Understanding The Bitcoin Rebound: A Guide For Investors

Table of Contents

Analyzing Past Bitcoin Rebounds

Identifying Historical Trends and Patterns

Analyzing Bitcoin's historical price is essential for understanding its rebound patterns. By studying previous price surges and subsequent corrections, we can identify recurring trends and potential predictors of future rebounds. Examining charts and graphs showing the "Bitcoin historical price" reveals crucial information. Many past rebounds have been linked to specific events:

- Bitcoin Halving Events: The halving, which reduces the rate of new Bitcoin creation, has historically been followed by significant price increases.

- Institutional Investment: Large-scale investments from institutions like MicroStrategy have often preceded bullish runs.

- Increased Market Adoption: Wider adoption of Bitcoin as a payment method or store of value frequently correlates with price appreciation.

[Insert a relevant Bitcoin price chart here, clearly labeled and sourced. Use alt text like "Bitcoin historical price chart showing major rebounds and corrections."]

Analyzing data like the "Bitcoin price chart" helps illustrate these correlations. Using tools for "cryptocurrency market analysis" is crucial in this process.

- Example 1: The rebound following the 2018 bear market was partly driven by increasing institutional interest and the narrative of Bitcoin as a "digital gold."

- Example 2: The significant price surge in 2021 was fueled by a combination of institutional adoption, retail investor enthusiasm, and the narrative of Bitcoin as a hedge against inflation.

Learning from Past Volatility

Understanding past volatility is crucial for predicting future Bitcoin rebounds. History demonstrates that sharp declines are often followed by equally dramatic rallies. However, predicting the exact timing and magnitude of a rebound remains impossible. Effective "crypto trading strategies" incorporating "risk management cryptocurrency" are paramount. This involves:

- Technical Analysis: Utilizing tools and indicators to identify potential entry and exit points. "Bitcoin technical analysis" can help signal potential rebound opportunities, but it’s not foolproof.

- Fundamental Analysis: Considering factors like macroeconomic conditions, regulatory developments, and technological advancements to assess the underlying value proposition of Bitcoin.

- Diversification: Spreading investments across different asset classes to mitigate risk.

Key lessons learned from past Bitcoin price fluctuations include:

- Patience is crucial; long-term strategies often outperform attempts to time the market perfectly.

- Risk management is non-negotiable; stop-loss orders and other risk mitigation techniques are vital.

- Emotional decision-making should be avoided; sticking to a well-defined investment plan is essential.

Factors Influencing Bitcoin Rebounds

Macroeconomic Conditions and Bitcoin

Global macroeconomic factors significantly influence Bitcoin's price. Inflation, interest rates, and overall economic uncertainty all play a role. The narrative of Bitcoin as a "Bitcoin inflation hedge" gains traction during periods of high inflation, as investors seek alternative stores of value.

- High Inflation: Periods of high inflation often lead to increased demand for Bitcoin as investors seek to protect their purchasing power.

- Low Interest Rates: Low interest rates can make Bitcoin a more attractive investment compared to traditional assets offering low returns.

Examples of macroeconomic events affecting Bitcoin's price include:

- The surge in Bitcoin's price during periods of high inflation in various countries.

- The correlation between Bitcoin's price and the performance of traditional markets.

Regulatory Landscape and its Impact

Government regulations heavily influence Bitcoin's price. Positive regulatory announcements, such as clearer legal frameworks for cryptocurrency trading, tend to drive prices up. Conversely, negative regulatory actions, like bans or restrictions, can trigger sharp declines. Understanding "Bitcoin regulation" and "crypto regulation impact" is crucial.

Examples of regulatory changes influencing Bitcoin's price:

- Increased regulatory clarity in certain jurisdictions has often led to positive price movements.

- Negative regulatory actions, such as bans in some countries, have often resulted in temporary price dips.

