Understanding Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

Key Valuation Metrics Used by BofA and Other Analysts

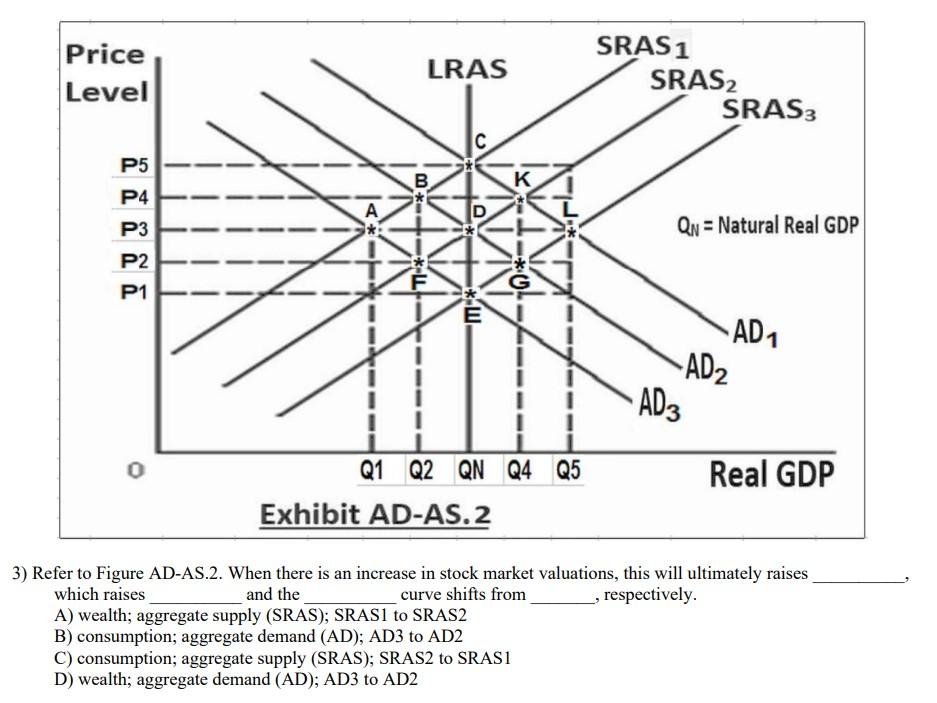

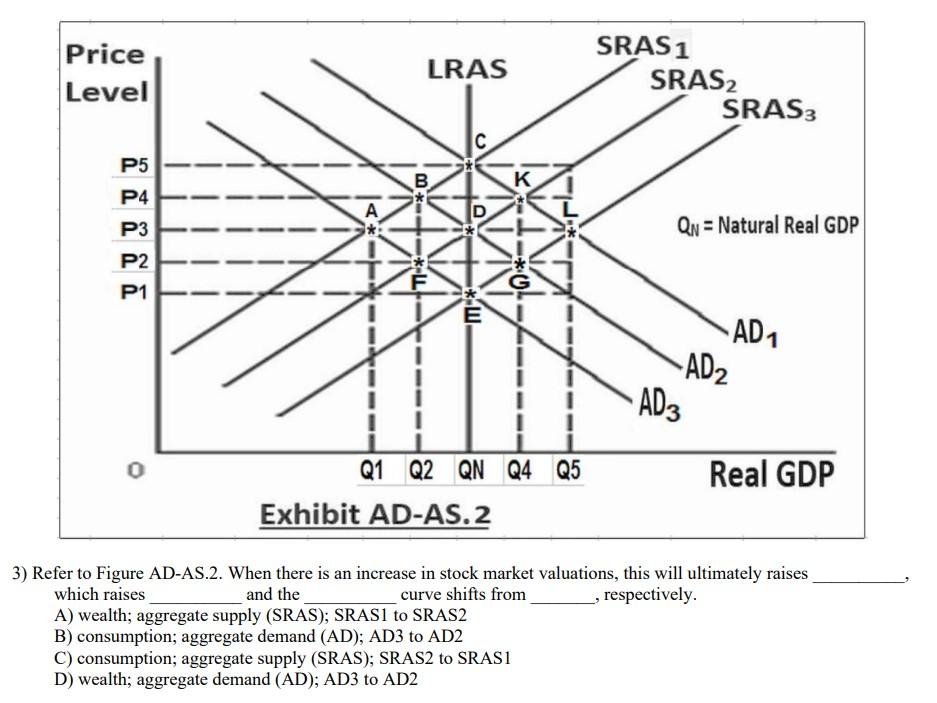

Understanding stock valuation methods is paramount. Several key metrics are commonly used by analysts like BofA to assess the intrinsic value of a company's stock. Let's examine some of the most prevalent:

-

Price-to-Earnings Ratio (P/E Ratio): This classic metric compares a company's stock price to its earnings per share (EPS). A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations. However, a high P/E ratio can also signal overvaluation.

- Calculation: Market Price per Share / Earnings per Share

- Strengths: Widely used and easily understood.

- Weaknesses: Sensitive to accounting manipulations and doesn't account for future growth.

- BofA's Use: BofA likely uses P/E ratios as a benchmark, comparing them to industry averages and historical trends to assess relative valuation.

- Industry Context: A high P/E ratio in a high-growth technology sector might be considered normal, while the same ratio in a mature utility sector might indicate overvaluation.

-

PEG Ratio: This metric adjusts the P/E ratio by considering the company's expected earnings growth rate. It helps to normalize P/E ratios across companies with different growth prospects.

