Uber's April Surge: Understanding The Double-Digit Rally

Table of Contents

Improved Financial Performance and Earnings Beat

Uber's Q1 2024 earnings report revealed a significant improvement in key performance indicators, exceeding analysts' expectations and fueling the "Uber's April Surge." The strong financial performance significantly boosted investor confidence. Several key metrics contributed to this positive outcome:

-

Stronger-than-anticipated revenue growth: Uber reported a substantial increase in revenue, surpassing projected figures. This growth stemmed from a combination of increased ridership and higher prices, demonstrating strong demand for Uber's services. This positive "Uber revenue growth" trend is a key indicator of the company's financial health.

-

Improved profitability margins, showcasing cost-cutting measures: Uber's ability to improve profitability margins demonstrates effective cost-cutting measures and operational efficiencies. This "Uber profitability" improvement is crucial for long-term sustainability and investor confidence.

-

Increased ridership numbers across various segments (rides, delivery, freight): The increase in ridership across all major segments – rides, Uber Eats (food delivery), and freight – shows broad-based growth and resilience in the face of economic headwinds. This diverse revenue stream mitigates risk and reinforces the strength of the "Uber's April Surge."

-

Positive outlook for future quarters based on the earnings call: Management's optimistic outlook for future quarters, communicated during the earnings call, further solidified investor confidence and contributed to the positive market reaction. This positive sentiment is a crucial component in understanding the reasons behind "Uber's April Surge."

The impact of these positive financials was immediate and substantial. Investors reacted favorably to the exceeding expectations, driving the significant stock price increase and solidifying the narrative of "Uber's April Surge." The strong "Uber earnings" report signaled a turning point for the company, offering a compelling investment case.

Strategic Initiatives and Positive Market Sentiment

Beyond the strong financials, Uber's strategic initiatives played a crucial role in the "Uber's April Surge." Several key factors contributed to the improved market sentiment:

-

Launch of new features or services enhancing user experience: New features and service improvements enhance user experience, leading to increased customer satisfaction and loyalty. These innovations are key to "Uber innovation" and its impact on sustained growth.

-

Successful marketing campaigns driving increased user engagement: Targeted marketing campaigns successfully increased user engagement, attracting new customers and boosting overall ridership. Effective marketing is critical for driving demand and contributing to "Uber's April Surge."

-

Strategic acquisitions or partnerships expanding market reach: Strategic acquisitions and partnerships broadened Uber's reach into new markets and service categories, diversifying its revenue streams. These strategic moves demonstrate "Uber partnerships" and market expansion.

-

Positive media coverage and analyst upgrades contributing to positive investor sentiment: Positive media coverage and upward revisions of analyst price targets generated a positive feedback loop, fueling investor optimism and contributing significantly to "Uber's April Surge."

These strategic moves, demonstrating "Uber market expansion" and enhancing the overall user experience, collectively contributed to a stronger market position and boosted investor confidence, directly impacting "Uber's April Surge."

Macroeconomic Factors and Industry Trends

The broader economic context and industry trends also played a part in Uber's April success. Several factors contributed to this favorable environment:

-

Post-pandemic recovery driving increased demand for ride-sharing services: The continued recovery from the pandemic led to increased demand for ride-sharing and delivery services, directly benefiting Uber. This post-pandemic recovery is a key element of the broader "ride-sharing market" growth.

-

Easing inflation and improved consumer spending: Easing inflation and improved consumer spending fueled increased discretionary spending, resulting in higher demand for ride-sharing and food delivery. This "economic recovery" positively impacted Uber's performance.

-

Positive shifts in the competitive landscape benefiting Uber's market share: Positive shifts in the competitive landscape, such as the struggles of competitors, allowed Uber to gain market share and solidify its position.

-

Overall positive sentiment in the technology sector influencing investor behavior: A broader positive sentiment in the technology sector contributed to a generally bullish investor outlook, further benefiting Uber's stock price. The overall "tech stock rally" helped drive "Uber's April Surge."

The confluence of these macroeconomic factors and favorable industry trends provided a fertile ground for Uber's success and contributed significantly to the magnitude of "Uber's April Surge."

