Understanding Front-Loading: Reducing Malaysian Ringgit (MYR) Volatility For Exporters

Table of Contents

2.1 Understanding MYR Volatility and its Impact on Exporters

The MYR’s value is influenced by a complex interplay of factors, making it susceptible to significant fluctuations. Understanding these influences is crucial for effective currency risk management.

- Global Economic Conditions: International economic downturns, changes in global demand, and commodity price fluctuations all impact the MYR. A weakening global economy can lead to a decline in the MYR's value.

- Political Stability: Political uncertainty or instability within Malaysia can cause investors to lose confidence, leading to MYR depreciation.

- Interest Rate Differentials: Differences between Malaysian interest rates and those in other countries affect the attractiveness of MYR-denominated assets, influencing the exchange rate.

- Government Policies: Changes in government policies, such as monetary policy adjustments, can also significantly affect the MYR.

The consequences of MYR volatility for exporters can be severe:

- Reduced Revenue Predictability: Fluctuations make it difficult to accurately forecast export revenues, hindering financial planning and investment decisions.

- Difficulty in Pricing: Uncertain exchange rates make it challenging to set competitive export prices, potentially leading to lost sales or reduced profit margins.

- Potential Losses: A sharp depreciation of the MYR can significantly reduce the value of export earnings when converted back into MYR, leading to substantial financial losses.

For example, a Malaysian exporter who agreed on a USD price for their goods might face a significant drop in MYR revenue if the MYR depreciates against the USD before receiving payment. This can severely impact profitability and long-term sustainability.

2.2 Front-Loading: A Proactive Approach to Currency Risk Management

Front-loading is a proactive strategy where exporters secure future export payments in advance, minimizing their exposure to MYR exchange rate volatility. Instead of waiting until the goods are delivered to receive payment, they negotiate payment terms that bring the payment schedule forward.

Several methods can be employed for front-loading:

- Negotiating Advance Payments: Requesting a portion of the payment upfront before production or shipment reduces the risk of losses due to MYR fluctuations.

- Utilizing Forward Contracts: These contracts lock in a specific exchange rate for a future transaction, eliminating the uncertainty associated with exchange rate movements.

- Using Options Contracts: Options provide the flexibility to buy or sell currency at a predetermined rate within a specific timeframe, offering a degree of protection without the full commitment of a forward contract.

Each method has its pros and cons:

| Method | Pros | Cons |

|---|---|---|

| Advance Payments | Reduces risk, improves cash flow | May be difficult to negotiate with buyers |

| Forward Contracts | Locks in exchange rate | Less flexibility, potential opportunity cost |

| Options Contracts | Flexibility, limits downside risk | Higher cost than forwards |

2.3 Forecasting MYR Exchange Rates for Effective Front-Loading

Accurate forecasting is paramount for successful front-loading. While perfect prediction is impossible, combining different forecasting methods can improve accuracy.

- Technical Analysis: Analyzing historical exchange rate patterns and trends to predict future movements.

- Fundamental Analysis: Examining economic indicators, political events, and other factors to assess the underlying value of the MYR.

- Professional Forecasters: Utilizing the services of specialized financial institutions and experts who provide exchange rate forecasts.

Each method has limitations. Technical analysis may not account for unforeseen events, while fundamental analysis requires deep expertise and interpretation. A combined approach leveraging the strengths of each method offers the best chance of achieving relatively accurate predictions. Reliable sources for MYR exchange rate forecasts include reputable financial institutions and economic news outlets.

2.4 Integrating Front-Loading into Your Export Business Strategy

Integrating front-loading requires a structured approach:

- Assess your risk: Evaluate your exposure to MYR volatility.

- Choose your method: Select the front-loading method(s) best suited to your circumstances.

- Negotiate with clients: Discuss payment terms and obtain agreement on advance payments or other front-loading mechanisms.

- Utilize financial tools: If necessary, use forward contracts or options to hedge against remaining risk.

- Monitor and adjust: Regularly monitor the MYR and adjust your strategy as needed.

Effective communication with clients and financial institutions is crucial. Negotiating favorable payment terms, such as shorter payment cycles or partial advance payments, is essential. Challenges such as client resistance or increased administrative burden can be mitigated through thorough planning and clear communication.

2.5 Hedging Strategies to Complement Front-Loading

Hedging strategies complement front-loading, providing an additional layer of protection against MYR volatility.

- Currency Forwards: Lock in a future exchange rate.

- Options: Provide the right, but not the obligation, to buy or sell currency at a specified rate.

- Currency Swaps: Exchange principal and interest payments in different currencies.

Each hedging instrument has specific advantages and disadvantages depending on your risk tolerance and financial situation. It is strongly recommended to seek advice from qualified financial professionals to determine the most appropriate hedging strategy for your business.

Conclusion: Mastering Front-Loading for MYR Stability

Front-loading offers significant advantages for Malaysian exporters by reducing their exposure to MYR volatility, improving revenue predictability, and enhancing overall profitability. Accurate forecasting, combined with the appropriate hedging strategies, is key to effective implementation. By strategically integrating front-loading into your export business strategy and maintaining open communication with clients and financial advisors, you can significantly minimize the negative impacts of MYR fluctuations. Start mitigating MYR volatility today by implementing front-loading strategies into your export operations. Contact a financial expert to discuss your options and develop a tailored currency risk management plan.

