Understanding High Stock Market Valuations: BofA's Insights For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's stance on current market valuations often shifts, reflecting the dynamic nature of the market. While pinpointing their exact current position requires referencing their most recent reports (easily accessible on their website), their analysis typically incorporates a range of valuation metrics to paint a comprehensive picture. It's crucial to remember that BofA, like any financial institution, provides analysis, not investment advice.

-

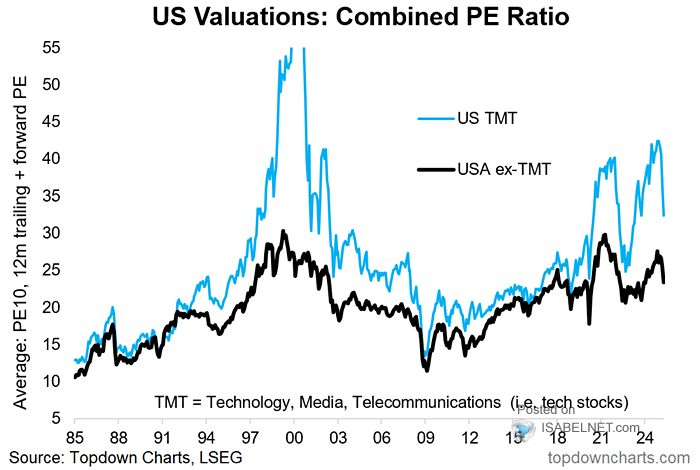

Key Valuation Metrics: BofA utilizes a variety of metrics, including the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller P/E), and the Price-to-Sales ratio (P/S). They also consider metrics specific to different sectors, reflecting industry-specific characteristics. The Shiller P/E, for example, adjusts for inflation and provides a longer-term perspective on valuation, offering a different view than the standard P/E.

-

Significance of Metrics: These metrics help BofA gauge whether the market is overvalued, undervalued, or fairly valued relative to historical data and future earnings expectations. A high P/E ratio, for instance, might suggest the market is pricing in significant future growth, while a low P/S ratio might indicate undervaluation. BofA's analysts carefully weigh these metrics against macroeconomic factors to arrive at their conclusions.

-

Sector-Specific Analysis: BofA's reports often highlight specific sectors or asset classes that they see as overvalued or undervalued. For example, they may identify technology stocks as potentially overvalued based on current P/E ratios compared to historical averages, while suggesting energy or certain cyclical sectors as relatively undervalued opportunities. Specific predictions should be sourced directly from their current publications, as these analyses are frequently updated.

Factors Contributing to High Stock Market Valuations

Several interconnected macroeconomic factors contribute to high stock market valuations. Understanding these is crucial for investors to assess the sustainability of current market levels.

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies, fueling investment and potentially boosting earnings. This also makes bonds less attractive relative to stocks, driving capital towards equities. Lower interest rates decrease the discount rate used in discounted cash flow (DCF) models, inflating valuations.

-

Quantitative Easing (QE): Central banks' QE programs have injected massive amounts of liquidity into the financial system, increasing the money supply and potentially pushing up asset prices, including stocks. This increase in liquidity can lead to higher demand for stocks and higher valuations.

-

Strong Corporate Earnings (and Expectations): Periods of robust corporate earnings or strong expectations for future earnings growth tend to drive higher stock prices and valuations. Analysts forecast future earnings and the market uses these forecasts to determine appropriate valuation multiples.

-

Technological Advancements: Rapid technological advancements, particularly in sectors like technology and biotechnology, often lead to high valuations due to the potential for disruptive innovation and significant future growth. Investors are willing to pay a premium for companies expected to benefit significantly from technological advancements.

-

Geopolitical Events: While often unpredictable, geopolitical events can significantly influence investor sentiment and market valuations. Periods of relative global stability often support higher valuations, while geopolitical uncertainty can lead to increased volatility and potentially lower valuations.

