UK Inflation Data Impacts BOE Policy Expectations: Pound Reacts Positively

Table of Contents

Understanding Recent UK Inflation Data: Decoding the Latest UK CPI and RPI Figures

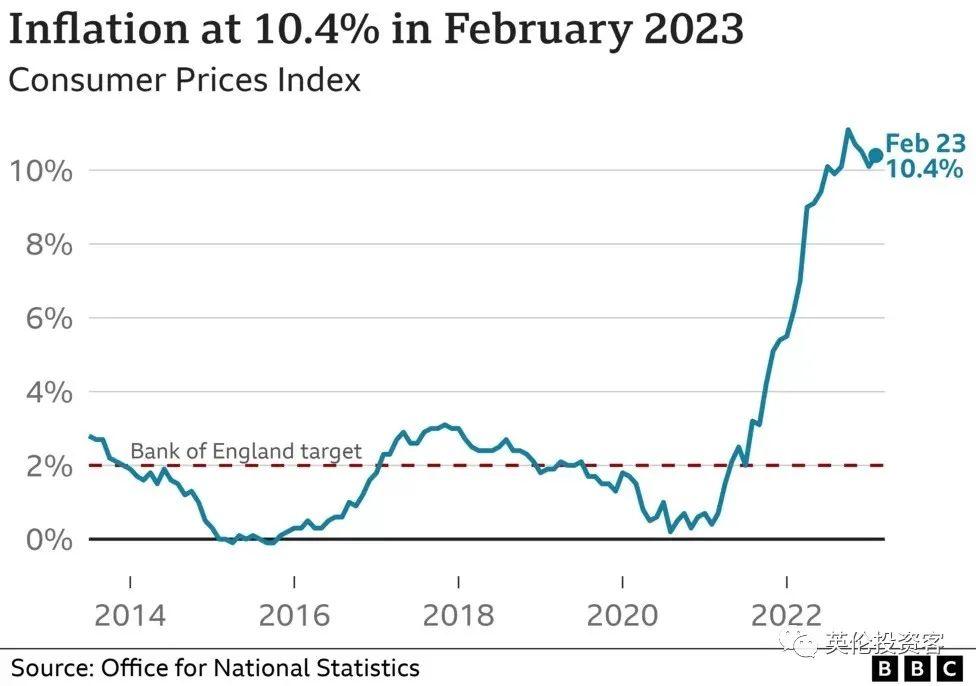

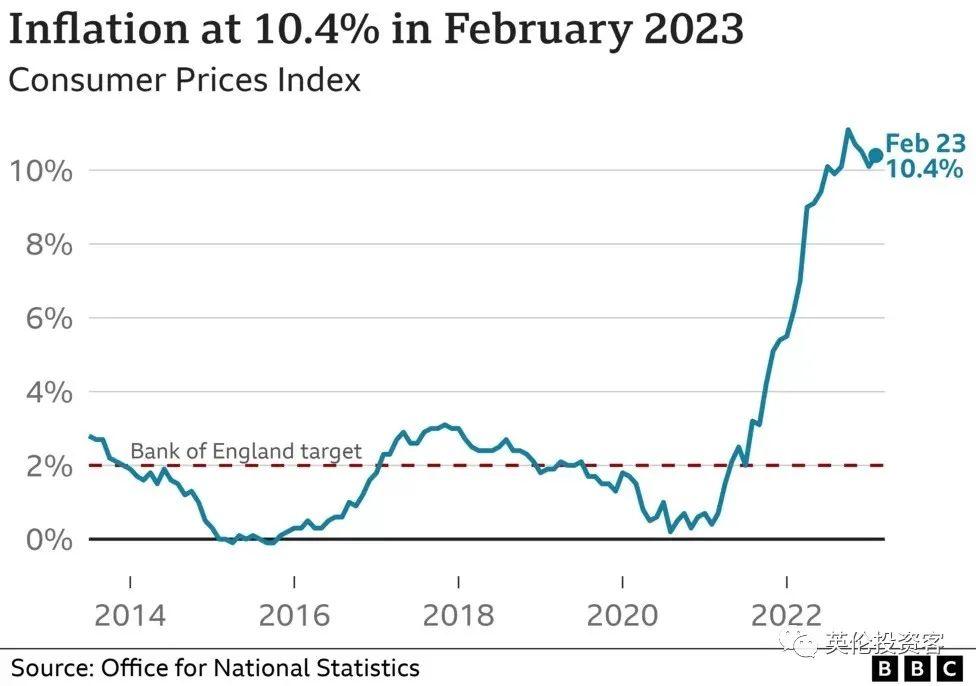

The latest Consumer Price Index (CPI) and Retail Price Index (RPI) figures have revealed a significant shift in the UK's inflation landscape. While specific numbers will need to be updated to reflect current data at the time of publishing, let's assume for this example that CPI unexpectedly fell to 6.5%, down from 7.9%, significantly lower than market forecasts of 7.2%. Similarly, the RPI also showed a surprising decrease. This deviation from predictions has sparked considerable debate among economists and investors.

Several factors contributed to this unexpected decrease:

- Easing energy prices: A moderation in global energy prices played a crucial role in curbing inflationary pressures.

