Understanding Stock Market Valuations: BofA's Perspective And Investor Reassurance

Table of Contents

Key Valuation Metrics Explained

Understanding how to assess the value of a stock is fundamental to successful investing. Several key valuation metrics help investors determine whether a stock is overvalued, undervalued, or fairly priced. Let's explore some of the most important ones:

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio (P/E) is one of the most widely used valuation metrics. It represents the market price of a company's stock relative to its earnings per share (EPS). The calculation is simple: Market Price per Share / Earnings per Share.

- High P/E ratios can suggest overvaluation, indicating investors are willing to pay a premium for future growth. However, this isn't always the case. A high P/E might be justified for a company with strong growth prospects.

- Low P/E ratios might signal undervaluation, but this could also reflect concerns about the company's future earnings potential. It's crucial to consider the industry benchmark. A low P/E in a high-growth sector might still represent a good value.

- Trailing P/E uses the previous year's earnings, while forward P/E uses projected future earnings. Forward P/E is inherently more speculative but can be useful for valuing growth stocks.

- Limitations: Relying solely on P/E ratios can be misleading. It’s essential to consider other factors like a company's debt levels, growth rate, and industry dynamics.

Price-to-Book Ratio (P/B)

The Price-to-Book ratio (P/B) compares a company's market capitalization to its book value – the net asset value of its assets. It's calculated as: Market Price per Share / Book Value per Share.

- The P/B ratio is particularly useful for valuing companies with significant tangible assets, like real estate or manufacturing companies. A low P/B ratio might suggest the stock is undervalued relative to its assets.

- For companies with significant intangible assets (like technology firms), the P/B ratio is less relevant, as it doesn't fully capture the value of intellectual property, brand recognition, etc.

- Industries with high tangible assets (e.g., banking, real estate) will generally have more meaningful P/B ratios than those with predominantly intangible assets (e.g., technology, pharmaceuticals).

Dividend Yield

Dividend yield is the annual dividend per share divided by the market price per share. It indicates the percentage return an investor receives from dividends.

- A high dividend yield can be attractive to income-focused investors, but it's crucial to examine the sustainability of the dividend. A company might be paying out a high percentage of its earnings as dividends, which could be unsustainable in the long term.

- A low dividend yield doesn't necessarily mean the stock is a bad investment; it might simply reflect a company reinvesting its earnings for future growth.

- Always consider the company's dividend payout ratio (dividends paid out as a percentage of earnings) to assess the sustainability of the dividend.

BofA's Perspective on Current Market Valuations

Bank of America (BofA) regularly publishes research and reports on market valuations, offering valuable insights for investors. Understanding their perspective is critical for navigating the current market landscape.

BofA's Recent Reports and Analyses

BofA's analysts constantly monitor various economic indicators and company performance. Their recent reports frequently touch upon specific sectors they deem overvalued or undervalued. For example, (insert specific example from a recent BofA report, citing source). They also often comment on the impact of interest rate hikes on stock valuations, providing insights into how monetary policy might influence market performance. (Insert another example from a BofA report, citing source). Finally, BofA might offer specific investment recommendations or strategies, suggesting adjustments to portfolios based on their assessment of market conditions. (Insert an example of investment strategy recommendation, citing source)

Addressing Investor Concerns

Market volatility and valuation uncertainties are common investor concerns. BofA's analysis helps provide context and reassurance.

- Inflation's Impact: BofA's reports usually address the effect of inflation on stock valuations. High inflation can erode corporate earnings and impact stock prices, but BofA's insights offer understanding of how specific sectors might fare (Insert example from BofA report on inflation's impact).

- Market Corrections: Concerns about potential market corrections are frequently addressed. BofA may offer perspectives on the likelihood and potential depth of a correction, guiding investors on how to approach such events (Insert example from BofA report on market corrections).

- Practical Advice: BofA might offer practical investment advice based on their valuation analysis. This can include suggestions on sector rotation, asset allocation strategies, or risk management techniques (Insert example of practical investment advice from BofA).

Developing a Robust Investment Strategy

Navigating the complexities of stock market valuations requires a well-defined investment strategy.

Diversification and Risk Management

Diversification is a cornerstone of any robust investment strategy. It involves spreading investments across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk.

- Asset Allocation: A well-diversified portfolio considers an investor’s risk tolerance and financial goals. BofA's research can provide insights into appropriate asset allocations based on market conditions.

- Risk Management Techniques: Dollar-cost averaging (investing a fixed amount regularly regardless of price) is a strategy to mitigate risk by reducing the impact of market volatility.

- Risk Tolerance: It’s crucial to align investment strategies with individual risk tolerance and financial goals. A conservative investor might favor a higher allocation to bonds, while a more aggressive investor might prefer a greater exposure to equities.

Long-Term Investing Perspective

A long-term investment horizon is vital for weathering short-term market fluctuations.

- Ignoring Short-Term Noise: Focusing on long-term goals helps investors avoid impulsive decisions based on short-term market movements.

- Power of Compounding: Over the long term, compounding returns can significantly enhance investment growth. A long-term strategy allows investors to benefit from this effect.

- Successful Strategies: Many successful long-term investors have employed strategies focused on value investing, growth investing, or a combination of both. BofA's research can offer guidance on these approaches.

