Understanding The Recent Decline In Scholar Rock Stock Price

Table of Contents

Market-Wide Factors Affecting Scholar Rock Stock Price

The recent decline in Scholar Rock's stock price isn't occurring in isolation. Several broader market trends have significantly impacted the performance of biotech stocks, including Scholar Rock.

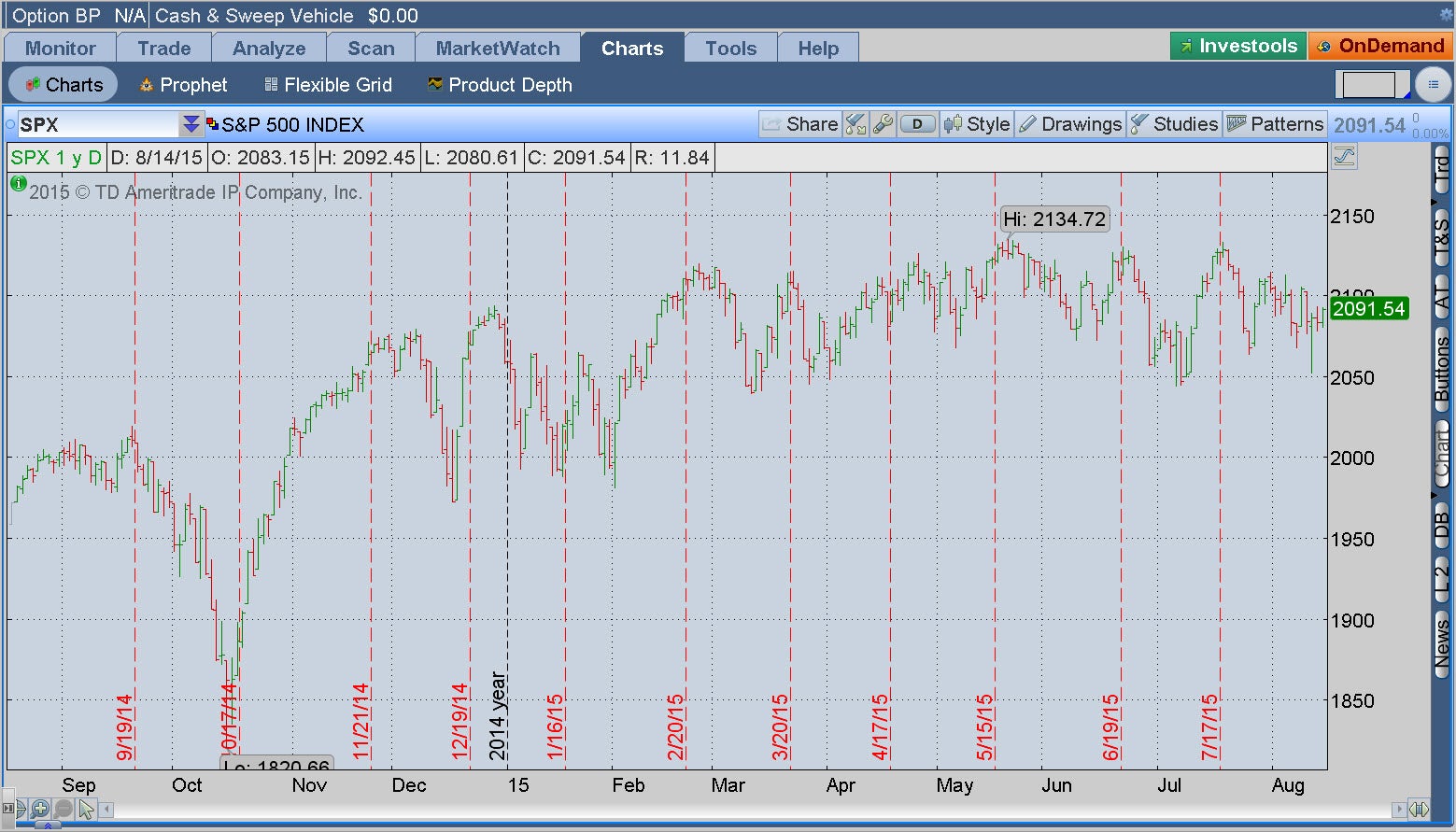

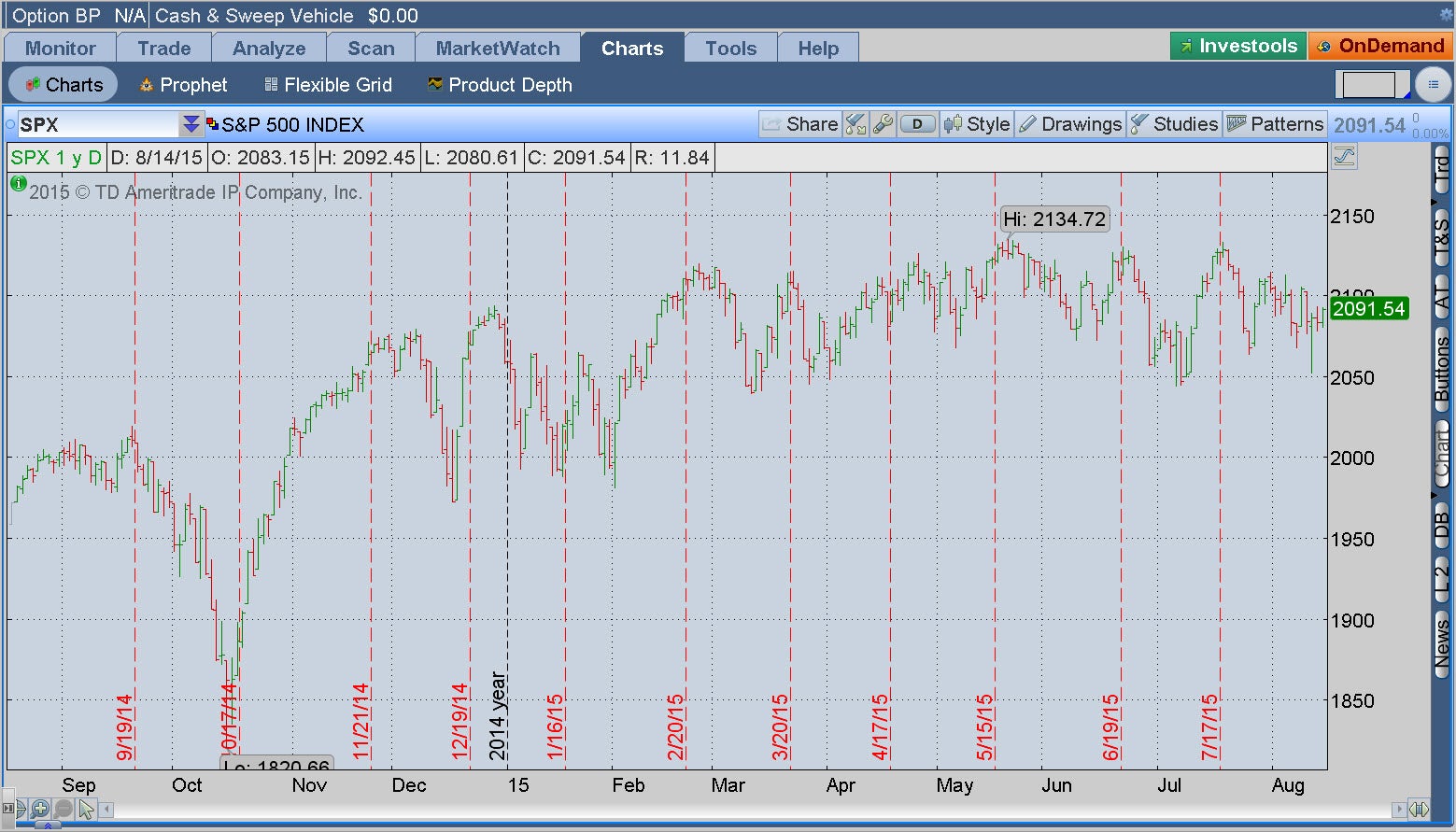

Overall Market Downturn

The overall economic climate has played a substantial role. Factors such as aggressive interest rate hikes by central banks to combat inflation have created a challenging environment for growth stocks, particularly in sectors like biotechnology.

- Market Indices Declines: The S&P 500 and Nasdaq Composite, key indicators of overall market performance, have experienced significant declines in recent months, negatively correlating with the performance of biotech stocks like Scholar Rock.

- Biotech Sector Correlation: The biotech sector often shows a strong correlation with the overall market sentiment. When investor confidence is low, biotech stocks, known for their higher risk profiles, are often the first to be sold off.

- Expert Opinions: Many financial experts have noted a general risk-averse sentiment among investors, leading to a sell-off in growth sectors including biotechnology.

Biotech Sector Specific Challenges

Beyond the overall market downturn, the biotech industry itself faces unique challenges that impact Scholar Rock Stock Price.

- Increased Regulatory Scrutiny: Stringent regulatory approvals and increasing scrutiny from agencies like the FDA can significantly delay drug development and increase costs, impacting investor confidence.

- Funding Challenges for Clinical Trials: Securing funding for lengthy and expensive clinical trials is a constant hurdle for biotech companies. Any delays or setbacks can negatively affect stock prices.

- Intense Competition: The biotech sector is highly competitive, with numerous companies vying for market share. The success of competitors can influence investor perception of Scholar Rock and its prospects.

- Pricing Pressures: Negotiating favorable pricing with payers (insurance companies and government programs) for new drugs is crucial for profitability. Pressure on drug pricing can impact a company's financial projections and thus its stock price.

Company-Specific Factors Impacting Scholar Rock Stock Price

While market forces play a role, several company-specific factors have also contributed to the recent decline in Scholar Rock Stock Price.

Clinical Trial Results and Updates

The success or failure of clinical trials is paramount for biotech companies. Any news regarding Scholar Rock's clinical trials, whether positive or negative, significantly impacts investor sentiment.

