Uber's Autonomous Driving Gamble: Will It Pay Off For Investors?

Table of Contents

1. The Potential Rewards of Autonomous Driving for Uber

Self-driving technology holds the potential to revolutionize Uber's operations and dramatically reshape its financial future. The potential rewards are substantial, but realizing them requires overcoming significant hurdles.

1.1 Disruption of the Ride-Sharing Market

Autonomous vehicles could drastically alter the economics of ride-sharing. By eliminating the need for human drivers, Uber could significantly reduce its operational costs.

- Lower per-ride costs: Reduced labor costs and insurance premiums would directly translate into lower prices for consumers and higher profit margins for Uber.

- Increased profitability: Higher profit margins could lead to substantial increases in overall profitability, potentially boosting shareholder value.

- Expansion into new markets: Lower operating costs could make it economically viable to expand into underserved markets or regions with previously prohibitive labor costs.

- Increased market share and revenue growth are also expected as a result of reduced costs and increased efficiency.

1.2 Expansion into New Service Areas

The technology behind autonomous vehicles extends far beyond ride-sharing. Uber could leverage its investment to diversify into several lucrative markets:

- Autonomous delivery services (Uber Eats): Self-driving vehicles could significantly improve the efficiency and cost-effectiveness of food and package delivery.

- Logistics and freight transportation: Autonomous trucks could revolutionize the logistics industry, offering greater efficiency and reducing transportation costs.

- Partnerships and collaborations: Uber's technology could be licensed to other companies, creating additional revenue streams and solidifying its position as a leader in autonomous technology. This diversification reduces reliance on the fluctuating ride-sharing market.

2. The Significant Risks and Challenges Facing Uber's Autonomous Vehicle Program

While the potential rewards are significant, Uber's autonomous driving program faces numerous challenges that could jeopardize its success.

2.1 Technological Hurdles

Developing fully reliable and safe self-driving technology is a monumental task. Several technological hurdles remain:

- Software glitches: Unpredictable software errors could lead to accidents and erode public trust in autonomous vehicles.

- Unpredictable situations: Adverse weather conditions, unexpected obstacles, and complex traffic scenarios pose significant challenges for autonomous vehicle navigation.

- Ethical dilemmas: Programming autonomous vehicles to make ethical decisions in accident scenarios is a complex and unresolved issue.

- Significant R&D costs: The development of autonomous driving technology requires massive and sustained investment in research and development.

2.2 Regulatory and Legal Landscape

The regulatory environment surrounding autonomous vehicles is complex and constantly evolving:

- Varying regulations across different states and countries: This inconsistency creates challenges for deploying autonomous vehicles on a large scale.

- Potential for delays and legal challenges: The regulatory approval process could be lengthy and fraught with legal challenges.

- Insurance complexities: Determining liability in the event of an accident involving an autonomous vehicle is a significant legal and insurance challenge.

2.3 Intense Competition in the Autonomous Vehicle Market

Uber faces fierce competition from established players such as Waymo and Cruise, as well as numerous emerging startups:

- Competition for talent: Attracting and retaining top engineers and researchers is crucial for success in this highly competitive field.

- Competition for technology licensing: Securing partnerships and licensing agreements is crucial to gaining a competitive edge.

- Competition for market share: The race to dominate the autonomous vehicle market is intense and will likely involve significant consolidation.

3. Analyzing Uber's Investment Strategy and Financial Viability

Evaluating the financial viability of Uber's autonomous driving program requires a close examination of its investment strategy and financial performance.

3.1 Financial Performance and Projections

Uber's financial statements provide insights into the costs and potential returns of its autonomous driving initiatives:

- R&D expenditure: The significant investment in research and development is impacting current profitability, but is considered crucial for long-term success.

- Potential ROI timelines: Determining when the investment will generate a positive return on investment is crucial for investors' confidence.

- Impact on overall profitability: The long-term impact of autonomous vehicles on Uber's overall profitability is uncertain and depends on several factors.

3.2 Strategic Partnerships and Acquisitions

Uber has pursued strategic partnerships and acquisitions to bolster its autonomous driving capabilities:

- Strength of partnerships: The success of these partnerships is crucial to Uber's technological advancement and market position.

- Impact of acquisitions on technology and market position: Acquisitions can accelerate technology development and enhance Uber's competitive advantage.

4. Conclusion

Uber's autonomous driving program presents both immense opportunities and substantial risks. The potential for disrupting the ride-sharing market and expanding into new service areas is undeniable, offering significant long-term growth potential. However, the technological hurdles, regulatory complexities, and intense competition pose significant challenges that could significantly impact the success of this endeavor. Weighing the potential rewards against these risks is crucial for investors. Understanding the intricacies of Uber's autonomous driving gamble is crucial for informed investment decisions. Continue researching the development and deployment of this groundbreaking technology to make your own assessment of its potential payoff. The future of Uber's autonomous driving program, and the impact on investor returns, remains to be seen.

