Uber's Autonomous Vehicle Push: ETFs To Consider For Potential Returns

Table of Contents

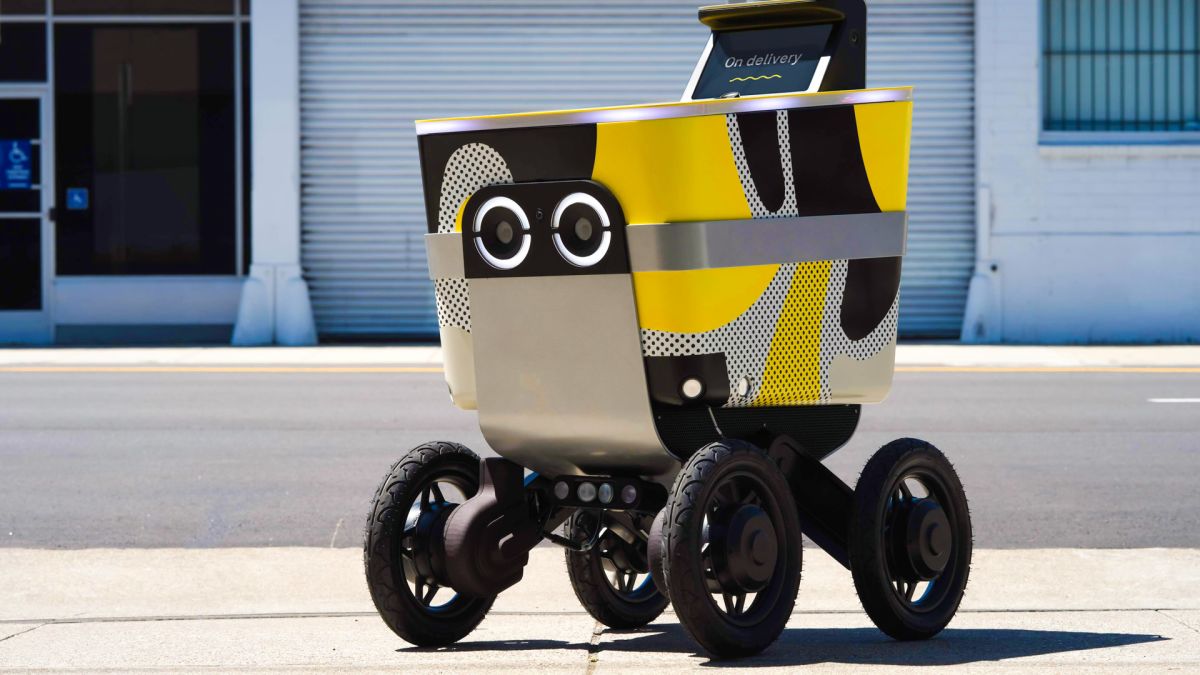

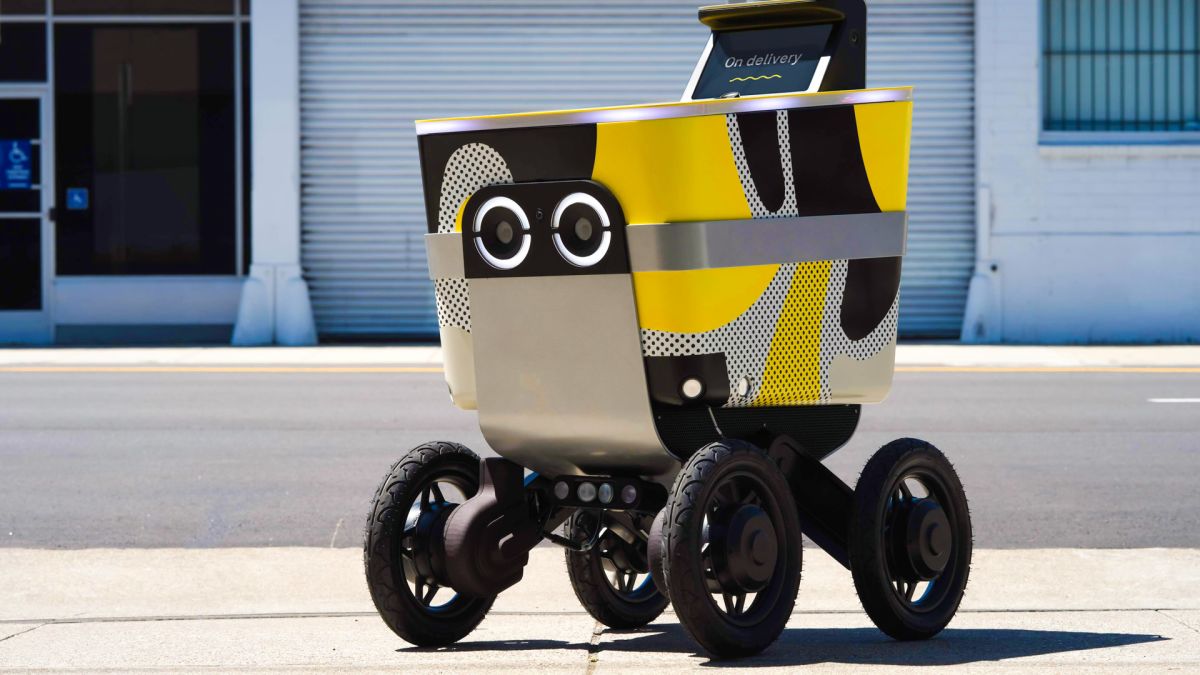

Understanding Uber's Autonomous Vehicle Strategy

Uber's ambition in the autonomous vehicle (AV) market is undeniable. Their Advanced Technologies Group (ATG) is aggressively pursuing the development of self-driving technology, aiming to disrupt not just ride-sharing but also logistics and delivery services. Their strategy involves significant investment in research and development, strategic partnerships, and navigating complex regulatory landscapes.

- Uber ATG Initiatives: Uber's ATG is focused on developing Level 4 and 5 autonomous driving capabilities, meaning vehicles capable of operating without human intervention in specific or all conditions, respectively.

- Key Technological Milestones: Uber ATG has achieved significant milestones in areas like sensor fusion, AI-powered perception systems, and robust control algorithms. However, achieving full autonomy remains a challenging and evolving process.

- Competition Analysis: Uber faces stiff competition from established players like Waymo (Alphabet's self-driving division) and Cruise (General Motors' autonomous vehicle subsidiary), along with other tech giants and automotive manufacturers entering the fray. This competitive landscape highlights the inherent risks associated with this sector.

- Regulatory Hurdles and Challenges: The regulatory environment surrounding autonomous vehicles is still developing, creating uncertainty and potential roadblocks for companies like Uber. Different jurisdictions have varying regulations, adding another layer of complexity.

Identifying Relevant ETF Sectors

Investing in Exchange-Traded Funds (ETFs) offers a diversified approach to gaining exposure to the autonomous vehicle market, mitigating the risk associated with investing in individual companies. Instead of focusing on a single company, ETFs allow for a spread of investment across numerous companies involved in various aspects of the autonomous vehicle ecosystem. This diversification strategy significantly reduces risk compared to concentrating investments in only one or two companies. Relevant ETF sectors include:

Technology ETFs

These ETFs focus on companies developing the crucial technologies that power autonomous vehicles. This includes companies specializing in artificial intelligence (AI), advanced sensor technologies (LiDAR, radar, cameras), and the sophisticated software required for self-driving systems.

- Examples: Technology Select Sector SPDR Fund (XLK), Invesco QQQ Trust (QQQ), iShares US Technology ETF (IYW)

Automotive ETFs

This category includes companies directly involved in the manufacturing of vehicles, components, and related technologies essential for autonomous driving functionality. These could range from traditional automakers adapting to the new technology to specialized parts suppliers.

