Understanding PwC's Decision To Leave Nine Sub-Saharan African Nations

Table of Contents

Reasons Behind PwC's Withdrawal from Nine Sub-Saharan African Nations

PwC's withdrawal wasn't a spontaneous decision; rather, it's the culmination of several interconnected factors impacting the firm's Africa strategy. These challenges highlight the complexities of operating in diverse Sub-Saharan African markets.

-

Financial viability and profitability challenges: Operating in several Sub-Saharan African nations presented significant financial hurdles for PwC. Low profit margins, coupled with high operating costs—including infrastructure limitations and logistical challenges—created an unsustainable business model in certain markets. The return on investment simply didn't align with PwC's global strategic goals.

-

Increasing regulatory hurdles and compliance requirements: Navigating the regulatory landscape across diverse Sub-Saharan African nations proved increasingly challenging. Varying accounting standards, complex tax codes, and evolving compliance requirements added significant operational burdens and increased costs. The lack of harmonization across different jurisdictions amplified these complexities.

-

Operational risks related to political instability, security concerns, and infrastructure limitations: Several of the affected nations grapple with political instability, security concerns, and underdeveloped infrastructure. These factors introduced significant operational risks for PwC, including disruptions to operations, increased security costs, and logistical difficulties. The risks outweighed the potential rewards in certain regions.

-

Shifting business priorities and strategic realignment within PwC's global network: The withdrawal also reflects PwC's internal strategic realignment. The firm might be prioritizing investment in markets with higher growth potential, better infrastructure, and a more stable regulatory environment. This strategic shift entails focusing resources on more profitable and less risky ventures.

Impact of PwC's Departure on the Affected Sub-Saharan African Nations

PwC's departure leaves a significant void in the Sub-Saharan African business environment. The impact extends beyond just the loss of a major auditing firm.

-

The potential loss of auditing expertise and its impact on financial reporting and transparency: PwC's exit diminishes the availability of high-quality audit services, potentially affecting the reliability of financial reporting and corporate transparency. This could deter investors and hamper economic growth.

-

The effect on investor confidence and foreign direct investment (FDI) in the region: The withdrawal could negatively impact investor confidence, particularly foreign direct investment (FDI). Investors often rely on reputable auditing firms like PwC to assess risk and ensure the financial soundness of potential investment opportunities.

-

The impact on small and medium-sized enterprises (SMEs) that relied on PwC's services: SMEs often rely heavily on the expertise and resources of large accounting firms. PwC's departure might disproportionately affect these businesses, limiting their access to crucial financial and advisory services.

-

The implications for the development of the local accounting profession and capacity building: The loss of PwC's presence could hinder the development of the local accounting profession. PwC’s departure reduces opportunities for knowledge transfer, training, and capacity building for local accountants.

Potential Long-Term Implications and Future Outlook for PwC in Africa

The long-term implications of PwC's withdrawal are multifaceted. While the immediate impact is negative, the event could also stimulate positive changes.

-

Opportunities for other accounting firms to fill the gap left by PwC: Other international and local accounting firms now have an opportunity to expand their presence in the affected markets. This could foster competition and potentially improve the quality of audit services.

-

The need for improved regulatory frameworks and business environments to attract and retain international firms in Africa: PwC's decision highlights the need for Sub-Saharan African nations to improve their regulatory frameworks, enhance infrastructure, and address security concerns to create a more attractive business environment for international firms.

-

Potential for PwC to re-enter the market in the future under altered conditions: It's not impossible that PwC might reconsider its strategy and return to these markets in the future, provided significant improvements are made to the operating environment.

-

Analysis of long-term economic prospects of Sub-Saharan African countries: The long-term economic outlook of the affected countries will depend on their ability to address the underlying issues that contributed to PwC's departure and to attract other investors.

Conclusion

PwC's withdrawal from nine Sub-Saharan African nations underscores the complex challenges of operating in this dynamic region. The decision reflects a combination of financial, regulatory, and operational risks. While the immediate impact is concerning, it also presents an opportunity for affected nations to improve their business environments. Understanding PwC's decision to leave nine Sub-Saharan African nations is crucial for navigating the complexities of doing business in the region. Stay informed about the evolving landscape and the strategies of major players by continuing your research on PwC Africa and related developments.

