Uber Calls Off Foodpanda Taiwan Purchase: Regulatory Hurdles Cited

Table of Contents

Key Regulatory Hurdles in Taiwan

The failure of the Uber-Foodpanda Taiwan deal can be largely attributed to several significant regulatory obstacles within the Taiwanese legal framework. These hurdles, encompassing antitrust concerns, stringent data privacy regulations, and limitations on foreign investment, ultimately proved too significant to overcome.

Antitrust Concerns

The Taiwanese Fair Trade Commission (FTC) likely raised concerns regarding the potential for market dominance and reduced competition if Uber acquired Foodpanda Taiwan. The combined market share of the two companies would have been substantial, potentially leading to:

- Price fixing: Reduced competition could have allowed the merged entity to increase prices for consumers and decrease payments to delivery drivers.

- Reduced consumer choice: A lack of robust competition could have limited consumer options and stifled innovation in the food delivery sector.

- Suppression of smaller competitors: The combined power of Uber and Foodpanda could have made it difficult for smaller, local food delivery services to compete effectively.

The FTC's investigation, although not publicly detailed in its entirety, likely focused on these potential anti-competitive practices. Their preliminary findings likely influenced Uber's decision to withdraw from the acquisition.

Data Privacy Regulations

Taiwan boasts stringent data privacy regulations, and the transfer of Foodpanda Taiwan's vast user data to a foreign entity like Uber presented significant challenges. Specific concerns likely included:

- Cross-border data transfer: The transfer of sensitive user information, including personal details, order histories, and payment information, to servers outside Taiwan may have violated existing data privacy laws.

- Data security and protection: Concerns about the security of user data in the hands of a foreign company would have needed to be addressed to comply with Taiwanese regulations.

- Compliance with the Personal Information Protection Act (PIPA): The acquisition would have needed to adhere to PIPA, which mandates strict data protection and user consent processes.

These concerns likely required extensive legal review and potentially significant modifications to the acquisition terms, contributing to the deal's ultimate collapse.

Foreign Investment Restrictions

Certain limitations on foreign investment in Taiwan's food delivery sector may also have played a role. These restrictions could have included:

- Ownership limits: Regulations might have placed restrictions on the percentage of ownership a foreign entity like Uber could hold in a Taiwanese company like Foodpanda.

- Approval processes: The acquisition might have required approval from multiple Taiwanese government bodies, a lengthy and complex process.

- National security concerns: In certain sectors, foreign investment is subject to stricter scrutiny to protect national interests.

These limitations, combined with the other regulatory hurdles, likely added significant complexity and risk to the deal, prompting Uber to abandon the acquisition.

Implications for Uber and Foodpanda

The failed acquisition has significant consequences for both Uber and Foodpanda Taiwan.

Strategic Impact on Uber

The failed acquisition represents a setback for Uber's expansion strategy in Asia and its ambitions in the food delivery market. It may force Uber to:

- Re-evaluate its Asian market entry strategies: Uber may need to reassess its approach to expansion in Asia, focusing on alternative strategies for market penetration.

- Explore alternative partnerships: Uber might seek out partnerships or joint ventures with other companies in Taiwan’s food delivery sector rather than pursuing direct acquisitions.

- Focus on organic growth: Uber may choose to focus on organic growth in Taiwan's food delivery market, building its presence from the ground up.

The financial and reputational costs of the failed acquisition are also considerable, impacting Uber's overall strategic planning.

Foodpanda Taiwan's Future

The failed acquisition leaves Foodpanda Taiwan with several options:

- Independent operation: Foodpanda Taiwan will continue operating independently, potentially focusing on expanding its market share and improving its services.

- Acquisition by a different company: Foodpanda Taiwan might become an acquisition target for another company interested in entering or consolidating the Taiwanese food delivery market.

- Altered business strategies: Foodpanda Taiwan may adjust its business strategies to respond to the changing market dynamics resulting from the failed Uber acquisition.

The future for Foodpanda Taiwan is uncertain but full of challenges and opportunities in the competitive Taiwanese market.

Impact on the Taiwanese Food Delivery Market

The failed Uber-Foodpanda merger has significant implications for the broader Taiwanese food delivery market:

Market Dynamics

The competitive balance between Foodpanda and other players, such as local competitors and perhaps even Uber Eats operating independently, will be altered. This could lead to:

- Increased competition: The absence of a merger means increased competition among existing players, potentially benefitting consumers through lower prices and better services.

- Market share realignment: Other food delivery services in Taiwan may see an opportunity to increase their market share, especially if Foodpanda’s strategic direction shifts.

- Innovation and improved services: The intensified competition might drive innovation and improve services offered to consumers.

The short-term and long-term effects on market prices, consumer choice, and overall market growth are yet to be fully seen, but the dynamism of the Taiwanese food delivery market is certainly heightened.

Conclusion

The cancellation of Uber's acquisition of Foodpanda Taiwan underscores the critical role of regulatory scrutiny in shaping major business deals, particularly in a dynamic market like Taiwan's food delivery sector. The numerous regulatory hurdles, including antitrust concerns, data privacy issues, and foreign investment restrictions, proved insurmountable, leading to the deal's collapse. The implications are significant for both Uber and Foodpanda, as well as the wider competitive landscape in Taiwan.

