U.S. Penny Phase-Out: Circulation To End By Early 2026

Table of Contents

The Economic Case for a U.S. Penny Phase-Out

The argument for eliminating the penny centers around simple economics: it costs more to make than it's worth.

The Cost of Production Exceeds Value

The rising cost of producing pennies significantly exceeds their one-cent value. The U.S. Mint's production costs, factoring in metal sourcing, manufacturing, and distribution, consistently surpass the penny's face value.

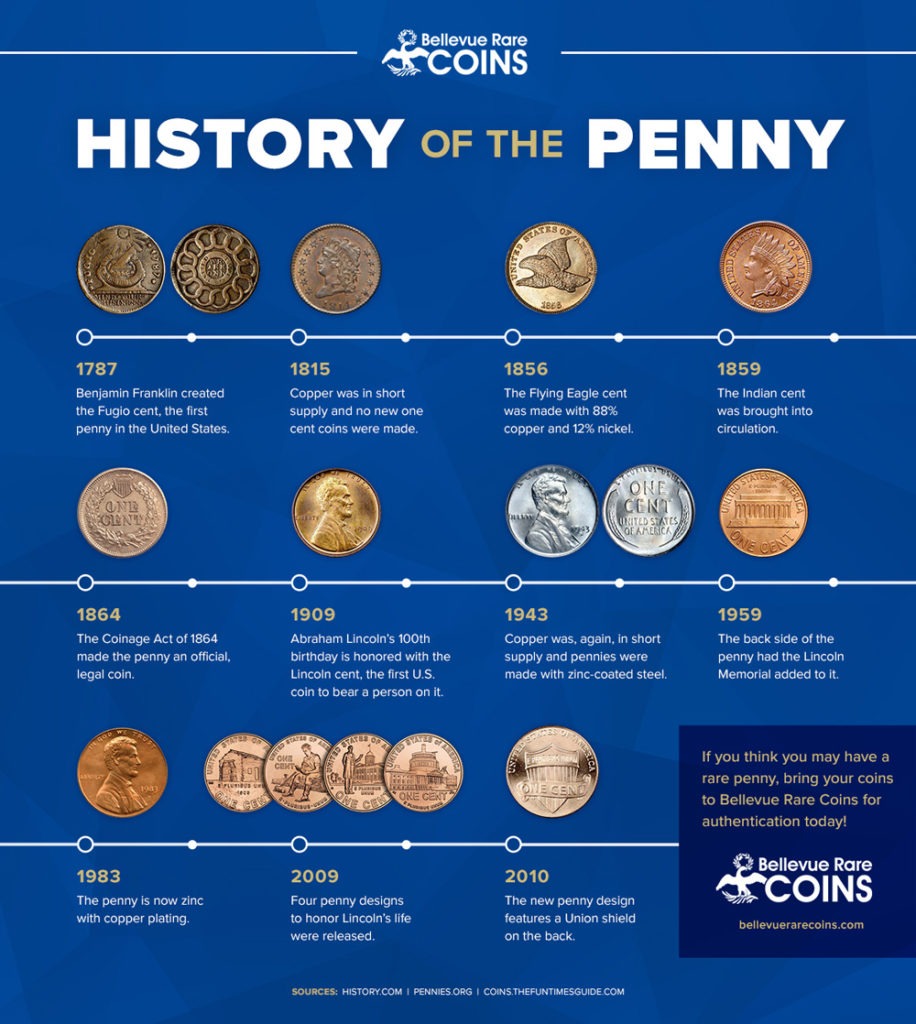

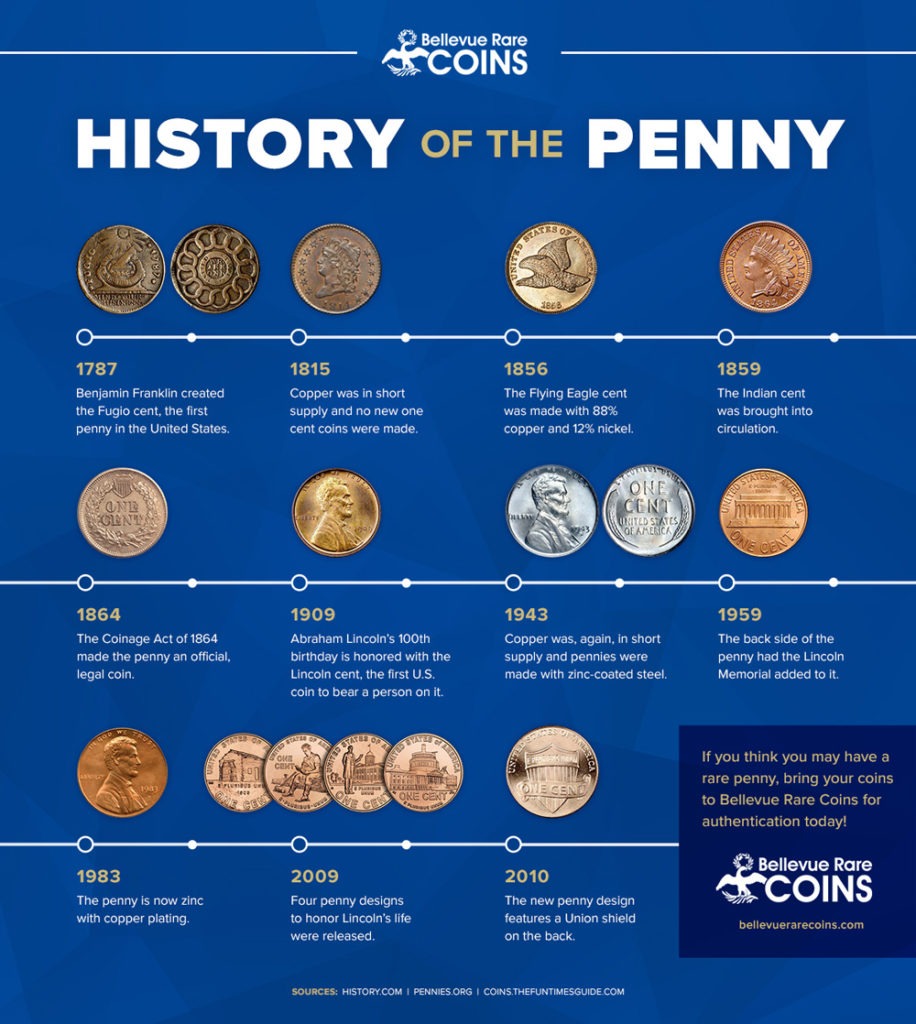

- Production Process: Pennies are primarily composed of zinc, with a thin copper plating. This manufacturing process involves several steps: die striking, plating, quality control, and packaging.

- Material Costs: Fluctuations in zinc and copper prices directly impact the minting cost. These costs have steadily increased over the years, widening the gap between production expense and the penny's worth.

- Cost vs. Value: Reports suggest that the cost to produce a single penny is well over one cent, representing a significant financial drain on the U.S. Mint and taxpayers. This makes the penny an economically unsustainable element of the currency system.

Inefficiency in Circulation

Beyond production costs, the penny presents significant logistical inefficiencies. Handling, transporting, and managing pennies place a burden on businesses and consumers.

