Understanding The Investment Landscape Of Uber Technologies (UBER)

Table of Contents

UBER's Business Model and Revenue Streams

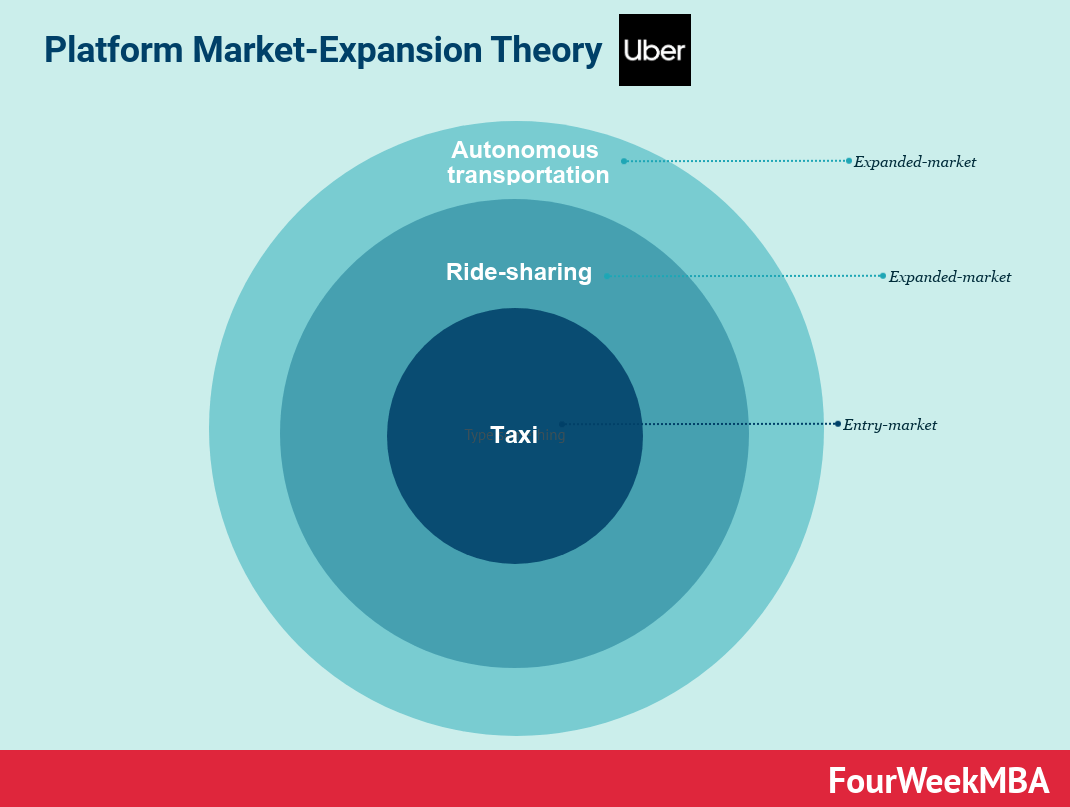

UBER's core business model centers around connecting riders and drivers through its ride-hailing app. This platform extends to food delivery (Uber Eats), freight transportation (Uber Freight), and other mobility services. Understanding these diverse revenue streams is crucial for any investor considering UBER stock.

Revenue Diversification and Growth

Diversification is key to mitigating risk for investors. UBER's multiple revenue streams provide a degree of resilience against downturns in any single sector.

- Ride-hailing: While still a significant revenue generator, its growth rate has shown some fluctuation depending on factors like economic conditions and competition.

- Uber Eats: This segment has experienced robust growth, benefiting from increased demand for food delivery services.

- Uber Freight: This segment targets the logistics industry, offering opportunities for expansion and potentially higher margins.

- Other Bets: UBER continues to explore new revenue streams, including micromobility (e-scooters, e-bikes) and other emerging transportation technologies. These ventures represent both opportunity and risk, impacting the overall UBER investment landscape. Geographical expansion into new markets also plays a crucial role in revenue growth.

Competition and Market Share

UBER faces stiff competition, primarily from Lyft in the US and Didi Chuxing in China. Analyzing market share and competitive strategies is essential.

- Key Competitors: Lyft, Didi Chuxing, regional ride-hailing and delivery services.

- Market Share Analysis: UBER maintains a significant global market share, but its dominance varies across different regions and services.

- Competitive Strategies: UBER focuses on technological innovation, strategic partnerships, and aggressive marketing to maintain its competitive edge.

- Potential Threats: Increased competition, regulatory changes, and evolving consumer preferences represent ongoing threats to UBER's market position.

