U.S. Federal Reserve Interest Rate Decision: A Balancing Act

Table of Contents

Inflationary Pressures and the Fed's Response

Inflation remains a significant concern. High inflation erodes purchasing power, impacting consumers and businesses alike. Currently, we're seeing elevated prices across various sectors, squeezing household budgets and impacting business profitability. Several factors contribute to this inflationary pressure:

- Supply chain disruptions: The lingering effects of the pandemic continue to create bottlenecks, limiting the supply of goods and driving up prices.

- Elevated energy prices: Fluctuations in global energy markets significantly impact production costs and consumer expenses, adding to inflationary pressure.

- Demand-pull inflation: Strong consumer demand, coupled with supply constraints, contributes to a situation where demand outpaces supply, leading to price increases.

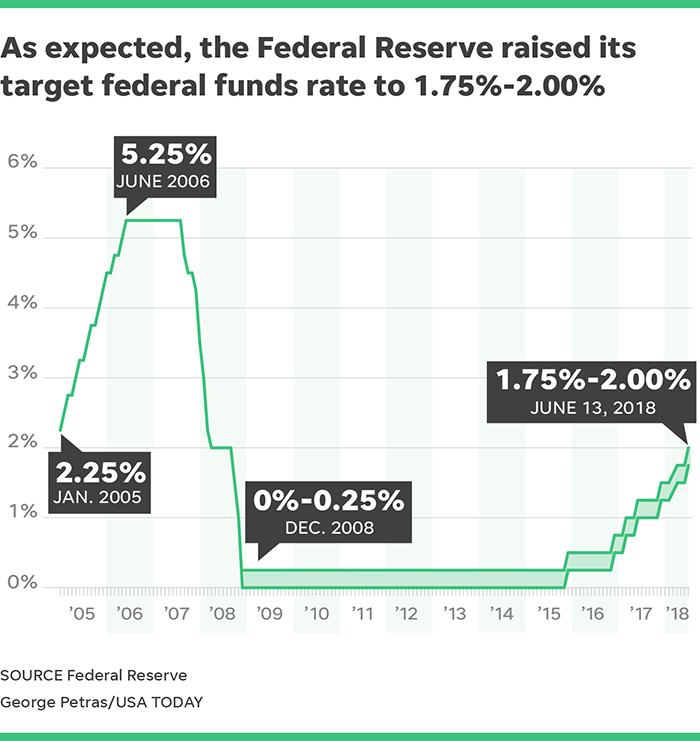

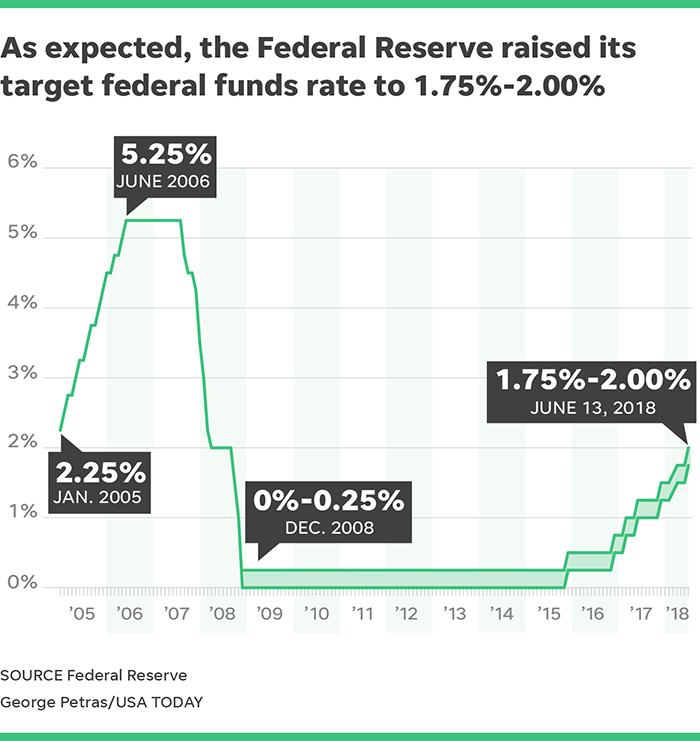

The Fed typically combats inflation by raising interest rates. Higher interest rates make borrowing more expensive, thus reducing consumer spending and business investment, ultimately cooling down demand and curbing inflationary pressures.

- CPI (Consumer Price Index): Recent CPI data shows [Insert recent CPI data and trend analysis here].

- PCE (Personal Consumption Expenditures): The PCE index, the Fed's preferred inflation measure, recently showed [Insert recent PCE data and trend analysis here].

- Industries most affected: Sectors like housing, energy, and transportation have been particularly vulnerable to recent inflationary surges.

- Downsides of aggressive hikes: Raising interest rates too aggressively risks triggering a recession, slowing economic growth significantly.

