Understanding High Stock Market Valuations: BofA's Investor Guidance

Table of Contents

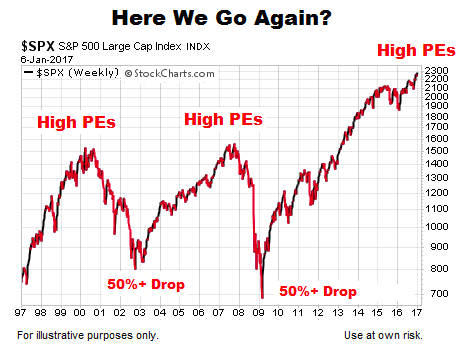

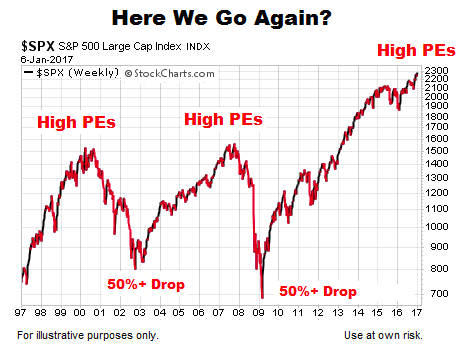

The stock market is currently experiencing elevated valuations, leaving many investors questioning the future. Navigating this complex landscape requires careful analysis and a clear understanding of the market's underlying dynamics. Bank of America (BofA), a leading financial institution, provides valuable investor guidance to help investors make informed decisions. This article will delve into BofA's assessment of current market conditions, explore strategies for navigating high valuations, and offer insights into making sound investment choices in this environment. We'll explore keywords like "high stock market valuations," "BofA," "investor guidance," "market analysis," and "stock market investment" to provide a comprehensive understanding.

BofA's Assessment of Current Market Conditions

Understanding the current market landscape is crucial for effective investment strategies. BofA's analysis offers valuable insights into the factors driving high stock market valuations and the potential risks involved.

Identifying Overvalued Sectors

BofA's research consistently identifies specific sectors exhibiting signs of overvaluation. This isn't a blanket statement across all sectors, but rather a targeted assessment based on rigorous analysis.

- Examples of Overvalued Sectors (according to BofA reports – Note: Specific sectors and data should be replaced with actual data from recent BofA reports.): Technology (particularly within specific sub-sectors), certain consumer discretionary segments, and some real estate investment trusts (REITs) have, at times, shown signs of overvaluation according to BofA's research. It's crucial to reference the most up-to-date BofA reports for current data.

- Reasons for Overvaluation: These overvaluations are often attributed to factors like aggressive investor speculation, low interest rates stimulating borrowing, and anticipation of continued strong earnings growth. However, such anticipation may not always materialize.

- Potential Risks: Overvalued sectors carry increased risk of significant corrections. Investors should understand that these sectors may experience sharper declines compared to others during market downturns. This risk increases proportionally with the degree of overvaluation.

Keywords: Overvalued stocks, sector analysis, market risk, BofA research, stock market analysis

Understanding the Drivers of High Valuations

Several key factors contribute to the current environment of high stock market valuations. BofA's analysis highlights the interplay of these forces.

- Low Interest Rates: Historically low interest rates incentivize investors to seek higher returns in the stock market, driving up demand and valuations.

- Quantitative Easing (QE): Central banks' QE programs inject liquidity into the market, further fueling asset price inflation.

- Strong Corporate Earnings (in certain sectors): While some sectors show robust earnings, it's essential to note that this is not universal. Strong earnings in specific sectors can support higher valuations within those sectors, while others lag.

- Investor Sentiment: Positive investor sentiment and expectations of future growth can also inflate valuations beyond what might be justified by fundamental analysis.

Keywords: Interest rates, quantitative easing, corporate earnings, investor sentiment, market drivers, market valuation

BofA's Predictions and Forecasts

BofA regularly publishes market forecasts and outlooks, offering investors valuable insights into potential future market performance. (Note: This section requires up-to-date information from actual BofA reports. Replace the following bullet points with accurate data.)

