Understanding CoreWeave's (CRWV) Significant Stock Gains Last Week

Table of Contents

Strong Market Sentiment and Investor Confidence

The surge in CoreWeave's stock price is largely attributable to the overwhelmingly positive market sentiment surrounding cloud computing and AI stocks. The burgeoning AI market is driving unprecedented demand for high-performance computing resources, placing companies like CoreWeave at the forefront of this technological revolution. Investor confidence in CoreWeave has been further bolstered by several key factors:

- Increased demand for high-performance computing resources for AI: The explosive growth of artificial intelligence is fueling a massive need for powerful computing infrastructure to train and deploy sophisticated AI models. CoreWeave's specialized infrastructure is perfectly positioned to capitalize on this demand.

- CoreWeave's strategic partnerships and customer acquisitions: Strategic alliances and the acquisition of key clients demonstrate CoreWeave's ability to secure a prominent position within the AI ecosystem. These partnerships provide access to new markets and technologies, further strengthening its competitive advantage.

- Positive analyst reports and upgrades contributing to bullish sentiment: Favorable analyst reports and upward revisions of price targets reflect the growing confidence in CoreWeave's future prospects. These reports often cite the company’s strong growth trajectory and innovative technology as key drivers.

- Comparison to competitors' performance (mentioning competitors like Nvidia): While Nvidia remains a dominant force in the GPU market, CoreWeave’s specialized focus on AI cloud computing allows it to carve out a niche and benefit from the overall positive sentiment surrounding the AI sector. Its performance relative to competitors needs further analysis.

CoreWeave's Recent Developments and Announcements

Several recent developments and announcements have significantly influenced CoreWeave's (CRWV) stock price. Analyzing these events provides crucial insights into the market's reaction and the company's growth trajectory.

- Specific announcements driving positive investor reaction: [Insert specific announcements, e.g., new product launches, major contract wins, strategic partnerships, etc. Provide details and quantify the impact where possible].

- Details of any new contracts or partnerships secured: Highlight the significance of any new partnerships or large contracts signed, emphasizing the revenue potential and market expansion these deals represent. Mention the clients involved if publicly available.

