Understanding Today's Personal Loan Interest Rates

Table of Contents

Securing a personal loan can be a great way to consolidate debt, fund a home improvement project, or cover unexpected medical expenses. However, understanding today's personal loan interest rates is crucial for making smart financial decisions. A high interest rate can significantly increase the total cost of your loan, making it harder to manage your repayments. This guide will break down the key factors affecting these rates and help you navigate the process of finding the best loan for your situation. We'll cover everything from credit scores and debt-to-income ratios to the best strategies for securing the lowest possible interest rate.

Factors Influencing Personal Loan Interest Rates

Several key factors influence the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a lower rate.

Credit Score: The Foundation of Your Interest Rate

Your credit score is arguably the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, your ability to repay borrowed money. A higher credit score indicates lower risk to the lender, resulting in a more favorable interest rate.

-

Impact of Credit Score Ranges:

- Excellent (750+): Expect the lowest interest rates available. You'll likely qualify for the best loan offers and terms.

- Good (700-749): You'll still receive competitive rates, though potentially slightly higher than those with excellent scores.

- Fair (650-699): Interest rates will be significantly higher, and you may face more stringent lending requirements.

- Poor (Below 650): Securing a personal loan might be challenging, and if approved, you'll likely face very high interest rates.

-

Checking Your Credit Report: Regularly check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors. Errors can negatively impact your score.

-

Improving Your Credit Score: Improving your credit score before applying for a loan is a proactive step towards securing better rates. This involves paying bills on time, keeping credit utilization low, and maintaining a diverse credit history.

Loan Amount and Term: Size and Time Matter

The amount you borrow and the length of your repayment term also influence your interest rate.

-

Loan Size and Interest: Larger loan amounts generally correlate with higher interest rates. Lenders perceive larger loans as riskier.

-

Loan Term and Total Interest: Longer loan terms mean lower monthly payments, but you'll pay significantly more interest over the life of the loan. Shorter terms mean higher monthly payments but less total interest paid.

-

Example: A $10,000 loan over 3 years might have a lower interest rate than the same loan over 5 years. However, the total interest paid over 5 years will be considerably higher.

Debt-to-Income Ratio (DTI): Managing Your Financial Obligations

Your debt-to-income ratio (DTI) measures your monthly debt payments relative to your gross monthly income. Lenders use DTI to assess your ability to manage additional debt.

-

Calculating DTI: Divide your total monthly debt payments (including the potential new loan) by your gross monthly income.

-

High DTI's Impact: A high DTI indicates that you're already heavily burdened with debt, increasing the perceived risk for lenders. This usually translates to higher interest rates or loan rejection.

-

Improving DTI: To improve your DTI, focus on paying down existing debts before applying for a new loan.

Lender Type: Banks, Credit Unions, and Online Lenders

Different types of lenders offer varying interest rates.

-

Banks: Typically offer a wide range of loan products but might have stricter eligibility requirements.

-

Credit Unions: Often provide more favorable rates to their members, but membership requirements might apply.

-

Online Lenders: Offer convenience and potentially competitive rates, but thorough research is essential to ensure legitimacy and transparency.

-

Comparison is Key: Always compare offers from multiple lenders before making a decision.

Current Economic Conditions: The Broader Picture

Broader economic factors, like inflation and the federal funds rate, influence personal loan interest rates.

-

Inflation's Impact: High inflation generally leads to higher interest rates as lenders adjust for the increased cost of borrowing.

-

Federal Reserve's Role: The Federal Reserve's monetary policy significantly affects interest rates across the economy, impacting personal loan rates.

How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rate requires a strategic approach.

Shop Around and Compare: Don't Settle for the First Offer

-

Online Comparison Tools: Utilize online comparison tools to quickly compare offers from different lenders.

-

Reputable Sources: Check reputable financial websites and review platforms for personal loan offers.

-

Read the Fine Print: Always carefully read the loan agreement before signing to understand all terms and conditions.

Improve Your Credit Score: A Powerful Tool

-

Actionable Steps: Pay down debts, keep credit utilization low, and maintain a good payment history.

-

Credit Score Improvement Resources: Consult credit counseling services or educational materials.

-

Long-Term Benefits: A good credit score benefits far beyond personal loans.

