Understanding The Dax's Response To German Political And Economic News

Table of Contents

The Impact of German Economic News on the DAX

The German economy's health significantly impacts the DAX. Key economic indicators directly influence investor sentiment and market volatility. Understanding these indicators is crucial for predicting DAX movements.

GDP Growth and the DAX:

Positive GDP growth is generally a bullish signal for the DAX, indicating a thriving economy and increased corporate profits. Conversely, negative or slowing growth often leads to investor pessimism and a falling DAX.

- Recent GDP releases: Analyzing recent GDP data reveals a direct correlation between growth rates and DAX performance. Strong GDP growth typically translates to higher DAX values, while weak growth or contraction can trigger market corrections.

- Long-term correlation: Historical data shows a strong positive correlation between German GDP growth and DAX performance over the long term. However, short-term fluctuations can be influenced by other factors.

- Forward-looking indicators: Investors also rely on forward-looking indicators like purchasing manager indices (PMI) and consumer confidence surveys to gauge future GDP growth and its potential impact on the DAX.

Inflation and Interest Rate Changes:

Inflation significantly affects the DAX. High inflation erodes corporate profits, prompting the European Central Bank (ECB) to raise interest rates. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting the DAX negatively.

- Inflation expectations: Investor behavior is highly influenced by inflation expectations. If inflation is expected to remain high, investors may demand higher returns, leading to lower DAX valuations.

- ECB monetary policy: Decisions by the ECB regarding interest rates directly impact the DAX. Rate hikes are generally bearish for the market, while rate cuts can stimulate growth and boost the DAX.

- Historical data analysis: Studying historical data reveals a negative correlation between high inflation and sustained DAX growth. Periods of high inflation often coincide with lower DAX performance.

Other Key Economic Indicators:

Beyond GDP and inflation, several other indicators provide valuable insights into the German economy's health and its influence on the DAX.

- Unemployment rate: Lower unemployment generally reflects a strong economy and increased consumer spending, positively impacting the DAX.

- Consumer confidence: High consumer confidence indicates robust spending and economic optimism, which usually supports DAX growth.

- Manufacturing PMI: This indicator measures the health of the German manufacturing sector, a vital component of the economy, directly influencing the DAX.

- Export data: Germany is a major exporter; strong export numbers signal a healthy economy and typically lead to a rising DAX. Conversely, weak export data can be bearish for the index.

The Influence of German Political News on the DAX

Political developments in Germany significantly influence investor confidence and market stability, directly impacting the DAX. Political uncertainty can lead to increased volatility, while stable governance generally fosters growth.

Elections and Coalition Formation:

Election periods and coalition negotiations often create uncertainty, impacting the DAX. The potential for policy changes and shifts in economic direction can cause market fluctuations.

- Historical examples: Analyzing past German elections reveals that periods of political uncertainty surrounding coalition negotiations often correspond with increased DAX volatility.

- Political stability: A stable government with a clear mandate generally fosters investor confidence and supports DAX growth. Conversely, political instability can trigger market declines.

Policy Changes and Regulatory Reforms:

New government policies, particularly those impacting businesses, significantly affect the DAX. Regulatory changes can either stimulate growth or hinder it depending on their nature and impact.

- Policy examples: Specific policies, such as tax reforms, environmental regulations, or labor market reforms, can have considerable effects on corporate profits and investor sentiment, leading to DAX fluctuations.

- Regulatory impact: Understanding the potential impact of regulatory changes on specific sectors and companies is crucial for effective DAX investment strategies.

Geopolitical Factors and International Relations:

Germany's role in the EU and its international relations significantly influence the DAX. Global events and trade relations have a considerable impact on the German economy and, subsequently, the DAX.

- Global impact: Global events such as trade wars, geopolitical tensions, or international crises can negatively impact the German economy and lead to DAX declines.

- International cooperation: Strong international cooperation and positive trade relationships generally support the German economy and the DAX.

