Understanding The D-Wave Quantum (QBTS) Stock Price Volatility: This Week's Events

Table of Contents

Impact of Recent News and Announcements on QBTS Stock

Recent news and announcements from D-Wave Quantum have had a direct impact on its stock price. Analyzing these communications is crucial to understanding the market's reaction and subsequent volatility.

-

Specific news item 1 and its impact on QBTS: [Insert specific news item 1 here, e.g., "On Monday, D-Wave announced a new partnership with a major aerospace company to explore quantum annealing applications for optimizing flight routes. This positive news initially boosted QBTS stock, leading to a 5% increase."]. The market reacted favorably to this strategic partnership, highlighting the growing demand for D-Wave's technology within the industry.

-

Specific news item 2 and its impact on QBTS: [Insert specific news item 2 here, e.g., "However, a subsequent announcement regarding a minor delay in the launch of a new software update caused a temporary dip in the QBTS price. Investors reacted cautiously to this setback, demonstrating the sensitivity of the market to even minor delays in the quantum computing sector."]. This illustrates the inherent risk associated with investing in a rapidly evolving technology sector.

-

Overall sentiment analysis of market reaction: The overall market sentiment this week reflects a combination of optimism and cautiousness. Positive announcements regarding partnerships and technological advancements are balanced against concerns about timelines and market competition. This mixed sentiment is a major contributor to the observed QBTS stock price volatility. Keywords like "D-Wave Quantum news", "QBTS announcement", and "market reaction" are critical for SEO purposes within this section.

Broader Market Trends Affecting Quantum Computing Stocks

The performance of QBTS is not solely dependent on company-specific news; broader market trends significantly influence its stock price. The entire quantum computing sector has experienced fluctuations this week.

-

General tech sector performance: The overall tech sector's performance is a major indicator. A general downturn in the tech market would likely negatively impact QBTS, while a positive trend could provide support. [Include data or references about tech sector performance this week].

-

Performance of competitor quantum computing companies: The performance of competitors like IBM, Google, and IonQ also influences investor sentiment towards QBTS. If competitors announce significant breakthroughs or secure major partnerships, it can impact investor confidence in D-Wave and thereby its stock price. [Mention specific competitor activities and their impact].

-

Overall investor sentiment towards the quantum computing industry: Investor sentiment towards the quantum computing industry as a whole plays a significant role. Periods of increased optimism or pessimism about the industry's future can directly affect QBTS stock price volatility, regardless of D-Wave's specific performance. [Mention any relevant data on investor sentiment, such as increased investment in the sector or the opposite]. Keywords like "quantum computing market trends" and "investor sentiment" are important for SEO.

Analyzing QBTS Trading Volume and Investor Behavior

Examining QBTS trading volume and investor behavior sheds light on the recent volatility. High trading volume often correlates with increased price fluctuations.

-

Trading volume data and its interpretation: [Insert trading volume data for QBTS this week. Analyze the data, explaining if high volume suggests increased speculation or investor interest]. High volumes can indicate heightened investor activity, either driven by bullish or bearish sentiment.

-

Analysis of buy/sell orders: Examining the ratio of buy and sell orders helps gauge the prevailing investor sentiment. A higher number of buy orders compared to sell orders typically pushes the price upwards, and vice versa. [Include data on buy/sell orders if available].

-

Identification of unusual trading patterns (if any): Look for any unusual trading patterns, such as unusually large buy or sell orders at specific price points, which could signal manipulation or significant shifts in investor sentiment. [Discuss unusual patterns if any are observed]. The keywords "QBTS trading volume", "investor behavior", and "trading patterns" are crucial for this section's SEO optimization.

Future Outlook and Potential for QBTS Stock Price

Predicting future stock price movements is inherently uncertain, but based on this week's events, we can offer a cautious outlook.

-

Short-term price prediction: [Offer a cautiously optimistic or pessimistic short-term prediction for QBTS stock, justifying your prediction based on the factors discussed above]. This prediction should be clearly stated as speculative.

-

Potential positive catalysts: Future positive catalysts could include successful product launches, securing major partnerships, or positive developments in the broader quantum computing market.

-

Potential negative catalysts: Negative catalysts could include setbacks in product development, increased competition, or a general downturn in the tech sector.