Addressing Potential Concerns and Future Outlook

While the "Uber's April Surge" is undoubtedly positive, potential challenges remain:

-

Potential regulatory hurdles in different markets: Navigating varying regulatory environments across different markets poses an ongoing challenge.

-

Ongoing competition from rival companies: Intense competition from established and emerging players in the ride-sharing and delivery sectors remains a key concern.

-

Economic uncertainties that could impact future growth: Economic downturns or unforeseen economic events could impact future growth and demand.

Despite these challenges, the strong Q1 earnings and strategic direction suggest a positive long-term outlook for Uber. Continued innovation, expansion into new markets, and effective cost management should contribute to sustained growth.

Conclusion:

Uber's April surge, a substantial double-digit rally, resulted from a combination of improved financial performance, strategic initiatives, and favorable macroeconomic conditions. The strong Q1 earnings, coupled with strategic moves focused on "Uber innovation" and "Uber market expansion," significantly boosted investor confidence. While challenges remain, understanding the drivers behind this "Uber's April Surge" is vital for investors. Stay informed on further developments in Uber's performance and its ongoing impact on the company's trajectory. Analyzing the factors contributing to "Uber's April Surge" provides valuable insights for investors considering opportunities within the dynamic ride-sharing industry.

Featured Posts

-

Asamh Bn Ladn Alka Yagnk Ky Fhrst Myn Sb Se Awpr

May 18, 2025

Asamh Bn Ladn Alka Yagnk Ky Fhrst Myn Sb Se Awpr

May 18, 2025 -

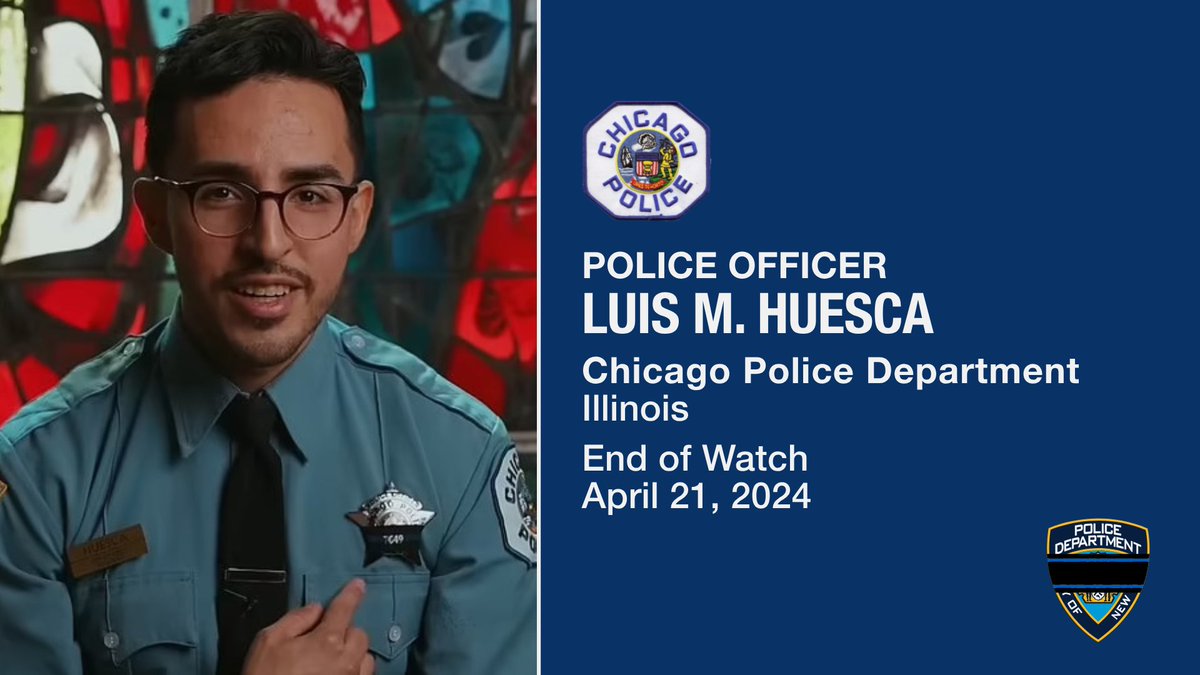

East Hampton Police Officer Luis Morales Charged With Dwi Southampton Police Report