- Examples: iShares U.S. Automobiles ETF (CARZ), First Trust Nasdaq Global Auto Index Fund (CAR), Global X Autonomous & Electric Vehicles ETF (DRIV)

Robotics and AI ETFs

Companies specializing in robotics and artificial intelligence are vital to the development of autonomous systems. These ETFs offer exposure to companies developing the core AI algorithms, robotic systems, and related technologies required for autonomous operation.

- Examples: ROBO Global Robotics and Automation Index ETF (ROBO), Global X Robotics & Artificial Intelligence ETF (BOTZ)

It's crucial to consider the expense ratio of each ETF – the annual fee charged to manage the fund – and the level of diversification within the ETF itself. A lower expense ratio and a well-diversified portfolio are generally preferred.

Assessing Risk and Potential Returns

Investing in emerging technologies like autonomous vehicles carries significant risk. The technology is still under development, and there are no guarantees of success. Market adoption rates, regulatory changes, and technological breakthroughs all play a crucial role in determining the ultimate success of the autonomous vehicle market.

- High Growth Potential versus High Risk: The potential for significant returns is high if the technology matures and gains widespread adoption. However, the high risk associated with this emerging technology demands careful consideration.

- Long-Term Investment Horizon Recommended: Investing in autonomous vehicle technology is a long-term play. Significant returns are more likely to materialize over a longer time horizon. Short-term market fluctuations should be expected and factored into the investment strategy.

- Importance of Due Diligence Before Investing: Thorough research and understanding of the risks involved are crucial before investing in any ETF related to autonomous vehicles. Consider consulting with a financial advisor.

- Diversification to Mitigate Risk: Diversification across different ETF sectors, as mentioned above, is key to reducing the overall risk associated with this volatile sector.

Conclusion: Investing in Uber's Autonomous Vehicle Future Through ETFs

Uber's ambitious push into autonomous vehicles presents a compelling investment opportunity, but it's not without considerable risk. By carefully selecting ETFs that offer diversified exposure across relevant technology, automotive, and robotics sectors, investors can potentially participate in this exciting and potentially lucrative market. Remember, careful consideration of the risks involved and a long-term investment horizon are essential. Start researching ETFs related to autonomous vehicle technology today and take advantage of the potential returns offered by Uber's ambitious autonomous vehicle push. Successful autonomous vehicle ETF investing requires diligent research and a well-defined investment strategy.

Featured Posts

-

Expected Spring Breakout Rosters For 2025

May 18, 2025

Expected Spring Breakout Rosters For 2025

May 18, 2025 -

Impact Of Trumps 30 Tariffs On China Extended Until Late 2025

May 18, 2025

Impact Of Trumps 30 Tariffs On China Extended Until Late 2025

May 18, 2025 -

Selena Gomez Claims Victory Was She Right About Blake Lively All Along

May 18, 2025

Selena Gomez Claims Victory Was She Right About Blake Lively All Along

May 18, 2025 -

Aimee Lou Wood And Bowen Yang In Snls White Lotus Parody Bowen Yangs Response

May 18, 2025

Aimee Lou Wood And Bowen Yang In Snls White Lotus Parody Bowen Yangs Response

May 18, 2025 -

Best Crypto Casino 2025 Jackbit Review And Guide

May 18, 2025

Best Crypto Casino 2025 Jackbit Review And Guide

May 18, 2025

Latest Posts

-

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025

Daily Lotto Draw Results Tuesday 29th April 2025

May 18, 2025 -

Find The Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025

Find The Daily Lotto Results For Tuesday 29 April 2025

May 18, 2025 -

Tuesday 29 April 2025 Daily Lotto Results

May 18, 2025

Tuesday 29 April 2025 Daily Lotto Results

May 18, 2025 -

Daily Lotto Results Tuesday 29 April 2025 Check Winning Numbers

May 18, 2025

Daily Lotto Results Tuesday 29 April 2025 Check Winning Numbers

May 18, 2025 -

View The Daily Lotto Results For Friday April 25 2025

May 18, 2025

View The Daily Lotto Results For Friday April 25 2025

May 18, 2025