Understanding The Volatility Of BigBear.ai (BBAI) Penny Stock.

Table of Contents

Understanding Penny Stock Volatility: The BBAI Case

Penny stocks, generally defined as stocks trading below $5 per share, are notorious for their price swings. This inherent volatility stems from several factors:

- Low Trading Volume: Fewer shares traded mean prices can be easily manipulated by relatively small buy or sell orders.

- Speculative Trading: Penny stocks often attract speculative investors looking for quick profits, leading to exaggerated price movements based on hype or rumor.

- Company News: Positive news (e.g., new contracts, technological breakthroughs) can send prices soaring, while negative news (e.g., financial setbacks, regulatory issues) can trigger sharp declines.

BBAI's volatility is influenced by several specific factors:

- Recent Financial Performance and Earnings Reports: Quarterly earnings reports significantly impact investor sentiment. Missing expectations can lead to sharp drops, while exceeding forecasts can fuel substantial gains.

- Government Contracts and Their Impact on the Stock Price: As a technology company, BBAI's success is often tied to securing government contracts. The award or loss of major contracts can dramatically affect its stock price.

- News and Announcements Related to the Company's Technology and Partnerships: Positive announcements regarding new technologies, strategic partnerships, or product launches can drive significant price increases. Conversely, negative news related to these areas can result in substantial losses.

- Analyst Ratings and Predictions: Analyst opinions and price target changes can influence investor confidence and, consequently, the stock price.

- Market Sentiment and Overall Economic Conditions: Broader market trends and overall economic health also play a role. During periods of economic uncertainty, investors may be less inclined to invest in riskier penny stocks like BBAI.

Analyzing BBAI's Historical Price Fluctuations

BBAI's historical price chart reveals a pattern of significant highs and lows. For example, [Insert specific example of a significant price increase and the factors contributing to it, e.g., "In [Month, Year], BBAI's price surged by X% following the announcement of a major government contract."]. Conversely, [Insert specific example of a significant price decrease and the contributing factors, e.g., "In [Month, Year], BBAI experienced a Y% drop after reporting disappointing quarterly earnings."]. Analyzing these historical trends, alongside relevant news and financial data, can offer insights into the drivers of BBAI's price volatility. While technical analysis tools like moving averages and relative strength index (RSI) can be used to identify potential trends, their predictive power is limited, and relying solely on them is risky.

Risk Assessment and Mitigation Strategies for BBAI

Investing in BBAI, or any penny stock, involves substantial risk. Potential for significant losses is high. To mitigate this risk:

- Diversification of Investment Portfolio: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes and stocks to reduce the impact of any single investment's poor performance.

- Setting Stop-Loss Orders to Limit Potential Losses: A stop-loss order automatically sells your shares when the price drops to a predetermined level, limiting potential losses.

- Thorough Due Diligence and Fundamental Analysis Before Investing: Before investing, conduct thorough research into BBAI's financials, business model, and competitive landscape. Understand the company's strengths and weaknesses.

- Understanding Your Own Risk Tolerance and Investment Goals: Only invest an amount you can comfortably afford to lose. Penny stocks are not suitable for risk-averse investors.

- Following Reputable Financial News Sources: Stay informed about BBAI and the broader market by following reputable financial news sources.

Future Outlook and Potential for BBAI

BBAI's future prospects depend on several factors. Positive catalysts could include securing additional government contracts, successful product launches, and strategic partnerships. However, challenges remain, including competition, maintaining profitability, and managing investor expectations. Industry trends in the technology sector will significantly influence BBAI's growth trajectory. While potential long-term growth opportunities exist, it's crucial to maintain a balanced and cautious outlook, avoiding overly optimistic or pessimistic predictions.

Conclusion: Making Informed Decisions About BigBear.ai (BBAI) Penny Stock

The volatility of BigBear.ai (BBAI) penny stock is undeniable. Understanding the factors influencing its price fluctuations, conducting thorough due diligence, and employing effective risk mitigation strategies are crucial for anyone considering investing in this high-risk asset. Remember, investing in BBAI or any penny stock necessitates a high-risk tolerance. Before making any investment decisions, conduct your own in-depth research and, if needed, consult with a qualified financial advisor. Understand the volatility of BigBear.ai (BBAI) and make informed investment decisions today!

Featured Posts

-

Assessing Climate Risk Its Influence On Your Home Purchase Credit Score

May 21, 2025

Assessing Climate Risk Its Influence On Your Home Purchase Credit Score

May 21, 2025 -

The Goldbergs Complete Guide To Characters Episodes And More

May 21, 2025

The Goldbergs Complete Guide To Characters Episodes And More

May 21, 2025 -

Jeremie Frimpongs Liverpool Transfer Latest News And Updates

May 21, 2025

Jeremie Frimpongs Liverpool Transfer Latest News And Updates

May 21, 2025 -

Celebrity Feud David Walliams Speaks Out Against Simon Cowell

May 21, 2025

Celebrity Feud David Walliams Speaks Out Against Simon Cowell

May 21, 2025 -

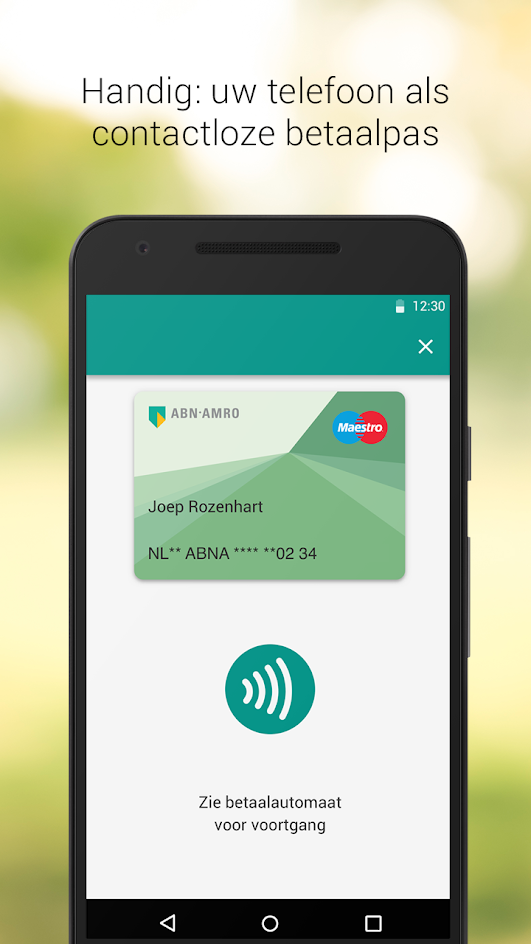

Abn Amro Alternatieven Voor Online Betalingen Bij Opslag

May 21, 2025

Abn Amro Alternatieven Voor Online Betalingen Bij Opslag

May 21, 2025