UK Inflation Report Prompts Pound Surge As BOE Rate Cut Expectations Ease

Table of Contents

The recent UK inflation report has triggered a significant upward movement in the value of the pound sterling against major global currencies. This unexpected development follows a period of speculation regarding potential interest rate cuts by the Bank of England (BOE). This article will delve into the key aspects of the report and its impact on the UK economy and the pound's performance.

Key Findings of the UK Inflation Report

The report revealed some surprising data points, altering market expectations significantly. Key findings include:

-

CPI (Consumer Price Index): The headline CPI figure showed a decrease to X%, down from Y% the previous month. This is lower than market forecasts which predicted Z%. This unexpected drop in the inflation rate signifies a potential easing of inflationary pressures. The lower than expected consumer price index is a significant factor in the pound's rise.

-

Producer Price Index (PPI): The PPI, which measures the price of goods at the wholesale level, also showed a decrease of A%, indicating that inflationary pressures might be subsiding across the supply chain. This positive economic indicator suggests reduced inflationary pressures on the horizon.

-

Core Inflation: Excluding volatile items like food and energy, core inflation remained at B%, slightly higher than expected. While this still indicates some underlying inflationary pressure, the overall picture suggested by the CPI and PPI data is far more positive for the UK economy and the pound. Core inflation continues to be monitored closely as an important economic indicator.

Impact on BOE Rate Cut Expectations

The unexpectedly lower-than-predicted inflation figures have significantly altered predictions about the BOE's next move regarding interest rates. Previously, many analysts anticipated a rate cut to stimulate economic growth and combat stubbornly high inflation. However, the latest data suggests that such a measure may no longer be necessary.

-

Reduced Likelihood of a Rate Cut: The lower inflation figures strongly indicate that the BOE may hold interest rates steady or even consider a potential rate hike in the coming months. The lower inflation rate decreases the pressure on the Bank of England to act.

-

Rationale for the Shift: The improved inflation figures suggest that the BOE's previous monetary policy actions, coupled with other economic factors, are beginning to have the desired effect of curbing inflation. This shift removes some urgency for further intervention.

-

Implications of Maintaining or Raising Rates: Maintaining or increasing interest rates would strengthen the pound further by attracting foreign investment seeking higher returns, but could potentially dampen economic growth by increasing borrowing costs for businesses and consumers. This is a delicate balancing act for the BOE.

Pound Sterling's Reaction and Market Volatility

The pound sterling reacted swiftly to the report's release, experiencing a significant surge against major currencies like the US dollar and the euro. This sharp movement indicates that the market was unprepared for such positive inflation data.

-

GBP Exchange Rate Surge: The GBP experienced a substantial increase in value, reflecting market confidence in the UK economy's improved outlook. The stronger pound reflects the positive interpretation of the inflation figures.

-

Factors Contributing to the Surge: The lower-than-expected inflation figures, reduced expectations of a BOE rate cut, and increased investor confidence all contributed to the pound's strong performance. These factors all played a role in strengthening the British pound.

-

Broader Market Reactions: Other asset classes also reacted positively, with UK equities (stocks) showing gains, reflecting investor optimism about the UK's economic prospects. These positive reactions across asset classes are linked to the lower inflation rate.

Long-Term Implications for the UK Economy

The UK inflation report's positive findings have significant implications for the UK's long-term economic outlook.

-

Potential for Sustained Growth: Reduced inflation could lead to more sustainable economic growth, enabling businesses to plan with more certainty and consumers to enjoy greater purchasing power. The reduced inflation rate is essential for sustained economic growth.

-

Risks and Opportunities: While the current picture appears positive, risks remain, including potential global economic shocks and the ongoing impact of geopolitical uncertainty. Businesses and consumers need to adapt to changing economic conditions.

-

Government Policy and Economic Growth: The government may adjust its fiscal policy in response to the evolving economic situation, potentially increasing investment in infrastructure or other growth-stimulating initiatives. The positive inflation report could lead to changes in government policy.

Conclusion

The recent UK inflation report delivered unexpectedly positive news, resulting in a significant surge in the pound sterling as expectations of a BOE rate cut eased. The lower-than-expected inflation rate, particularly the CPI figure, played a pivotal role in this market shift. The report suggests a potential easing of inflationary pressures, altering the outlook for the Bank of England’s monetary policy. This has positive implications for the UK economy in the long term, although risks remain. Understanding the implications of UK inflation reports and their effect on the pound is crucial for navigating the evolving economic landscape. Stay informed about the evolving economic landscape in the UK. Continue to monitor future UK inflation reports and BOE announcements for insights into the ongoing fluctuations in the pound and the broader economic outlook. Follow [Your Website/Source] for the latest updates on UK inflation and its impact.

