Understanding Palantir's Valuation: A Deep Dive Into Its Financial Performance

Table of Contents

Revenue Growth and Key Revenue Streams

Analyzing Palantir's revenue growth is crucial to understanding its valuation. Historically, Palantir has demonstrated periods of both significant acceleration and deceleration in revenue growth. This fluctuation is largely attributable to the nature of its two primary revenue streams: government contracts and commercial clients.

-

Government Contracts: This sector has historically provided a stable, albeit sometimes slower-growing, revenue base for Palantir. Government contracts often involve long-term engagements and substantial upfront investments, leading to predictable revenue streams but potentially limiting short-term growth. The stability of this revenue stream contributes significantly to Palantir's overall valuation.

-

Commercial Clients: This sector presents greater potential for rapid revenue expansion, driven by increasing demand for Palantir's data analytics platform across diverse industries like finance, healthcare, and manufacturing. The growth trajectory of this sector is a key factor influencing Palantir's future valuation. Successful penetration into new commercial markets is essential for sustained long-term growth.

-

Revenue Mix: The balance between government and commercial revenue significantly impacts Palantir's overall valuation. A heavier reliance on government contracts might indicate lower growth potential, while a stronger commercial presence suggests higher future growth potential, but also potentially increased risk. Analyzing this revenue mix over time is essential for a complete picture of Palantir's financial health.

[Insert chart/graph visualizing Palantir's revenue growth over time, segmented by government and commercial sectors]

Profitability and Margins

Assessing Palantir's profitability requires examining gross profit margins, operating margins, and net income. Several factors influence its profitability, including substantial investments in research and development (R&D), sales and marketing expenses, and operating leverage.

-

Margin Analysis: Palantir's margins should be benchmarked against industry competitors to understand its relative profitability. A comparison against similar big data analytics companies allows for a clearer picture of its performance and potential. Analyzing trends in these margins over time reveals the effectiveness of its cost management strategies.

-

Cost-Cutting Measures: Palantir's history includes periods focused on cost optimization and improving operating efficiency. The impact of these measures on profitability needs careful examination to gauge their long-term sustainability and their contribution to improved margins.

-

R&D Investment: The substantial investment in R&D is a key aspect of Palantir's strategy. This investment, while impacting short-term profitability, is crucial for maintaining its technological leadership and driving future growth.

[Insert data table showcasing Palantir's key profitability metrics – gross margin, operating margin, net income – across different reporting periods]

Cash Flow and Liquidity

Analyzing Palantir's cash flow statements – from operations, investing, and financing activities – is essential for assessing its financial strength and stability. This includes examining cash on hand, short-term debt, and working capital.

-

Cash Flow Generation: Palantir's ability to generate positive cash flow from operations is critical for its long-term sustainability. Consistent positive operating cash flow indicates financial health and supports future investments and growth initiatives.

-

Investment Activity: Palantir's investment activities reflect its strategic priorities. Analyzing investments in R&D, acquisitions, and other capital expenditures provides insights into its growth strategy and future prospects.

-

Liquidity: A strong liquidity position, characterized by sufficient cash reserves and manageable short-term debt, is essential for navigating economic downturns and unforeseen challenges. This is crucial for maintaining operational stability and pursuing growth opportunities.

[Present a detailed analysis of Palantir's cash flow statement and balance sheet data]

Valuation Metrics and Comparisons

Palantir's valuation can be evaluated using several key metrics, including Price-to-Sales (P/S) ratio, Price-to-Earnings (P/E) ratio, and Enterprise Value-to-Revenue (EV/R) ratio. Comparing these metrics to its competitors provides context for understanding its relative valuation.

-

Metric Appropriateness: The suitability of different valuation metrics depends on Palantir's specific business model and growth stage. Given its focus on high-growth and potentially longer-term returns, some metrics might be more relevant than others.

-

Valuation Drivers: Identifying the key drivers of future valuation changes is crucial. These drivers may include revenue growth, margin expansion, market share gains, and changes in investor sentiment.

-

Market Sentiment: Investor expectations and overall market sentiment significantly influence Palantir's valuation. Periods of high investor confidence might lead to higher valuations, while periods of uncertainty can result in lower valuations.

[Include comparative tables showcasing valuation metrics for Palantir and its peers]

Conclusion

Understanding Palantir's valuation requires a comprehensive analysis of its financial performance, encompassing revenue growth, profitability, cash flow, and key valuation metrics. While Palantir's unique business model presents challenges in traditional valuation methods, a thorough examination of its financial data provides insights into its long-term potential. By considering the factors discussed above, investors and analysts can develop a more informed perspective on Palantir's current valuation and its future prospects. To stay updated on Palantir's financial performance and its impact on its valuation, continue following in-depth analyses of its financial reports. Further research into Palantir's valuation is crucial for informed investment decisions.