Technological Advancements and Adoption

Technological upgrades and increased adoption significantly impact Bitcoin's price. Advancements like the Lightning Network, which improves transaction speed and scalability, boost Bitcoin's appeal. "Bitcoin adoption" and wider "cryptocurrency technology" acceptance fuels growth. "Institutional Bitcoin investment" also plays a critical role.

Examples of technological advancements driving Bitcoin's price:

- The introduction of the Lightning Network contributed to increased transaction efficiency and potentially fueled price increases.

- Increased institutional adoption through the use of Bitcoin as a reserve asset.

Strategies for Bitcoin Rebound Investing

Diversification and Risk Management

Diversification is crucial for any investment portfolio, and Bitcoin is no exception. Don't put all your eggs in one basket! Effective "Bitcoin portfolio diversification" minimizes risk. Implement strategies like:

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Stop-Loss Orders: Automatically selling Bitcoin if the price drops below a predetermined level.

Specific strategies for managing risk in Bitcoin investments include:

- Only investing what you can afford to lose.

- Regularly reviewing and adjusting your investment strategy based on market conditions.

Timing the Market (Cautious Approach)

Attempting to perfectly "time the market" is exceptionally challenging, even for experienced investors. A long-term investment strategy is generally more successful. "Long-term Bitcoin investment" mitigates the impact of short-term price fluctuations.

Tips for a cautious approach to timing the market:

- Focus on fundamental analysis and long-term trends rather than trying to predict short-term price movements.

- Avoid emotional decision-making, especially during periods of extreme volatility.

Conclusion: Understanding and Navigating the Bitcoin Rebound

Bitcoin rebounds are influenced by a complex interplay of macroeconomic conditions, regulatory developments, technological advancements, and market adoption. Understanding past rebounds, employing effective "Bitcoin rebound analysis" and implementing robust risk management strategies are paramount for successful Bitcoin investment. While Bitcoin rebound investing offers potentially high rewards, it also carries substantial risks. Remember to conduct thorough research and only invest what you can afford to lose. Continue your journey towards understanding Bitcoin rebounds by exploring further resources and developing your own informed investment strategy. Become proficient in "Bitcoin investment guide" principles and master "understanding Bitcoin price" movements for successful long-term results.