- Calculation: P/E Ratio / Earnings Growth Rate

- Strengths: Accounts for growth, providing a more nuanced valuation.

- Weaknesses: Relies on projected growth rates, which can be inaccurate.

- BofA's Use: BofA likely uses PEG ratios to compare companies with varying growth trajectories.

-

Price-to-Sales Ratio (P/S Ratio): This ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings.

- Calculation: Market Capitalization / Revenue

- Strengths: Useful for valuing companies with negative earnings or high growth potential.

- Weaknesses: Doesn't consider profitability or expenses.

- BofA's Use: BofA might utilize P/S ratios for early-stage companies or those in turnaround situations.

-

Price-to-Book Ratio (P/B Ratio): This ratio compares a company's market capitalization to its book value (assets minus liabilities). It's often used to assess the value of asset-heavy companies.

- Calculation: Market Price per Share / Book Value per Share

- Strengths: Useful for valuing asset-heavy companies.

- Weaknesses: Book value can be affected by accounting practices and may not reflect the true market value of assets.

- BofA's Use: BofA might use P/B ratios for companies in sectors like banking or manufacturing.

-

Dividend Yield: This metric represents the annual dividend per share relative to the stock price. It's relevant for income-oriented investors.

- Calculation: Annual Dividend per Share / Market Price per Share

- Strengths: Indicates the potential income stream from the investment.

- Weaknesses: Dividend payouts can be unreliable and subject to change.

- BofA's Use: BofA will likely consider dividend yield when evaluating companies for income-focused investors.

These valuation metrics are crucial tools, but their interpretation depends heavily on the context.

BofA's Approach to Stock Market Valuation

BofA's investment philosophy generally reflects a long-term perspective, focusing on fundamental analysis and identifying companies with sustainable competitive advantages. Their stock market analysis involves a multi-faceted approach:

-

Proprietary Models: BofA likely employs proprietary quantitative models to analyze financial data and generate valuations. These models likely incorporate a range of factors, including historical financial performance, industry trends, and macroeconomic indicators.

-

Qualitative Factors: BofA analysts don't rely solely on quantitative data. They also assess qualitative factors like management quality, competitive landscape, technological disruptions, and regulatory changes. Understanding the management team's competence and the company's strategic direction is critical for a thorough stock valuation.

-

Macroeconomic Factors: BofA's valuation approach incorporates macroeconomic considerations like interest rates, inflation, and economic growth. These factors significantly influence the overall market environment and individual company performance. For instance, rising interest rates can impact valuations of growth stocks more significantly than value stocks. Understanding the BofA valuation model involves acknowledging this sensitivity.

BofA’s investment strategy is complex, combining quantitative and qualitative data within the broader macroeconomic context.

Interpreting BofA's Valuation Reports and Recommendations

BofA publishes extensive research reports containing investment recommendations (Buy, Sell, or Hold) for various stocks. Interpreting these reports requires careful consideration:

-

Key Takeaways: Focus on the analysts' rationale for their rating, considering the valuation metrics used, qualitative assessments, and macroeconomic outlook.

-

Context: Pay close attention to the time horizon of the recommendation and the associated risk tolerance. A "Buy" recommendation for a long-term growth stock carries different implications than a "Buy" for a short-term trading opportunity.

-

Independent Research: Never rely solely on one source. Always perform your own due diligence, corroborating BofA's findings with data from other reputable sources.

-

Integrating into Your Strategy: Use BofA's analysis as one input in your overall investment decision-making process, combining it with your personal investment goals and risk tolerance. Don't blindly follow their buy sell hold ratings.

Risks and Limitations of Relying on BofA's Valuations

While BofA's analysis provides valuable insights, it's crucial to acknowledge its limitations:

-

Analyst Bias: Potential conflicts of interest exist. BofA's investment banking division might influence research recommendations, creating a bias.

-

Limitations of Historical Data: Past performance isn't indicative of future results. Using historical data to project future growth can be misleading.

-

Diversification: Relying solely on one analyst's opinion is risky. Always diversify your investment portfolio across multiple asset classes and sectors.

Conclusion

Understanding stock market valuations is crucial for successful investing. BofA's perspective, while valuable, should be considered alongside your own research and risk tolerance. By understanding key valuation metrics and BofA's approach, you can make more informed investment decisions. Continue your learning journey by exploring other resources and refining your understanding of stock market valuations. Remember to always conduct your own thorough due diligence before investing. Learn to analyze stock valuation data yourself, and make informed decisions based on your own research and understanding of the market.

Featured Posts

-

Buducnost Svetoveho Pohara 2028 Vplyv Nhl A Otazka Ucasti Ruska

May 07, 2025

Buducnost Svetoveho Pohara 2028 Vplyv Nhl A Otazka Ucasti Ruska

May 07, 2025 -

George Pickens Trade Speculation Heats Up During Nfl Draft

May 07, 2025

George Pickens Trade Speculation Heats Up During Nfl Draft

May 07, 2025 -

Warriors Contact Kevon Looney In Nba Free Agency

May 07, 2025

Warriors Contact Kevon Looney In Nba Free Agency

May 07, 2025 -

Is This Xrps Big Moment Etf Applications Sec Actions And Market Impact

May 07, 2025

Is This Xrps Big Moment Etf Applications Sec Actions And Market Impact

May 07, 2025 -

A24s Latest Horror Film Marks The End Of Jenna Ortegas Five Year Trend

May 07, 2025

A24s Latest Horror Film Marks The End Of Jenna Ortegas Five Year Trend

May 07, 2025