Understanding The Economic Consequences Of The Student Loan Crisis

Table of Contents

Impact on Individual Finances and Economic Mobility

The crushing weight of student loan repayments significantly impacts individual finances and economic mobility, creating a ripple effect throughout the economy.

Reduced Disposable Income

Massive student loan payments drastically reduce disposable income, leaving borrowers with less money for essential needs and hindering their ability to build wealth.

- Reduced spending on housing: Difficulty affording adequate housing, potentially leading to homelessness or substandard living conditions.

- Limited transportation options: Reliance on less reliable or more expensive transportation, impacting job opportunities and overall quality of life.

- Delayed or forgone healthcare: Postponing necessary medical care due to financial constraints, leading to potential health complications.

- Difficulty saving for retirement: The significant portion of income allocated to loan repayments leaves little to nothing for retirement savings, jeopardizing financial security in later life.

- Impact on starting a family: The financial burden makes it challenging to afford childcare and other expenses associated with raising a family.

According to the Federal Reserve, a significant percentage of borrowers dedicate over 20% of their monthly income to student loan repayments, severely limiting their ability to save and invest.

Delayed Major Life Purchases

Student loan debt forces many to postpone major life milestones, delaying homeownership, marriage, and starting families.

- Delayed homeownership: The high cost of housing coupled with substantial loan repayments makes homeownership an unattainable dream for many young adults.

- Postponed marriage: Financial instability due to debt can lead to postponing marriage or forgoing it altogether.

- Fewer children: The cost of raising children, combined with loan repayments, discourages many from having the families they desire.

Data from the National Association of Realtors shows a decline in first-time homebuyers, largely attributable to increased student loan debt and reduced purchasing power among young adults.

Increased Financial Stress and Mental Health Issues

The constant pressure of overwhelming student loan debt takes a significant psychological toll, contributing to increased financial stress and mental health issues.

- Increased anxiety and depression: The constant worry about debt repayment leads to chronic stress, anxiety, and depression.

- Reduced productivity: Financial stress negatively impacts work performance and overall productivity.

- Strain on relationships: Financial strain can put a significant strain on personal relationships.

Studies consistently link high levels of student loan debt to increased rates of anxiety, depression, and other mental health challenges, highlighting the detrimental impact on overall well-being.

Macroeconomic Effects of Student Loan Debt

The student loan crisis isn't just a personal problem; it has far-reaching macroeconomic consequences, impacting consumer spending, entrepreneurship, and public budgets.

Stifled Consumer Spending

High levels of student loan debt reduce overall consumer spending, potentially slowing economic growth.

- Reduced consumer confidence: The burden of debt diminishes consumer confidence, leading to less discretionary spending.

- Impact on retail sales: Decreased consumer spending negatively affects retail sales and overall economic activity.

- Slowed economic growth: Reduced consumer demand can contribute to slower overall economic growth.

Economic data reveals a strong correlation between student loan debt and reduced consumer spending, highlighting the debt's drag on economic activity.

Impact on Entrepreneurship and Innovation

The burden of student loan debt discourages young people from starting businesses, hindering innovation and job creation.

- Missed entrepreneurial opportunities: The financial risk associated with starting a business, coupled with existing debt, deters many from pursuing entrepreneurial ventures.

- Difficulty securing business loans: Existing student loan debt can make it harder to secure additional loans for business ventures.

- Reduced innovation: A decrease in entrepreneurship translates to fewer innovative businesses and fewer job creation opportunities.

Statistics show a lower rate of entrepreneurship among young adults with high levels of student loan debt, suggesting a direct link between debt and stifled innovation.

Strain on the Public Budget

The student loan crisis places a significant strain on public budgets, as governments grapple with managing student loan programs and potential defaults.

- Increased government spending: Government expenditures on student loan programs are continuously increasing.

- Potential impact on other social programs: The rising costs of student loan programs can divert funds from other essential social programs.

- Risk of defaults: An increase in loan defaults could further strain public finances.

The long-term fiscal implications of the student loan crisis are substantial, posing a challenge to government budgets and potentially impacting the availability of other public services.

Potential Solutions and Policy Implications

Addressing the student loan crisis requires a multi-pronged approach involving debt relief measures and addressing the root causes of the problem.

Debt Forgiveness Programs

Widespread student loan forgiveness could provide immediate relief, but also carries potential economic drawbacks.

- Potential benefits: Could stimulate consumer spending and boost economic activity.

- Potential drawbacks: Could increase the national debt and potentially lead to inflation.

- Existing programs: Current income-based repayment plans and targeted forgiveness programs provide some relief but are often insufficient.

Estimating the economic impact of large-scale forgiveness programs is complex, requiring careful consideration of both the positive and negative consequences.

Income-Driven Repayment Plans

Income-driven repayment plans aim to make student loan repayments more manageable by basing payments on income.