- [Specific Clinical Trial Name 1]: [Discuss the results and their impact on the stock price. Mention any delays or unexpected outcomes.]

- [Specific Clinical Trial Name 2]: [Discuss the results and their impact on the stock price. Mention any delays or unexpected outcomes.]

- Analyst Commentary: The interpretation of clinical trial data by financial analysts greatly influences investor perception and subsequent trading activity.

Financial Performance and Projections

Scholar Rock's financial health, including revenue, expenses, and future projections, is another key factor impacting its stock price.

- Recent Financial Reports: A thorough analysis of Scholar Rock's recent financial reports (10-K, 10-Q) can reveal key trends in revenue growth, profitability, and cash burn rate.

- Key Financial Metrics: Investors closely monitor metrics like revenue growth, operating expenses, and research and development spending to assess the company's financial stability and future potential.

- Unexpected Financial News: Any unexpected financial news, such as missed earnings expectations or changes in financial guidance, can trigger negative market reactions.

Management Changes and Corporate Actions

Changes in leadership or significant corporate decisions can also influence investor confidence and ultimately, Scholar Rock Stock Price.

- Management Changes: Any significant changes in senior management, particularly the CEO or CFO, can send signals about the company's direction and stability.

- Partnerships and Acquisitions: Announcements of new partnerships, acquisitions, or divestitures can impact investor perception depending on the strategic value of these actions.

- Strategic Direction: Changes in the company's overall strategic direction can also influence investor confidence, particularly if they involve a significant shift in focus or resources.

Investor Sentiment and Analyst Ratings

Investor sentiment and analyst ratings are crucial in shaping the perception of Scholar Rock and its stock price.

Changes in Analyst Ratings

Financial analysts provide ratings and price targets for stocks, influencing investor decisions.

- Upgrades and Downgrades: Any changes in analyst ratings, whether upgrades or downgrades, can significantly impact the Scholar Rock Stock Price.

- Reasons for Rating Changes: Understanding the reasons behind analyst rating changes is essential for assessing the validity of their assessments.

Investor Behavior and Trading Volume

Observing trading volume and price fluctuations can shed light on investor sentiment.

- Trading Volume and Price Changes: High trading volume coupled with significant price drops often indicates a strong sell-off driven by negative sentiment.

- Fear, Uncertainty, and Doubt (FUD): Negative news, even unsubstantiated rumors, can fuel fear, uncertainty, and doubt among investors, leading to decreased demand and lower stock prices.

Conclusion

The recent decline in Scholar Rock Stock Price is a result of a complex interplay of market-wide factors, company-specific issues, and investor sentiment. Understanding these contributing elements – from the broader economic downturn impacting the biotech sector to Scholar Rock's specific clinical trial updates and financial performance – is crucial for investors. The volatility highlights the importance of thorough due diligence and continuous monitoring of the company’s progress.

To make informed decisions regarding Scholar Rock Stock, or Scholar Rock investment opportunities, stay informed about upcoming clinical trial results, financial reports, and any significant corporate announcements. Follow reputable financial news sources and conduct your own comprehensive research before making any investment decisions related to Scholar Rock Stock Price. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Inter Milans Historic Champions League Final Victory Over Barcelona

May 08, 2025

Inter Milans Historic Champions League Final Victory Over Barcelona

May 08, 2025 -

Brezilya Da Bitcoin Maas Oedemeleri Yasal Oluyor Mu

May 08, 2025

Brezilya Da Bitcoin Maas Oedemeleri Yasal Oluyor Mu

May 08, 2025 -

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Gelismeler Ve Analiz

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Gelismeler Ve Analiz

May 08, 2025 -

Updated Batman Costume And New 1 Comic Book Dc Comics Announcement

May 08, 2025

Updated Batman Costume And New 1 Comic Book Dc Comics Announcement

May 08, 2025 -

Lahwr Ke Jjz Kw Sht Ky Nyy Bymh Shwlt

May 08, 2025

Lahwr Ke Jjz Kw Sht Ky Nyy Bymh Shwlt

May 08, 2025

Latest Posts

-

Despite Shorter Race Fur Rondy Mushers And Dogs Push On

May 09, 2025

Despite Shorter Race Fur Rondy Mushers And Dogs Push On

May 09, 2025 -

Alaskas Fur Rondy Mushers Persevere Despite Shorter Race

May 09, 2025

Alaskas Fur Rondy Mushers Persevere Despite Shorter Race

May 09, 2025 -

Fur Rondy Shorter Race Unwavering Spirit

May 09, 2025

Fur Rondy Shorter Race Unwavering Spirit

May 09, 2025 -

Nevozmozhnost Tochnogo Prognoza Mayskikh Snegopadov Obyasnenie Sinoptikov

May 09, 2025

Nevozmozhnost Tochnogo Prognoza Mayskikh Snegopadov Obyasnenie Sinoptikov

May 09, 2025 -

Alaskan Protests Against Doge And Trump Administration A Deep Dive

May 09, 2025

Alaskan Protests Against Doge And Trump Administration A Deep Dive

May 09, 2025