Understanding Personal Loan Interest Rates Today

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors determine the personal loan interest rates you'll be offered. Understanding these factors is the first step to securing a favorable loan.

Credit Score's Impact

Your credit score is arguably the most significant factor affecting your personal loan interest rates. Lenders use your credit score to assess your creditworthiness – your ability to repay the loan. A higher credit score indicates lower risk to the lender, resulting in a lower interest rate.

- Credit Score Ranges and Rates: Generally, a credit score above 750 is considered excellent and qualifies you for the best interest rates. Scores between 700-749 are good, while scores below 670 are considered subprime and will likely result in significantly higher interest rates.

- Improving Your Credit Score: There are several steps you can take to improve your credit score:

- Pay all bills on time.

- Keep your credit utilization ratio low (the amount of credit you use compared to your total available credit).

- Maintain a diverse mix of credit accounts.

- Credit Scoring Models: Remember that different credit scoring models exist, such as FICO and VantageScore. While they are similar, slight variations can impact your scores across different lenders.

Loan Amount and Term

The amount you borrow and the length of your repayment term (loan term) also influence your personal loan interest rates. Larger loan amounts and longer terms generally lead to higher rates because they represent a greater risk to the lender.

- Illustrative Examples: A $10,000 loan over 3 years might have a lower interest rate than a $20,000 loan over 5 years.

- Amortization: Amortization is the process of gradually paying off a loan over time through regular installments. A longer loan term means smaller monthly payments, but you'll pay more in total interest over the life of the loan.

Lender Type and Fees

Different lenders offer varying personal loan interest rates and fee structures. Comparing offers across multiple lenders is crucial.

- Lender Types and Fees:

- Banks: Often offer competitive rates but may have stricter lending requirements.

- Credit Unions: Typically offer lower rates to their members but may have membership restrictions.

- Online Lenders: Can offer convenient applications and potentially competitive rates but carefully check their fees.

- Fees: Be aware of additional fees, including origination fees (a percentage of the loan amount charged upfront), prepayment penalties (fees for paying off the loan early), and late payment fees. Always compare the Annual Percentage Rate (APR), which includes the interest rate and all fees, to get a true picture of the loan's cost.

Current Economic Conditions

Prevailing economic conditions significantly influence personal loan interest rates. Factors such as inflation and central bank interest rate hikes directly impact lending rates.

- Inflation and Interest Rates: High inflation often leads to higher interest rates as lenders adjust to protect against the erosion of the value of their money.

- Federal Funds Rate: Changes in the federal funds rate (the target rate set by the Federal Reserve) influence the prime rate, which, in turn, affects personal loan interest rates.