Featured Posts

-

Decouvrir Le Lioran A Partir D Onet Le Chateau Conseils Et Informations Pratiques

May 07, 2025

Decouvrir Le Lioran A Partir D Onet Le Chateau Conseils Et Informations Pratiques

May 07, 2025 -

San Francisco Giants Excited By Kyle Harrison And Carson Whisenhunts Performances

May 07, 2025

San Francisco Giants Excited By Kyle Harrison And Carson Whisenhunts Performances

May 07, 2025 -

The White Lotus Season 3 Kenny Tims Coworker Who Is The Voice Actor

May 07, 2025

The White Lotus Season 3 Kenny Tims Coworker Who Is The Voice Actor

May 07, 2025 -

Hkdha Ahtfl Wyl Smyth Beyd Mylad Jaky Shan Dhk Rqs Wghnae

May 07, 2025

Hkdha Ahtfl Wyl Smyth Beyd Mylad Jaky Shan Dhk Rqs Wghnae

May 07, 2025 -

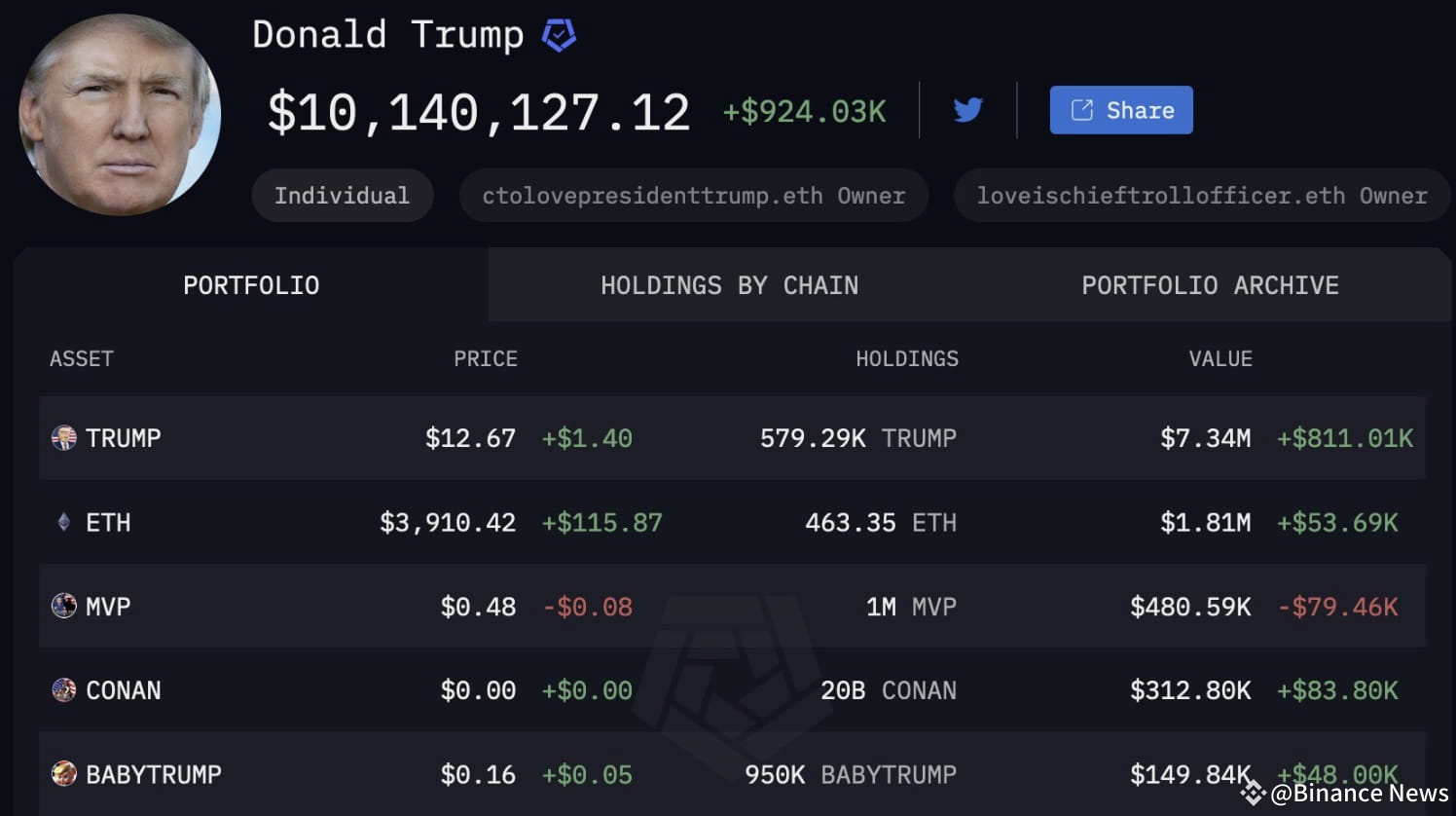

Trumps Crypto Journey A Political And Financial Analysis

May 07, 2025

Trumps Crypto Journey A Political And Financial Analysis

May 07, 2025