- Business Challenges: Businesses face challenges with penny handling in cash registers, vending machines, and overall cash management. The weight and volume of pennies compared to other coins lead to storage and transportation difficulties.

- Consumer Inconvenience: Consumers often find pennies cumbersome, leading to accumulation of large quantities of low-value coins. This creates inconvenience and often results in pennies being discarded, further exacerbating the economic inefficiency.

- Overall Handling Burden: The sheer volume of pennies in circulation requires significant resources for transportation, storage, and counting, adding to the overall economic inefficiency.

Potential Impacts of the U.S. Penny Phase-Out

A U.S. penny phase-out would undeniably create ripples across the economy, affecting businesses and consumers alike.

Impact on Businesses

The transition to a pennyless system would necessitate adjustments for many businesses, particularly smaller ones.

- Cash Register Upgrades: Many businesses would require software and hardware upgrades to their cash registers to accommodate the rounding of transactions.

- Vending Machine Modifications: Vending machines would need to be recalibrated to function without accepting pennies.

- Potential Savings: While initial adjustments might involve costs, the long-term savings from reduced handling and storage of pennies could be significant.

Impact on Consumers

Consumers would experience a change in the way they make transactions.

- Rounding Up/Down: Transactions would be rounded to the nearest nickel. This means consumers could sometimes pay slightly more or less than the exact amount.