Featured Posts

-

Arsenal Domakjin Na Ps Zh Predviduvanja Za Prviot Mech

May 08, 2025

Arsenal Domakjin Na Ps Zh Predviduvanja Za Prviot Mech

May 08, 2025 -

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025 -

Cryptocurrencys Resilience Amidst Trade Wars

May 08, 2025

Cryptocurrencys Resilience Amidst Trade Wars

May 08, 2025 -

Ethereum Transaction Volume Jumps A Sign Of Increased Network Activity

May 08, 2025

Ethereum Transaction Volume Jumps A Sign Of Increased Network Activity

May 08, 2025 -

Seged Go Shokira Pariz Chetvrtfinale Vo Ligata Na Shampionite

May 08, 2025

Seged Go Shokira Pariz Chetvrtfinale Vo Ligata Na Shampionite

May 08, 2025

Latest Posts

-

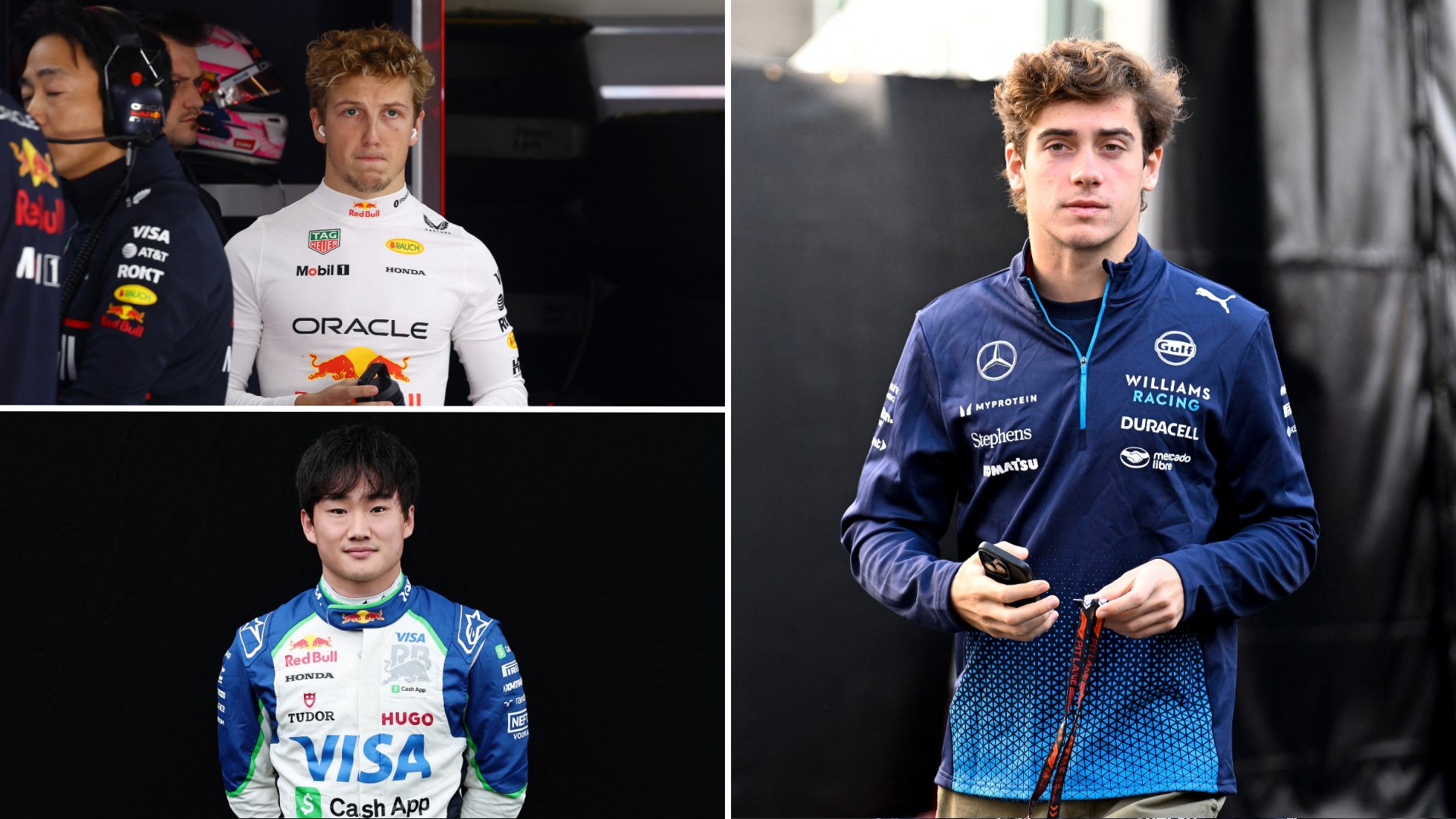

Sergio Perez And Franco Colapintos Emotional Tributes After F1 Tragedy

May 09, 2025

Sergio Perez And Franco Colapintos Emotional Tributes After F1 Tragedy

May 09, 2025 -

Franco Colapintos Deleted Drive To Survive Message Context And Controversy

May 09, 2025

Franco Colapintos Deleted Drive To Survive Message Context And Controversy

May 09, 2025 -

F1 World Mourns Colapinto And Perez Lead Tributes Following Devastating Loss

May 09, 2025

F1 World Mourns Colapinto And Perez Lead Tributes Following Devastating Loss

May 09, 2025 -

What Did Franco Colapinto Say In His Deleted Drive To Survive Message

May 09, 2025

What Did Franco Colapinto Say In His Deleted Drive To Survive Message

May 09, 2025 -

Unexpected F1 News Colapinto Sponsors Live Tv Slip Up

May 09, 2025

Unexpected F1 News Colapinto Sponsors Live Tv Slip Up

May 09, 2025