Call to Action: Understanding the complexities of navigating cross-border mergers and acquisitions, particularly in the context of Taiwan's regulatory environment, is crucial for businesses operating in or looking to enter this market. Stay informed on the latest developments concerning Foodpanda Taiwan and other related regulatory changes to understand the evolving landscape of the Taiwanese food delivery market and avoid similar pitfalls. Further research into Taiwan's regulatory framework for foreign investment is recommended for companies considering similar ventures in the region.

Featured Posts

-

Mirax Casino A Top Rated Online Casino In Ontario For 2025

May 18, 2025

Mirax Casino A Top Rated Online Casino In Ontario For 2025

May 18, 2025 -

How To Save Money On Downtown Las Vegas Resort Fees

May 18, 2025

How To Save Money On Downtown Las Vegas Resort Fees

May 18, 2025 -

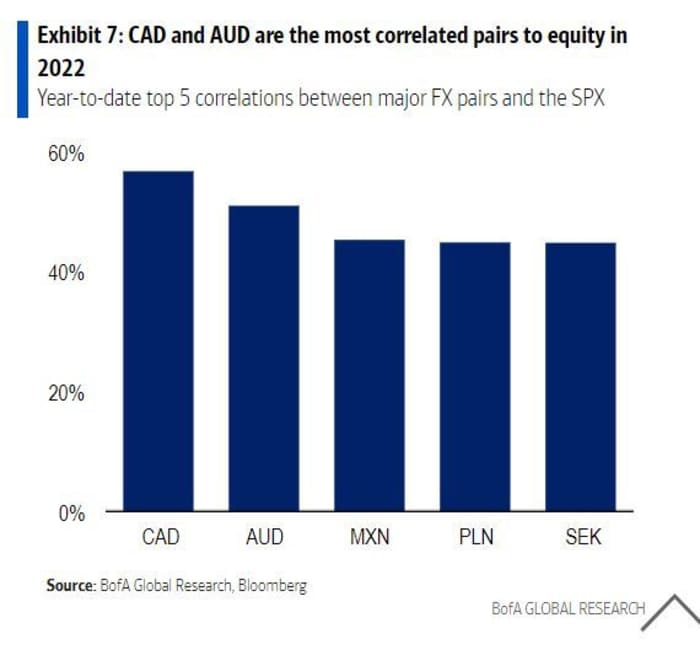

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 18, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 18, 2025 -