-

Upcoming events to watch: [Mention any upcoming conferences, product launches, or earnings reports that could significantly impact QBTS stock price in the coming weeks]. Keywords like "QBTS future outlook", "stock price prediction", and "market forecast" are vital for SEO here.

Conclusion: Navigating the Volatility of D-Wave Quantum (QBTS) Stock

This week's D-Wave Quantum (QBTS) stock price volatility is a result of a complex interplay of factors: company-specific news, broader market trends in the quantum computing sector, and investor behavior. The analysis highlights the importance of careful research and consideration of various factors before making investment decisions. Remember that the quantum computing sector is dynamic, and volatility is to be expected. Conduct your own thorough research before investing in QBTS or any other quantum computing stock. Stay informed about D-Wave Quantum (QBTS) stock price movements and continue monitoring the quantum computing market for informed investment decisions. Regularly check for updates on D-Wave Quantum and other quantum computing stocks for the best insights.

Featured Posts

-

62 5m Transfer Battle Man Utd Makes Move For Arsenal And Chelsea Target

May 20, 2025

62 5m Transfer Battle Man Utd Makes Move For Arsenal And Chelsea Target

May 20, 2025 -

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Exorbitant

May 20, 2025

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Exorbitant

May 20, 2025 -

Tyler Bates Wwe Raw Return Reunion With Pete Dunne

May 20, 2025

Tyler Bates Wwe Raw Return Reunion With Pete Dunne

May 20, 2025 -

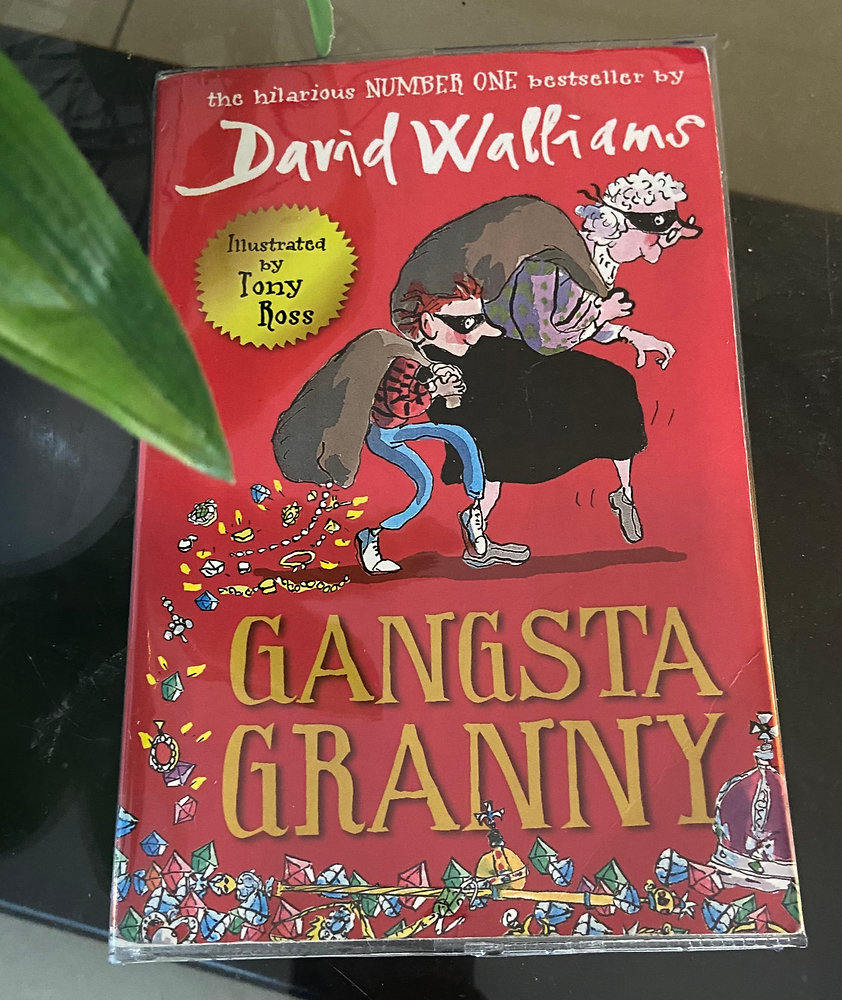

Is Gangsta Granny Appropriate For Young Readers A Parents Guide

May 20, 2025

Is Gangsta Granny Appropriate For Young Readers A Parents Guide

May 20, 2025 -

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025