Understanding Stock Market Valuations: BofA's Advice For Investors

Table of Contents

Key Valuation Metrics Explained

Several key valuation metrics help investors assess the intrinsic value of a company's stock. Understanding these metrics is fundamental to making sound investment choices. Let's explore some of the most commonly used:

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio (P/E) is arguably the most widely used valuation metric. It represents the price of a company's stock relative to its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating high growth expectations or market optimism. Conversely, a low P/E ratio might suggest the stock is undervalued.

It's crucial to differentiate between forward P/E (based on projected future earnings) and trailing P/E (based on past earnings). Forward P/E is useful for growth stocks, while trailing P/E provides a historical perspective. However, relying solely on P/E can be misleading; it's essential to consider other factors and compare P/E ratios within the same industry.

- Strengths: Widely used, readily available, simple to calculate.

- Weaknesses: Can be misleading for companies with inconsistent earnings, susceptible to manipulation through accounting practices, doesn't account for debt.

Price-to-Book Ratio (P/B)

The Price-to-Book ratio (P/B) compares a company's market capitalization to its book value (assets minus liabilities). P/B is particularly relevant for asset-heavy industries like banking and manufacturing. A high P/B ratio may suggest the market values the company's intangible assets (brand, intellectual property) highly. A low P/B ratio could indicate undervaluation or potential financial distress. The interpretation of P/B ratios varies significantly across sectors.

- Strengths: Useful for valuing asset-heavy companies, less susceptible to earnings manipulation than P/E.

- Weaknesses: Book value can be subjective, doesn't reflect future growth potential, less relevant for service-based companies.

Price-to-Sales Ratio (P/S)

The Price-to-Sales ratio (P/S) measures the price of a stock relative to its revenue. It’s particularly useful for valuing companies with negative earnings, as it provides a benchmark even when traditional metrics like P/E are not applicable. Comparing P/S across competitors within the same industry provides insights into relative valuation.

- Strengths: Useful for companies with negative earnings, less susceptible to accounting manipulations than P/E.

- Weaknesses: Doesn't reflect profitability, ignores expenses and debt.

Dividend Yield

Dividend yield, expressed as a percentage, represents the annual dividend per share relative to the stock price. It's a crucial metric for income-focused investors. A higher dividend yield generally indicates a higher payout relative to the stock price, but it's vital to consider the company's ability to sustain dividend payments. While not a direct valuation metric, a high and sustainable dividend yield can indirectly suggest undervaluation.

- Strengths: Important for income investors, provides a steady stream of returns.

- Weaknesses: Dividend payments can be cut, not all companies pay dividends.

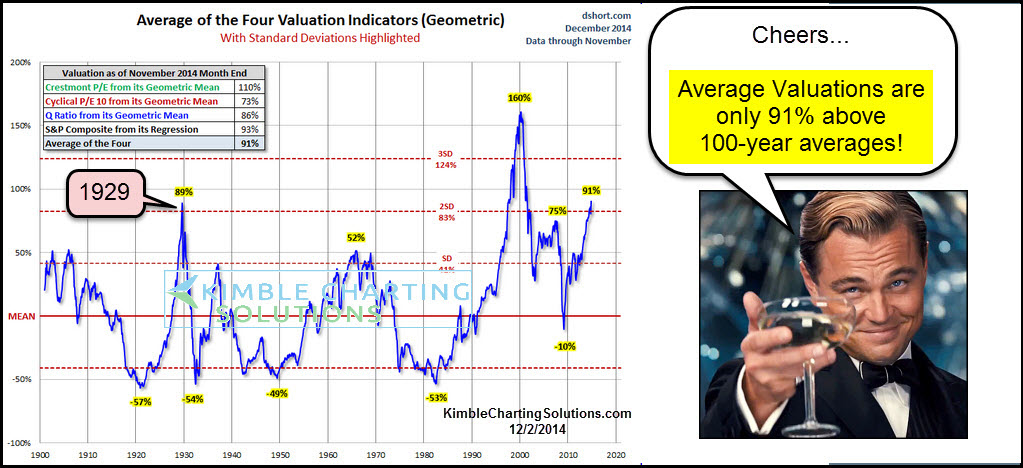

BofA's Perspective on Current Market Valuations

Bank of America's research frequently provides insights into current market valuations. (Note: This section would ideally include specific references to current BofA reports and analyses, including hyperlinks. Due to the dynamic nature of financial markets, I cannot provide specific real-time data here.) For example, BofA might suggest that certain sectors are overvalued due to high P/E ratios, while others might be undervalued based on their P/B ratios. Their analysis would likely consider macroeconomic factors, interest rates, and industry-specific trends.

