UK Inflation Slows: Impact On BOE Rate Cuts And The Pound

Table of Contents

The Bank of England (BOE) and Interest Rate Decisions

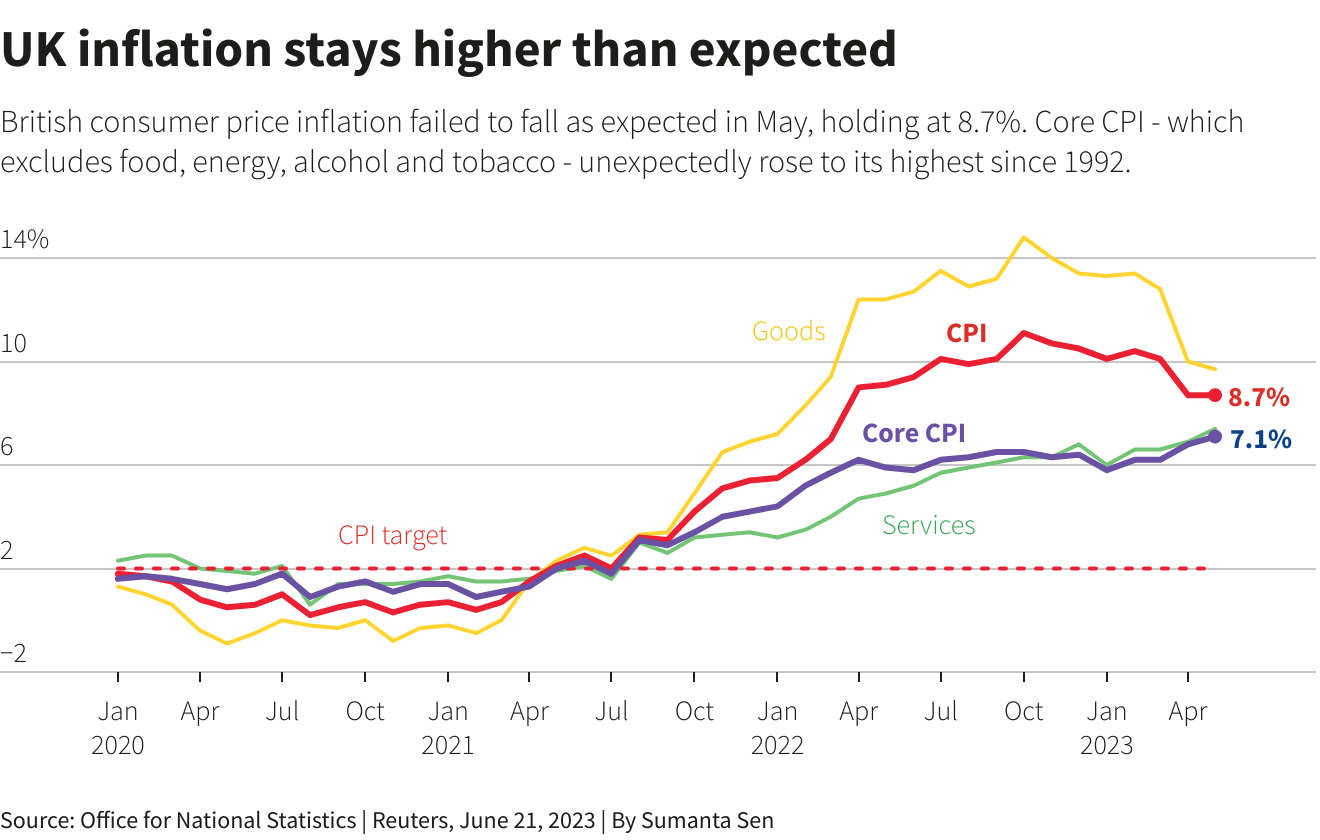

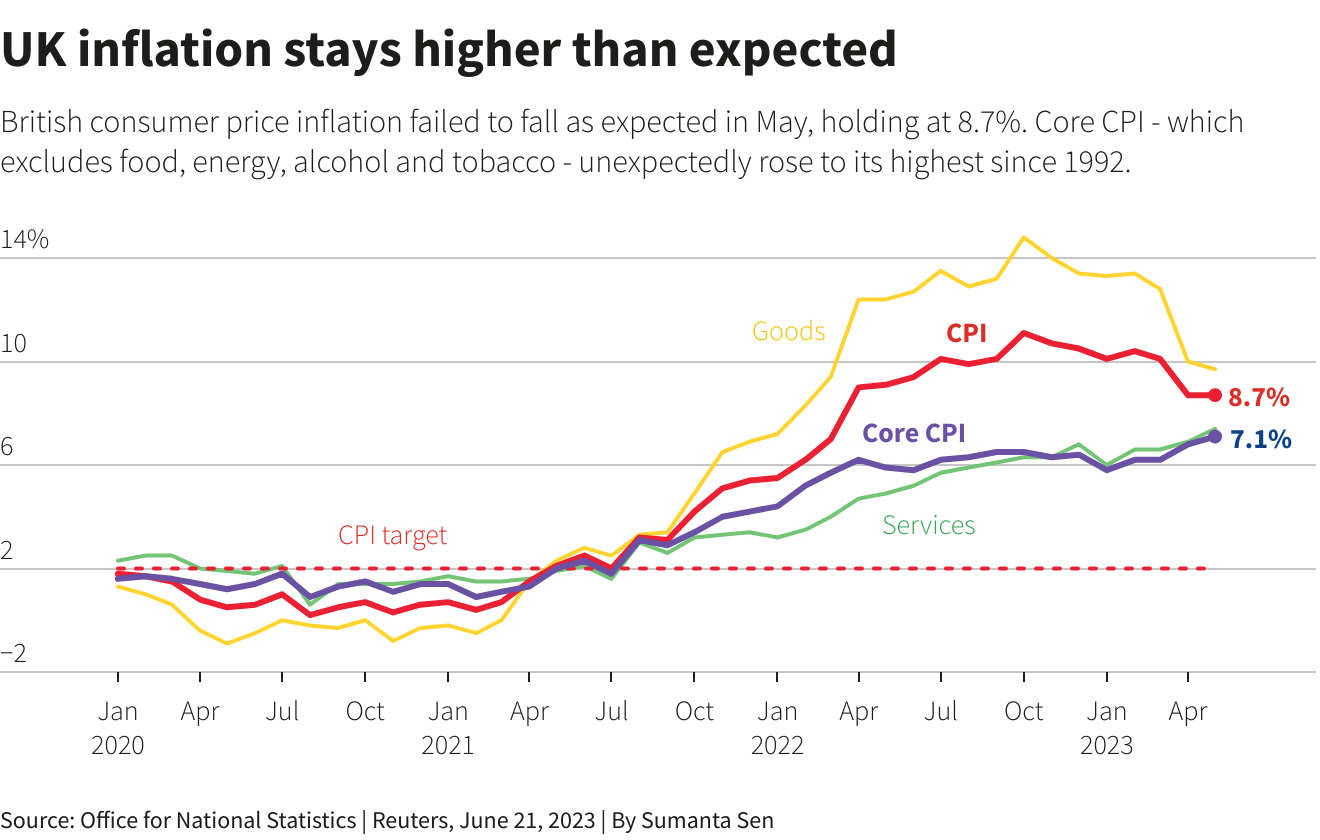

Easing Inflationary Pressures

The deceleration of the UK inflation rate provides the BOE with greater flexibility in its approach to interest rate policy. The BOE's primary mandate is price stability, meaning it aims to keep inflation at its target level (currently 2%). High inflation necessitates higher interest rates to cool down the economy, but with inflation easing, the pressure to maintain aggressively high rates diminishes. The current interest rate level, while still elevated, might be adjusted downwards.

- The BOE's mandate focuses on achieving and maintaining price stability.

- Slowing UK inflation opens the door to potential future interest rate cuts.

- The current high interest rate environment could see some moderation.

Potential for Rate Cuts and Their Implications

The prospect of BOE rate cuts raises important questions about timing and magnitude. A reduction in interest rates could stimulate economic growth by making borrowing cheaper for businesses and consumers, encouraging investment and spending. However, prematurely cutting rates too aggressively could reignite inflationary pressures.

- Gradual rate cuts might be preferred to avoid triggering a surge in inflation.

- A more aggressive approach to rate cuts could boost economic growth but risk inflationary resurgence.

- Lower borrowing costs could benefit businesses and consumers, stimulating economic activity.

- Businesses may see reduced financing costs, encouraging investment and expansion.

- Consumers could find it easier to access credit for purchases, potentially boosting consumer spending.

Factors Influencing BOE Decisions

The BOE's decisions are not solely based on inflation. Other key economic indicators significantly influence their policy choices.

- Unemployment rates: High unemployment might necessitate stimulative measures, potentially outweighing concerns about inflation.

