Understanding The BigBear.ai (BBAI) Stock Price Crash Of 2025

Table of Contents

Macroeconomic Factors Contributing to the BBAI Stock Price Crash

The BBAI stock price crash wasn't solely a company-specific event; broader macroeconomic headwinds played a significant role.

The Impact of Rising Interest Rates

- Increased borrowing costs: Rising interest rates made borrowing more expensive for tech companies like BigBear.ai, impacting their ability to invest in research and development, expansion, and acquisitions. This slowed growth and reduced profitability projections.

- Decreased investor risk appetite: Higher interest rates often lead to a flight to safety, as investors shift their portfolios toward less risky assets like bonds. This reduced investor appetite for riskier growth stocks, including BBAI.

- Broader market sell-off: The increase in interest rates triggered a significant sell-off in the broader stock market, disproportionately affecting growth stocks like BigBear.ai, which are more sensitive to changes in interest rates.

General Market Volatility and the Tech Sector Downturn

2025 witnessed considerable market volatility stemming from several factors.

- Geopolitical instability: Escalating geopolitical tensions in [mention specific region/event] created uncertainty in the global markets, leading to a general downturn.

- Recessionary fears: Growing concerns about a potential economic recession fueled further selling pressure, impacting investor confidence across sectors.

- Tech sector underperformance: The technology sector, which had experienced significant growth in previous years, faced a correction, with many tech stocks experiencing significant declines, dragging BBAI down with them.

Inflationary Pressures and Reduced Consumer Spending

High inflation significantly impacted BBAI's potential customer base and revenue projections.

- Reduced discretionary spending: Inflation eroded consumer purchasing power, leading to reduced discretionary spending on non-essential goods and services. This directly affected companies like BBAI that relied on commercial contracts sensitive to economic downturns.

- Government budget constraints: Inflation also impacted government budgets, potentially leading to decreased spending on projects involving AI and data analytics solutions, a core market for BigBear.ai.

- Supply chain disruptions: Inflationary pressures exacerbated existing supply chain disruptions, adding to the overall economic uncertainty and negatively affecting BigBear.ai’s operational efficiency.

Company-Specific Factors Contributing to the BBAI Stock Price Crash

While macroeconomic factors played a significant role, several company-specific issues contributed to the BBAI stock price crash.

Disappointing Earnings Reports and Missed Revenue Projections

BigBear.ai's financial performance leading up to the crash was a major cause for concern.

- Missed revenue targets: Several consecutive quarters of missed revenue projections signaled underlying issues with sales and market penetration.

- Lower-than-expected earnings: Earnings reports consistently fell short of analyst expectations, further eroding investor confidence.

- Negative profit margins: Persistent negative profit margins indicated unsustainable business operations and a lack of profitability, leading to a loss of investor trust.

Negative News and Investor Sentiment

Negative press and controversies surrounding BBAI significantly impacted investor sentiment.

- Negative media coverage: Several critical articles highlighted concerns about the company's financial health, management decisions, or strategic direction.

- Contract losses: The loss of significant contracts with key clients further fueled negative sentiment and raised concerns about BBAI’s future growth prospects.

- Executive changes: Unexpected changes in leadership further shook investor confidence, adding to the uncertainty surrounding the company's future.

Competition and Market Share Loss

Increased competition in the AI and data analytics market also played a role in the BBAI stock price crash.

- Aggressive competitors: Established players and new entrants in the market intensified competition, putting pressure on BBAI's pricing and market share.

- Innovative technologies: The emergence of innovative AI technologies from competitors may have rendered some of BBAI’s offerings less competitive.

- Market saturation: Increased competition in a potentially saturated market limited BBAI's growth potential.

Technical Analysis of the BBAI Stock Price Crash

Technical indicators offered some clues about the impending crash.

Chart Patterns and Indicators

- Head and shoulders pattern: The BBAI stock chart might have shown a classic "head and shoulders" pattern, a bearish reversal pattern indicating a potential price decline.