Featured Posts

-

Analyzing The Ny Times Coverage Of The January 29th Dc Air Disaster

Apr 29, 2025

Analyzing The Ny Times Coverage Of The January 29th Dc Air Disaster

Apr 29, 2025 -

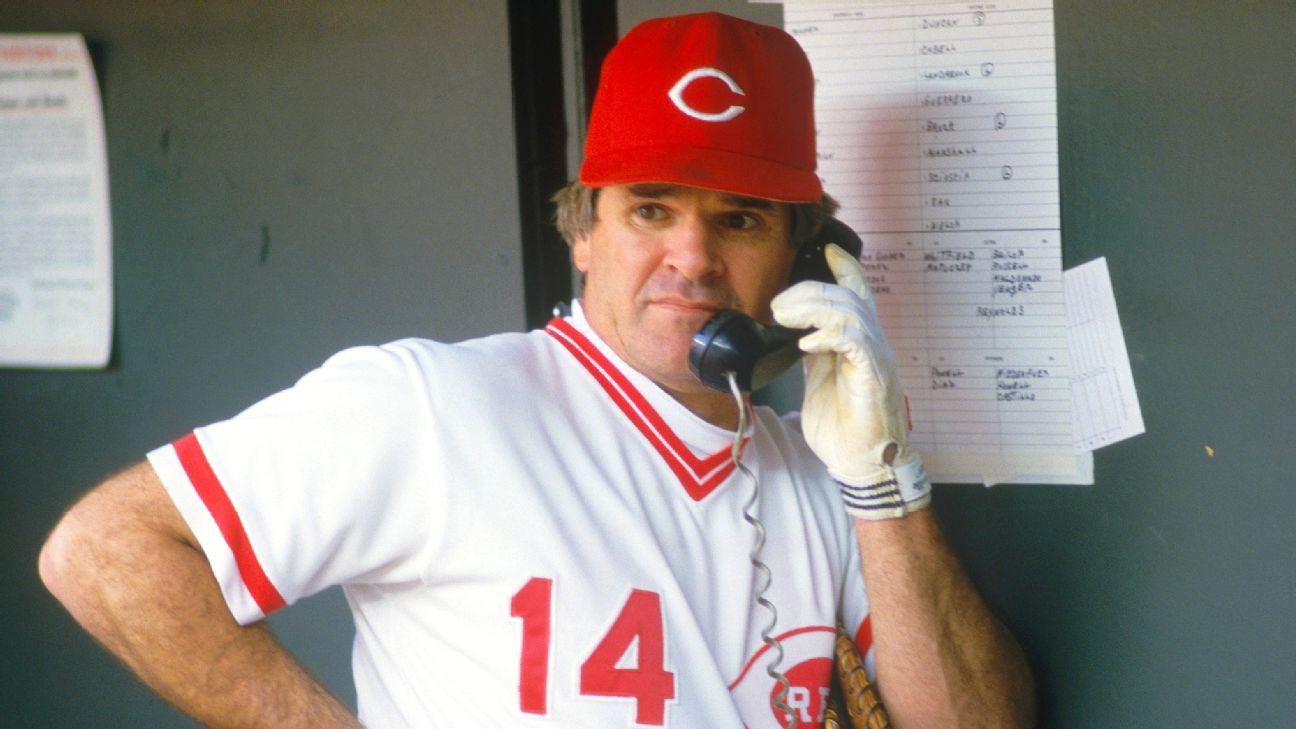

President Trump And Pete Rose The Pardon Debate Explained

Apr 29, 2025

President Trump And Pete Rose The Pardon Debate Explained

Apr 29, 2025 -

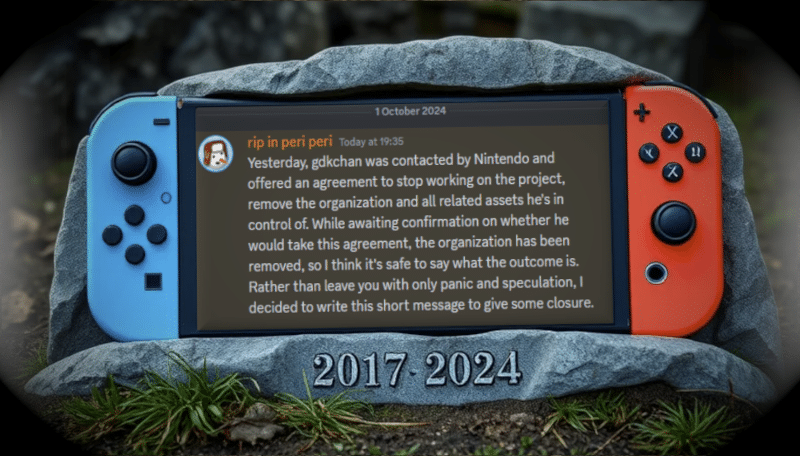

Ryujinx Emulator Project Ends After Alleged Nintendo Intervention

Apr 29, 2025

Ryujinx Emulator Project Ends After Alleged Nintendo Intervention

Apr 29, 2025 -

Linda Evans Valentines Day Message A Look At The Dynasty Star At 82