- BofA's Outlook on Specific Sectors: BofA's analysts provide sector-specific forecasts, highlighting potential growth areas and risks. (Insert specific sectors and their outlook based on recent BofA reports.)

- Potential Market Volatility: BofA’s predictions often acknowledge the potential for increased market volatility due to the current elevated valuations.

- Expected Return Rates: BofA typically provides ranges for expected return rates, indicating the potential returns and associated risks across different asset classes. (Insert data from BofA reports if available.)

Keywords: Market forecast, market prediction, BofA outlook, stock market predictions, investment outlook

Strategies for Navigating High Valuations

Given the current high valuations, investors need to adopt strategic approaches to mitigate risk and identify potential opportunities.

Defensive Investment Strategies

In a high-valuation market, a defensive investment approach is often prudent.

- Diversification: Spreading investments across various asset classes and sectors reduces overall portfolio risk.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns.

- Dividend Stocks: Dividend-paying stocks can provide a steady income stream, mitigating some of the risks associated with market volatility.

- Hedging Strategies: Employing hedging strategies can help to limit potential losses during market corrections.

Keywords: Defensive investing, risk mitigation, diversification, value investing, dividend stocks, risk management

Growth Opportunities within a High-Valuation Environment

Despite high overall valuations, opportunities for growth still exist.

- Identifying Undervalued Companies: Even within overvalued sectors, some companies may be undervalued due to specific circumstances. Thorough fundamental analysis is crucial here.

- Emerging Markets: Emerging markets might offer higher growth potential than developed markets, although with increased risk.

- Technological Advancements: Investing in companies at the forefront of technological advancements can unlock significant long-term growth opportunities.

Keywords: Growth investing, undervalued stocks, emerging markets, technological advancements, investment opportunities

The Importance of Long-Term Investing

Maintaining a long-term investment horizon is crucial, even during periods of high valuations.

- Averaging Down: Systematic investing allows investors to purchase more shares during market dips, reducing the average cost per share.

- Avoiding Emotional Decision-Making: Panic selling in response to market fluctuations can lead to significant losses. Sticking to a well-defined investment plan is essential.

- Power of Compounding Returns: Over the long term, the power of compounding returns can significantly outweigh short-term market fluctuations.

Keywords: Long-term investing, patience, market volatility, compound interest, investment strategy

Conclusion

BofA's analysis highlights the elevated valuations in the current stock market, emphasizing the need for careful consideration and strategic investment approaches. While some sectors show signs of overvaluation and increased risk, opportunities for growth still exist for those investors who can identify undervalued assets and adopt a long-term perspective. Understanding the drivers of these high valuations—low interest rates, QE, and investor sentiment—is crucial for navigating this environment. By employing defensive investment strategies, diversifying portfolios, and focusing on long-term growth, investors can mitigate risks and capitalize on opportunities.

Call to Action: To gain a deeper understanding of high stock market valuations and develop an informed investment strategy, we encourage you to explore BofA's comprehensive research and analysis. Visit the BofA website (insert relevant link here) for access to their latest reports and investor guidance on navigating this dynamic market. Understanding BofA's perspective on high stock market valuations is vital for making smart investment choices. Remember to always conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Virginia Giuffre Prince Andrew Accuser Involved In Car Accident Four Day Deadline Claim

May 11, 2025

Virginia Giuffre Prince Andrew Accuser Involved In Car Accident Four Day Deadline Claim

May 11, 2025 -

Win Tickets For Tales From The Track Presented By Relay

May 11, 2025

Win Tickets For Tales From The Track Presented By Relay

May 11, 2025 -

Review Of Military Academy Texts Ordered By Pentagon

May 11, 2025

Review Of Military Academy Texts Ordered By Pentagon

May 11, 2025 -

Celebrating The Bundesliga Bayerns Win And Mullers Home Farewell

May 11, 2025

Celebrating The Bundesliga Bayerns Win And Mullers Home Farewell

May 11, 2025 -

From Bundesliga Hopefuls To Relegation Holstein Kiels Story

May 11, 2025

From Bundesliga Hopefuls To Relegation Holstein Kiels Story

May 11, 2025