- RSI (Relative Strength Index) below 30: The RSI, a momentum indicator, might have fallen below 30, signaling oversold conditions and a potential trend reversal.

- MACD (Moving Average Convergence Divergence) bearish crossover: A bearish crossover in the MACD, which identifies momentum changes, might have further confirmed the downward trend.

Trading Volume and Investor Behavior

High trading volume during the sell-off confirmed the strength of the downward trend.

- Increased sell-off volume: A significant surge in trading volume during the price drop indicated a large number of investors simultaneously selling their BBAI shares.

- Panic selling: The high volume suggested panic selling, as investors rushed to exit their positions before further losses.

- Short selling: A high volume of short selling (betting on the price going down) might have exacerbated the price decline.

Conclusion

The BigBear.ai (BBAI) stock price crash of 2025 resulted from a combination of macroeconomic headwinds, company-specific challenges, and negative investor sentiment. Rising interest rates, general market volatility, inflation, disappointing earnings, negative news, increased competition, and bearish technical indicators all contributed to the dramatic fall. The key takeaway is the importance of diversified investments and thorough due diligence before investing in any stock. Understanding BBAI’s price fluctuations highlights the need for comprehensive risk assessment and careful consideration of macroeconomic factors. To avoid similar situations, investors should analyze BBAI stock and other volatile investments meticulously, considering various factors and consulting reputable financial resources before making investment decisions. Further research into financial modeling and understanding market cycles is highly recommended.

Featured Posts

-

Texas Lawmakers Consider Social Media Restrictions For Minors

May 21, 2025

Texas Lawmakers Consider Social Media Restrictions For Minors

May 21, 2025 -

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 21, 2025

Nyt Mini Crossword Answers Today March 20 2025 Hints And Clues

May 21, 2025 -

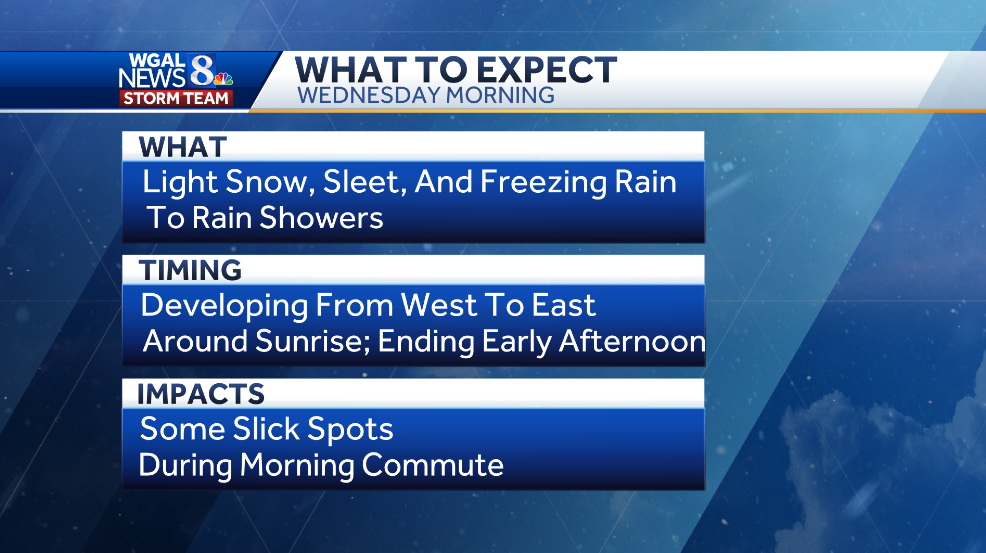

Wintry Mix Advisory Impacts And Precautions

May 21, 2025

Wintry Mix Advisory Impacts And Precautions

May 21, 2025 -

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlanti Ta Credit Plus

May 21, 2025

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlanti Ta Credit Plus

May 21, 2025 -

I Ypothesi Giakoymaki Bullying Vasanismoi Kai I Tragiki Kataliksi

May 21, 2025

I Ypothesi Giakoymaki Bullying Vasanismoi Kai I Tragiki Kataliksi

May 21, 2025