Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

Factors Contributing to High Stock Market Valuations

Several intertwined factors contribute to the current state of high stock market valuations. Understanding these factors is crucial for making informed investment decisions.

Low Interest Rates

The inverse relationship between interest rates and stock valuations is well-established. Low interest rates make bonds, traditionally considered a safe haven, less attractive compared to the potential returns offered by stocks. This shift in investor preference fuels demand for equities, driving prices higher and contributing to high stock market valuations. BofA's recent reports consistently highlight the significant impact of the current accommodative monetary policy on market valuations. The low cost of borrowing also benefits companies, boosting their profitability and further supporting higher stock prices.

- Reduced borrowing costs for companies: This enables increased investment in growth initiatives and expansion.

- Increased corporate profitability: Higher profits translate to higher dividends and stock buybacks, driving up stock prices.

- Higher present value of future earnings: Low discount rates used in valuation models increase the present value of future earnings, making stocks more appealing.

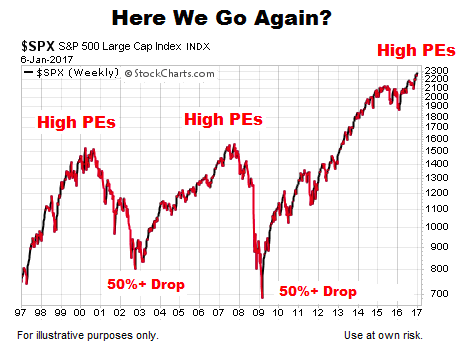

Strong Corporate Earnings

Robust corporate earnings play a significant role in supporting high stock market valuations. Many sectors are experiencing exceptional growth, fueled by various factors. BofA's research frequently points to the resilience and even expansion of corporate earnings in the face of economic uncertainty.

- Increased consumer spending: A strong consumer base drives demand for goods and services, boosting company revenues.

- Technological advancements: Innovation fuels productivity gains and creates new growth opportunities.

- Successful cost-cutting measures: Companies are improving their efficiency, leading to higher profit margins.

Positive Economic Outlook

Positive economic expectations significantly influence investor sentiment, driving demand and contributing to high stock market valuations. While BofA acknowledges the potential for unforeseen events, their analyses generally reflect a cautiously optimistic outlook. Factors like government stimulus programs, though debated, can further stimulate economic activity and investor confidence. However, it's crucial to note that positive projections always come with inherent risks.

- Expected GDP growth: Projections of sustained GDP growth encourage investment.

- Employment figures: Strong employment data indicates a healthy economy, supporting market confidence.

- Inflation expectations: While moderate inflation is generally positive, rapid inflation can negatively impact market valuations.

Assessing the Risks Associated with High Stock Market Valuations

While the current market environment presents opportunities, it's crucial to acknowledge the inherent risks associated with these high stock market valuations.

