U.S. Investment In Canada: A Call For Diversification

Table of Contents

Current State of U.S. Investment in Canada

Major Sectors of U.S. Investment

U.S. investment in Canada is heavily concentrated in specific sectors. While this concentration has yielded significant returns in the past, it presents considerable risks. Major sectors include:

- Energy: This sector historically accounts for a substantial portion of U.S. investment in Canada, particularly in oil and gas extraction and related services. Estimates suggest this sector may represent upwards of 30% of total foreign direct investment (FDI). Leading companies include ExxonMobil, Chevron, and ConocoPhillips.

- Technology: The tech sector is a rapidly growing area for U.S. investment, driven by Canada's strong talent pool and supportive regulatory environment. This includes software development, AI, and fintech companies.

- Real Estate: U.S. investment in Canadian real estate, particularly in major urban centers, represents a significant portion of FDI. This encompasses both residential and commercial properties.

Geographic Distribution of Investment

The majority of U.S. investment in Canada is concentrated in specific provinces, notably Ontario, British Columbia, and Alberta. This concentration is largely driven by existing infrastructure, a skilled workforce, and established industry clusters in these regions. [Insert map/chart visualizing investment distribution across Canadian provinces here]. However, this geographical concentration represents a significant risk, making the overall investment portfolio vulnerable to regional economic downturns.

Risks of Concentrated Investment

Over-reliance on specific sectors or geographic regions exposes U.S. investors to various risks:

- Sector-Specific Economic Downturns: A decline in the energy sector, for example, could significantly impact the overall return on investment.

- Political and Regulatory Uncertainty: Changes in government policies or regulations in specific provinces could negatively affect investments.

- Resource Dependence: Over-dependence on natural resources makes investments susceptible to price fluctuations and environmental concerns.

- Geopolitical Risks: Global events can disproportionately impact concentrated investments.

