Understanding The Low Adoption Rate Of 10-Year Mortgages In Canada

Table of Contents

Financial Uncertainty and the Risk-Averse Nature of Canadian Homebuyers

The Canadian housing market, while often robust, is not immune to fluctuations. The inherent risk in committing to a 10-year mortgage in Canada is a significant deterrent for many.

Predicting Long-Term Interest Rates: A Crystal Ball?

Predicting interest rate fluctuations over a decade is nearly impossible. Choosing a 10-year mortgage means locking into a specific interest rate for the entire term.

- Increased risk of higher rates: If interest rates rise significantly during the 10-year period, borrowers could end up paying substantially more than if they had opted for a shorter-term mortgage and refinanced at a lower rate.

- Potential for refinancing penalties: Breaking a 10-year mortgage early often incurs significant penalties, limiting flexibility.

- Uncertainty about future financial situations: Life throws curveballs. Job loss, unexpected medical expenses, or other unforeseen circumstances can impact a borrower's ability to manage long-term mortgage payments.

Preference for Flexibility: The Allure of Shorter Terms

Canadians often prioritize flexibility when it comes to their mortgage. Shorter-term mortgages, like 5-year mortgages, offer the opportunity to reassess and refinance as needed.

- Ability to adjust payments: Shorter terms allow for adjustments to mortgage payments based on changing financial circumstances.

- Opportunity to take advantage of lower interest rates: Refinancing allows homeowners to capitalize on lower interest rates that may become available during the mortgage term.

- Increased control over mortgage payments: The ability to adjust and refinance provides a sense of control over monthly expenses.

Impact of Economic Volatility: Navigating Uncertainty

Economic downturns and periods of uncertainty heighten the risk associated with a long-term commitment like a 10-year mortgage.

- Job security concerns: The fear of job loss makes committing to a decade of fixed payments a daunting prospect for many.

- Potential for decreased income: Unforeseen economic events can impact household income, making long-term mortgage payments challenging.

- Impact of rising inflation: Inflation erodes purchasing power, making fixed-rate payments potentially more burdensome over time.

Limited Awareness and Understanding of 10-Year Mortgage Benefits

The low adoption rate of 10-year mortgages in Canada is also influenced by a lack of awareness and understanding of their potential benefits.

Lack of Information and Education: The Missing Piece

Many Canadian homebuyers may simply not be fully informed about the long-term advantages of 10-year mortgages.

- Limited marketing campaigns: Marketing efforts for 10-year mortgages are often less prominent compared to those for shorter-term options.

- Infrequent discussion by mortgage brokers: Brokers may focus more on shorter-term mortgages due to factors discussed later.

- Lack of consumer education resources: Clear and concise information about the nuances of 10-year mortgages is often lacking.

Complexity and Perceived Barriers to Entry: Navigating the Nuances

The perceived complexity of 10-year mortgages can deter potential borrowers.

- Stricter lending criteria: Lenders may apply stricter criteria for longer-term mortgages.

- Potential for prepayment penalties: The penalties for early repayment can be substantial.

- Perceived lack of flexibility: The fixed-rate nature and long-term commitment are often perceived as inflexible.

The Role of Mortgage Brokers and Lenders

The actions of mortgage brokers and lenders significantly influence the mortgage market landscape, including the adoption rate of 10-year mortgages.

Brokerage Incentives: A Commission-Driven Landscape

Mortgage brokers often receive higher commissions on shorter-term mortgages due to higher turnover.

- Higher frequency of transactions: Shorter-term mortgages lead to more frequent refinancing opportunities, resulting in more commissions for brokers.

- Immediate commission income: Brokers receive their commission upfront with shorter-term mortgages, unlike long-term options.

Lender Policies and Product Offerings: Shaping the Market

Lenders also play a crucial role through their product offerings and lending practices.

- Limited availability of 10-year mortgage products: Some lenders may offer limited or no 10-year mortgage options.

- Stricter lending criteria: Higher barriers to entry for 10-year mortgages make them less accessible.

- Higher interest rates on longer terms (in some cases): In certain situations, lenders might charge slightly higher interest rates for longer mortgage terms.

Conclusion: Re-evaluating the Appeal of 10-Year Mortgages in Canada

The low adoption rate of 10-year mortgages in Canada stems from a confluence of factors: financial uncertainty, limited awareness, and the influence of brokers and lenders. While the decision to opt for a 10-year mortgage requires careful consideration of your personal circumstances and risk tolerance, understanding the potential long-term benefits is crucial. Start exploring your 10-year mortgage options in Canada today and make an informed decision about your home financing, considering both the advantages of long-term mortgage options and potential risks associated with Canadian mortgage rates. Weigh the potential long-term savings against the reduced flexibility before making your choice. Don't hesitate to consult with a financial advisor to determine what type of mortgage term is best for your unique financial situation.