Negotiate with Lenders: Your Bargaining Power

-

Negotiation Tips: Present a strong financial profile, highlighting your stable income and responsible debt management.

-

Leverage Competing Offers: If you have multiple offers, use them to negotiate a better rate.

Conclusion: Making Informed Decisions about Personal Loan Interest Rates

Understanding today's personal loan interest rates is essential for securing a favorable loan and managing your finances effectively. By understanding the factors that influence rates, such as your credit score, DTI, and the loan amount, you can proactively improve your chances of securing lower interest rates. Remember to shop around, compare offers, and negotiate to find the best personal loan for your needs. Start comparing personal loan interest rates today and secure the best financing option for your future!

Featured Posts

-

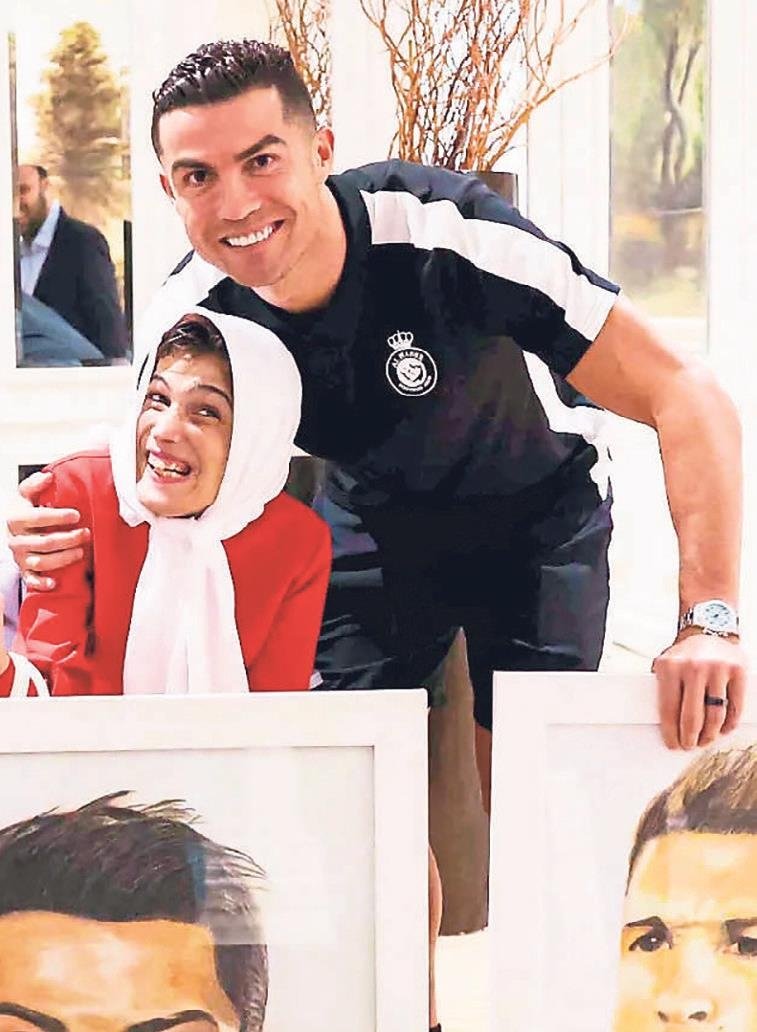

Cok Cirkinsin Diyen Ronaldoya Adanali Ronaldo Dan Sert Yanit

May 28, 2025

Cok Cirkinsin Diyen Ronaldoya Adanali Ronaldo Dan Sert Yanit

May 28, 2025 -

Garnachos Future Man Utd Or Chelsea His Stance Revealed

May 28, 2025

Garnachos Future Man Utd Or Chelsea His Stance Revealed

May 28, 2025 -

Barrick Claims Malis Gold Mine Nationalization Is Illegal

May 28, 2025

Barrick Claims Malis Gold Mine Nationalization Is Illegal

May 28, 2025 -

French Open Musetti And Sabalenka Secure Second Round Wins Nadal Celebrated

May 28, 2025

French Open Musetti And Sabalenka Secure Second Round Wins Nadal Celebrated

May 28, 2025 -

Nine Points Separated Ajax From Glory A Game By Game Breakdown

May 28, 2025

Nine Points Separated Ajax From Glory A Game By Game Breakdown

May 28, 2025