- Advantages: Provides more manageable monthly payments for borrowers.

- Disadvantages: Can lead to longer repayment periods and potentially higher overall interest paid.

- Effectiveness: The effectiveness varies depending on the specific plan and the borrower's circumstances.

While income-driven repayment plans offer some relief, their effectiveness in alleviating the overall burden of student loan debt remains a subject of ongoing debate.

Addressing the Root Causes

Addressing the underlying causes of the student loan crisis is crucial for long-term solutions.

- Increased funding for public universities: Lowering tuition costs through increased public funding could make higher education more accessible and affordable.

- Trade school initiatives: Promoting vocational training and trade schools could provide alternative pathways to well-paying jobs without the need for expensive college degrees.

- Tuition reform: Exploring tuition reform options to limit the rapid rise in tuition costs.

Tackling the rising costs of higher education is essential to prevent future generations from facing the same crushing burden of student loan debt.

Conclusion: Understanding the Economic Consequences of the Student Loan Crisis – A Call to Action

The economic consequences of the student loan crisis are far-reaching, impacting individual finances, macroeconomic stability, and the overall health of the economy. The burden of student loan debt hinders economic mobility, stifles consumer spending, and strains public budgets. Understanding these long-term economic implications is critical. We need proactive measures to address both the immediate crisis and its underlying causes. We must advocate for policy changes that promote affordable higher education, provide effective debt relief, and foster a more sustainable financial future for all. Contact your elected officials and demand action to address the pressing issue of the economic consequences of the student loan crisis. Learn more about the issue and get involved – the future of our economy depends on it. For further information and resources, visit [link to relevant resource 1] and [link to relevant resource 2].