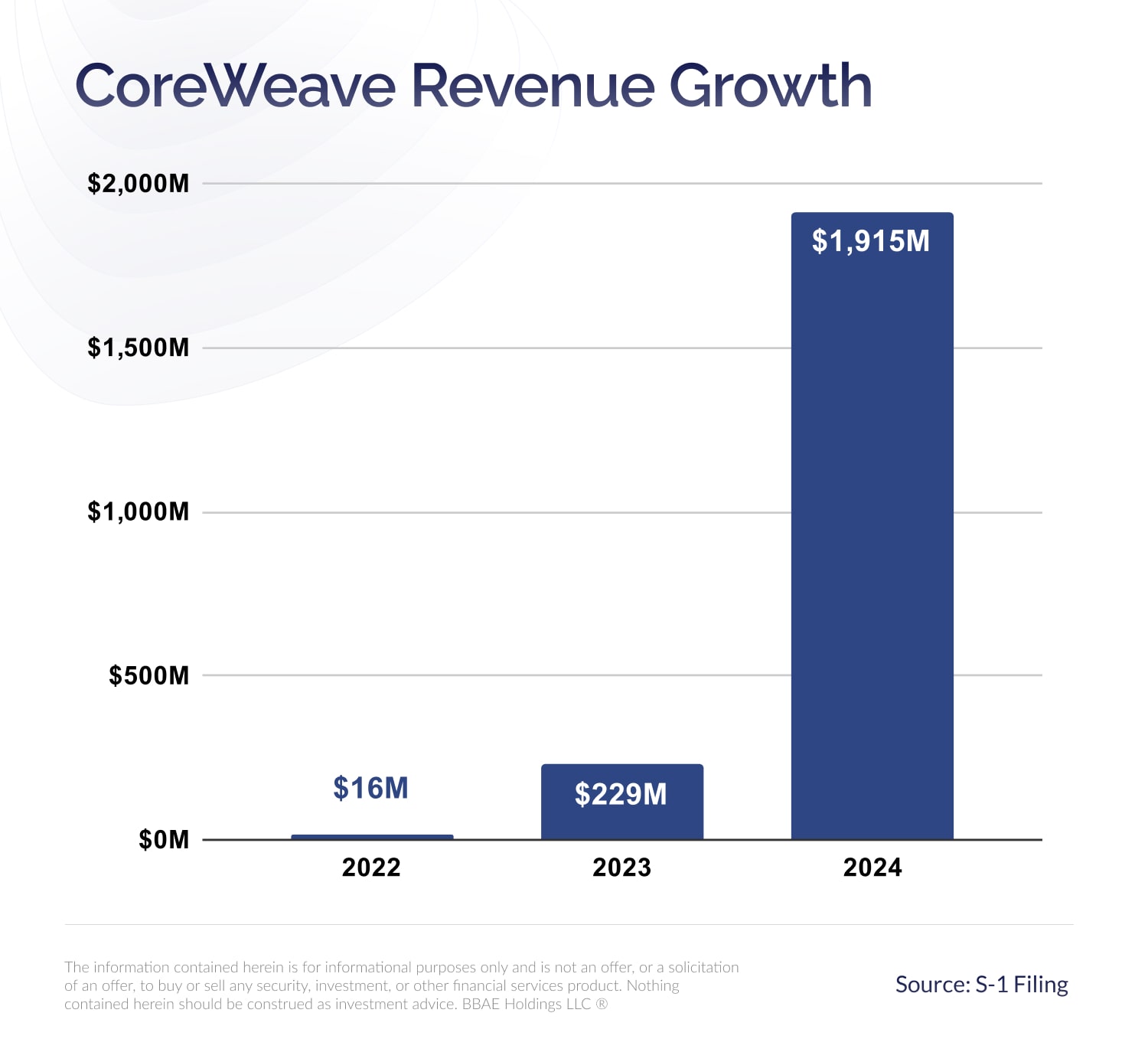

- Impact of any earnings reports or guidance on the stock price: Analyze the most recent earnings report, focusing on key metrics like revenue growth, profitability, and future guidance. Explain how these figures influenced investor perception and the subsequent stock price movement.

- Mention any positive industry-wide news that boosted CRWV specifically: Consider any positive developments in the broader AI or cloud computing sector that may have had a disproportionately positive impact on CoreWeave.

Macroeconomic Factors and Sectoral Trends

Broader macroeconomic factors and industry trends also play a crucial role in shaping CoreWeave's stock performance. Understanding these influences provides a more comprehensive picture of the company's trajectory.

- Overall market conditions and investor risk appetite: The general state of the stock market, investor sentiment, and risk tolerance significantly influence investment decisions. Positive market conditions generally lead to higher valuations for growth stocks like CRWV.

- Influence of interest rates and inflation on technology stocks: Interest rate hikes and inflation can impact technology stocks, as higher rates can increase borrowing costs and reduce investor appetite for growth investments. Analyze how these factors may have influenced CRWV specifically.

- Growth projections for the AI market and its impact on CRWV: The projected growth of the AI market directly impacts CoreWeave's potential. Highlight the market's impressive growth forecasts and how they translate to potential future revenue for CRWV.

- Comparison of CRWV's performance to overall market trends: Compare CoreWeave's performance to the broader technology sector and the overall market. This comparative analysis provides context and identifies whether the stock's performance is driven by company-specific factors or broader market trends.

Deciphering CoreWeave's (CRWV) Rise: A Look Ahead

CoreWeave's (CRWV) impressive stock gains last week are a result of a confluence of factors: strong market sentiment toward AI and cloud computing, positive company-specific developments, and favorable macroeconomic conditions. The company's strategic position within the rapidly expanding AI market is a key driver of its success. However, it's crucial to maintain a balanced perspective, acknowledging potential risks and uncertainties inherent in the technology sector.

While the outlook for CoreWeave appears promising, investors should conduct thorough due diligence before making any investment decisions. The AI cloud computing sector is dynamic and competitive, and unforeseen challenges could impact the company's future performance.

To stay informed about CoreWeave (CRWV) and its performance within the evolving AI cloud computing landscape, further research is essential. Understanding the intricacies of the market, competitive dynamics, and potential risks is crucial for making informed investment decisions regarding CoreWeave stock and other AI cloud computing investments. Subscribe to our newsletter for further updates and in-depth analysis on CRWV and the AI market.