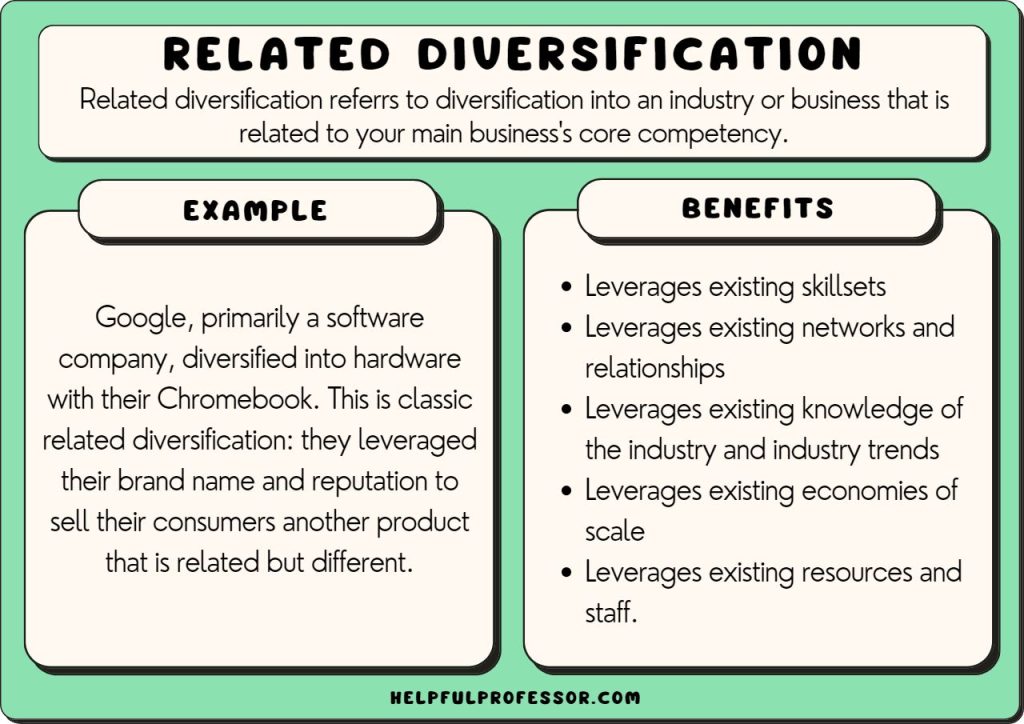

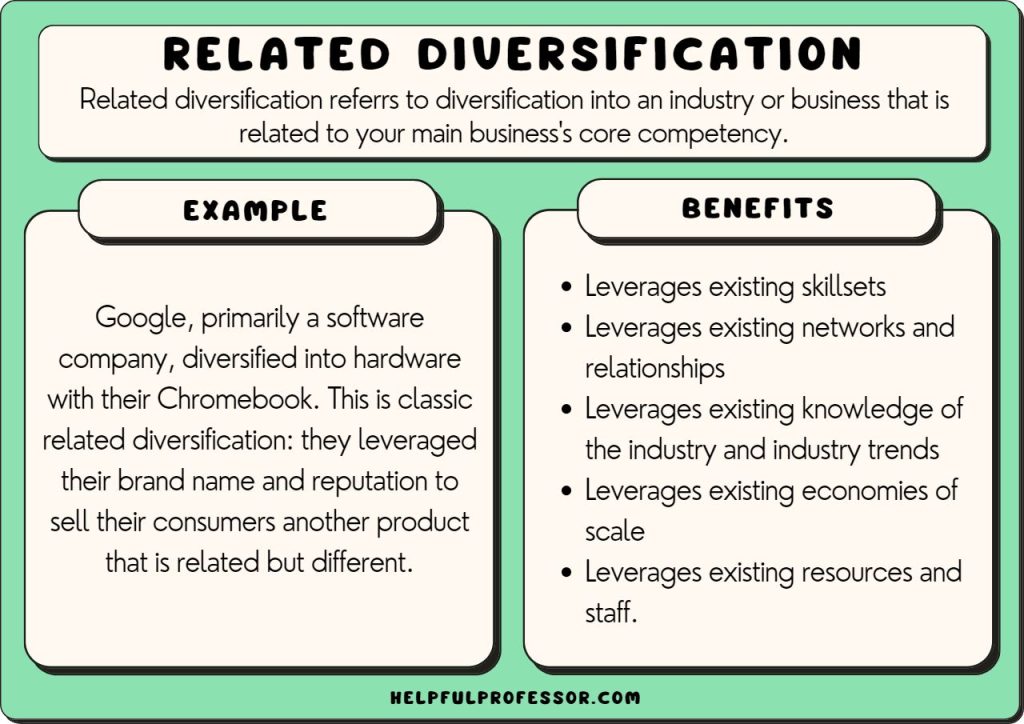

The Case for Diversification

Expanding into Untapped Sectors

Diversifying into under-invested sectors offers significant opportunities for U.S. investors:

- Clean Technology: Canada is a global leader in cleantech innovation, offering substantial growth potential for U.S. investors seeking environmentally responsible ventures.

- Life Sciences: The Canadian life sciences sector is rapidly expanding, attracting significant investment in pharmaceuticals, biotechnology, and medical devices.

- Advanced Manufacturing: Canada possesses a highly skilled workforce and strong manufacturing infrastructure, making it an attractive destination for advanced manufacturing investments.

These sectors offer not only higher potential returns but also contribute to a more resilient and sustainable investment portfolio.

Investing in Emerging Canadian Regions

Expanding beyond traditional investment hubs like Toronto and Vancouver presents unique opportunities:

- Atlantic Canada offers a growing tech sector and a strong focus on sustainable industries.

- The Prairie provinces, beyond Alberta's energy focus, are home to thriving agricultural and technology sectors.

- Quebec, with its strong manufacturing base and French-speaking population, offers a distinct market opportunity.

Investing in these regions helps stimulate economic growth across Canada, reducing reliance on established centers and diversifying the overall risk profile.

Strategic Partnerships and Collaboration

Joint ventures and collaborative initiatives between U.S. and Canadian companies offer numerous advantages:

- Reduced risk through shared expertise and resources.

- Access to new markets and technologies.

- Enhanced innovation through collaborative research and development.

Successful collaborations can create a mutually beneficial ecosystem fostering growth and innovation for both nations.

Government Policies and Incentives

Canadian Investment Incentives

The Canadian government offers various programs and tax incentives to attract foreign direct investment:

- Invest in Canada Hub: Provides information and support to foreign investors. [Link to Invest in Canada website]

- Provincial Investment Programs: Each province has its own incentive programs tailored to specific industries and regions. [Links to relevant provincial websites]

These incentives can significantly reduce the cost of investment and increase overall profitability.

U.S. Government Support for International Investment

The U.S. government also provides support for outbound foreign direct investment:

- International Trade Administration: Offers resources and assistance to U.S. businesses investing abroad. [Link to International Trade Administration website]

These resources can streamline the investment process and reduce bureaucratic hurdles.

A Future of Diversified U.S. Investment in Canada

Diversification of U.S. investment in Canada is paramount for long-term success and reduced risk. By expanding into untapped sectors, investing in emerging regions, and fostering strategic partnerships, U.S. investors can unlock the full potential of this vital economic relationship. This approach mitigates the risks associated with concentrated investment, creating a more resilient and sustainable investment portfolio for both countries. Explore the potential of diversified U.S. investment in Canada today! Learn more about maximizing returns through diversified U.S. investment in Canada by researching the opportunities available in various sectors and regions.

Featured Posts

-

Coldplay Rejoint Stromae Et Pomme Pour Une Reprise De Ma Meilleure Ennemie D Arcane

May 29, 2025

Coldplay Rejoint Stromae Et Pomme Pour Une Reprise De Ma Meilleure Ennemie D Arcane

May 29, 2025 -

The Impact Of Covid 19 Vaccines On Long Covid Incidence

May 29, 2025

The Impact Of Covid 19 Vaccines On Long Covid Incidence

May 29, 2025 -

Paris Rally Marine Le Pen Calls Conviction A Political Maneuver

May 29, 2025

Paris Rally Marine Le Pen Calls Conviction A Political Maneuver

May 29, 2025 -

Venloer Strasse In Koeln Einbahnstrasse Pro Und Contra

May 29, 2025

Venloer Strasse In Koeln Einbahnstrasse Pro Und Contra

May 29, 2025 -

Is This Fantasy Show Better Than The Witcher Henry Cavills Pick

May 29, 2025

Is This Fantasy Show Better Than The Witcher Henry Cavills Pick

May 29, 2025