Understanding Principal Financial Group (PFG): An Analyst Perspective

Table of Contents

PFG's Core Business Segments and Revenue Streams

Principal Financial Group's diverse business model generates revenue across several key segments. Understanding the strengths and weaknesses of each is vital for assessing the overall health and future potential of PFG.

Retirement and Income Solutions

PFG's Retirement and Income Solutions segment is a cornerstone of its business, offering a wide range of retirement plans, annuities, and other income solutions designed to help individuals secure their financial future. This segment faces intense competition, but PFG leverages its established brand and extensive distribution network to maintain a significant market share.

- Market share: While precise figures fluctuate, PFG consistently ranks among the leading providers of retirement solutions in the US.

- Key competitors: Vanguard, Fidelity, Schwab, and other large financial institutions are key competitors in this space.

- Growth prospects: The aging population and increasing demand for retirement security provide significant growth opportunities.

- Regulatory impact: Changes in retirement regulations, such as those affecting 401(k) plans and annuities, can significantly impact profitability.

- Recent performance data: Analyzing PFG's financial reports reveals the revenue and profitability generated by this segment, offering insights into its performance trends.

Asset Management

PFG's asset management arm manages a substantial amount of Assets Under Management (AUM). Their investment strategies span various asset classes, catering to both institutional and individual investors. The performance of this segment is directly tied to market conditions and the effectiveness of its investment strategies.

- AUM figures: Regularly reviewing PFG's financial reports will provide up-to-date figures on AUM.

- Key investment strategies: PFG employs a diverse range of investment approaches, including active and passive management strategies, across various asset classes.

- Performance benchmarks: Comparing PFG's asset management performance to relevant benchmarks provides insights into its competitive position.

- Client base: Understanding the diversity and stability of PFG's client base is crucial for assessing the segment's long-term prospects.

- Geographic diversification: Analyzing the geographic spread of PFG's investments sheds light on the diversification of its portfolio and its exposure to various market risks.

Insurance Solutions

PFG also offers a range of insurance solutions, including life insurance and other protection products. This segment contributes significantly to the company's overall revenue and profitability but is subject to regulatory scrutiny and fluctuating market demand.

- Product types: The breadth and depth of PFG's insurance product offerings influence its competitiveness.

- Market demand: Economic conditions and demographic trends influence the demand for insurance products.

- Profitability margins: Analyzing profitability margins provides insights into the effectiveness of pricing and risk management strategies.

- Regulatory changes: Changes in insurance regulations, such as those affecting capital requirements and product design, can significantly impact profitability.

- Competitive advantages: Identifying PFG's competitive advantages within the insurance sector is crucial for evaluating its long-term potential.

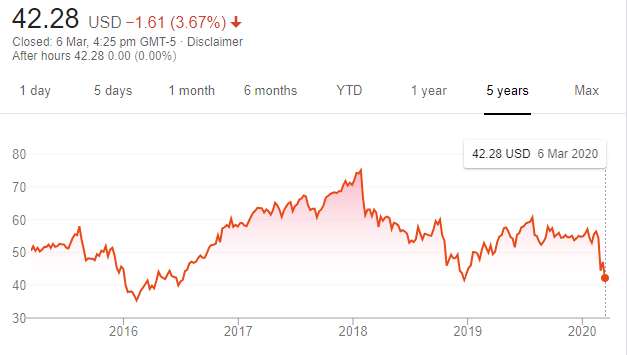

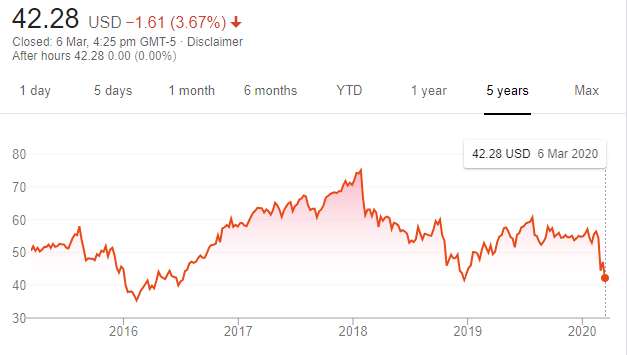

Financial Performance and Key Metrics

A thorough analysis of Principal Financial Group’s financial performance requires examining several key metrics and ratios. This section delves into the financial health and valuation of PFG.

Revenue Growth and Profitability

Analyzing PFG's financial statements reveals trends in revenue growth, profit margins, and return on equity (ROE). These metrics are fundamental in understanding the company's financial health and its ability to generate returns for shareholders.

- Year-over-year revenue growth: Consistent revenue growth is indicative of a healthy and expanding business.

- Net income trends: Tracking net income trends highlights the company's profitability and its ability to manage expenses effectively.

- Operating margins: Operating margins reveal the efficiency of PFG's operations and its ability to convert revenue into profit.

