Understanding The Surge In The Venture Capital Secondary Market

Table of Contents

Increased Liquidity Needs Driving the Secondary Market

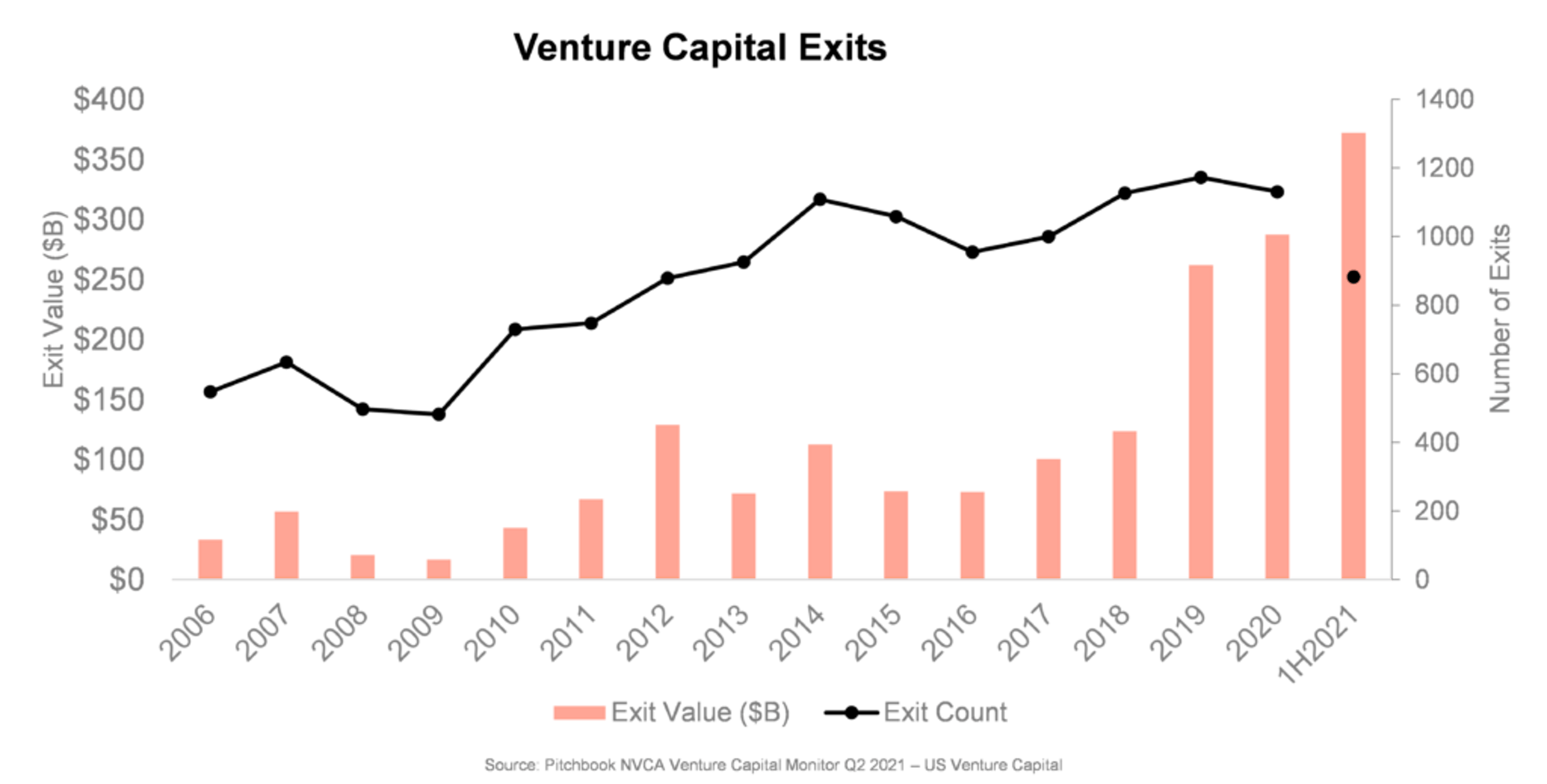

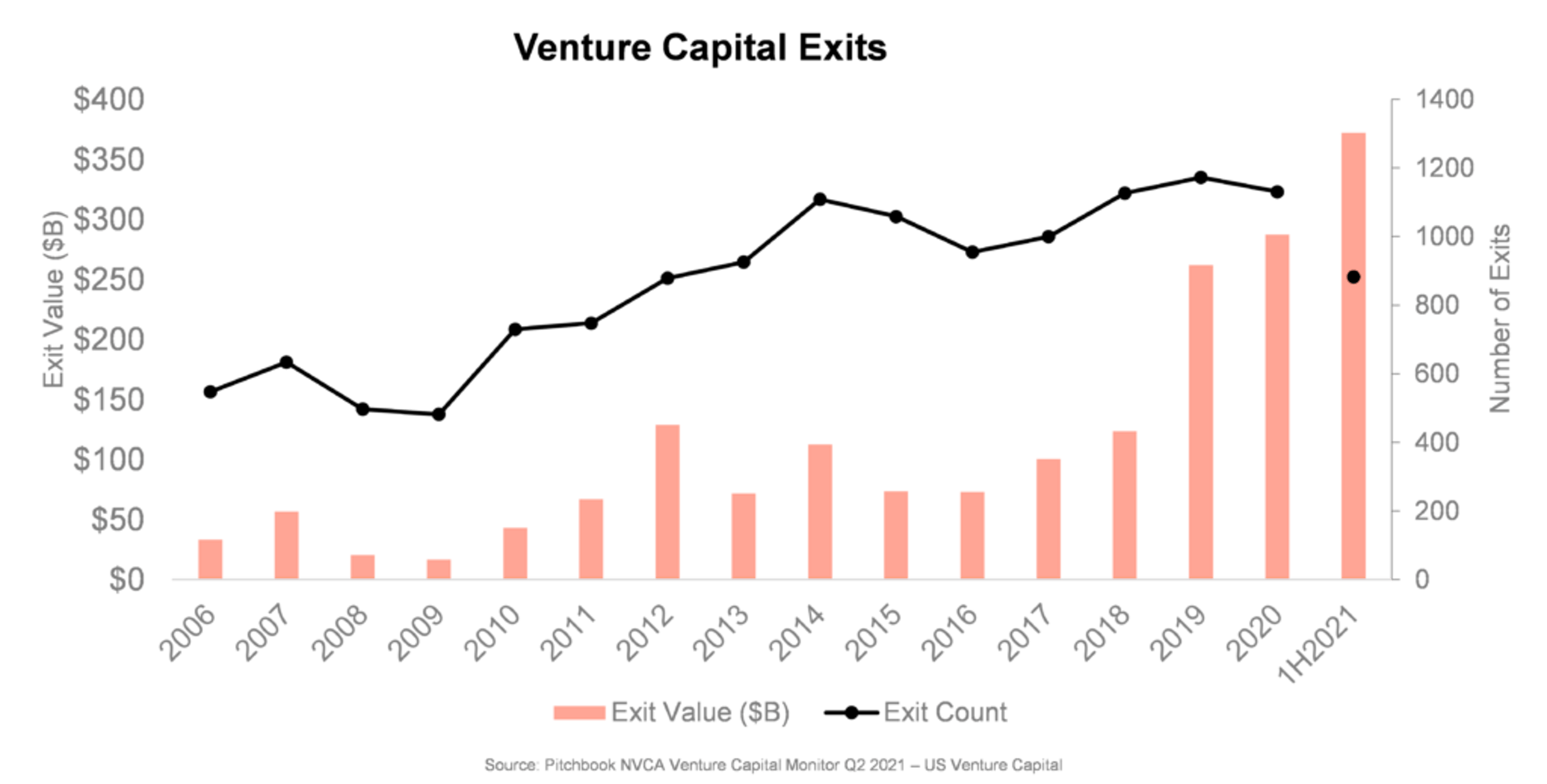

The primary driver behind the booming Venture Capital Secondary Market is the increasing need for liquidity among both Limited Partners (LPs) and General Partners (GPs).

LPs Seeking Earlier Returns

Limited partners, the investors in venture capital funds, are increasingly seeking ways to realize returns on their investments earlier than the traditional exit routes of Initial Public Offerings (IPOs) or acquisitions. This is due to several factors:

- Reduced lock-up periods: The traditional long-term nature of venture capital investments is becoming less appealing to some LPs.