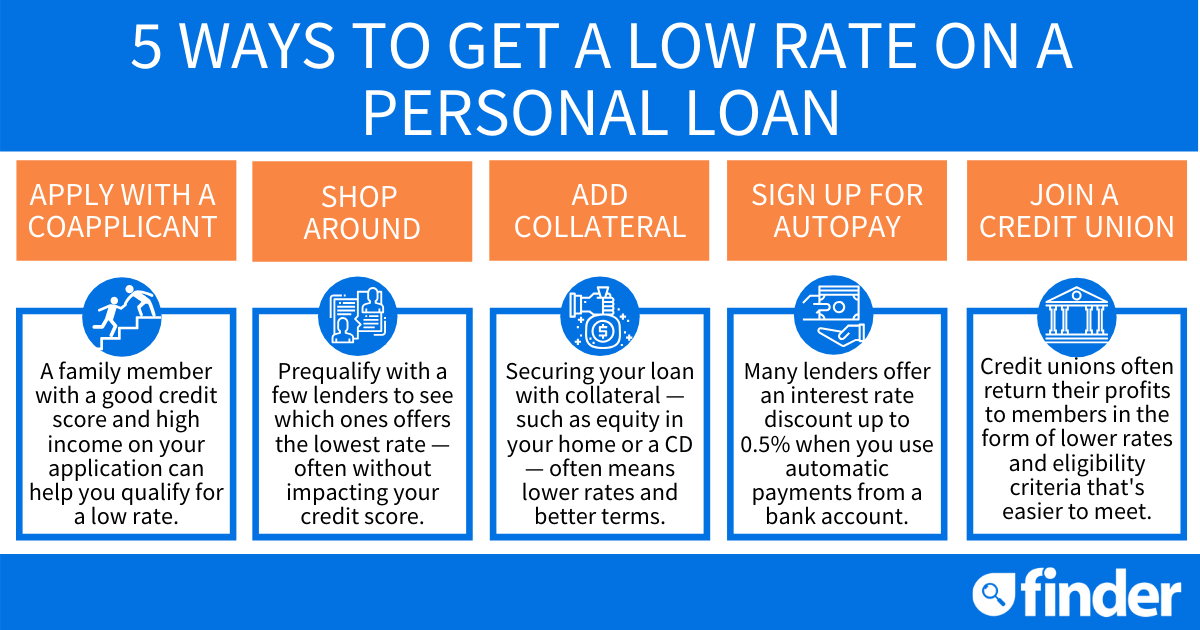

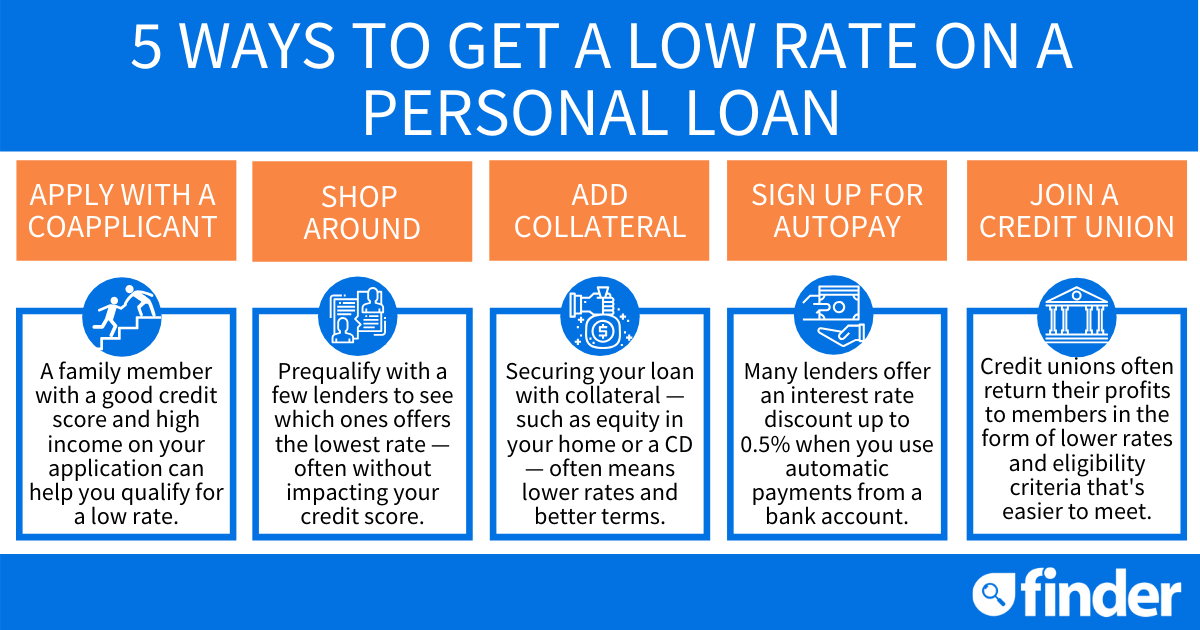

How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rate requires proactive steps.

Shop Around and Compare

Never settle for the first offer you receive. Compare offers from multiple lenders to find the most competitive rates.

- Online Loan Comparison Websites: Use reputable online comparison websites to quickly compare offers from various lenders.

- Lender Reviews and Ratings: Check online reviews and ratings to assess the reputation and customer service of different lenders.

Improve Your Credit Score

A higher credit score significantly improves your chances of securing a lower personal loan interest rate.

- Resources to Improve Credit Scores: Consider using credit counseling services or regularly checking your credit reports for errors.

- Time to Improve: Improving your credit score takes time; consistent responsible financial behavior is key.

Negotiate with Lenders

Don't hesitate to negotiate with lenders. You might be surprised at how willing they are to adjust rates based on your circumstances.

- Negotiation Tactics:

- Present competing offers from other lenders.

- Highlight your strong financial history and low debt-to-income ratio.

Understanding APR and Other Loan Costs

Understanding the true cost of a personal loan goes beyond the stated interest rate.

Decoding APR

The Annual Percentage Rate (APR) represents the total cost of borrowing, including interest and all fees. It's a crucial metric for comparing loans.

- APR vs. Interest Rate: The interest rate is just one component of the APR. Fees such as origination fees are included in the APR calculation.

- Illustrative Example: A loan with a 10% interest rate and a $200 origination fee will have a higher APR than a loan with a 10.5% interest rate and no origination fee, depending on the loan amount.

Other Loan Fees

Various other fees can significantly impact your total loan cost.

- Common Loan Fees: Late payment fees, insufficient funds fees, and early repayment penalties can add up over the loan's lifespan.

Conclusion: Making Informed Decisions about Personal Loan Interest Rates

Securing the best personal loan interest rates depends on several factors, including your credit score, the loan amount, the lender, and prevailing economic conditions. By diligently shopping around, comparing offers, improving your credit score, and negotiating, you can significantly reduce the total cost of borrowing. Understanding the APR and other associated fees is essential for making informed decisions. Start comparing personal loan interest rates today to find the best deal tailored to your financial situation and secure the most favorable terms for your needs.

Featured Posts

-

Jalen Brunsons Reaction To Haliburton Wwe Prediction Knicks News

May 28, 2025

Jalen Brunsons Reaction To Haliburton Wwe Prediction Knicks News

May 28, 2025 -

Een Literaire Analyse Van Bert Natters Concentratiekamproman

May 28, 2025

Een Literaire Analyse Van Bert Natters Concentratiekamproman

May 28, 2025 -

Broadway Battle Clooney And Jackman To Clash

May 28, 2025

Broadway Battle Clooney And Jackman To Clash

May 28, 2025 -

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

May 28, 2025

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

May 28, 2025 -

Low Personal Loan Interest Rates Available Today

May 28, 2025

Low Personal Loan Interest Rates Available Today

May 28, 2025