Analyzing the DAX: Tools and Strategies

Effectively navigating the DAX requires a combination of technical and fundamental analysis, coupled with sound risk management strategies.

Utilizing Technical Analysis:

Technical analysis involves studying past market data—price and volume—to predict future price movements. Various tools and indicators can help identify potential trading opportunities.

- Technical indicators: Moving averages, relative strength index (RSI), and MACD are commonly used technical indicators for DAX analysis.

- Chart patterns: Identifying chart patterns like head and shoulders or double tops/bottoms can offer insights into potential price reversals.

Employing Fundamental Analysis:

Fundamental analysis focuses on evaluating the intrinsic value of German companies listed on the DAX. This involves examining financial statements, industry trends, and macroeconomic factors.

- Company fundamentals: Analyzing a company's financial health, including revenue growth, profitability, and debt levels, is essential for long-term investment decisions.

- Macroeconomic factors: Understanding the overall economic climate and its potential impact on German companies is crucial for making informed investment choices.

Implementing Risk Management Strategies:

Risk management is crucial for protecting your investments. Diversification and hedging are vital components of a sound DAX investment strategy.

- Diversification: Spreading investments across various DAX companies or asset classes reduces the impact of any single investment's underperformance.

- Hedging: Employing hedging techniques, such as using options or futures contracts, can help mitigate potential losses due to market volatility.

- Stop-loss orders: Setting stop-loss orders helps limit potential losses by automatically selling an investment when it reaches a predetermined price.

Conclusion

The DAX's intricate relationship with German political and economic news underscores the importance of staying informed. Understanding economic indicators, political developments, and employing both technical and fundamental analysis, along with robust risk management, is critical for successful DAX investing. By consistently monitoring these factors and adapting your investment strategy accordingly, you can improve your ability to navigate the complexities of the DAX and potentially capitalize on market opportunities. Continue learning about the DAX and its response to German political and economic news to optimize your investment outcomes.

Featured Posts

-

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Sam Carraro From Mafs To Love Triangles Quick Exit

Apr 27, 2025

Sam Carraro From Mafs To Love Triangles Quick Exit

Apr 27, 2025 -

Indian Wells Una Favorita Cae En La Gran Campanada Del Torneo

Apr 27, 2025

Indian Wells Una Favorita Cae En La Gran Campanada Del Torneo

Apr 27, 2025 -

Justin Herberts Chargers To Play First Game Of 2025 In Brazil

Apr 27, 2025

Justin Herberts Chargers To Play First Game Of 2025 In Brazil

Apr 27, 2025 -

Getting Ariana Grandes Look Professional Hair And Tattoo Advice

Apr 27, 2025

Getting Ariana Grandes Look Professional Hair And Tattoo Advice

Apr 27, 2025

Latest Posts

-

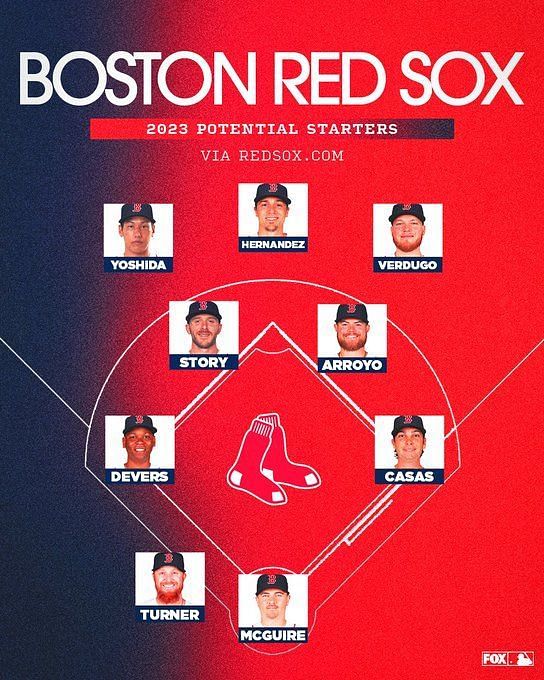

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025