Catch Spencer Brown At Audio Sf San Francisco Concert May 2nd 2025

May 18, 2025

Catch Spencer Brown At Audio Sf San Francisco Concert May 2nd 2025

May 18, 2025 -

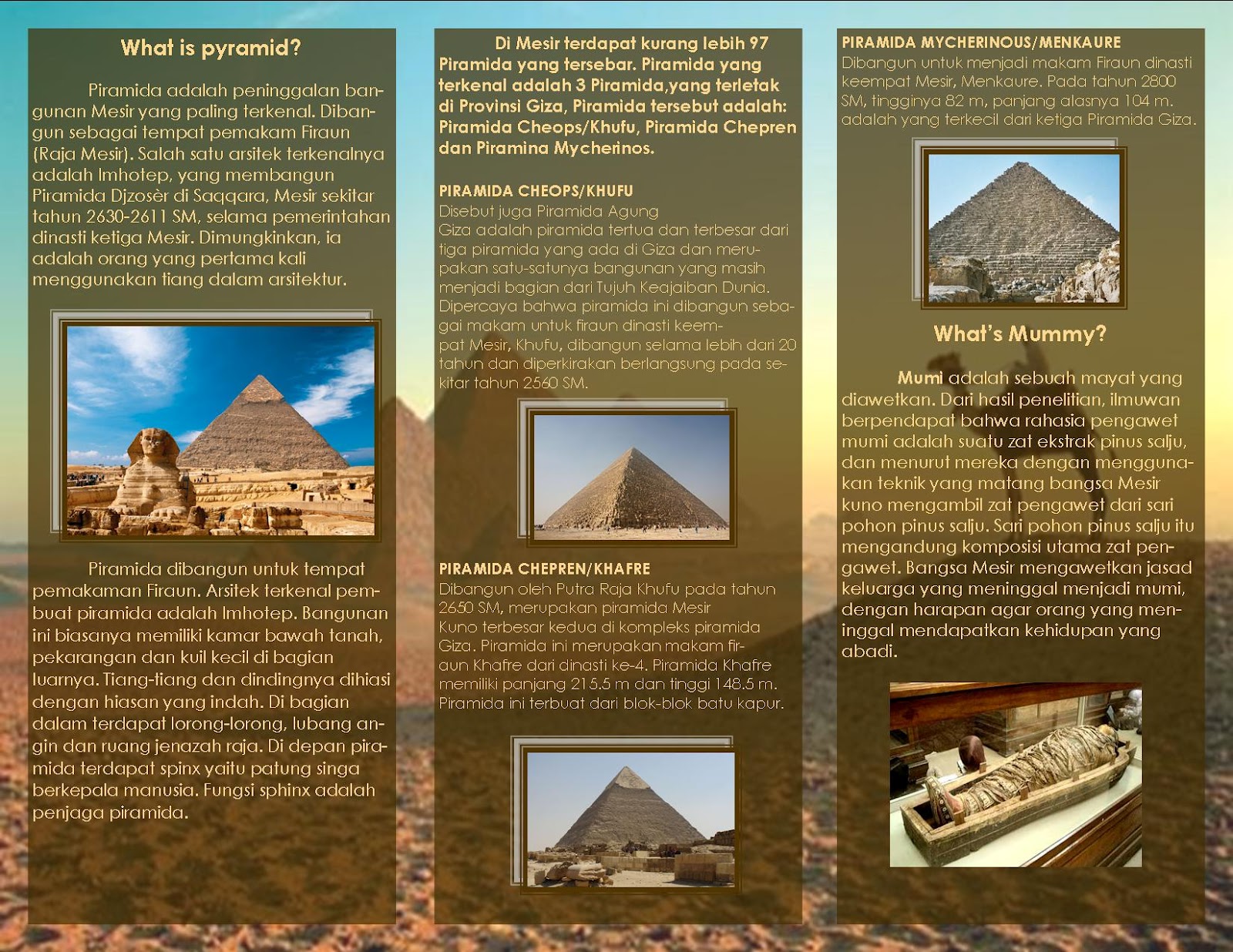

End Of An Era Luxors Ancient Egypt Buffet Shuts Down

May 18, 2025

End Of An Era Luxors Ancient Egypt Buffet Shuts Down

May 18, 2025

Latest Posts

-

Pedro Pascal The Last Decades Rise To Hollywood Leading Man

May 18, 2025

Pedro Pascal The Last Decades Rise To Hollywood Leading Man

May 18, 2025 -

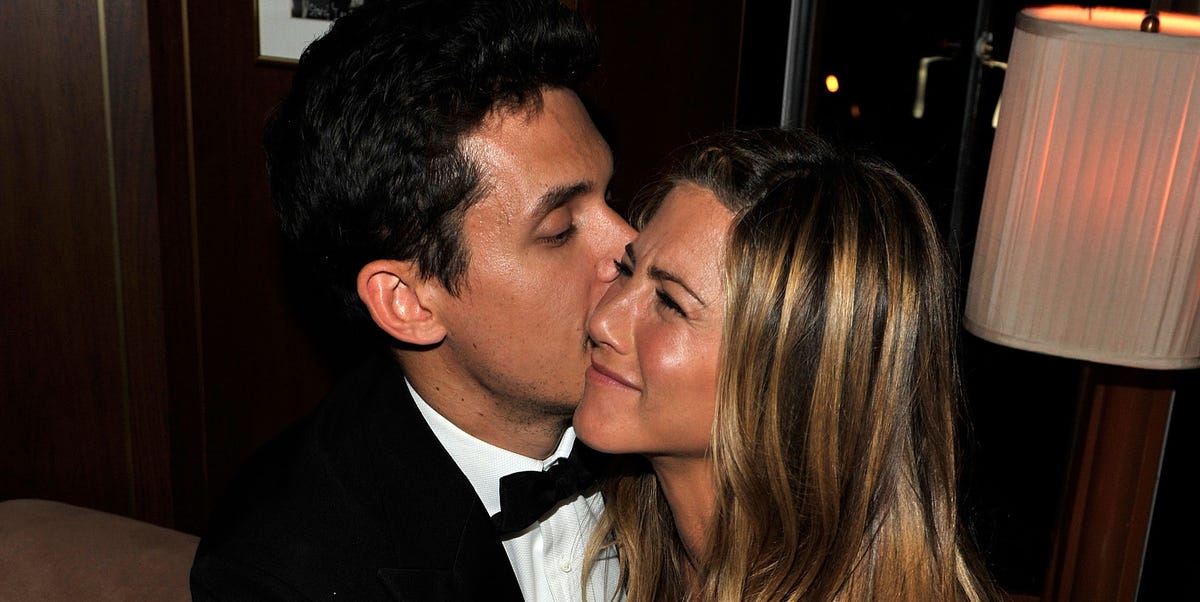

Jennifer Aniston Celebrates Pedro Pascals Birthday Amid Romance Speculation

May 18, 2025

Jennifer Aniston Celebrates Pedro Pascals Birthday Amid Romance Speculation

May 18, 2025 -

Jennifer Anistons Birthday Wish For Pedro Pascal Fuels Dating Rumors

May 18, 2025

Jennifer Anistons Birthday Wish For Pedro Pascal Fuels Dating Rumors

May 18, 2025 -

Aniston Shares Heartfelt Note For Pascal Post Dinner Viral Moment

May 18, 2025

Aniston Shares Heartfelt Note For Pascal Post Dinner Viral Moment

May 18, 2025 -

Jennifer Aniston And Pedro Pascal A Sweet Exchange After Their Recent Dinner Outing

May 18, 2025

Jennifer Aniston And Pedro Pascal A Sweet Exchange After Their Recent Dinner Outing

May 18, 2025