BofA's predictions for future market trends would stem from their valuation analysis. They may anticipate sector rotations, identifying potentially strong performers based on their valuation models. Their perspective would be compared against other financial institutions to provide a more comprehensive view of market sentiment.

- Key Takeaways from BofA's Analysis: (Insert key takeaways based on actual BofA reports at the time of writing.)

Applying Valuation Metrics to Your Investment Strategy

Investors can use valuation metrics to identify potentially undervalued or overvalued stocks. For instance, if a company within a specific industry has a significantly lower P/E ratio than its peers, it might be considered undervalued. However, it's crucial to conduct thorough due diligence before making any investment decisions.

Beyond valuation metrics, consider company fundamentals (revenue growth, profit margins, debt levels), industry trends, and the overall economic outlook. Diversification across different sectors and asset classes is also crucial to mitigate risk.

- Step-by-Step Process for Valuation Analysis:

- Identify potential investment opportunities.

- Gather financial data on target companies.

- Calculate relevant valuation metrics (P/E, P/B, P/S, Dividend Yield).

- Compare metrics to industry averages and historical trends.

- Analyze company fundamentals and industry outlook.

- Assess overall risk tolerance and diversification strategy.

- Make informed investment decisions.

Risk Management and Valuation

Understanding valuation helps manage risk. By identifying overvalued stocks, you can avoid potential losses. Undervalued stocks, when carefully researched, offer opportunities for growth.

Common Valuation Mistakes to Avoid

Investors often make mistakes when interpreting valuation metrics.

- Ignoring qualitative factors: Focusing solely on numbers without considering management quality, competitive landscape, or regulatory risks.

- Focusing solely on one metric: Relying on a single metric like P/E without considering other indicators.

- Misunderstanding industry-specific valuations: Comparing companies across vastly different industries without accounting for industry-specific norms.

Performing thorough due diligence is crucial before making investment decisions.

Conclusion: Mastering Stock Market Valuations with BofA's Insights

Understanding stock market valuations is essential for investment success. BofA's analysis provides valuable insights into current market conditions and potential future trends. By incorporating these insights and using valuation metrics effectively, combined with a diversified investment strategy, you can significantly enhance your investment decision-making process. Start mastering stock market valuations today by exploring BofA's research and incorporating these techniques into your investment strategy. (Insert link to relevant BofA resources here, if available.)

Featured Posts

-

Solved The 21 Year Old Mystery That Shocked Peppa Pig Fans

May 22, 2025

Solved The 21 Year Old Mystery That Shocked Peppa Pig Fans

May 22, 2025 -

Significant Zebra Mussel Infestation Detected In Casper

May 22, 2025

Significant Zebra Mussel Infestation Detected In Casper

May 22, 2025 -

Blake Lively Accused Of Blackmailing Taylor Swift Details Of The Alleged Text Leak

May 22, 2025

Blake Lively Accused Of Blackmailing Taylor Swift Details Of The Alleged Text Leak

May 22, 2025 -

Tesla Ceo Musk Stepping Back From Politics Focusing On Company

May 22, 2025

Tesla Ceo Musk Stepping Back From Politics Focusing On Company

May 22, 2025 -

Self Guided Walking Tour Of Provence Mountain To Mediterranean Coastline

May 22, 2025

Self Guided Walking Tour Of Provence Mountain To Mediterranean Coastline

May 22, 2025

Latest Posts

-

The Blake Lively Allegations A Summary Of Events

May 22, 2025

The Blake Lively Allegations A Summary Of Events

May 22, 2025 -

Understanding The Allegations Against Blake Lively

May 22, 2025

Understanding The Allegations Against Blake Lively

May 22, 2025 -

Core Weaves Crwv Thursday Stock Rally Factors Contributing To The Increase

May 22, 2025

Core Weaves Crwv Thursday Stock Rally Factors Contributing To The Increase

May 22, 2025 -

Blake Lively And Taylor Swift Reconciliation Rumors Following Public Lawsuit

May 22, 2025

Blake Lively And Taylor Swift Reconciliation Rumors Following Public Lawsuit

May 22, 2025 -

Core Weave Crwv Stock Soars On Thursday Reasons Behind The Rise

May 22, 2025

Core Weave Crwv Stock Soars On Thursday Reasons Behind The Rise

May 22, 2025