Featured Posts

-

Onet Le Chateau Et Le Lioran Votre Sejour Au C Ur Du Volcan

May 07, 2025

Onet Le Chateau Et Le Lioran Votre Sejour Au C Ur Du Volcan

May 07, 2025 -

Cavaliers Vs Pacers Betting Preview Eastern Conference Semifinals

May 07, 2025

Cavaliers Vs Pacers Betting Preview Eastern Conference Semifinals

May 07, 2025 -

Lottozahlen 6aus49 Vom 12 04 2025 Ueberpruefen Sie Ihre Tipps

May 07, 2025

Lottozahlen 6aus49 Vom 12 04 2025 Ueberpruefen Sie Ihre Tipps

May 07, 2025 -

Rianna Provokatsiyna Fotosesiya V Rozhevomu Merezhivi

May 07, 2025

Rianna Provokatsiyna Fotosesiya V Rozhevomu Merezhivi

May 07, 2025 -

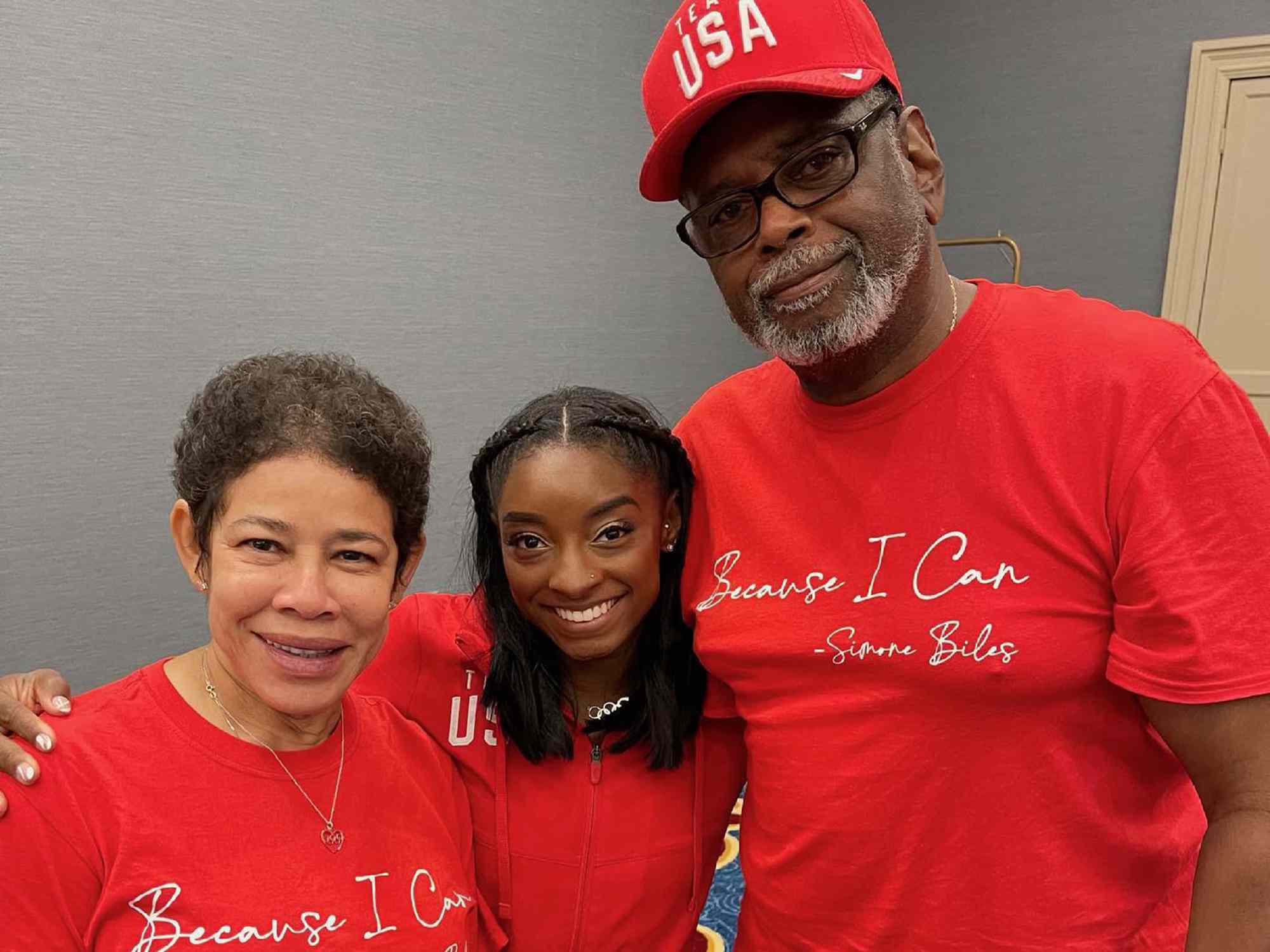

Simone Biles Y Los Angeles 2028 Dudas Sobre Su Participacion

May 07, 2025

Simone Biles Y Los Angeles 2028 Dudas Sobre Su Participacion

May 07, 2025