- Diversification needs: LPs often need to rebalance their portfolios, and the secondary market provides a mechanism to do so.

- Improved portfolio rebalancing: Access to liquidity allows LPs to strategically reallocate capital to other promising opportunities.

The pressure to meet investor commitments and demonstrate consistent returns is significant. The secondary market allows LPs to access capital before a traditional exit event, providing much-needed flexibility and mitigating some of the inherent risks of long-term illiquid investments. This increased demand directly fuels the growth of the secondary market.

General Partner (GP) Portfolio Management

General Partners, the managers of venture capital funds, are also leveraging the secondary market for strategic portfolio management. This includes:

- Addressing underperforming assets: The secondary market offers a way to exit investments that aren't meeting expectations without triggering a complete fund failure.

- Focusing on high-growth investments: By selling less promising assets, GPs can free up capital to invest in more promising ventures.

- Capital recycling for future investments: Selling mature investments provides funds for new investments, ensuring continued fund growth and performance.

This strategic use of the secondary market allows GPs to optimize their portfolios, improve overall fund performance, and enhance their reputation with LPs by demonstrating active portfolio management and capital efficiency.

Technological Advancements and Increased Transparency

Technological advancements have significantly contributed to the growth of the Venture Capital Secondary Market by improving efficiency and transparency.

Data-Driven Valuation and Due Diligence

The availability of sophisticated data analytics and improved valuation models is transforming how secondary market transactions are conducted:

- Increased transparency in pricing: Data-driven valuation methods provide more accurate and consistent pricing, reducing uncertainty.

- Reduced information asymmetry between buyers and sellers: Access to comprehensive data empowers both parties with better insights, leading to more efficient negotiations.

Platforms and data providers are crucial players here, providing access to deal flow, historical performance data, and comparable transaction information. This increased transparency fosters greater confidence and participation in the market.

Improved Online Platforms and Marketplaces

Digital platforms are streamlining the entire transaction process, making it more accessible and cost-effective:

- Increased efficiency: Online platforms automate many aspects of the transaction, from initial screening to closing.

- Lower transaction fees: Reduced administrative overhead translates to lower costs for both buyers and sellers.

- Broader access to buyers and sellers: Online marketplaces connect a wider range of investors and fund managers, increasing liquidity and competition.

Examples like [mention specific platforms if appropriate, avoiding direct endorsement] illustrate the positive impact of technology on market liquidity and accessibility.

Shifting Investor Landscape and Appetite for Secondary Assets

The Venture Capital Secondary Market is attracting a broader range of investors, further fueling its growth.

Increased Institutional Participation

More institutional investors, including:

- Pension funds: Seeking stable, long-term returns.

- Sovereign wealth funds: Looking for diversification beyond traditional asset classes.

- Family offices: Seeking access to high-growth private equity opportunities.

are actively participating in the secondary market, drawn by the potential for attractive returns and diversification benefits. These investors bring significant capital and expertise, expanding the market's overall depth and liquidity.

Growth of Specialized Secondary Funds

The emergence of funds specifically focused on secondary investments reflects the growing confidence and demand for this asset class:

- Dedicated fund managers: These specialists possess the expertise and resources to effectively navigate the complexities of the secondary market.

- Improved liquidity: Their participation enhances liquidity, providing more options for both LPs and GPs.

These specialized secondary funds are actively shaping the market, providing expertise, capital, and further contributing to its overall growth and sophistication.

Conclusion

The surge in the Venture Capital Secondary Market is a result of interconnected factors: increased liquidity needs among LPs and GPs, technological advancements that improve efficiency and transparency, and a shifting investor landscape with increased institutional participation and the rise of specialized secondary funds. This market offers significant opportunities for both LPs and GPs, enabling greater portfolio management flexibility, improved returns, and more efficient capital allocation. Understanding the dynamics of this evolving Venture Capital Secondary Market is crucial for anyone involved in venture capital. To stay informed about the latest trends and opportunities in the Venture Capital Secondary Market, continue researching market data and consider consulting with experts in this field. Proactive engagement with the secondary market can lead to significant strategic advantages.