Apr 29, 2025

Linda Evans Valentines Day Message A Look At The Dynasty Star At 82

Apr 29, 2025 -

Asegura El Gol Con El Metodo Alberto Ardila Olivares

Apr 29, 2025

Asegura El Gol Con El Metodo Alberto Ardila Olivares

Apr 29, 2025

Latest Posts

-

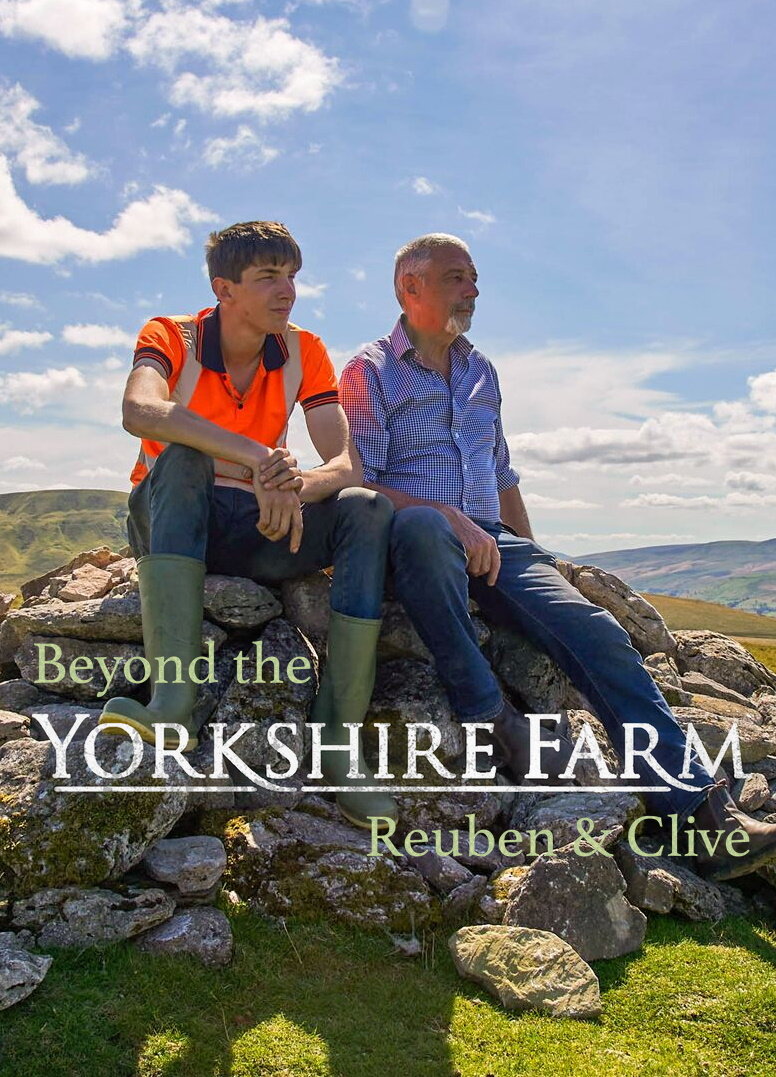

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025 -

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025 -

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025 -

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025 -

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025

Our Farm Next Doors Amanda Owen Family Photos And Rural Life

Apr 30, 2025