Conclusion

Understanding stock market valuations is essential for successful investing. By utilizing key valuation metrics like P/E, P/B, and dividend yield, and by staying informed on expert perspectives like those offered by BofA, investors can navigate market volatility with greater confidence. Remember that a well-diversified portfolio and a long-term investment strategy are crucial for mitigating risk and achieving financial goals. Continue learning about stock market valuations and stay updated on BofA's insights to make sound investment decisions. Don't hesitate to consult with a financial advisor for personalized guidance on your investment strategy.

Featured Posts

-

Four Gorillaz Shows Copper Box Arena London Tickets Available Now

May 30, 2025

Four Gorillaz Shows Copper Box Arena London Tickets Available Now

May 30, 2025 -

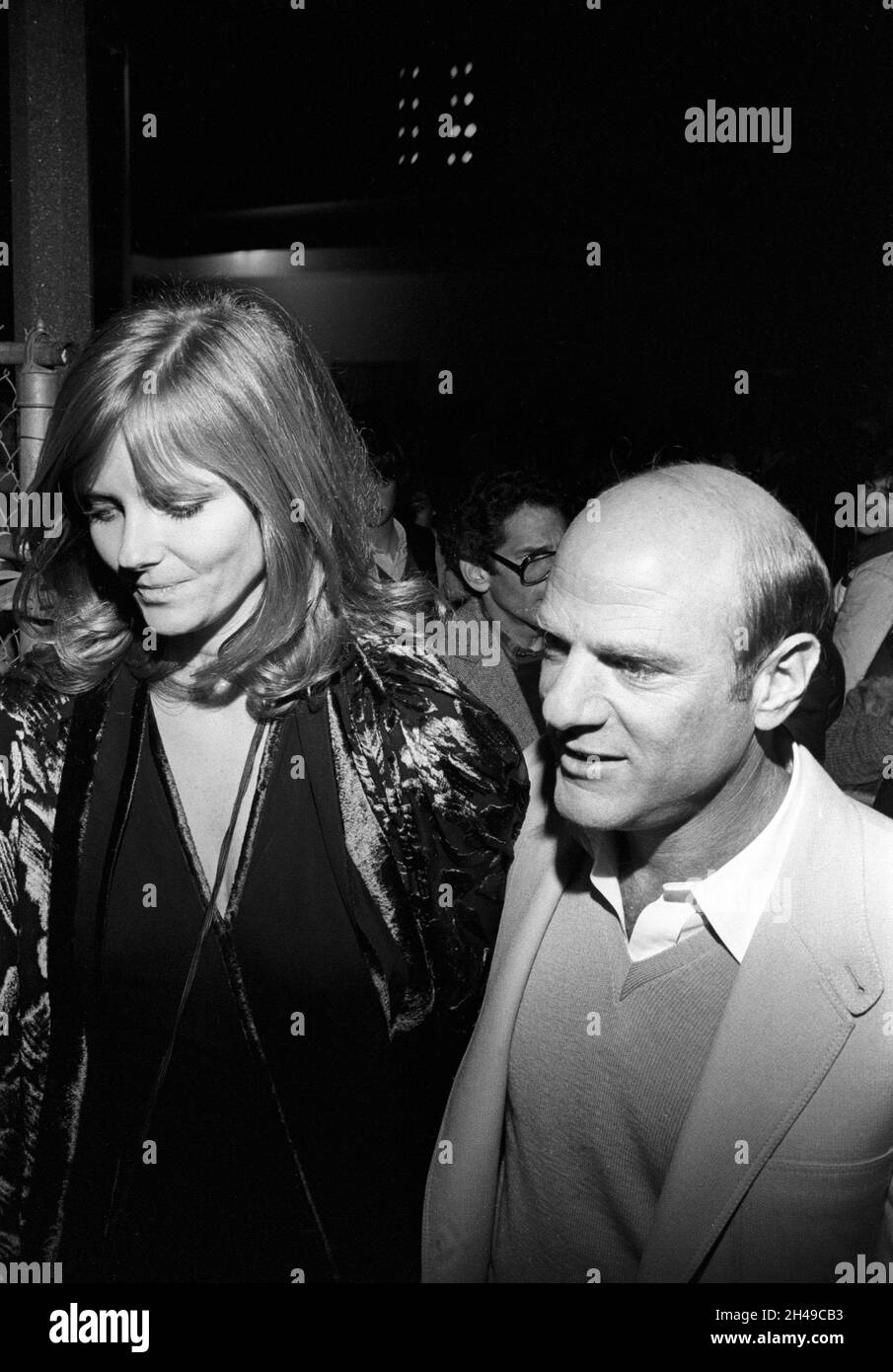

Popeye 1980 Barry Dillers Account Of Rampant Cocaine Use On Set

May 30, 2025

Popeye 1980 Barry Dillers Account Of Rampant Cocaine Use On Set

May 30, 2025 -

Bayern Muenih Augsburg Maci Canli Yayin Bilgileri

May 30, 2025

Bayern Muenih Augsburg Maci Canli Yayin Bilgileri

May 30, 2025 -

Talq Awstabynkw Ela Almlaeb Altrabyt Thlyl Ladayha

May 30, 2025

Talq Awstabynkw Ela Almlaeb Altrabyt Thlyl Ladayha

May 30, 2025 -

Gare Du Nord Le Trafic Chamboule Toute La Journee Suite A La Decouverte D Une Bombe

May 30, 2025

Gare Du Nord Le Trafic Chamboule Toute La Journee Suite A La Decouverte D Une Bombe

May 30, 2025