Featured Posts

-

Nyt Spelling Bee Answers For March 13 2025

Apr 29, 2025

Nyt Spelling Bee Answers For March 13 2025

Apr 29, 2025 -

Is Kevin Bacon Returning For Tremor 2 On Netflix

Apr 29, 2025

Is Kevin Bacon Returning For Tremor 2 On Netflix

Apr 29, 2025 -

Astedwa Lantlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025

Astedwa Lantlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025 -

Hungary Defies Us Pressure Maintaining Strong Economic Ties With China

Apr 29, 2025

Hungary Defies Us Pressure Maintaining Strong Economic Ties With China

Apr 29, 2025 -

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 29, 2025

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 29, 2025

Latest Posts

-

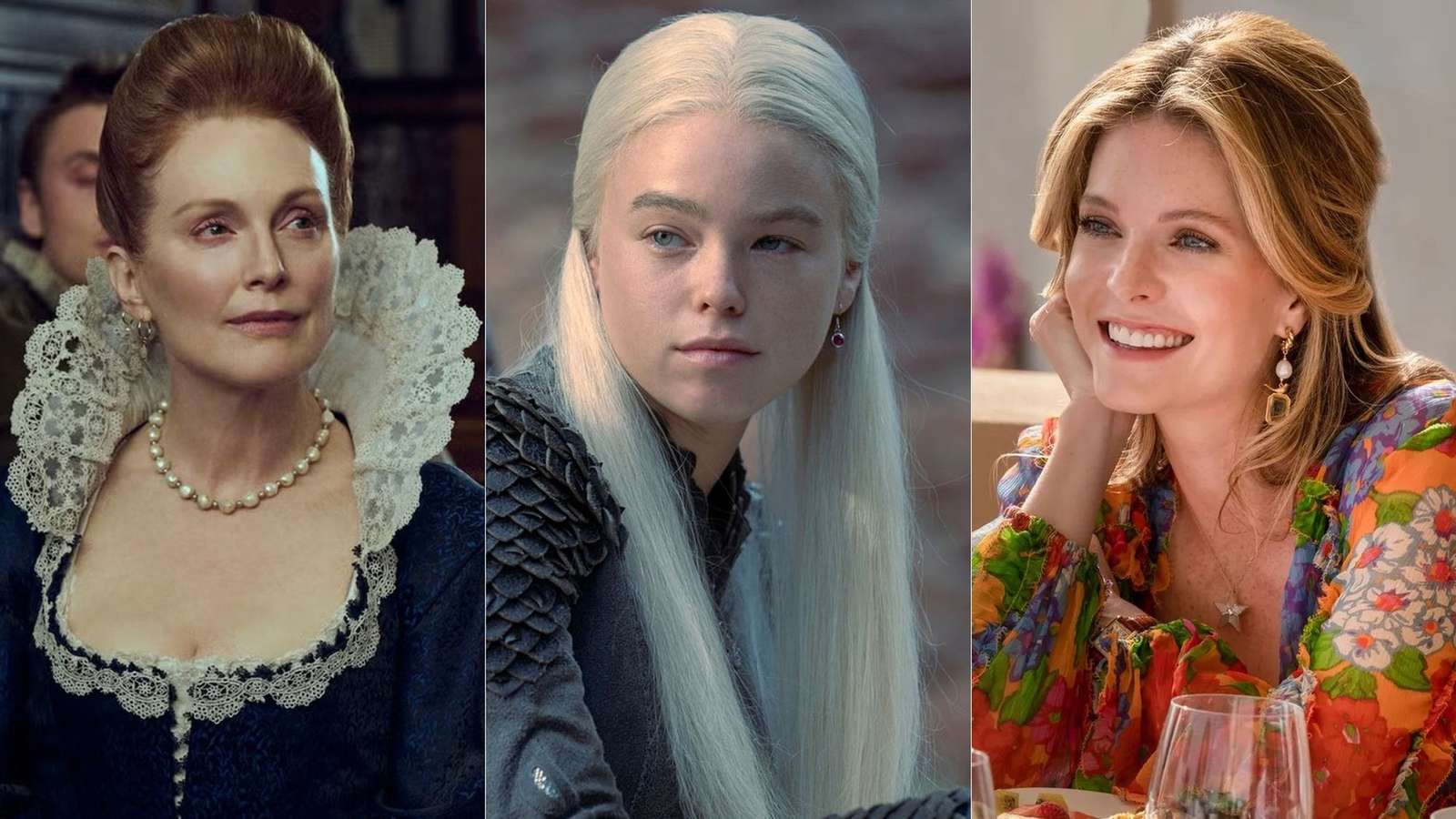

Milly Alcock As Supergirl Netflixs Sirens Trailer Reveals Cult Connection With Julianne Moore