Economic Growth and the Risk of Recession

Interest rates and economic growth are inversely related. Higher interest rates increase borrowing costs for businesses, potentially leading to reduced investment and hiring, ultimately slowing economic growth. Aggressive interest rate hikes could stifle economic activity and increase the risk of a recession.

Currently, the economy shows [Insert current state of the economy: GDP growth rate, positive or negative indicators]. Several key indicators provide clues about the economy's health and vulnerability to a recession:

- GDP growth rate: Forecasts for GDP growth are [Insert GDP growth forecasts and analysis here].

- Unemployment figures: The unemployment rate currently stands at [Insert unemployment rate and trend analysis here].

- Consumer confidence: Consumer confidence indicators suggest [Insert analysis of consumer confidence indicators here].

The Fed's Balancing Act: A Delicate Juggling Act

The Fed faces the monumental challenge of balancing the need to control inflation with the risk of triggering a recession. This is a delicate balancing act, requiring careful consideration of various economic factors and potential consequences.

The Fed might adopt different approaches:

- Gradual rate hikes: This approach aims to curb inflation gradually, minimizing the risk of a sharp economic slowdown.

- More aggressive action: This involves more significant interest rate increases, aiming to quickly control inflation, even at the risk of a sharper economic contraction.

Analyzing the Federal Open Market Committee (FOMC) meeting minutes offers insight into the Fed's thinking. [Insert analysis of FOMC meeting minutes, if available]. Expert opinions and predictions on future interest rate movements vary widely, with some anticipating [Insert expert opinions and predictions here]. Political pressures also play a role, potentially influencing the Fed's decisions.

Impact on Financial Markets and Investors

The Fed's interest rate decision significantly impacts various financial markets. For example:

- Stock market: Higher interest rates generally lead to lower stock valuations, as higher borrowing costs reduce corporate profits and investor sentiment.

- Bond market: Bond yields typically rise with interest rate increases, affecting bond prices.

Investors can adjust their portfolios to mitigate potential risks:

- Potential effects on stock prices and bond yields: [Insert analysis of potential market impacts].

- Investment strategies for different risk tolerances: Investors with higher risk tolerance might consider [Insert investment strategies], while those with lower risk tolerance should consider [Insert investment strategies].

- Advice for investors: Consult with a financial advisor for personalized investment advice and to create a strategy appropriate for your risk tolerance.

Conclusion: Understanding the Implications of the U.S. Federal Reserve Interest Rate Decision

The U.S. Federal Reserve's interest rate decision is a complex undertaking, influenced by numerous interacting economic factors. The Fed must carefully balance the need to control inflation with the potential risks to economic growth. The outcome will significantly impact businesses, consumers, and financial markets. Understanding the implications of these decisions is crucial for both individuals and businesses. Stay updated on the latest Federal Reserve monetary policy and interest rate announcements to make informed decisions, and consult with a financial advisor for personalized investment strategies tailored to your circumstances.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike A 1 050 Cost Surge For At And T

May 09, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Cost Surge For At And T

May 09, 2025 -

The Future Of Bitcoin Bitcoin Seoul 2025 Conference

May 09, 2025

The Future Of Bitcoin Bitcoin Seoul 2025 Conference

May 09, 2025 -

High Potential Why The Season 1 Underdog Deserves A Season 2 Spotlight And Maybe A Villainous Arc

May 09, 2025

High Potential Why The Season 1 Underdog Deserves A Season 2 Spotlight And Maybe A Villainous Arc

May 09, 2025 -

Bilateral Trade Deal On The Horizon India And Us To Commence Talks

May 09, 2025

Bilateral Trade Deal On The Horizon India And Us To Commence Talks

May 09, 2025 -

Madhyamik 2025 Result Date Merit List And Passing Percentage

May 09, 2025

Madhyamik 2025 Result Date Merit List And Passing Percentage

May 09, 2025

Latest Posts

-

Is Wynne And Joanna All At Sea Worth Reading A Critical Review

May 09, 2025

Is Wynne And Joanna All At Sea Worth Reading A Critical Review

May 09, 2025 -

Wynne Evans Go Compare Future Uncertain After Strictly Scandal

May 09, 2025

Wynne Evans Go Compare Future Uncertain After Strictly Scandal

May 09, 2025 -

Singer Wynne Evanss Cosy Date Following Bbc Meeting Delay

May 09, 2025

Singer Wynne Evanss Cosy Date Following Bbc Meeting Delay

May 09, 2025 -

Wynne And Joanna All At Sea A Detailed Analysis

May 09, 2025

Wynne And Joanna All At Sea A Detailed Analysis

May 09, 2025 -

Go Compare Advert Star Wynne Evans Removed Following Strictly Incident

May 09, 2025

Go Compare Advert Star Wynne Evans Removed Following Strictly Incident

May 09, 2025