Ultra-Low Growth Forecast For Canada's Economy In The Coming Year

Table of Contents

Impact of High Interest Rates on Canadian Economic Growth

The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are significantly impacting Canadian economic growth. Higher interest rates increase borrowing costs for both individuals and businesses, leading to reduced spending and investment. This ripple effect permeates various sectors, slowing economic expansion.

For example, the recent increase to the overnight rate has directly impacted mortgage rates, making homeownership less attainable for many Canadians. This, in turn, can lead to a slowdown in the housing market, affecting related industries like construction and real estate.

- Decreased consumer confidence: Higher interest rates translate to less disposable income, dampening consumer spending and overall economic activity.

- Increased borrowing costs for businesses: Businesses face higher costs for loans and lines of credit, hindering investment in expansion and job creation. This particularly impacts small and medium-sized enterprises (SMEs), the backbone of the Canadian economy.

- Potential for a housing market slowdown: Higher mortgage rates reduce affordability, potentially leading to a decline in housing prices and construction activity.

- Impact on specific sectors: Sectors heavily reliant on borrowing, such as construction and manufacturing, are particularly vulnerable to higher interest rates.

Global Economic Uncertainty and its Influence on Canada's Economy

Canada's economy is intricately linked to the global landscape. Current global economic uncertainty, characterized by persistent inflation, supply chain disruptions, and geopolitical instability, significantly impacts Canada's growth prospects. The ultra-low growth forecast is partly a reflection of these external headwinds.

These global challenges create a climate of uncertainty, discouraging both domestic and foreign investment. Reduced global demand for Canadian exports further exacerbates the situation.

- Reduced demand for Canadian exports: Global economic slowdown reduces demand for Canadian goods and services, impacting key export-oriented sectors.

- Increased uncertainty among investors: Global instability makes investors hesitant, reducing investment in Canadian businesses and projects.

- Potential for decreased foreign investment: Uncertainty surrounding the global economy can deter foreign direct investment, crucial for Canadian economic growth.

- Impact of global recessionary fears: Concerns about a global recession further dampen investor confidence and consumer spending, contributing to the low growth forecast.

Inflationary Pressures and their Effect on Consumer Spending and Business Investment

High inflation erodes consumer purchasing power, forcing households to prioritize essential goods and services. This reduced consumer spending directly impacts economic growth. Simultaneously, businesses face increased input costs, squeezing profit margins and discouraging investment.

The current inflation rate in Canada, while showing signs of moderation, remains a significant concern. This persistent inflationary pressure directly contributes to the ultra-low growth forecast.

- Erosion of consumer purchasing power: Rising prices for essential goods and services leave less disposable income for discretionary spending.

- Increased input costs for businesses: Businesses face higher costs for raw materials, energy, and labor, impacting profitability and investment decisions.

- Impact on different income groups: Lower-income households are disproportionately affected by inflation, leading to a further contraction in consumer demand.

- Government policies to combat inflation: The Bank of Canada's interest rate hikes and government fiscal policies aim to control inflation, but their effectiveness remains a subject of ongoing debate.

Potential Mitigation Strategies and Government Response to Ultra-Low Growth

The Canadian government is likely to implement various strategies to mitigate the impact of the ultra-low growth forecast. These could include fiscal stimulus packages, tax incentives, and increased infrastructure spending. However, the effectiveness of these strategies will depend on several factors, including the severity and duration of the economic slowdown.

- Government stimulus packages: Government spending on infrastructure projects and social programs can stimulate demand and boost economic activity.

- Tax incentives for businesses and investors: Tax cuts or credits can encourage investment and job creation.

- Investments in infrastructure projects: Infrastructure projects create jobs and improve productivity, offering a long-term boost to the economy.

- Evaluation of past government responses: Analyzing the effectiveness of past government responses to economic downturns can inform current policy decisions.