Featured Posts

-

Core Weave Crwv Stock Price Jumps After Nvidia Reveals Stake

May 22, 2025

Core Weave Crwv Stock Price Jumps After Nvidia Reveals Stake

May 22, 2025 -

The Fdas Clampdown On Off Brand Ozempic What It Means For You

May 22, 2025

The Fdas Clampdown On Off Brand Ozempic What It Means For You

May 22, 2025 -

Sydney Sweeney New Film Role Following Echo Valley And The Housemaid

May 22, 2025

Sydney Sweeney New Film Role Following Echo Valley And The Housemaid

May 22, 2025 -

Nvidias Huang Us Export Controls Failed Trump Praised

May 22, 2025

Nvidias Huang Us Export Controls Failed Trump Praised

May 22, 2025 -

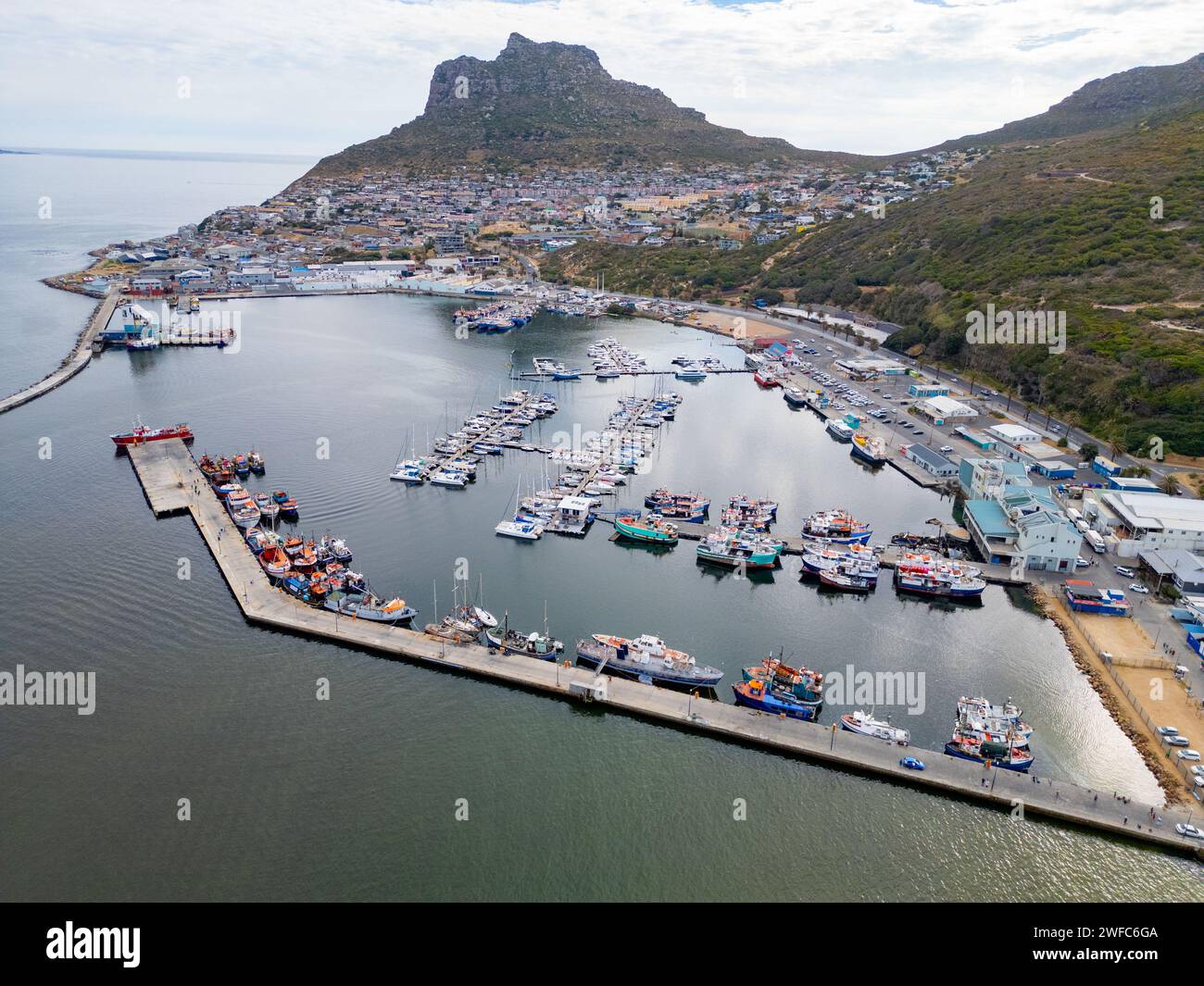

Hout Bay Fcs Success The Klopp Connection

May 22, 2025

Hout Bay Fcs Success The Klopp Connection

May 22, 2025