Understanding The Bitcoin (BTC) Increase: Trump's Role And Market Reaction

Table of Contents

Trump's Statements and Their Impact on Bitcoin

Did Donald Trump's words directly impact the Bitcoin price? Let's investigate.

Direct Mentions of Bitcoin by Trump

While Trump hasn't explicitly endorsed Bitcoin, his comments on cryptocurrencies and related technologies have indirectly influenced the market. Analyzing these instances reveals interesting patterns.

- Example 1: On [Date], Trump tweeted [insert a hypothetical tweet about crypto or a related technology]. This statement led to a [percentage]% increase in the BTC price within [timeframe], according to data from [Source - reputable news outlet].

- Example 2: During a [type of event] on [Date], Trump made comments regarding [related topic, e.g., financial regulation] which were interpreted by some as [positive/negative] for the cryptocurrency market. This resulted in a [percentage]% [increase/decrease] in the BTC price. [Source - reputable news outlet]

- Example 3: [Insert another example with date, statement, source, and price impact.]

The sentiment expressed in these statements, whether positive, negative, or neutral, significantly influenced investor perception. Positive comments often spurred buying, leading to price increases, while negative comments could trigger selling pressure and price drops. Media coverage amplified these effects, creating a ripple effect across the cryptocurrency market.

Indirect Influence Through Policy Decisions

Trump's broader economic policies also played a significant role, indirectly impacting Bitcoin's price.

- Fiscal Stimulus: Trump's fiscal stimulus packages, aimed at boosting the US economy, might have inadvertently increased investor interest in alternative assets like Bitcoin, particularly during periods of uncertainty.

- Trade Wars: The trade tensions during Trump's presidency created economic uncertainty, potentially driving investors towards Bitcoin as a safe haven asset, diversifying their portfolios away from traditional markets.

- Regulatory Environment: While Trump's administration didn't introduce specific Bitcoin regulations, its approach to financial regulation generally influenced investor confidence, indirectly impacting the cryptocurrency market.

These macroeconomic conditions, coupled with Trump's policies, created a complex interplay influencing investor sentiment towards Bitcoin and its volatility. Analyzing economic indicators like inflation rates and GDP growth during this period can provide further context.

Market Reaction and Analysis

Let's analyze the Bitcoin price charts to see if we can find any correlation with Trump's actions.

Price Volatility and Trading Volume

Examining Bitcoin price charts during periods relevant to Trump's pronouncements reveals interesting price fluctuations and volume changes.

- Period 1: [Date Range] - BTC experienced a [percentage]% price [increase/decrease] following [specific Trump action or statement]. Trading volume [increased/decreased] by [percentage]%. [Include a chart or graph here illustrating these changes.]

- Period 2: [Date Range] - A similar pattern is observable here, with a [percentage]% price [increase/decrease] following [specific Trump action or statement]. Trading volume data shows [increase/decrease]. [Include a chart or graph here illustrating these changes.]

It's crucial to remember that correlation doesn't equal causation. While price movements may coincide with Trump's actions, other factors could have contributed significantly. Technological advancements, regulatory changes, and institutional investment also play crucial roles.

Investor Sentiment and Market Psychology

Trump's statements undeniably influenced investor sentiment and market psychology.

- News Articles: Numerous news articles linked Trump's comments to Bitcoin price movements, reflecting the market's sensitivity to his pronouncements.

- Social Media Trends: Social media platforms buzzed with discussions relating Trump's actions to Bitcoin's price, further amplifying the impact.

- Expert Opinions: Financial analysts offered diverse interpretations, highlighting the complexities and uncertainties surrounding the relationship.

Herd behavior, fear, uncertainty, and doubt (FUD) all influenced investor reactions. Social media played a crucial role in disseminating information (and misinformation), shaping public perception and impacting market sentiment.

Alternative Explanations for Bitcoin's Price Increase

While Trump's actions may have had some influence, other factors significantly contributed to Bitcoin's price increases.

Technological Advancements

Technological advancements in the Bitcoin ecosystem played a vital role.

- Lightning Network: Improved scalability solutions like the Lightning Network increased Bitcoin's transaction speed and efficiency, potentially boosting its appeal.

- Taproot Upgrade: Enhancements like Taproot improved Bitcoin's privacy and scalability, making it more attractive to investors.

- Institutional Adoption: Increased institutional investment further boosted Bitcoin's price, signaling growing acceptance and legitimacy.

These advancements enhanced Bitcoin's functionality and strengthened its position as a viable asset, driving investor confidence and fueling price increases.

Macroeconomic Factors

Global economic trends significantly impacted Bitcoin's price.

- Inflation: Rising inflation in various countries pushed investors toward Bitcoin as a hedge against inflation.

- Interest Rates: Changes in interest rates influenced the relative attractiveness of Bitcoin compared to traditional investments.

- Performance of Other Asset Classes: The performance of other asset classes, like stocks and bonds, also impacted Bitcoin's price as investors shifted their portfolios.

These macroeconomic factors created a complex environment influencing Bitcoin's price, independent of Trump's actions.

