Understanding Finance Loans: Interest Rates, EMIs, Tenure, And The Application Process

Table of Contents

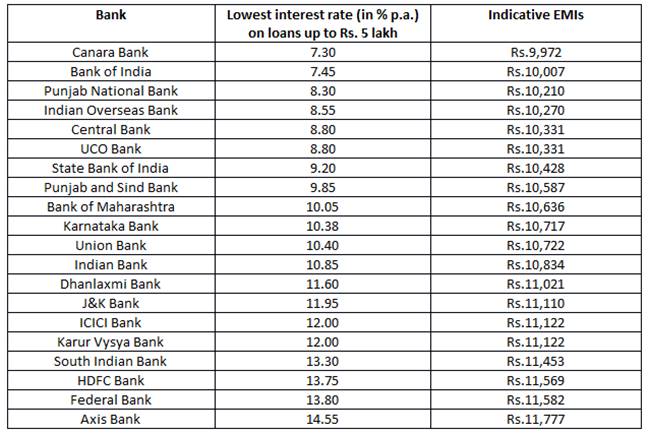

Decoding Interest Rates in Finance Loans

Interest rates are the cornerstone of any finance loan. They represent the cost of borrowing money and significantly impact the total amount you'll repay. Understanding loan interest rates is paramount to making a smart financial choice. The interest rate, expressed as a percentage, is applied to your outstanding loan balance, increasing the overall cost.

The two primary types of interest rates are fixed and variable:

-

Fixed interest rates: These rates remain constant throughout the loan tenure, offering predictability and allowing for easier budgeting. You know exactly how much you'll pay each month.

-

Variable interest rates: These rates fluctuate based on market conditions. While they might initially be lower than fixed rates, they carry the risk of increasing, potentially leading to higher monthly payments.

Several factors influence the interest rate you'll receive:

- Credit score: A higher credit score generally translates to lower interest rates, reflecting your creditworthiness.

- Loan amount: Larger loan amounts might attract higher interest rates.

- Loan type: Different types of loans (e.g., home loans, personal loans, business loans) carry varying interest rates.

- Market conditions: Prevailing economic conditions, such as inflation and central bank policies, also play a role.

The Annual Percentage Rate (APR) is a crucial factor to consider when comparing loan offers. APR represents the total annual cost of the loan, including interest and other fees. Always compare the APRs of different loan options to ensure you're getting the best deal. Understanding loan interest rates and their calculation is crucial for securing the best possible terms for your finance loan.

Understanding EMIs (Equated Monthly Installments)

Your EMI, or Equated Monthly Installment, is the fixed amount you pay each month to repay your finance loan. This amount covers both the principal loan amount and the accumulated interest. The EMI calculation considers three main factors: the loan amount, the interest rate, and the loan tenure.

The formula for EMI calculation is complex, but essentially, a higher loan amount, a higher interest rate, or a longer tenure will all result in a higher EMI. Conversely, a lower loan amount, lower interest rate, or shorter tenure will result in a lower EMI.

Example: A ₹10,00,000 loan at 10% interest over 10 years will have a significantly higher EMI than the same loan amount at 8% interest over 15 years.

Choosing between a higher EMI and a longer tenure involves a trade-off. A shorter tenure leads to higher monthly payments but lower overall interest paid, while a longer tenure results in lower monthly payments but higher overall interest paid.

Choosing the Right Loan Tenure

The loan tenure, or repayment period, significantly influences your monthly payments and the total interest you pay. Selecting the appropriate loan term is a crucial step in managing your finances effectively.

-

Shorter Tenure: This option leads to higher EMIs but significantly reduces the total interest paid over the life of the loan. It’s ideal for borrowers comfortable with larger monthly payments and prioritizing minimizing interest costs.

-

Longer Tenure: This option results in lower EMIs, making monthly payments more manageable. However, it increases the total interest paid over the loan’s lifetime. This option suits borrowers who prioritize affordability but accept paying more in interest over the long term.

Determining the ideal loan tenure involves carefully assessing your financial capacity, repayment capabilities, and long-term financial goals.

Navigating the Finance Loan Application Process

Applying for a finance loan involves several key steps:

- Gather necessary documents: This typically includes proof of income, identity proof, address proof, and other documents as required by the lender.

- Compare loan offers: Research and compare loan offers from different lenders to secure the best interest rates, fees, and terms.

- Complete the application form accurately: Ensure all information provided is correct and complete to avoid delays in processing.

- Submit the application and supporting documents: Follow the lender's instructions for submission.

- Follow up on the application status: Stay informed about the progress of your application.

Maintaining a good credit score is crucial for securing favorable loan terms. A strong credit history demonstrates your financial responsibility, increasing your chances of approval and securing lower interest rates. Always thoroughly understand the loan terms and conditions before signing any agreements.

Conclusion

Understanding finance loans requires a grasp of interest rates, EMIs, loan tenure, and the application process. By carefully considering these factors and making informed decisions, you can navigate the loan process effectively and avoid potential financial difficulties. Remember to research thoroughly, compare different finance loan options, and choose a loan that aligns with your financial capacity and long-term goals. Learn more about finance loans today and find the best finance loan for your needs. Start your finance loan journey now!

Featured Posts

-

Khyu Dzhakman I Stn Fostr Zaedno

May 28, 2025

Khyu Dzhakman I Stn Fostr Zaedno

May 28, 2025 -

Bon Plan Samsung Galaxy S25 Ultra 1 To 5 Etoiles A 1294 90 E 13

May 28, 2025

Bon Plan Samsung Galaxy S25 Ultra 1 To 5 Etoiles A 1294 90 E 13

May 28, 2025 -

13th Century Construction Unearthed During Binnenhof Renovations

May 28, 2025

13th Century Construction Unearthed During Binnenhof Renovations

May 28, 2025 -

Hollywood Production Ground To A Halt Amidst Actors And Writers Strike

May 28, 2025

Hollywood Production Ground To A Halt Amidst Actors And Writers Strike

May 28, 2025 -

Appeal Filed Ftc Challenges Microsoft Activision Blizzard Acquisition

May 28, 2025

Appeal Filed Ftc Challenges Microsoft Activision Blizzard Acquisition

May 28, 2025