Financial Performance and Key Metrics

Analyzing UBER's financial health is vital for any potential investor. Key metrics provide insights into its profitability, growth trajectory, and overall stability.

Profitability and Financial Health

While UBER has demonstrated significant revenue growth, achieving sustained profitability remains a challenge.

- Revenue Growth: UBER's revenue has shown significant growth over the years, although the pace may fluctuate.

- Operating Margin: The operating margin provides insights into the efficiency of its operations and its ability to translate revenue into profit. Analyzing the trend in this metric is crucial.

- Free Cash Flow: Free cash flow indicates the company's ability to generate cash after covering its operating expenses and capital expenditures. A positive and growing free cash flow is a positive sign.

- Debt Levels: Examining UBER's debt levels helps assess its financial risk. High levels of debt can impact the company’s ability to handle economic downturns.

Earnings Reports and Analyst Forecasts

Quarterly earnings reports offer a snapshot of UBER's financial performance. These reports, alongside analyst forecasts, significantly influence UBER's stock price.

- Recent Earnings Reports: Analyze the most recent earnings reports to understand the company's financial performance, identifying key takeaways and surprises.

- Key Takeaways: Look for trends in revenue, profitability, and user growth to assess the company's progress.

- Analyst Opinions: Consensus analyst ratings and price targets provide a summary of market sentiment toward UBER stock, providing additional context for investment decisions.

Investment Risks and Opportunities

Investing in UBER involves considering both significant opportunities and substantial risks. A thorough evaluation is crucial.

Regulatory Risks and Legal Challenges

UBER faces ongoing regulatory and legal challenges globally, impacting its operations and profitability.

- Labor Disputes: Classifying drivers as independent contractors versus employees is a persistent legal and regulatory challenge.

- Safety Concerns: Ensuring passenger and driver safety is paramount, and any significant safety issues can negatively impact the company's reputation and stock price.

- Licensing Issues: Obtaining and maintaining necessary licenses and permits in various jurisdictions is crucial for continued operation.

Technological Disruptions and Future Trends

The transportation industry is undergoing rapid technological change. Understanding these trends is vital for assessing UBER's long-term prospects.

- Autonomous Vehicles: The development and adoption of autonomous vehicles could significantly disrupt UBER's business model, presenting both opportunities and threats.

- Evolving Consumer Preferences: Shifting consumer preferences towards alternative transportation modes or services can impact demand for UBER's offerings.

- Emerging Transportation Technologies: New technologies and transportation options may pose a competitive threat to UBER’s existing services.

Economic Factors and Market Volatility

Macroeconomic factors play a significant role in influencing UBER's stock price and investor sentiment.

- Economic Downturns: During economic downturns, consumers may reduce spending on ride-hailing and delivery services, impacting UBER's revenue.

- Fuel Prices: Fluctuations in fuel prices directly impact the cost of operations for UBER drivers and, consequently, UBER's profitability.

- Consumer Spending Habits: Changes in consumer spending habits influence demand for ride-hailing and food delivery services.

Conclusion

Understanding the investment landscape of Uber Technologies (UBER) requires a comprehensive assessment of its diversified business model, financial performance, and the broader economic and technological landscape. While UBER has demonstrated significant growth and innovation, it also faces substantial risks, including regulatory hurdles, intense competition, and the potential for technological disruption. Its strong revenue diversification presents opportunities for growth, but the path to consistent profitability remains a key factor in evaluating UBER's long-term investment potential. Remember to carefully evaluate the investment landscape of Uber Technologies (UBER) before making any investment decisions. Conduct thorough research and consult with a financial advisor before investing in UBER stock or other Uber-related investments.