Featured Posts

-

Best Online Tribal Loans Guaranteed Approval For Bad Credit

May 28, 2025

Best Online Tribal Loans Guaranteed Approval For Bad Credit

May 28, 2025 -

Las Vegas American Music Awards How To Get Free Tickets

May 28, 2025

Las Vegas American Music Awards How To Get Free Tickets

May 28, 2025 -

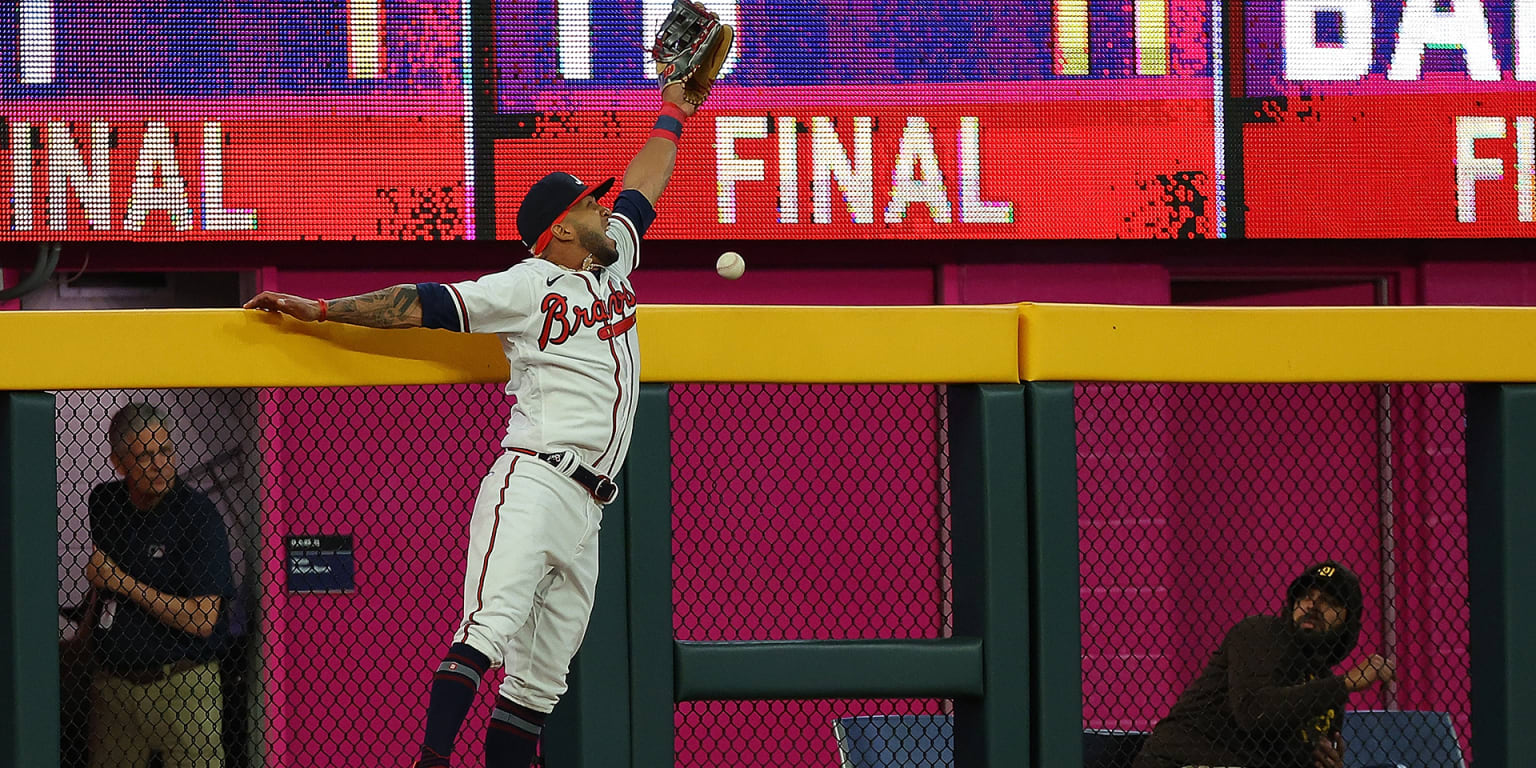

The Padres Fight Against Acuna And The Braves In Atlanta

May 28, 2025

The Padres Fight Against Acuna And The Braves In Atlanta

May 28, 2025 -

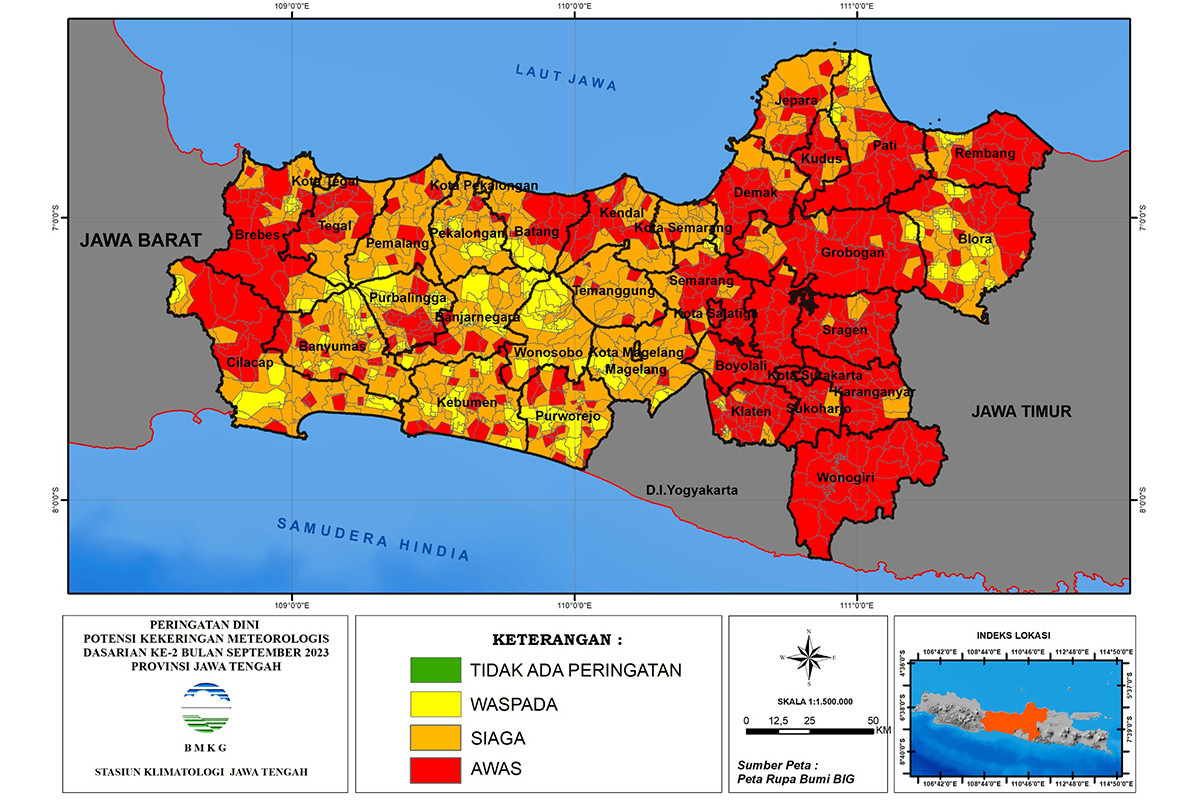

Info Hujan Di Jawa Tengah Prakiraan Cuaca 23 April 2024

May 28, 2025

Info Hujan Di Jawa Tengah Prakiraan Cuaca 23 April 2024

May 28, 2025 -

Domaci Politika Pirati A Zeleni Planuji Spolecny Boj O Snemovnu

May 28, 2025

Domaci Politika Pirati A Zeleni Planuji Spolecny Boj O Snemovnu

May 28, 2025