Understanding Sovereign Bond Market Trends With Swissquote Bank

Table of Contents

Current Global Sovereign Bond Market Landscape

The global sovereign bond market is currently experiencing a dynamic period shaped by several key factors. Rising interest rates implemented by central banks worldwide to combat inflation are a primary driver of change. This impacts government bond yields, influencing investor decisions. Geopolitical uncertainties, from the ongoing war in Ukraine to trade tensions between major economies, add further complexity. Key players like US Treasuries, German Bunds, and UK Gilts are significantly affected by these global shifts.

Recent significant events influencing Sovereign Bond Market Trends include:

- The Federal Reserve's aggressive interest rate hikes.

- Unexpected inflation surges in several major economies.

- The ongoing energy crisis and its impact on global growth.

- Increased government borrowing to fund social programs and infrastructure projects.

[Insert relevant chart or graph here illustrating yield curve movements for major government bonds]. This visual representation helps to understand the current landscape of Sovereign Bond Market Trends.

Analyzing Sovereign Bond Yields with Swissquote Bank

Sovereign bond yields represent the return an investor receives on a government bond. Understanding these yields is fundamental to making profitable investment decisions. Higher yields generally indicate higher risk, while lower yields suggest lower risk but potentially lower returns. Swissquote Bank provides a comprehensive suite of tools and resources to analyze bond yields effectively.

Swissquote Bank offers:

- Real-time charts displaying yield curves for various sovereign bonds.

- Advanced analytical tools for evaluating yield spreads and historical performance.

- In-depth research reports providing expert analysis of Sovereign Bond Market Trends.

Different yield curve scenarios and their implications include:

- Steepening yield curve: Suggests expectations of future economic growth and higher inflation.

- Flattening yield curve: Often signals a slowdown in economic growth or uncertainty about future inflation.

- Inverted yield curve: Historically considered a predictor of recessions. Understanding these nuances is key when studying Sovereign Bond Market Trends.

Interpreting yield spreads – the difference between the yields of two bonds – is equally important. A widening spread between a government bond and a corporate bond, for example, might reflect increased credit risk for the corporate issuer.

Risk Assessment in the Sovereign Bond Market

Investing in sovereign bonds carries inherent risks. These include:

- Interest rate risk: Rising interest rates can decrease the value of existing bonds.

- Inflation risk: High inflation erodes the purchasing power of bond returns.

- Credit risk: While less common with highly-rated sovereign bonds, there's always a risk of default, especially in emerging markets. This is another important aspect of understanding Sovereign Bond Market Trends.

- Geopolitical risk: Global events can significantly impact bond prices.

Swissquote Bank offers risk management tools and resources to help mitigate these risks, including sophisticated portfolio analysis and diversification strategies. Understanding and managing these risks is paramount for successful investing.

Trading Sovereign Bonds through Swissquote Bank

Swissquote Bank provides a user-friendly platform for trading sovereign bonds. The platform offers:

- Ease of use, even for less experienced traders.

- Competitive pricing and low transaction fees.

- Access to real-time market data and research.

Different types of sovereign bond orders available through the platform include:

- Market orders

- Limit orders

- Stop-loss orders

Swissquote Bank also provides educational resources and tutorials on bond trading to help you confidently navigate the market. This support is integral when considering the complexities of Sovereign Bond Market Trends.

Opportunities and Strategies in the Sovereign Bond Market

The current Sovereign Bond Market Trends, despite the challenges, present several investment opportunities. Potential strategies include:

- Value investing: Identifying undervalued sovereign bonds based on fundamental analysis.

- Income investing: Focusing on bonds offering high yields for stable income generation.

- Diversification: Spreading investments across different sovereign bonds to reduce risk.

However, it's crucial to conduct thorough research and understand the risks associated with each strategy before making investment decisions. Successful investing in sovereign bonds requires careful analysis and a well-defined strategy.

Conclusion: Unlocking the Potential of the Sovereign Bond Market with Swissquote Bank

Understanding Sovereign Bond Market Trends is essential for investors seeking to harness the opportunities within this asset class. This article has highlighted the current market landscape, the importance of yield analysis, risk assessment strategies, and different trading approaches. Swissquote Bank provides the tools, resources, and support to facilitate your journey in this market. Explore Swissquote Bank's comprehensive resources and begin your exploration of the sovereign bond market today! [Link to Swissquote Bank's sovereign bond trading page]. By carefully analyzing Sovereign Bond Market Trends and leveraging Swissquote Bank's offerings, you can unlock the potential for growth and stability in your investment portfolio.

Featured Posts

-

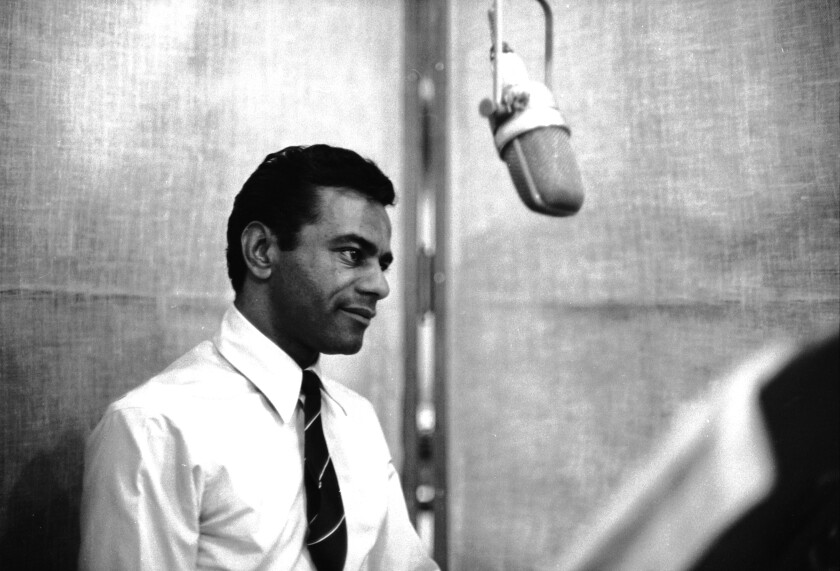

Legendary Singer Johnny Mathis Retiring From The Stage

May 19, 2025

Legendary Singer Johnny Mathis Retiring From The Stage

May 19, 2025 -

Eurovision Voting Explained A Breakdown Of The Process

May 19, 2025

Eurovision Voting Explained A Breakdown Of The Process

May 19, 2025 -

Access To Capital Supporting Sustainability In Small And Medium Enterprises

May 19, 2025

Access To Capital Supporting Sustainability In Small And Medium Enterprises

May 19, 2025 -

Public Reaction To Spring Budget Disappointment And Uncertainty

May 19, 2025

Public Reaction To Spring Budget Disappointment And Uncertainty

May 19, 2025 -

Prohibicion De Celulares En Elecciones El Correismo Presenta Impugnacion

May 19, 2025

Prohibicion De Celulares En Elecciones El Correismo Presenta Impugnacion

May 19, 2025