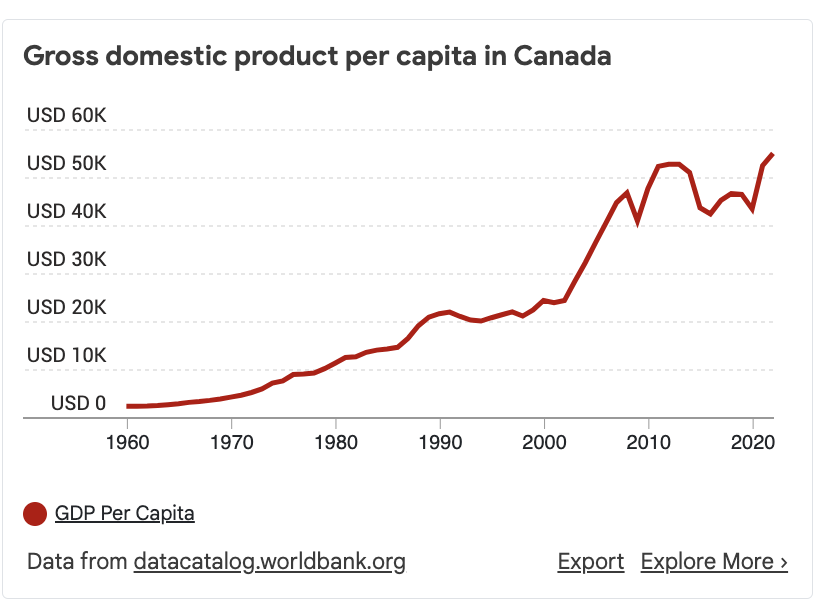

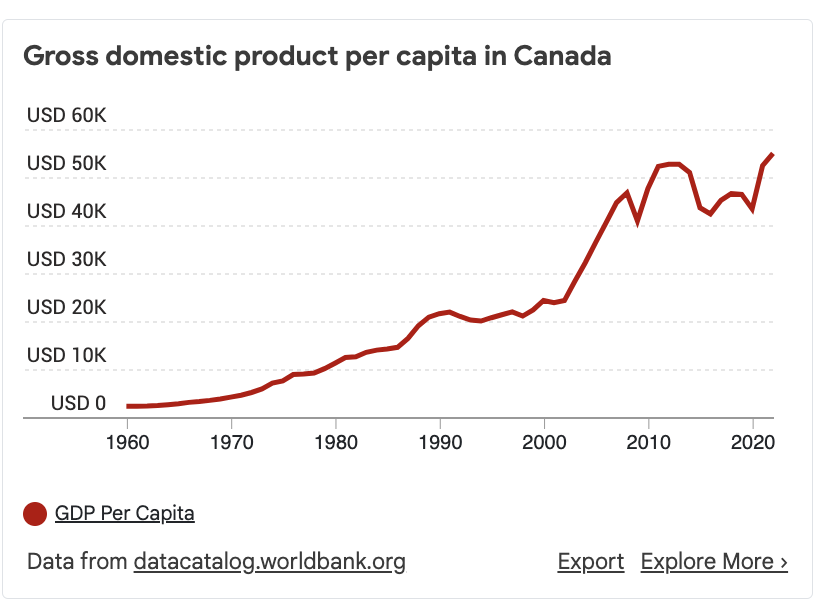

Understanding the Ultra-Low Growth Forecast for Canada's Economy

The ultra-low growth forecast for Canada's economy stems from a confluence of factors: high interest rates curbing spending and investment, global economic uncertainty dampening investor confidence, and persistent inflationary pressures squeezing consumer purchasing power and business profitability. These factors are impacting various sectors, potentially leading to a prolonged period of sluggish economic growth. While potential mitigation strategies exist, their effectiveness remains to be seen. Stay informed on the latest developments regarding Canada's economic growth and understand how this ultra-low growth forecast may impact you. Follow us for regular updates on the Canadian economy and learn how to navigate this challenging period of low economic growth in Canada.

Featured Posts

-

1 050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Acquisition

May 02, 2025

1 050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Acquisition

May 02, 2025 -

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 02, 2025

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 02, 2025 -

Avrupa Birligi Ile Iliskilerde Yeni Bir Safha

May 02, 2025

Avrupa Birligi Ile Iliskilerde Yeni Bir Safha

May 02, 2025 -

Trumps Tariffs A Judges Review Blocked

May 02, 2025

Trumps Tariffs A Judges Review Blocked

May 02, 2025 -

Find The Winning Lotto Numbers Wednesday April 9th

May 02, 2025

Find The Winning Lotto Numbers Wednesday April 9th

May 02, 2025