Featured Posts

-

Ukraine Conflict Putins Victory Day Ceasefire Takes Effect

May 09, 2025

Ukraine Conflict Putins Victory Day Ceasefire Takes Effect

May 09, 2025 -

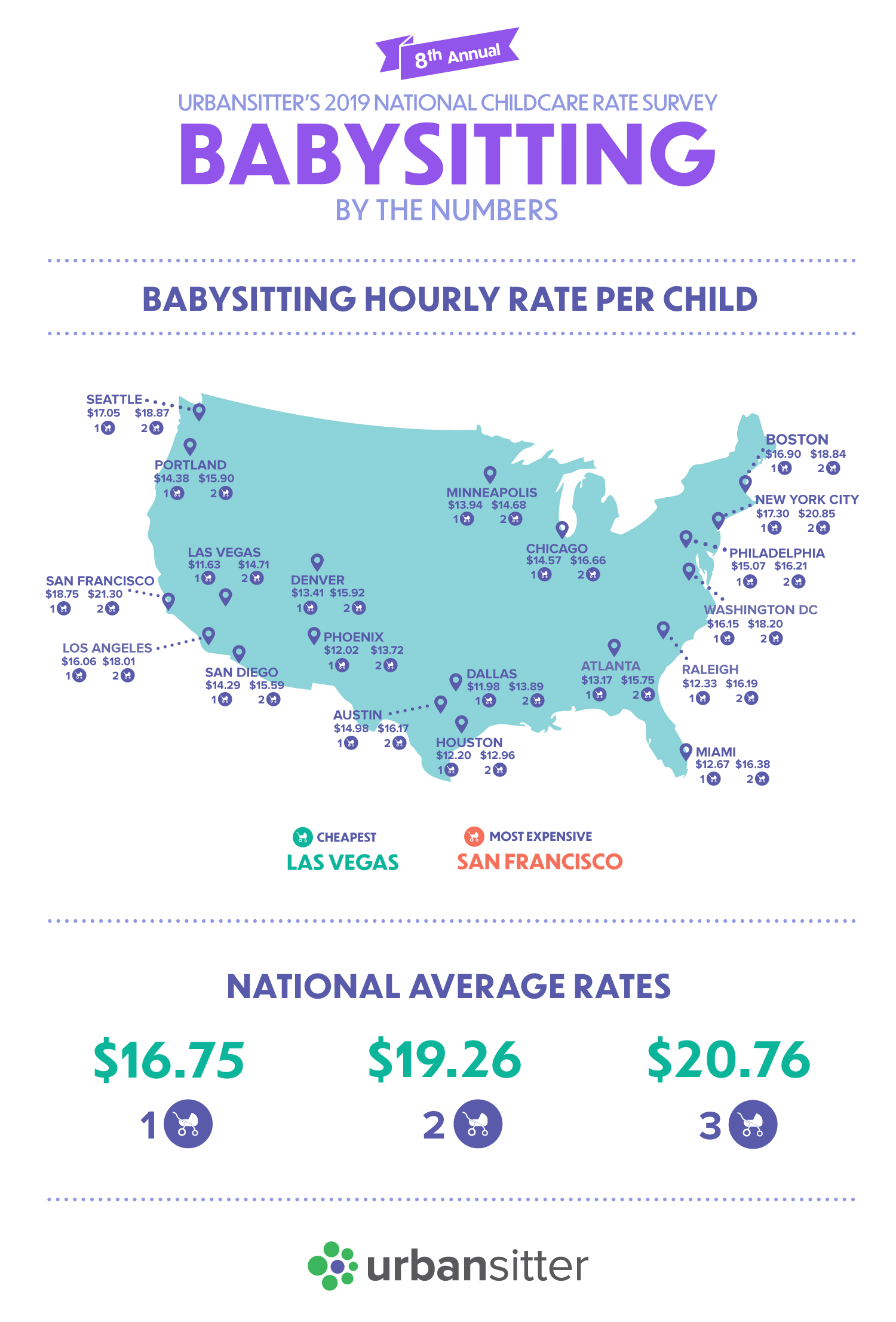

Expensive Babysitting Costs Father A Fortune In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father A Fortune In Daycare Fees

May 09, 2025 -

Pam Bondi And The Epstein Client List What We Know

May 09, 2025

Pam Bondi And The Epstein Client List What We Know

May 09, 2025 -

Julia Wandelts Madeleine Mc Cann Claim Arrest And Investigation In The Uk

May 09, 2025

Julia Wandelts Madeleine Mc Cann Claim Arrest And Investigation In The Uk

May 09, 2025 -

Revealed The Content Of Franco Colapintos Deleted Drive To Survive Message

May 09, 2025

Revealed The Content Of Franco Colapintos Deleted Drive To Survive Message

May 09, 2025

Latest Posts

-

Pam Bondi Laughs Comers Epstein Files Tirade Sparks Controversy

May 09, 2025

Pam Bondi Laughs Comers Epstein Files Tirade Sparks Controversy

May 09, 2025 -

Analysis Attorney Generals Fentanyl Demonstration And Its Impact

May 09, 2025

Analysis Attorney Generals Fentanyl Demonstration And Its Impact

May 09, 2025 -

Fake Fentanyl Prop Attorney Generals Demonstration Sparks Debate

May 09, 2025

Fake Fentanyl Prop Attorney Generals Demonstration Sparks Debate

May 09, 2025 -

Attorney Generals Fentanyl Display A Deep Dive Into The Implications

May 09, 2025

Attorney Generals Fentanyl Display A Deep Dive Into The Implications

May 09, 2025 -

Chinas Canola Imports Beyond Canada New Partnerships And Sources

May 09, 2025

Chinas Canola Imports Beyond Canada New Partnerships And Sources

May 09, 2025