- Psychological Impact: While the rounding effect is likely to be minimal for most transactions, some consumers might experience a psychological impact from the rounding-up process.

- Concerns about Lost Value: Consumers have expressed concerns about losing small amounts of money through the rounding-up process, but statistically, the effect is projected to be negligible.

Environmental Considerations

Eliminating penny production would offer substantial environmental benefits.

- Reduced Metal Mining: The production of pennies requires the mining of copper and zinc, which has environmental consequences. A phase-out would decrease the demand for these metals and minimize their mining impact.

- Waste Reduction: The disposal of millions of pennies contributes to waste. A phase-out would significantly reduce this waste stream, decreasing landfill burden.

- Carbon Footprint Reduction: The entire process of penny production, from mining to distribution, contributes to carbon emissions. Eliminating it would reduce the overall carbon footprint.

Alternatives to the Penny and Future of Small Transactions

The potential disappearance of the penny necessitates alternative solutions for small transactions.

Rounding Up/Down Systems

Several rounding systems could replace the penny.

- Nearest Nickel Rounding: This is the most likely scenario, rounding transactions to the nearest 5 cents. This is considered simple and easy to implement.

- Other Rounding Methods: Other methods exist, but they are generally more complex and less likely to be adopted. The key is to find a system that minimizes disruption and maintains fairness.

Digital Payment Systems

The rise of digital payment methods offers a further solution.

- Increased Adoption: Contactless payments, mobile apps, and online banking are reducing reliance on physical cash.

- Benefits of Digital Payments: Digital systems offer speed, efficiency, and a reduction in the need for physical currency.

- Challenges: Concerns remain about digital security, accessibility for all population segments, and the digital divide.

Conclusion

The potential phase-out of the U.S. penny by early 2026 presents a complex issue with significant economic and social implications. While the rising cost of production and logistical inefficiencies strongly support the elimination of the penny, understanding the potential effects on businesses and consumers is crucial. The transition to a pennyless system might involve adopting rounding methods and expanding the use of digital payment systems. This necessitates careful planning and public education to ensure a smooth transition. Staying informed about the ongoing debate surrounding the U.S. penny phase-out is vital for businesses and consumers alike. Continue following developments to understand how this potential change will affect you and your finances. Learn more about the U.S. penny phase-out and its potential impact by staying updated on financial news and government announcements.

Featured Posts

-

Planned Resurfacing Works M62 Westbound Closure Between Manchester And Warrington

May 24, 2025

Planned Resurfacing Works M62 Westbound Closure Between Manchester And Warrington

May 24, 2025 -

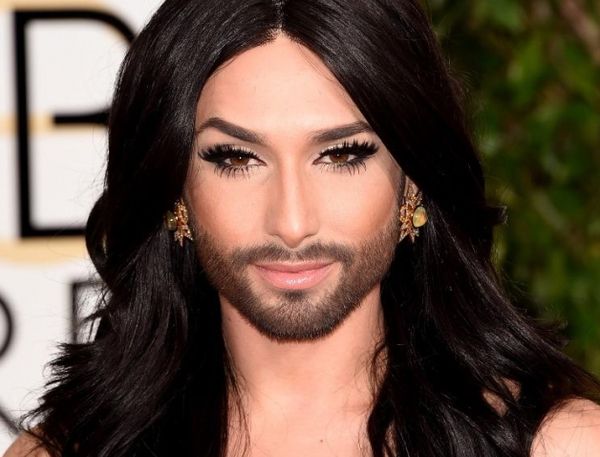

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Chotirokh Peremozhtsiv

May 24, 2025

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Chotirokh Peremozhtsiv

May 24, 2025 -

Shtutgart Aleksandrova Oderzhivaet Pobedu Nad Samsonovoy

May 24, 2025

Shtutgart Aleksandrova Oderzhivaet Pobedu Nad Samsonovoy

May 24, 2025 -

De Ai Aangedreven Groei Van Relx Een Duurzaam Succesmodel

May 24, 2025

De Ai Aangedreven Groei Van Relx Een Duurzaam Succesmodel

May 24, 2025 -

Boe Rate Cut Odds Reduce Following Uk Inflation Figures Pound Gains

May 24, 2025

Boe Rate Cut Odds Reduce Following Uk Inflation Figures Pound Gains

May 24, 2025