Featured Posts

-

Canelo Alvarez Plant Fight Takes Priority Crawford Talk Postponed

May 04, 2025

Canelo Alvarez Plant Fight Takes Priority Crawford Talk Postponed

May 04, 2025 -

Fleetwood Mac Achieves Top Chart Position In The Us With Existing Catalog

May 04, 2025

Fleetwood Mac Achieves Top Chart Position In The Us With Existing Catalog

May 04, 2025 -

The Potent Powder Fueling Cocaines Global Surge Understanding The Narco Subs Factor

May 04, 2025

The Potent Powder Fueling Cocaines Global Surge Understanding The Narco Subs Factor

May 04, 2025 -

Sheung Wans Honjo A Review Of A Modern Japanese Restaurant

May 04, 2025

Sheung Wans Honjo A Review Of A Modern Japanese Restaurant

May 04, 2025 -

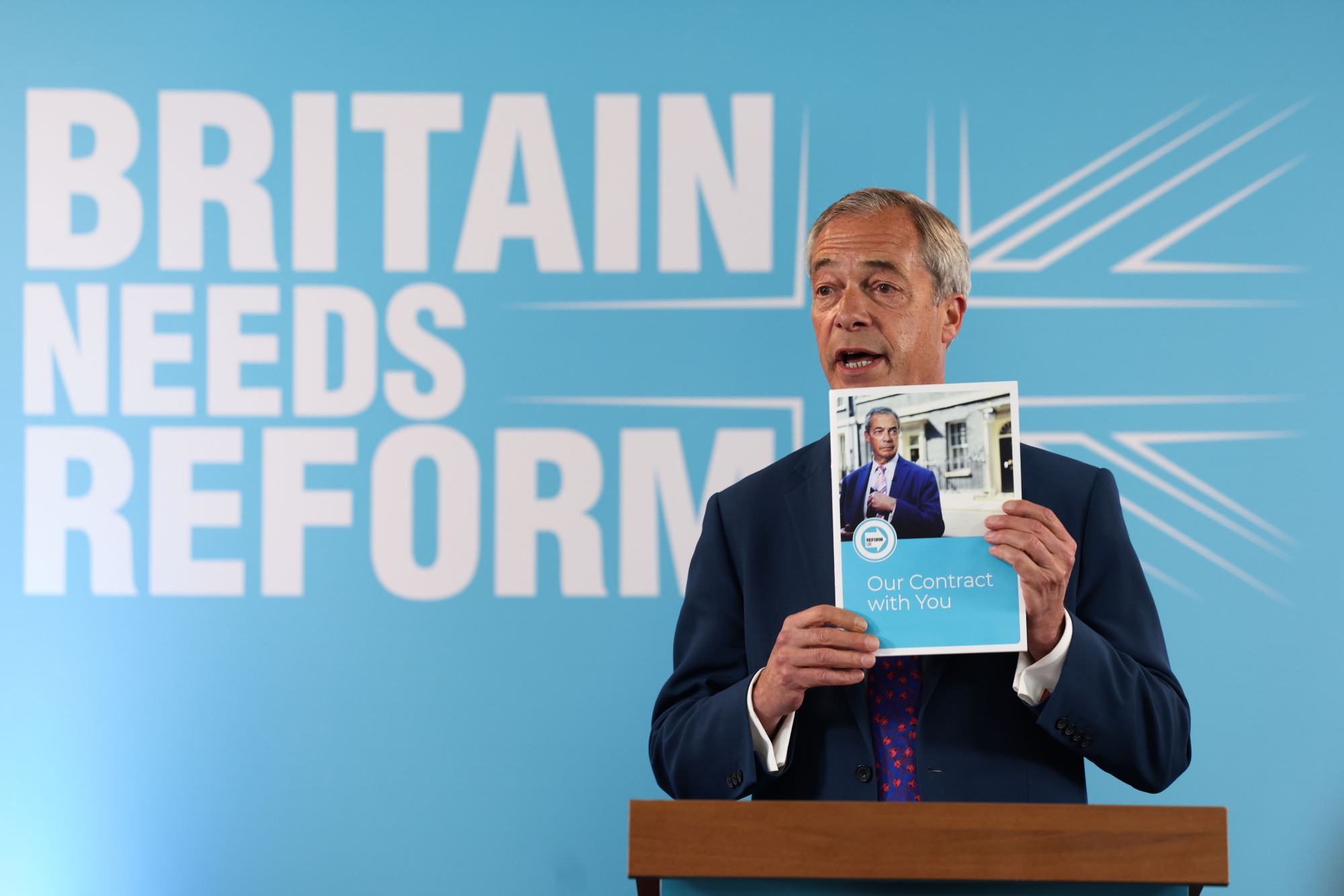

Farage Backs Snp Reforms Shocking Holyrood Election Prediction

May 04, 2025

Farage Backs Snp Reforms Shocking Holyrood Election Prediction

May 04, 2025