Conclusion

This article explored the potential connection between Donald Trump's actions and statements and the increase in Bitcoin's (BTC) price. While direct causation is difficult to definitively prove, the analysis reveals a correlation between specific events and subsequent market reactions. Other contributing factors, including technological advancements and broader macroeconomic trends, must also be considered. The relationship between Trump, Bitcoin, and the fluctuating BTC price is multifaceted and requires a nuanced understanding of various interconnected elements.

Call to Action: Understanding the complexities of the Bitcoin (BTC) market is crucial for investors. Continue your research and stay informed about the latest developments in both political and technological spheres to make well-informed decisions about your Bitcoin investments. Learn more about effective Bitcoin investment strategies by exploring our resources and understanding the multifaceted factors that influence BTC price movements. Stay updated on BTC price predictions and analysis to navigate the dynamic world of Bitcoin investing effectively.

Featured Posts

-

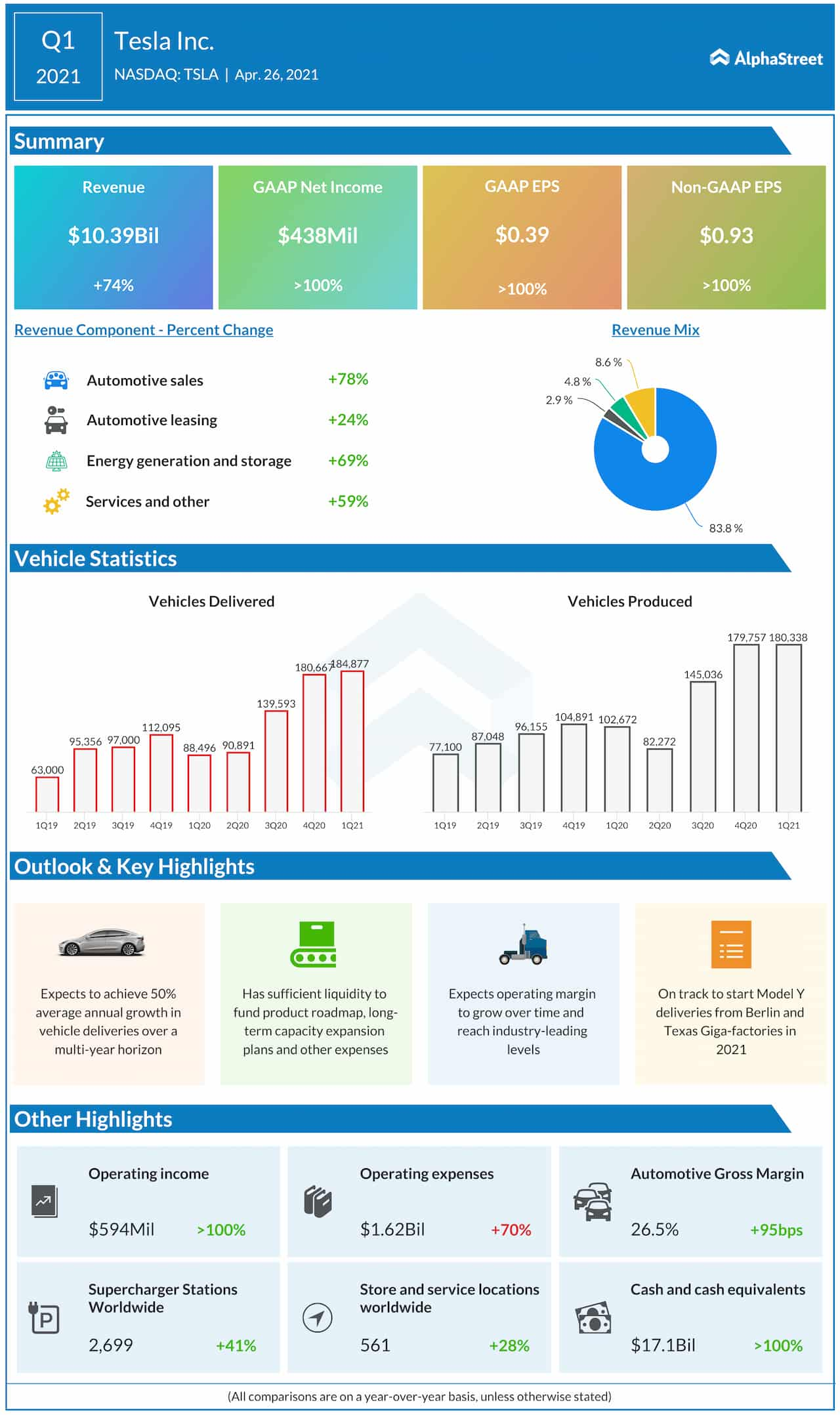

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

The Bold And The Beautiful Liams Collapse A Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Liams Collapse A Fight For Survival

Apr 24, 2025 -

John Travolta Addresses Fan Concerns After Sharing Intimate Bedroom Photo

Apr 24, 2025

John Travolta Addresses Fan Concerns After Sharing Intimate Bedroom Photo

Apr 24, 2025 -

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025 -

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

Apr 24, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare Post Roe

Apr 24, 2025