Apr 29, 2025

Milly Alcock As Supergirl Netflixs Sirens Trailer Reveals Cult Connection With Julianne Moore

Apr 29, 2025 -

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025 -

Kevin Bacons Tremor 2 Fact Or Fiction Netflix Series Update

Apr 29, 2025

Kevin Bacons Tremor 2 Fact Or Fiction Netflix Series Update

Apr 29, 2025 -

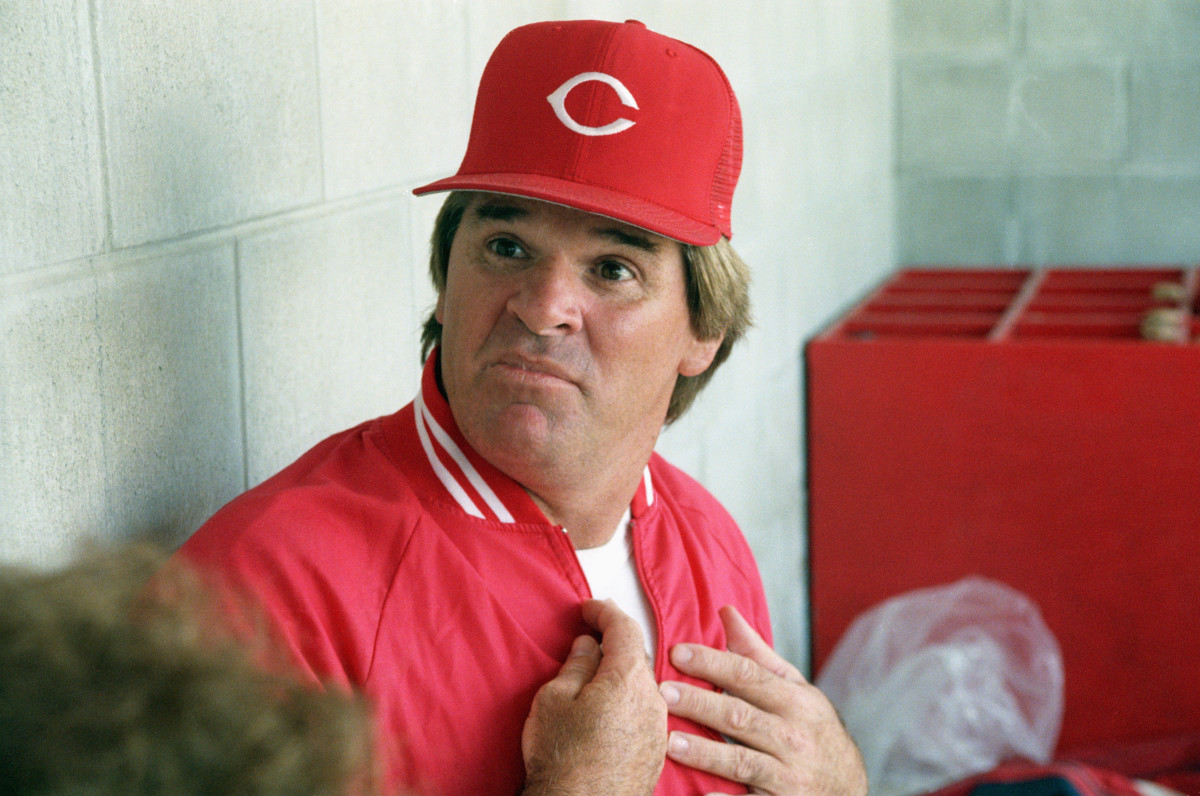

The Future Of Pete Roses Mlb Ban Trumps Potential Pardon Decision

Apr 29, 2025

The Future Of Pete Roses Mlb Ban Trumps Potential Pardon Decision

Apr 29, 2025 -

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025