Strategies for Investors in a High-Valuation Market

Navigating a market with high valuations requires a prudent approach. While BofA's specific recommendations change, some general strategies remain relevant:

-

Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk in a potentially volatile market. Don't put all your eggs in one basket, especially when valuations appear stretched.

-

Focus on Undervalued Opportunities: BofA's research may identify specific sectors or companies that appear undervalued relative to their fundamentals. Focusing on these opportunities can enhance returns and mitigate the risks associated with overvalued sectors.

-

Long-Term Investing: Maintain a long-term perspective, avoiding short-term market fluctuations. High valuations don't always indicate an immediate market crash; they could simply reflect high investor confidence in future growth.

-

Alternative Investments: Depending on your risk tolerance and investment goals, BofA might suggest exploring alternative investments like private equity or real estate, which can offer diversification and potentially different return profiles than traditional equities.

-

Value Investing: Value investing focuses on identifying companies trading below their intrinsic value. This strategy is particularly relevant in high-valuation markets, as it allows investors to capitalize on potential market inefficiencies.

-

Risk Management and Asset Allocation: A crucial component of any strategy is rigorously assessing your own risk tolerance and carefully managing asset allocation to align with your investment goals and risk profile.

Risks Associated with High Stock Market Valuations

While high valuations can be indicators of future growth, they also present significant risks:

-

Market Volatility and Corrections: Markets with high valuations are often more susceptible to significant corrections or even crashes. These corrections can lead to sharp declines in portfolio value and high levels of volatility.

-

Higher Risk of Capital Loss: Investing in an overvalued market inherently carries a higher risk of capital loss compared to investing in a market with more moderate valuations. The higher you pay for an asset, the less room there is for future appreciation and the greater the potential loss.

-

Rising Interest Rates: Rising interest rates can negatively impact stock valuations, as they increase borrowing costs for companies and make bonds more attractive compared to stocks. This can lead to a decrease in the price-to-earnings multiples that the market uses to value companies.

-

Market Bubbles: High valuations can be symptomatic of speculative bubbles, where asset prices are driven by hype and speculation rather than fundamentals. The bursting of such bubbles can lead to significant and rapid price declines.

-

Understanding Your Risk Tolerance: Before making any investment decisions, carefully consider your personal risk tolerance and make sure your investment strategy aligns with your risk profile and overall financial goals.

Conclusion

BofA's insights regarding high stock market valuations highlight the importance of a balanced and diversified investment strategy. While high valuations don't automatically signal an impending crash, they do increase the risk of future corrections and capital losses. The strategies discussed – diversification, a focus on undervalued opportunities, long-term investing, and prudent risk management – are crucial for navigating these market conditions. Remember to understand your risk tolerance and seek professional financial advice if needed. Stay informed about market valuations by regularly reviewing BofA's research and reports. Understanding high stock market valuations is crucial for making informed investment decisions. Use this information to develop your own robust investment strategy tailored to your risk profile. Don't hesitate to consult with a financial advisor for personalized guidance on navigating these complex market conditions.

Featured Posts

-

Papal Funeral Seating Protocol And Practical Considerations

Apr 30, 2025

Papal Funeral Seating Protocol And Practical Considerations

Apr 30, 2025 -

Canada Election Trumps Assessment Of Us Canada Interdependence

Apr 30, 2025

Canada Election Trumps Assessment Of Us Canada Interdependence

Apr 30, 2025 -

Bmw Porsche And The China Conundrum A Deeper Dive Into Market Pressures

Apr 30, 2025

Bmw Porsche And The China Conundrum A Deeper Dive Into Market Pressures

Apr 30, 2025 -

Independent Police Complaints Commission Challenges Bbcs Chris Kaba Panorama

Apr 30, 2025

Independent Police Complaints Commission Challenges Bbcs Chris Kaba Panorama

Apr 30, 2025 -

Plummeting Travel Impacts Peace Bridge Duty Free Shop Leading To Receivership

Apr 30, 2025

Plummeting Travel Impacts Peace Bridge Duty Free Shop Leading To Receivership

Apr 30, 2025