- Economic growth projections: Weak economic growth might prompt the BOE to prioritize stimulating the economy, even at the risk of slightly higher inflation.

- Global economic conditions: International economic instability can impact the UK economy and influence BOE policy.

- Brexit's ongoing impact: The lingering effects of Brexit continue to affect the UK economy and influence the BOE's considerations.

- Energy prices: Fluctuations in energy prices remain a significant factor, impacting inflation and economic growth.

- Wage growth: Rapid wage growth can exacerbate inflationary pressures, influencing the BOE’s rate decisions.

Impact on the British Pound (GBP)

The Relationship Between Inflation and the Pound

Lower inflation can positively influence the value of the pound. Reduced inflationary pressures can attract foreign investment, increasing demand for the GBP and strengthening its exchange rate. Investor sentiment plays a crucial role; a belief in a stable and improving UK economy boosts demand for the pound.

- Lower inflation generally improves investor confidence in the UK economy.

- Interest rate differentials affect currency exchange rates; lower UK rates compared to other countries might weaken the GBP.

- International capital flows are influenced by perceived economic stability and growth prospects.

Potential for GBP Appreciation

If the BOE cuts interest rates less aggressively than markets anticipate, or if global economic conditions improve, the pound could strengthen against other major currencies like the US dollar (USD) and the Euro (EUR). A stable and improving economic outlook can make the GBP more attractive to investors.

- A less aggressive approach to rate cuts could signal confidence in the UK economy, supporting the GBP.

- Positive global economic developments could increase demand for the GBP, leading to appreciation.

- Scenarios range from modest appreciation to more significant gains, depending on various factors.

Risks and Uncertainties

Several factors could negatively impact the GBP, even with slowing inflation. Geopolitical risks, unexpected economic shocks, and persistent inflationary pressures could all undermine GBP appreciation.

- Geopolitical instability can create uncertainty and reduce demand for the GBP.

- Unexpected negative economic shocks can weaken the pound.

- Persistent inflationary pressures, even if slowing, could still deter investors.

- Global uncertainty can lead to a flight to safety, potentially weakening the GBP against stronger currencies.

Analyzing the Economic Outlook

Economic Growth Projections

Forecasts for UK economic growth vary, but slowing inflation and potential BOE policy adjustments are key factors. Most predictions suggest moderate growth, though the extent depends on various economic and geopolitical events.

- Reputable economic institutions offer varying growth projections, reflecting the inherent uncertainty.

- The impact of BOE policy on growth will depend on the timing and scale of any rate cuts.

- Global economic conditions significantly affect UK growth prospects.

Unemployment Trends

The interplay between inflation, interest rates, and unemployment is complex. Lower interest rates can stimulate employment by encouraging business investment and consumer spending, but excessively low rates might fuel inflation.

- Lower interest rates generally support job creation through increased economic activity.

- Different sectors of the economy will be impacted differently by interest rate changes.

- The BOE aims to find a balance between controlling inflation and maintaining a healthy employment rate.

Conclusion: Navigating the Changing Landscape of UK Inflation

Slowing UK inflation offers potential benefits for the BOE and the GBP, but navigating this changing economic landscape requires careful consideration. The potential for interest rate cuts exists, but the timing and magnitude will depend on various factors. While the pound may appreciate, several risks and uncertainties could impact its exchange rate. Monitoring economic indicators and BOE announcements is crucial for understanding the evolving situation. Stay informed about "UK inflation slows" developments and consult financial professionals for personalized advice. Follow us for further updates on the impact of UK inflation.

Featured Posts

-

Jaap Stam Criticises Man Uniteds Costly Gamble Under Ten Hag

May 23, 2025

Jaap Stam Criticises Man Uniteds Costly Gamble Under Ten Hag

May 23, 2025 -

El Horoscopo De La Semana 1 Al 7 De Abril De 2025

May 23, 2025

El Horoscopo De La Semana 1 Al 7 De Abril De 2025

May 23, 2025 -

Daco Valerie Rodriguez Erazo En Nuevo Cargo

May 23, 2025

Daco Valerie Rodriguez Erazo En Nuevo Cargo

May 23, 2025 -

Helicopter Cow Rescue 96 Animals Saved In Swiss Village Operation

May 23, 2025

Helicopter Cow Rescue 96 Animals Saved In Swiss Village Operation

May 23, 2025 -

Ihanetin Bedelini Hemen Oedeten Burclar

May 23, 2025

Ihanetin Bedelini Hemen Oedeten Burclar

May 23, 2025