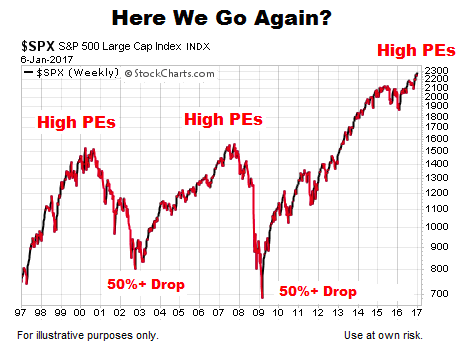

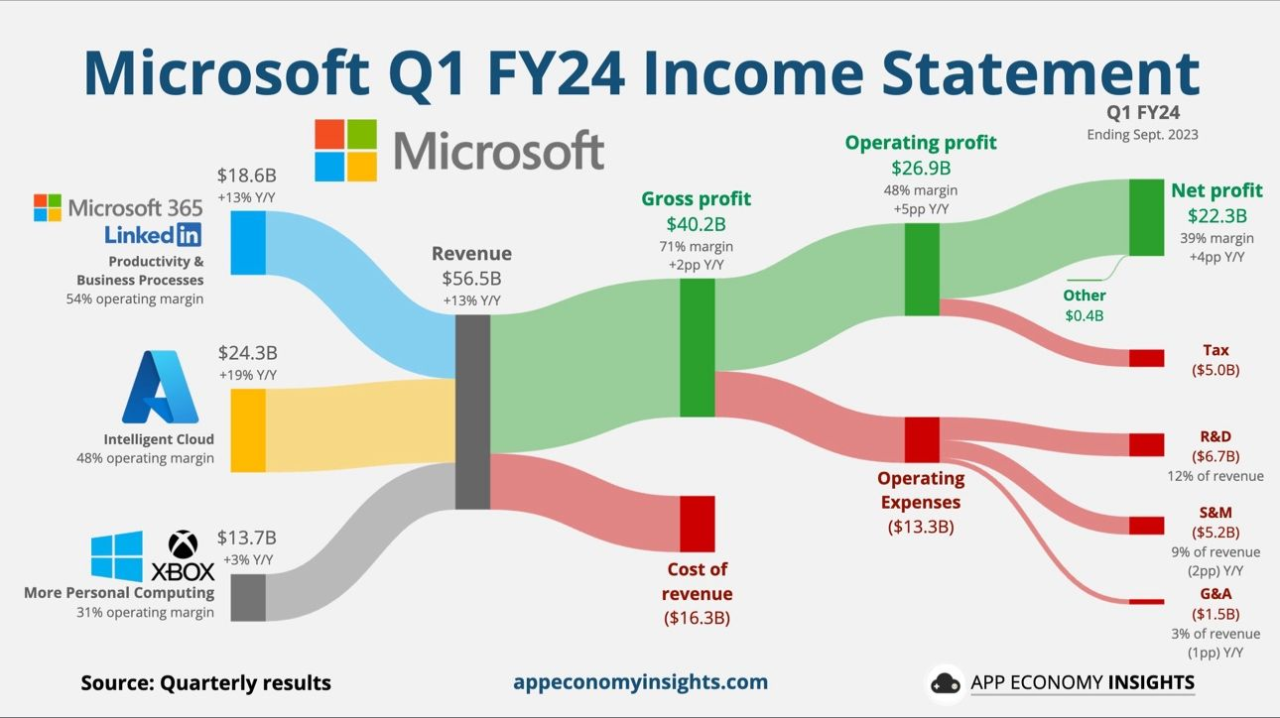

Valuation Metrics and Their Implications

Several key valuation metrics offer insights into the market's potential for future growth or correction. BofA closely monitors these metrics, providing context and perspective.

- P/E Ratio (Price-to-Earnings Ratio): A high P/E ratio suggests investors are willing to pay a premium for current earnings, which can be a sign of overvaluation.

- Price-to-Sales Ratio: This metric compares a company's market capitalization to its revenue, providing another perspective on valuation.

- Comparison to historical averages: Comparing current valuation metrics to historical averages helps gauge whether the market is overvalued or undervalued.

Potential Market Corrections

Based on BofA's analysis, a market correction remains a possibility. Several potential triggers could initiate a downturn.

- Rising interest rates: An increase in interest rates could reduce investor appetite for stocks, leading to price declines.

- Geopolitical events: Unforeseen geopolitical events can negatively impact investor sentiment and market stability.

- Risk management strategies: Diversification and hedging techniques are crucial to mitigate potential losses during a correction.

BofA's Recommendations and Outlook for High Stock Market Valuations

BofA's overall assessment of the current market is nuanced. While acknowledging the risks associated with high stock market valuations, they offer a balanced outlook and specific recommendations. Their analyses often suggest a cautious approach, emphasizing risk management and diversification.

- Short-term outlook: BofA's short-term outlook may suggest selective investment opportunities while managing risk.

- Long-term outlook: The long-term outlook might still be positive, but with a focus on fundamental analysis and value investing.

- Investment strategies for different risk profiles: BofA often provides tailored advice based on investors' risk tolerance and financial goals.

Understanding and Navigating High Stock Market Valuations

In conclusion, several factors, including low interest rates, strong corporate earnings, and positive economic expectations, contribute to the current high stock market valuations. However, it's crucial to carefully consider the associated risks, such as potential market corrections and the implications of high valuation metrics. BofA's analysis provides valuable insights into this complex landscape, offering guidance for navigating this challenging market. We strongly encourage you to conduct further research on high stock market valuations and utilize BofA's resources for informed investment decisions. [Link to relevant BofA resources (if available)]

Featured Posts

-

Analysis Of Teslas Q1 2024 Earnings 71 Net Income Decrease And Political Factors

Apr 24, 2025

Analysis Of Teslas Q1 2024 Earnings 71 Net Income Decrease And Political Factors

Apr 24, 2025 -

Btc Price Climbs Amidst Eased Trade Tensions And Fed Uncertainty

Apr 24, 2025

Btc Price Climbs Amidst Eased Trade Tensions And Fed Uncertainty

Apr 24, 2025 -

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025 -

Alterya Acquired By Chainalysis A Strategic Move In Blockchain And Ai

Apr 24, 2025

Alterya Acquired By Chainalysis A Strategic Move In Blockchain And Ai

Apr 24, 2025