Unaffordable Homes: How High Down Payments Exclude Canadians

Table of Contents

The Soaring Cost of Housing in Canada and its Impact on Down Payments

Canadian housing prices have skyrocketed in recent years, making homeownership a distant prospect for many. Cities like Vancouver and Toronto consistently rank among the most expensive real estate markets globally. This dramatic increase in prices directly translates into significantly higher down payment requirements, creating a substantial barrier to entry for prospective homebuyers.

The widening gap between average household income and house prices further exacerbates the issue. While wages have remained relatively stagnant, house prices have surged, necessitating larger and larger down payments. This disparity creates an insurmountable hurdle for many, especially first-time buyers.

- Average House Prices vs. Average Household Income: In Toronto, the average house price is approximately $X, while the average household income is $Y, requiring a down payment of Z% of the average income. In Vancouver, the figures are even more stark.

- Down Payment Percentage by Region: The percentage of income needed for a down payment varies significantly across Canada, with higher percentages in major urban centers. This disparity highlights the uneven distribution of housing affordability across the country.

- Impact of Interest Rates: Fluctuations in interest rates further complicate the equation, impacting both mortgage affordability and the overall cost of homeownership.

The Challenges of Saving for a Large Down Payment

Saving a substantial down payment, often 20% or more of the purchase price, presents a formidable challenge for many Canadians. This is particularly true for first-time homebuyers who lack the benefit of accumulated savings or equity from previous properties.

Existing financial burdens, such as student loans, credit card debt, and the rising cost of living, make it even more difficult to save enough for a down payment. These competing financial priorities often leave little room for substantial home savings. Younger generations and low-income earners are disproportionately affected, facing a steeper uphill battle.

- Time Required to Save: At an income of $50,000 per year, saving a 20% down payment on a $750,000 home would take approximately X years, assuming a consistent savings rate and no significant changes in income or expenses.

- Impact of Inflation: Inflation further erodes the purchasing power of savings, making it harder to accumulate the necessary funds for a substantial down payment.

- Alternative Saving Strategies: While challenging, utilizing alternative saving strategies like Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) can potentially assist in accelerating the savings process.

The Impact of High Down Payments on Homeownership Rates

High down payment requirements have a demonstrably negative correlation with homeownership rates. This is particularly evident among younger generations, low-income earners, and marginalized communities. The inability to access homeownership limits social mobility and exacerbates economic inequality.

The decreased homeownership rate also contributes to a potential increase in rental costs. As fewer people own homes, the demand for rental properties increases, driving up rental prices and making it even more challenging for those who cannot afford to buy.

- Homeownership Rates by Demographics: Statistics show a significant disparity in homeownership rates across different age groups, income levels, and regions. Young adults, in particular, are struggling to enter the housing market.

- Social Mobility and Economic Inequality: Limited access to homeownership significantly impacts social mobility and contributes to a widening wealth gap. Owning a home is a significant wealth-building tool, and its inaccessibility for many perpetuates economic disparities.

- Widening Wealth Gap: The inability to access homeownership perpetuates the wealth gap, creating a cycle of economic disadvantage.

Potential Solutions to Improve Housing Affordability

Addressing the unaffordable housing crisis requires a multifaceted approach involving both government intervention and private sector collaboration. Various policy initiatives can help to improve affordability and make homeownership more accessible.

Lenders also have a role to play in offering more flexible mortgage options with lower down payment requirements and tailored programs to support first-time homebuyers. Increased housing supply is critical to reducing the pressure on prices and creating more competitive market conditions.

- Government Programs: Government programs such as grants, tax incentives, and low-interest loans can help first-time homebuyers overcome the high down payment hurdle.

- Flexible Mortgage Options: Lenders can introduce innovative mortgage products with reduced down payment requirements and extended repayment terms to make homeownership more accessible.

- Increasing Housing Supply: Building more affordable housing units, particularly in urban centers, can alleviate pressure on housing prices and improve overall market conditions.

Conclusion: Addressing the Unaffordable Housing Crisis in Canada

High down payments are a significant barrier to homeownership in Canada, disproportionately affecting young people, low-income earners, and marginalized communities. The resulting decrease in homeownership rates contributes to increased rental costs, reduced social mobility, and a widening wealth gap. Addressing this crisis requires a collaborative effort from government, the private sector, and individuals. We need comprehensive solutions, including affordable housing initiatives, flexible mortgage options, and a significant increase in housing supply.

Demand better solutions to the unaffordable homes crisis in Canada! Learn more about government programs to combat unaffordable homes and find resources to help you achieve your homeownership goals.

Featured Posts

-

Caso Maddie Mc Cann Polonesa Detida No Reino Unido

May 09, 2025

Caso Maddie Mc Cann Polonesa Detida No Reino Unido

May 09, 2025 -

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 09, 2025

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 09, 2025 -

Why Is The Us Attorney General On Fox News Every Day A More Important Question Than Epstein

May 09, 2025

Why Is The Us Attorney General On Fox News Every Day A More Important Question Than Epstein

May 09, 2025 -

Leon Draisaitls Century Mark Oilers Win In Overtime Against Islanders

May 09, 2025

Leon Draisaitls Century Mark Oilers Win In Overtime Against Islanders

May 09, 2025 -

The Emotional Toll Of Daycare Support For Working Parents

May 09, 2025

The Emotional Toll Of Daycare Support For Working Parents

May 09, 2025

Latest Posts

-

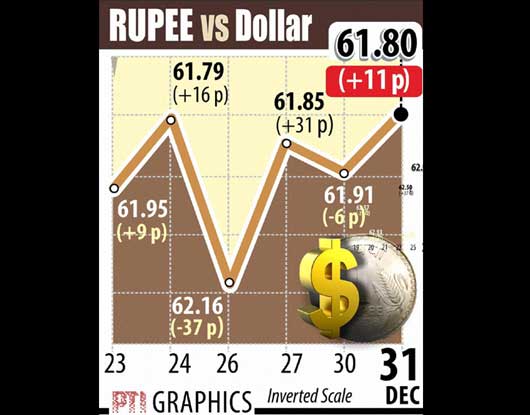

Indian Stock Market Update Sensex And Nifty Rally Key Gainers And Losers

May 09, 2025

Indian Stock Market Update Sensex And Nifty Rally Key Gainers And Losers

May 09, 2025 -

Sensex Nifty

May 09, 2025

Sensex Nifty

May 09, 2025 -

Sensex 600 Nifty

May 09, 2025

Sensex 600 Nifty

May 09, 2025 -

R4 5

May 09, 2025

R4 5

May 09, 2025 -

Stock Market News Sensex And Nifty Close Higher Despite Ultra Tech Fall

May 09, 2025

Stock Market News Sensex And Nifty Close Higher Despite Ultra Tech Fall

May 09, 2025