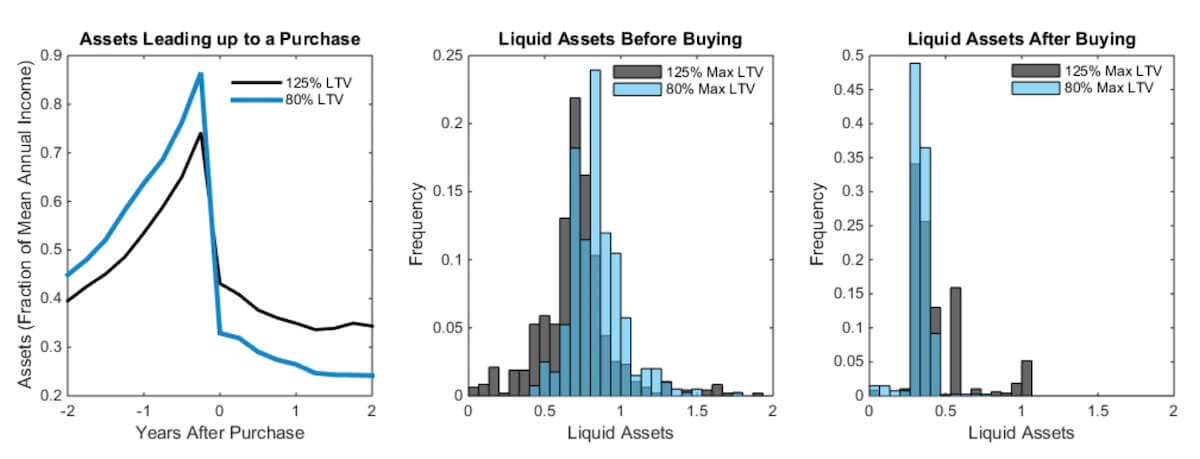

Posthaste High Down Payments And The Canadian Dream Of Homeownership

May 09, 2025

Posthaste High Down Payments And The Canadian Dream Of Homeownership

May 09, 2025 -

The Snl Harry Styles Impression A Disappointing Take And His Reaction

May 09, 2025

The Snl Harry Styles Impression A Disappointing Take And His Reaction

May 09, 2025 -

Wynne Evans Health Scare Recent Illness And Potential Stage Comeback

May 09, 2025

Wynne Evans Health Scare Recent Illness And Potential Stage Comeback

May 09, 2025

Latest Posts

-

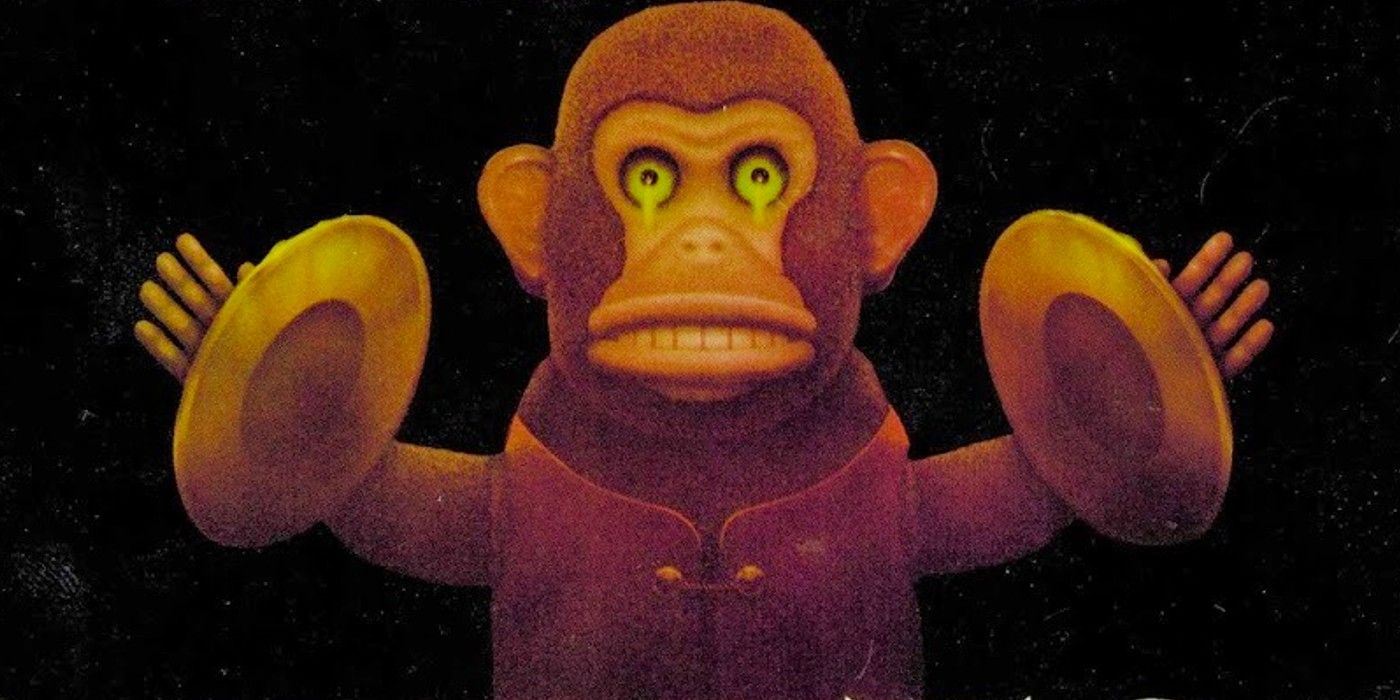

Kultov Roman Na Stivn King Netflix Gotvi Rimeyk

May 10, 2025

Kultov Roman Na Stivn King Netflix Gotvi Rimeyk

May 10, 2025 -

Vegas Golden Knights Win Hertls Double Hat Trick Leads The Charge

May 10, 2025

Vegas Golden Knights Win Hertls Double Hat Trick Leads The Charge

May 10, 2025 -

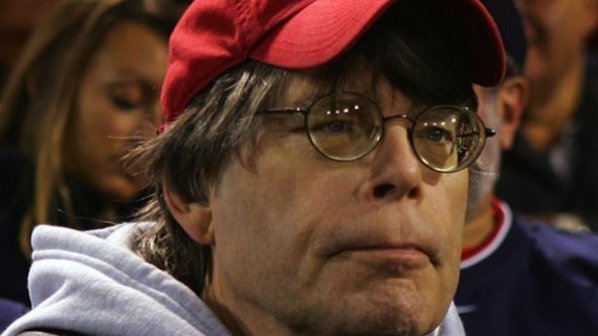

2025 A Banner Year For Stephen King Thanks To The Monkey

May 10, 2025

2025 A Banner Year For Stephen King Thanks To The Monkey

May 10, 2025 -

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 10, 2025

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 10, 2025 -

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025