Featured Posts

-

Secure Your No Deposit Casino Bonus March 2025 Offers

May 18, 2025

Secure Your No Deposit Casino Bonus March 2025 Offers

May 18, 2025 -

Promocyjna Cena Onet Premium Odbierz Fakt W Najlepszej Ofercie

May 18, 2025

Promocyjna Cena Onet Premium Odbierz Fakt W Najlepszej Ofercie

May 18, 2025 -

Bowen Yang Reacts Snls Aimee Lou Wood Starring White Lotus Parody

May 18, 2025

Bowen Yang Reacts Snls Aimee Lou Wood Starring White Lotus Parody

May 18, 2025 -

Uber One Kenya Your Guide To Discounted Rides And Deliveries

May 18, 2025

Uber One Kenya Your Guide To Discounted Rides And Deliveries

May 18, 2025 -

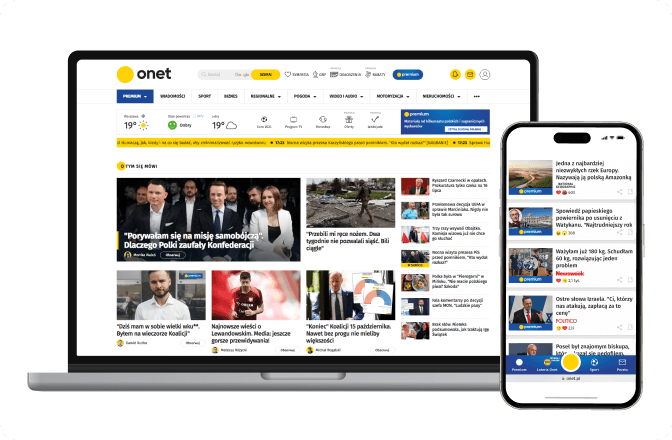

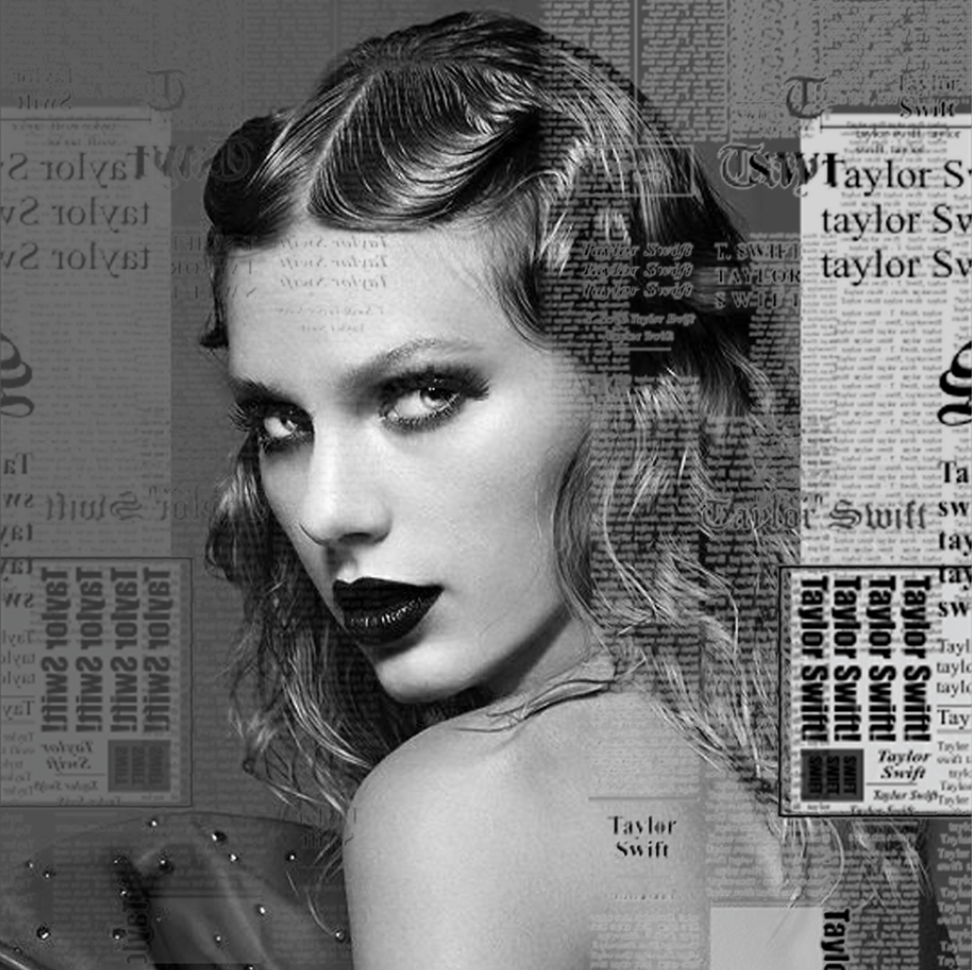

Taylor Swifts Reputation Taylors Version Teaser Analyzing The Clues And Hints

May 18, 2025

Taylor Swifts Reputation Taylors Version Teaser Analyzing The Clues And Hints

May 18, 2025

Latest Posts

-

Find The Daily Lotto Results Monday April 28 2025

May 18, 2025

Find The Daily Lotto Results Monday April 28 2025

May 18, 2025 -

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

28 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025

Check Daily Lotto Results For Monday April 28 2025

May 18, 2025 -

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025

29 April 2025 Daily Lotto Results Winning Numbers Announced

May 18, 2025 -

Daily Lotto 29 April 2025 Results

May 18, 2025

Daily Lotto 29 April 2025 Results

May 18, 2025