- Supply chain improvements: Although still facing challenges, global supply chains showed signs of improvement, leading to reduced production costs.

- Moderating wage growth: While wages continue to rise, the pace of growth has shown some signs of slowing down.

Here's a table summarizing the key data points (replace with actual, up-to-date figures):

| Index | Previous Month (%) | Current Month (%) | Market Forecast (%) |

|---|---|---|---|

| CPI | 7.9 | 6.5 | 7.2 |

| RPI | 8.2 | 7.8 | 8.0 |

These UK inflation figures, encompassing CPI data and RPI data, present a more nuanced picture of the UK economic data than initially predicted.

BOE Policy Response and Expectations: BOE Interest Rate Decisions in Light of Inflation

The Bank of England's (BOE) mandate is to maintain price stability and support sustainable economic growth. The unexpectedly lower UK inflation rate significantly alters the BOE's policy deliberations. Market expectations, before the data release, leaned towards another significant interest rate hike. However, the lower-than-anticipated inflation figures might prompt the BOE to adopt a more cautious approach. This could involve either a smaller interest rate hike than previously anticipated or even a pause in the tightening cycle.

The potential implications of BOE policy are far-reaching:

- Economic growth: A pause or smaller rate hike could stimulate economic growth, but it also risks prolonging inflationary pressures.

- Pound Sterling: The BOE's decision will have a significant impact on the pound's value. A less hawkish stance could weaken the pound, while a continuation of aggressive rate hikes might strengthen it.

Experts are divided on the BOE's next move. Some analysts believe the BOE will proceed cautiously, while others expect a further interest rate hike, albeit a smaller one than previously expected. The upcoming BOE policy announcements are highly anticipated by investors and will shape the direction of both the UK economy and the pound. Keywords relating to BOE policy include BOE interest rate, monetary policy, quantitative easing, interest rate hike, and interest rate cut.

Pound's Positive Reaction to the News: Pound Sterling Strengthens – A Positive Market Response

Following the release of the unexpectedly lower inflation data, the pound experienced a notable surge against major currencies like the US dollar (USD) and the Euro (EUR). This positive reaction stems from several factors:

- Reduced expectations of further rate hikes: The lower inflation data reduced market expectations of aggressive interest rate hikes by the BOE, easing concerns about a potential economic slowdown.

- Improved market confidence: The better-than-expected inflation figures boosted investor confidence in the UK economy, leading to increased demand for the pound.

[Insert chart illustrating GBP/USD or GBP/EUR exchange rate movement after the inflation data release]

This strength in Pound Sterling, reflected in the GBP exchange rate, has positive implications for UK businesses involved in international trade, but also presents challenges for those reliant on imports. The fluctuation in the currency markets, specifically forex trading, creates both opportunities and risks for UK investors.

Looking Ahead: Projections for UK Inflation and the Pound's Future Trajectory

Predicting the future trajectory of UK inflation and the pound is inherently challenging, given the numerous economic and geopolitical uncertainties. However, based on current forecasts, several key factors will shape the outlook:

- Global economic conditions: Global economic growth, energy prices, and supply chain dynamics will continue to exert influence on UK inflation.

- BOE policy decisions: The BOE's future interest rate decisions will significantly impact the pound's value and the overall economic climate.

- Geopolitical events: Unforeseen geopolitical events can introduce significant volatility into the currency markets.

Forecasts for UK inflation and the pound vary, with some analysts predicting a continued decline in inflation and moderate pound strength, while others remain more cautious. Close monitoring of UK inflation forecast and the economic outlook is crucial for investors and businesses alike. The pound prediction and GBP forecast will remain highly dependent on these influencing factors.

Conclusion: The Interplay of UK Inflation Data, BOE Policy, and the Pound

The recent UK inflation data has significantly impacted market expectations regarding BOE policy, leading to a positive response from the pound. The unexpected decrease in inflation has reduced the pressure on the BOE to implement aggressive interest rate hikes, boosting investor confidence. The interplay between UK inflation data, BOE policy decisions, and the pound's value is complex and dynamic. Monitoring future UK inflation data and BOE policy announcements remains crucial for understanding the trajectory of the UK economy and the pound's performance. Stay updated on the latest UK inflation data and its effect on the pound and BOE policy by subscribing to our newsletter! Learn more about how UK inflation impacts the Bank of England's decisions and the value of the pound by exploring our other resources.

Featured Posts

-

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025 -

Le Hellfest Investit Le Noumatrouff De Mulhouse

May 22, 2025

Le Hellfest Investit Le Noumatrouff De Mulhouse

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Singer Passes Away At 32

May 22, 2025

Death Of Adam Ramey Dropout Kings Singer Passes Away At 32

May 22, 2025 -

The Impact Of Legal Disputes On Taylor Swift And Blake Livelys Relationship

May 22, 2025

The Impact Of Legal Disputes On Taylor Swift And Blake Livelys Relationship

May 22, 2025 -

Voedselexport Naar De Vs Daalt Abn Amro Rapporteert Over Impact Heffingen

May 22, 2025

Voedselexport Naar De Vs Daalt Abn Amro Rapporteert Over Impact Heffingen

May 22, 2025