Understanding The Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. It's a crucial metric for investors because it reflects the actual worth of your investment. For ETFs, the NAV is calculated daily by subtracting the ETF's liabilities (expenses, management fees) from its total assets (the market value of all the securities it holds). This calculation provides a snapshot of the ETF's net worth.

- Definition of NAV in the context of ETFs: The market value of the ETF's holdings minus liabilities, expressed per share.

- Calculation methodology: Assets - Liabilities = NAV. This is done daily at market close.

- Daily NAV updates and accessibility: The NAV is usually published at the end of each trading day and is readily accessible through your brokerage account or the ETF provider's website.

- Importance of NAV for investment decisions: NAV provides a benchmark for evaluating ETF performance and making informed buy/sell decisions.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist is a passively managed ETF that aims to track the performance of the MSCI World Index. This index represents a broad range of large and mid-cap companies across developed markets globally, providing investors with significant diversification. The "USD Hedged" aspect means the ETF employs strategies to mitigate the impact of currency fluctuations between the USD and other currencies represented in the index. This is beneficial for investors who primarily hold USD and want to reduce their exposure to currency risk. The "Dist" signifies that the ETF distributes dividends to its shareholders.

- ETF's investment objective: Global market diversification across developed countries.

- Underlying index: MSCI World Index – a widely recognized benchmark for global equity performance.

- Currency hedging strategy: Aims to minimize currency risk for USD investors, leading to more predictable NAV movements.

- Dividend distribution policy: The ETF distributes dividends periodically, impacting the NAV (NAV will typically decrease by the dividend amount on the ex-dividend date).

Factors Affecting the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

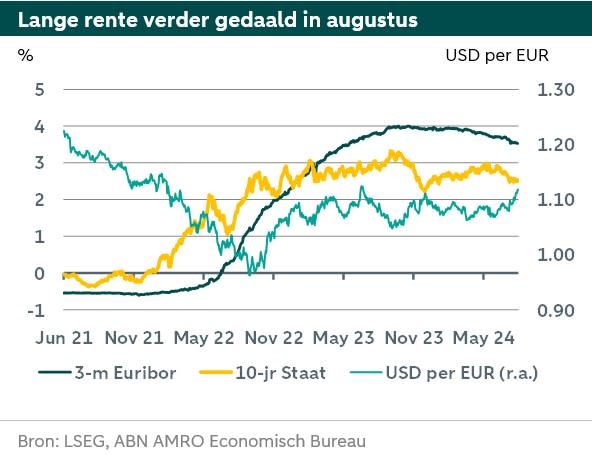

Several factors influence the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV. The most significant is the performance of the underlying MSCI World Index. When the index rises, so does the NAV, and vice versa. However, even with currency hedging, fluctuations in exchange rates between the USD and other currencies can still have a minor impact. Furthermore, dividend distributions directly reduce the NAV (though investors receive the dividend payment), and the expense ratio (the annual fee charged by the ETF provider) gradually impacts NAV growth over time.

- MSCI World Index performance: The primary driver of NAV fluctuations. Positive index performance generally leads to NAV increases.

- Currency fluctuations (USD/other currencies): Despite hedging, residual currency risk can slightly affect the NAV.

- Dividend distributions: Cause a reduction in NAV on the ex-dividend date, reflecting the payment to shareholders.

- Expense ratio: A long-term drag on NAV growth, impacting returns over extended periods.

How to Interpret the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Investors can utilize the NAV to track the performance of their investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist. By comparing the current NAV to past NAVs, you can assess the ETF's growth or decline over time. Comparing the current NAV to your purchase price helps calculate your return on investment. The NAV, in conjunction with other market indicators and your investment goals, can assist in making informed buy or sell decisions. NAV data is typically available through your brokerage account, the Amundi website, or reputable financial data providers.

- Tracking performance: Compare the current NAV to previous NAVs to monitor the ETF's performance.

- Calculating returns: Subtract your purchase price from the current NAV per share to determine your profit or loss.

- Buy/sell decisions: Use the NAV in conjunction with your investment strategy and market analysis to determine optimal buying and selling points.

- Accessing NAV data: Obtain NAV data from reliable sources such as your brokerage platform, the Amundi website, or financial news websites.

Conclusion

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value is crucial for informed investment decisions. By analyzing the factors that influence its NAV and understanding how to interpret its fluctuations, investors can better manage their portfolio and track the performance of their investment in this globally diversified ETF. Remember to regularly monitor the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and consider consulting a financial advisor for personalized guidance. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and make informed investment choices today.

Featured Posts

-

Kapitaalmarkt Update Hogere Rentes En Sterke Euro

May 24, 2025

Kapitaalmarkt Update Hogere Rentes En Sterke Euro

May 24, 2025 -

Brest Urban Trail Qui Sont Les Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail Qui Sont Les Benevoles Artistes Et Partenaires

May 24, 2025 -

Frankfurt Aktienmarkt Dax Entwicklung Und Futures Verfall Zum 21 Maerz 2025

May 24, 2025

Frankfurt Aktienmarkt Dax Entwicklung Und Futures Verfall Zum 21 Maerz 2025

May 24, 2025 -

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 24, 2025

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 24, 2025 -

Escape To The Country Budgeting And Financing Your Rural Dream

May 24, 2025

Escape To The Country Budgeting And Financing Your Rural Dream

May 24, 2025