May 18, 2025

East Hampton Police Officer Luis Morales Charged With Dwi Southampton Police Report

May 18, 2025 -

Brooklyn Bridge Park Homicide Investigation Following Gunshot Victim Discovery

May 18, 2025

Brooklyn Bridge Park Homicide Investigation Following Gunshot Victim Discovery

May 18, 2025 -

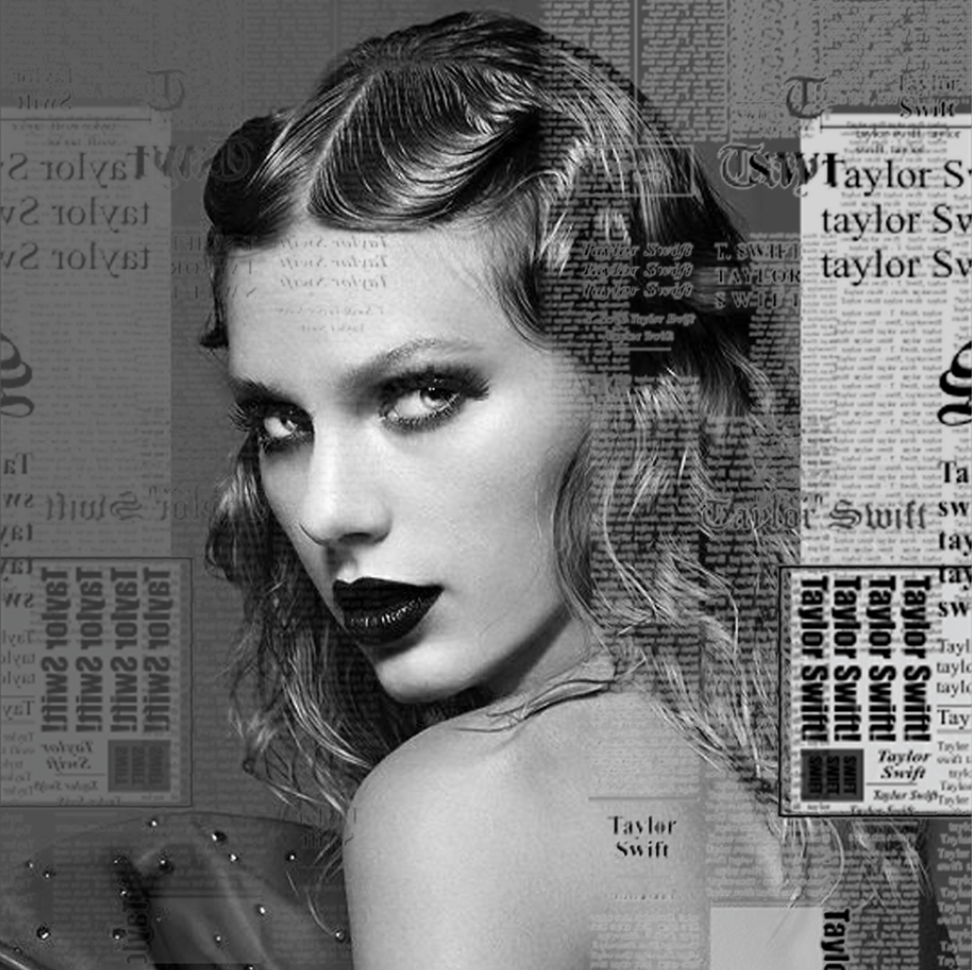

Taylor Swifts Reputation Taylors Version Teaser Analyzing The Clues And Hints

May 18, 2025

Taylor Swifts Reputation Taylors Version Teaser Analyzing The Clues And Hints

May 18, 2025 -

Jackbit Casino Review Leading Bitcoin Casino For 2025

May 18, 2025

Jackbit Casino Review Leading Bitcoin Casino For 2025

May 18, 2025

Latest Posts

-

Find The Daily Lotto Results Monday April 28 2025

May 18, 2025

Find The Daily Lotto Results Monday April 28 2025

May 18, 2025 -

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025 -

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Daily Lotto 29 April 2025 Results

May 18, 2025

Daily Lotto 29 April 2025 Results

May 18, 2025