U.S. Federal Reserve: Rate Decision And The Mounting Economic Challenges

Table of Contents

Inflationary Pressures and the Fed's Response

Current Inflation Rates and Underlying Factors

The U.S. is grappling with persistent inflation. The Consumer Price Index (CPI) and Producer Price Index (PPI) remain elevated, reflecting a broad-based increase in prices. Several factors contribute to this inflationary pressure:

- Supply Chain Disruptions: Ongoing supply chain bottlenecks continue to constrain the availability of goods, driving up prices.

- Energy Prices: Soaring energy costs, particularly gasoline and natural gas, significantly impact inflation, affecting both consumer spending and business production.

- Robust Consumer Demand: Strong consumer spending, fueled in part by pent-up demand following the pandemic, further contributes to inflationary pressures.

- Wage Growth: While beneficial for workers, significant wage increases can also contribute to higher production costs and inflation.

The Fed's Tools for Combating Inflation

The Federal Reserve employs several tools to combat inflation. The most prominent are interest rate hikes and quantitative tightening:

- Interest Rate Hikes: By raising the federal funds rate, the Fed makes borrowing more expensive for banks, increasing the cost of loans for businesses and consumers. This reduces spending and investment, thus cooling down the economy and lowering inflation.

- Quantitative Tightening (QT): This involves reducing the Fed's balance sheet by allowing Treasury securities and mortgage-backed securities to mature without reinvestment. This reduces the money supply, further curbing inflation. The impact of QT on interest rates is subtle but significant over time.

Economic Growth and Recessionary Risks

GDP Growth and its Trajectory

The current state of GDP growth is a key indicator of economic health. While recent data may show some positive momentum, the Fed's aggressive rate hikes pose a significant risk to future growth. Potential scenarios include:

- Slowed Growth: A moderate rate hike could result in a slowdown of economic growth, a “soft landing.”

- Recession: An overly aggressive approach could tip the economy into a recession, characterized by declining GDP for two consecutive quarters. This scenario includes higher unemployment and reduced consumer confidence.

The Risk of Recession

The probability of a recession is a major concern. Several recession indicators warrant attention:

- Inverted Yield Curve: When short-term interest rates exceed long-term rates, it often precedes a recession.

- Falling Consumer Confidence: Declining consumer confidence suggests reduced spending and potential economic contraction.

- High Inflation: Persistently high inflation erodes purchasing power and can trigger a recessionary spiral. A recession would significantly impact various sectors, leading to job losses, business closures, and reduced investment.

Impact on Financial Markets and Investment Strategies

Stock Market Volatility and Investor Sentiment

The Fed's rate decision significantly impacts stock market performance and investor sentiment. Potential market reactions include:

- Sell-offs: Aggressive rate hikes can trigger sell-offs as investors anticipate slower economic growth and reduced corporate profits.

- Rallies: If the rate hike is perceived as measured and appropriate, markets might rally on the belief that inflation is under control. The impact varies across different asset classes. For example, bonds are generally sensitive to interest rate changes, while stocks are susceptible to changes in economic outlook.

Implications for Investment Strategies

Navigating current economic uncertainty requires careful consideration of investment strategies:

- Diversification: A diversified portfolio across different asset classes can mitigate risk and reduce exposure to market volatility.

- Risk Management: Investors should assess their risk tolerance and adjust their portfolios accordingly.

- Long-Term Perspective: Focusing on long-term investment goals can help mitigate short-term market fluctuations. Consider dollar-cost averaging to reduce the impact of market timing.

Conclusion

The U.S. Federal Reserve rate decision is a critical factor influencing the trajectory of the U.S. and global economies. The Fed’s actions directly impact inflation, economic growth, and financial markets. Understanding the interplay between these factors is crucial for navigating the current economic challenges. The potential for both a soft landing or a recession remains, underscoring the need for prudent financial planning and diversified investment strategies.

To stay informed about future U.S. Federal Reserve rate decisions and their implications for your personal finances and investment strategies, follow reputable financial news sources and seek professional financial advice regarding your portfolio. Subscribe to newsletters or follow relevant social media channels for ongoing updates on the U.S. Federal Reserve rate decision and its effects on the economy.

Featured Posts

-

Tech Billionaire Losses Post Trump Inauguration A 194 Billion Decline

May 10, 2025

Tech Billionaire Losses Post Trump Inauguration A 194 Billion Decline

May 10, 2025 -

Microsoft Activision Deal Ftc Files Appeal Against Court Decision

May 10, 2025

Microsoft Activision Deal Ftc Files Appeal Against Court Decision

May 10, 2025 -

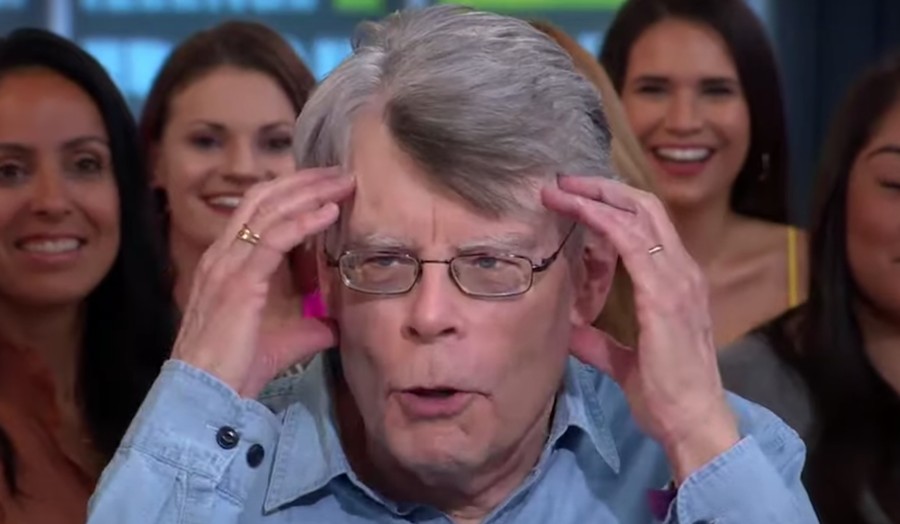

Under 5 Hours The Best Stephen King Show For A Quick Binge

May 10, 2025

Under 5 Hours The Best Stephen King Show For A Quick Binge

May 10, 2025 -

Young Thug Hints At Uy Scuti Album Release

May 10, 2025

Young Thug Hints At Uy Scuti Album Release

May 10, 2025 -

Elon Musk Wealth Increase Billions Added After Tesla Rally And Dogecoin Step Back

May 10, 2025

Elon Musk Wealth Increase Billions Added After Tesla Rally And Dogecoin Step Back

May 10, 2025