- ROE: Return on Equity (ROE) measures how effectively PFG uses its shareholders' investment to generate profit.

- Debt-to-equity ratio: This ratio reveals the company’s financial leverage and its risk profile.

Key Financial Ratios and Indicators

Several key financial ratios provide insights into PFG's valuation and investment attractiveness. Comparing these ratios to industry peers and historical trends helps investors make informed decisions.

- P/E ratio compared to industry peers: A comparison of PFG's P/E ratio to those of its competitors provides insights into its relative valuation.

- Price-to-book ratio: This ratio compares PFG's market capitalization to its book value, indicating potential undervaluation or overvaluation.

- Dividend payout ratio: This ratio indicates the proportion of earnings paid out as dividends to shareholders.

- Free cash flow generation: Free cash flow is a critical indicator of a company's ability to generate cash after covering its operating expenses and capital expenditures.

Investment Outlook and Future Prospects for PFG

Assessing the future prospects of Principal Financial Group requires analyzing potential growth opportunities and challenges. This section explores the factors that could influence PFG's performance in the coming years.

Growth Opportunities and Challenges

Several factors could drive future growth for PFG, while others present significant challenges. A comprehensive understanding of both is crucial for making accurate predictions.

- Growth strategies: PFG's strategic initiatives, including acquisitions, market expansions, and product innovations, play a crucial role in determining future growth.

- Technological advancements: The adoption of technology and digital solutions can either help PFG gain a competitive advantage or create new challenges.

- Demographic trends: The aging population and changes in consumer preferences strongly influence the demand for PFG's products and services.

- Regulatory risks: Changes in regulations can create both opportunities and threats for PFG.

- Macroeconomic factors: Economic conditions such as interest rates, inflation, and economic growth significantly impact PFG's performance.

Analyst Ratings and Price Targets

Analyst ratings and price targets provide valuable insights into the market's expectations for PFG's future performance. However, it's crucial to remember that these are only estimates and shouldn't be taken as definitive predictions.

- Average analyst rating (buy, hold, sell): The consensus view of financial analysts regarding PFG's stock.

- Average price target: The average price analysts predict PFG's stock will reach in the future.

- Range of price targets from different analysts: The variation in price targets reflects the uncertainty surrounding PFG's future performance.

Conclusion

This analysis of Principal Financial Group (PFG) highlights a diverse business model operating within a competitive and ever-evolving financial landscape. While PFG possesses strengths in its established market presence and diversified revenue streams, it also faces challenges related to regulatory changes and intense competition. Understanding the interplay of these factors is crucial for assessing PFG’s investment potential. Remember to conduct your own thorough due diligence, reviewing PFG’s financial reports and investor presentations, before making any investment decisions related to Principal Financial Group (PFG). A comprehensive understanding of Principal Financial Group (PFG) is paramount for making informed investment choices.

Featured Posts

-

Sheyenne Highs Eagleson Outstanding Science Educator

May 17, 2025

Sheyenne Highs Eagleson Outstanding Science Educator

May 17, 2025 -

Officials Admit Missed Call In Knicks Pistons Game Finish

May 17, 2025

Officials Admit Missed Call In Knicks Pistons Game Finish

May 17, 2025 -

Ny Knicks Vs Brooklyn Nets Free Live Stream 4 13 25 Time Tv Channel And Nba Season Finale Details

May 17, 2025

Ny Knicks Vs Brooklyn Nets Free Live Stream 4 13 25 Time Tv Channel And Nba Season Finale Details

May 17, 2025 -

From Scatological Data To Engaging Podcasts The Power Of Ai

May 17, 2025

From Scatological Data To Engaging Podcasts The Power Of Ai

May 17, 2025 -

Ex Mariners Star Blasts Teams Inaction During Offseason

May 17, 2025

Ex Mariners Star Blasts Teams Inaction During Offseason

May 17, 2025

Latest Posts

-

Meri Enn Maklaud Nevidomi Fakti Pro Matir Donalda Trampa

May 17, 2025

Meri Enn Maklaud Nevidomi Fakti Pro Matir Donalda Trampa

May 17, 2025 -

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025

Zhittya Ta Dosyagnennya Meri Enn Maklaud Materi Donalda Trampa

May 17, 2025 -

The Impact Of Multiple Affairs And Sexual Misconduct Accusations On Donald Trumps Political Career

May 17, 2025

The Impact Of Multiple Affairs And Sexual Misconduct Accusations On Donald Trumps Political Career

May 17, 2025 -

Did Allegations Of Multiple Affairs And Sexual Misconduct Impact Donald Trumps Presidential Bid

May 17, 2025

Did Allegations Of Multiple Affairs And Sexual Misconduct Impact Donald Trumps Presidential Bid

May 17, 2025 -

I Megaloprepis Teleti I Episimi Ypodoxi Toy Proedroy Tramp

May 17, 2025

I Megaloprepis Teleti I Episimi Ypodoxi Toy Proedroy Tramp

May 17, 2025