Featured Posts

-

Novye Foto Naomi Kempbell Smelye I Otkrovennye Obrazy

May 26, 2025

Novye Foto Naomi Kempbell Smelye I Otkrovennye Obrazy

May 26, 2025 -

Learning From Sarah Vine Avoiding Whats App Disasters

May 26, 2025

Learning From Sarah Vine Avoiding Whats App Disasters

May 26, 2025 -

Review Of The Best Nike Running Shoes In 2025

May 26, 2025

Review Of The Best Nike Running Shoes In 2025

May 26, 2025 -

Israeli Premier League Maccabi Tel Avivs Path To Victory

May 26, 2025

Israeli Premier League Maccabi Tel Avivs Path To Victory

May 26, 2025 -

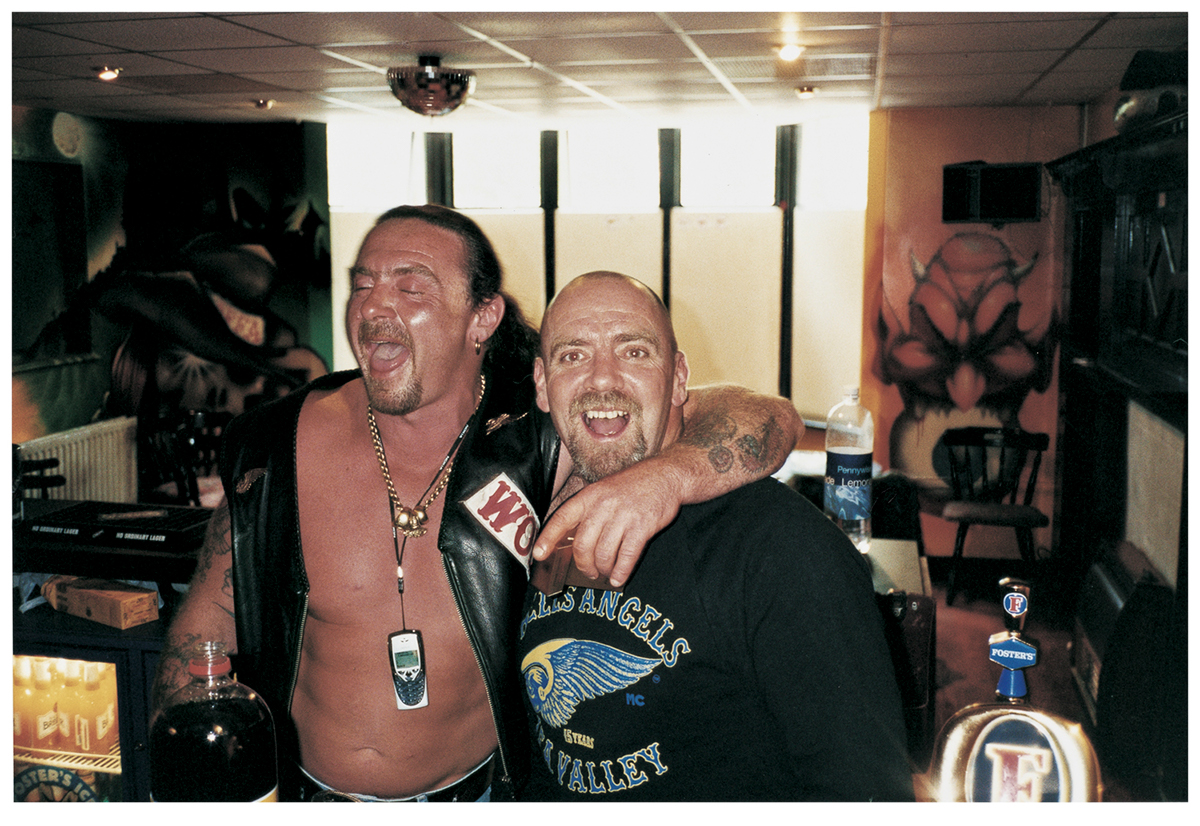

Understanding The Hells Angels Motorcycle Club

May 26, 2025

Understanding The Hells Angels Motorcycle Club

May 26, 2025